HFC Refrigerants Market Size (2025 – 2030)

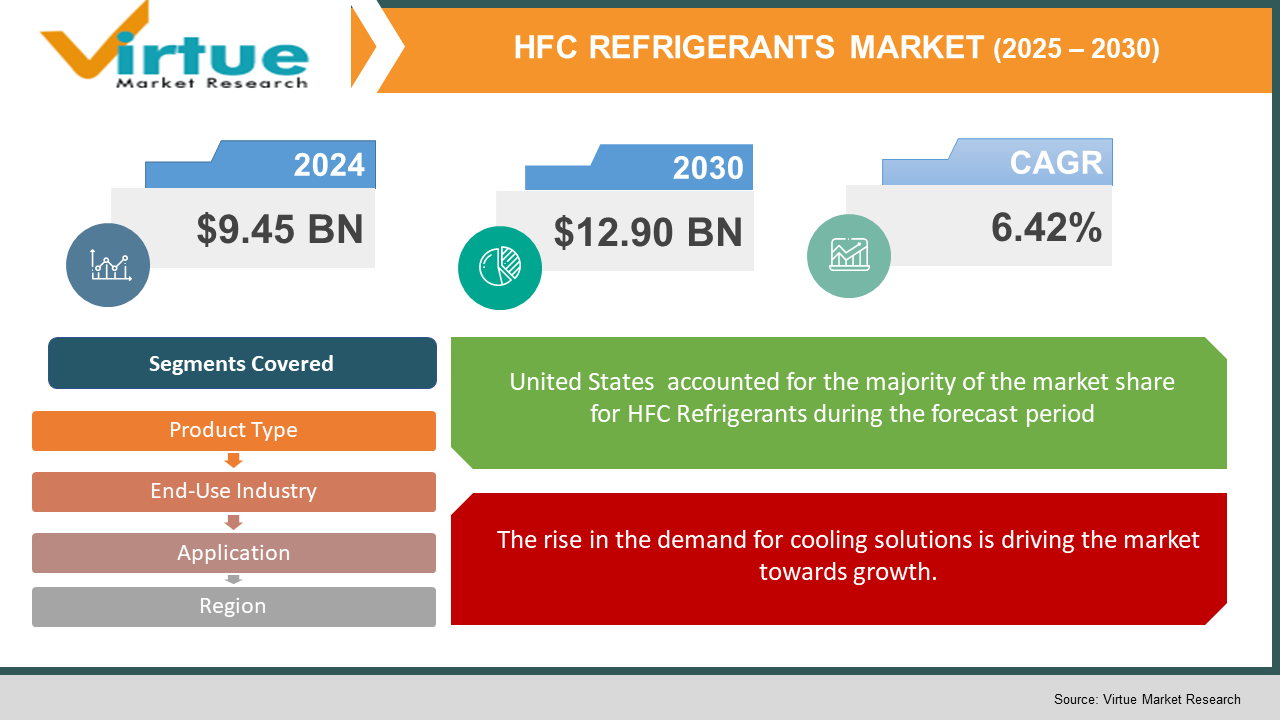

The Global HFC Refrigerants Market was valued at USD 9.45 billion and is projected to reach a market size of USD 12.90 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 6.42%.

Rising environmental rules intended to phase out high global warming potential (GWP) refrigerants are causing the worldwide HFC (Hydrofluorocarbon) refrigerants market to undergo a substantial change. Because of their exceptional thermodynamic properties, HFCs have been widely used in several different uses including heat pumps, refrigeration, and air conditioning. Their high GWP, however, has resulted in treaties such as the Kigali Modification to the Montreal Protocol ordering their slow phase-down. Therefore, the market is defined by a movement toward lower-HWP solutions including hydrofluoride and organic refrigerants. Even though the phase-down will keep a significant market for HFCs in the projected period, their use, along with a downward trend, will be reduced by ongoing maintenance needs and current machinery.

Key Market Insights:

- Ratified by several nations, the Kigali Amendment seeks to cut HFC use by over 80% over the next three decades. This has put a great strain on consumers and producers to switch to different refrigerants. For instance, the F-Gas Regulation of the EU has already established rigorous phase-down plans, therefore affecting the European market dynamics.

- As companies aim to meet standards, the need for HFOs and natural refrigerants (including ammonia, CO2, and hydrocarbons) is fast growing. Data from the market shows the HFO market is forecast to expand at a CAGR of more than 10% over the years ahead, hence showing a departure from HFCs.

HFC Refrigerants Market Drivers:

The rise in the demand for cooling solutions is driving the market towards growth.

Rising worldwide temperatures, growing disposable incomes, and the rising need for temperature-controlled environments in several industries are among the reasons driving an unparalleled explosion in the worldwide need for cooling solutions. This requirement results directly in the need for refrigerants since they are the main ingredients of air conditioning and refrigeration systems. The growing frequency and strength of heatwaves are driving many homes to install air conditioners in residential environments. The preservation of perishable products, the running of data center operations, and the maintenance of manufacturing process efficiency all depend on accurate temperature control, which is especially important in commercial and industrial sectors. One major contributor is the rising world mean temperature brought about by climate change. In many places, cooling is now seen as a necessity for existence rather than a luxury. This reality is driving the market forward.

The rapid urbanization is a major market driver as it is contributing towards market growth.

Especially in developing countries like China, India, and Southeast Asian nations, fast urbanization and industrialization are greatly driving the expansion of the HVAC (Heating, Ventilation, and Air Conditioning) market. Corresponding with the growing number of people living in cities is the rise of residential and commercial building construction, all of which calls for HVAC systems. The development of manufacturing facilities, warehouses, and data centers all demand advanced cooling solutions resulting directly from industrial growth. Furthermore requiring the use of refrigeration and air conditioning is the development of logistics operations and transportation networks together with other logistics backgrounds.

The recent advancements in HVAC systems are driving the demand for the market.

The general efficiency of HVAC systems is benefiting from developments in control systems, compressor technology, and heat exchanger design. These developments are allowing the use of alternative refrigerating agents, including HFOs and natural refrigerants, which have different thermodynamic properties than standard HFCs. Also becoming well-liked are intelligent HVAC systems that have connectivity capabilities and sensors. These systems help to reduce refrigerant use and maximize energy consumption, therefore supporting sustainability initiatives. More effective systems developed allow less refrigerant to be used and let as well more green refrigerants to be applied. The greater emphasis on energy efficiency is driving corporate creativity and hence altering the refrigerants chosen.

The government policies are playing a major role in promoting the HFC Refrigerants Market.

The refrigerant sector is being mainly shaped by government rules and international treaties. Policies meant to support energy efficiency and cut greenhouse gas emissions are driving the acceptance of lower-GWP refrigerants. For instance, the Kigali Amendment to the Montreal Protocol requires the slow phase-down of HFCs, so compelling businesses to switch to different coolants. Regulations in other parts of the world such as the EU's F-Gas Regulation and the U.S. SNAP initiative by EPA are also driving lower-GWP technology uptake. Tax incentives as well as rebates are also being used to stimulate the acquisition of environmentally friendly HVAC systems, thus also encouraging the use of more environmentally friendly refrigerants.

HFC Refrigerants Market Restraints and Challenges:

The concerns related to the environment are posing a big challenge for the market, affecting its growth.

Though useful refrigerants, hydrofluorocarbons (HFCs) have a high Global Warming Potential (GWP). This implies that minor leaks can noticeably affect climate change. Rising knowledge of climate change and the desperate need to cut greenhouse gas emissions have resulted in strict national as well as international legislation. The environmental worry extends beyond only legal dictates. Increasing environmental awareness among consumers and companies is also driving a change in tastes toward sustainable options. Businesses that still mainly depend on HFCs run the risk of losing market share and suffering reputational damage.

The availability of alternatives is a challenge for the market as it increases competition making it hard for the market to survive.

Although the phase-down of HFCs is challenging, it also opens doors for low-GWP alternatives' invention and marketization. Useful substitutions are becoming hydrofluoroolefins (HFOs) and natural refrigerants (such as carbon dioxide, ammonia, and hydrocarbons). Particularly among HFOs, they strike a good compromise between performance and environmental friendliness, since their GWP is much less than that of HFCs. Their availability and price can still be an issue in some areas, though. Although they are ecologically friendly, natural refrigerants might call for special handling and raise safety issues such as combustibility or toxicity. Ongoing is the creation of more efficient and safer technologies for the application of natural refrigerants.

The need for significant investment is making it difficult for the SMEs to adopt it.

Moving to alternative refrigerants calls for major expenditures in new technology, infrastructure, and instruction. Particularly for small and medium-sized businesses (SMEs), absorbing these expenses could be difficult. Adapting current systems to utilize different refrigerants can be costly and challenging. Sometimes it might make more sense to replace the equipment, hence increasing the financial strain. Adding to company operational costs is the cost of alternative refrigerants themselves, which can also be greater than that of conventional HFCs. The makers of the refrigerants also experience financial ramifications. Huge amounts must be spent on R&D as well as on the establishment of fresh production facilities. This expense is then transmitted to the supply chain.

The technological barriers faced by the market are a great challenge as they make it difficult to integrate it with the existing systems.

Major technological obstacles result from compatibility problems between current solutions and new refrigerants. Alternative refrigerants could have varied thermodynamic qualities, therefore compressors, heat exchanges, and other components might need adjusting. New HVAC systems that can effectively run on alternative refrigerants need a lot of research and development. Manufacturers must commit resources toward creating and validating new technologies, a slow and expensive process. Particular alternative refrigerants, such as dangerous or combustible materials, need expert instruction and precautions in their handling and use. For companies without the required knowledge and means, this could present obstacles. Moreover raising technological obstacles is the requirement for new detection and recovery processes. New systems must be developed since many of the other refrigerants have characteristics different from those of HFCs. This increases the complexity as well as the cost of the transformation.

HFC REFRIGERANTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6.42% |

|

Segments Covered |

By Product Type, end user industry, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Daikin Industries Ltd., Honeywell International Inc., The Chemours Company, Arkema S.A., Dongyue Group, Asahi Glass Co., Ltd., Linde plc, Sinochem Group, SRF Limited, Orbia Advance Corporation |

HFC Refrigerants Market Opportunities:

The development of low-GWP refrigerants has increased the demand for environment-friendly refrigerants.

The world's drive to phase out high-GWP HFCs has generated a strong need for environmentally friendly refrigerants. Companies that generate creative, low GWP alternatives utilizing research and development (R&D) may substantially improve their level of competition. This encompasses the search for new refrigerant chemistries, innovations in natural refrigerants (CO2, ammonia, hydrocarbons), and the creation of new HFO mixtures. The aim is to strike a mix of low GWP, high energy efficiency, and safety. Moreover, the creation of refrigerants with better thermal qualities and lower flammability will broaden their use across many sectors. This covers the formulation of coolants suitable for application in high ambient temperatures.

Retrofitting the existing systems presents a great opportunity for the market to grow.

HVAC systems worldwide with a large installed base still depend upon high-GWP HFCs. Significant market opportunities arise from the retrofit of these systems to operate low-GWP coolants. Using affordable and fast retrofitting services can help businesses here respond. This covers offering refrigerant recycling and reclamation solutions, technical know-how, and retrofit kit development. Particularly for companies on tight budgets, retrofitting might be a more affordable solution than complete system replacement. Especially in developing areas where the shift to new machinery might be slower, this is pertinent. Highly favorable are drop-in replacements that call for just small modifications to current systems.

The developing nations present a great market growth opportunity helping the market to expand.

Rapid industrialization and urbanization in developing countries in Asia-Pacific, Latin America, and Africa are driving a great need for cooling systems. For firms providing sustainable refrigerant solutions, these markets offer quite a bit of growth potential. Developing their infrastructures allows these areas to jump ahead of older, less effective technologies and use the latest, environmentally friendly solutions. A strong presence in these markets helps companies to get first-mover advantages. This encompasses establishing distribution channels, developing nearby relationships, and delivering technical help. A very big advantage is the capacity to offer systems meant to work in the high ambient temperatures of numerous developing countries.

Collaborating with the regulatory bodies can help facilitate a smoother transition towards sustainable refrigerants.

Engaging with legislators and regulatory agencies is vital for negotiating the changing terrain of the HFC refrigerants business. Businesses that actively engage with the creation of practical rules can guarantee a more easy change to sustainable refrigeration. This encompasses sharing research results, presenting technical knowledge, and lobbying for legislation supporting investment and creativity. Working with regulatory organizations also permits businesses to prepare for future regulations and tweak their plans correspondingly. By participating in international conferences and trade groups, businesses can help steer world refrigerant rules. Greatly aiding the entire sector is helping to develop workable guidelines.

HFC Refrigerants Market Segmentation:

HFC Refrigerants Market Segmentation: By Product Type

- R-32

- R-125

- R-134a

- R-152a

Presently the dominant segment is R-32 since it is widely used in air conditioning systems, which can be credited to its somewhat lower GWP and great energy efficiency. Driven by rising regulatory demands for refrigerants with less environmental impact, R-32 is also the fastest-growing segment. R-32 (Difluoromethane) is a popular HFC refrigerant in commercial and residential air conditioning systems since it has lower Global Warming Potential (GWP) than some other HFCs.

R-125 (Pentafluoroethane) is commonly found in refrigerant mixtures this compound improves the safety as well as efficiency of refrigeration systems. R-134a (1,1,1),2-Tetrafluoroethane is mostly used in medium-temperature cooling systems and automobile air conditioning. R-152a is often used in particular refrigeration mixtures and applications needing precise thermodynamic qualities. Used in certain refrigeration and aerosol propellant uses, R-152a (1,1-difluoroethane) is known for its low GWP.

HFC Refrigerants Market Segmentation: By Application

- Refrigeration

- Air Conditioning

Air Conditioning is the dominant segment here, mostly because of the worldwide rise in the need for cooling systems in residential and business properties, air conditioning is the prevalent application segment. The refrigeration segment is the fastest-growing segment. Driven by the development of the food and beverage industry and the call for large-scale refrigeration solutions, industrial refrigeration is the fastest-growing sector.

HFC Refrigerants Market Segmentation: By End-Use Industry

- Residential

- Commercial

- Industrial

- Automotive

Driven by the extensive use of refrigeration and air conditioning systems in commercial establishments, the commercial segment is the leading end-use sector. Automotive is the fastest-growing segment since the number of autos equipped with air conditioning systems is rising.

HFC refrigerant usage in home appliances like air conditioners and refrigerators comes under the residential segment. Utilization in manufacturing plants, chemical handling, and cold storage facilities comes under the industrial segment.

HFC Refrigerants Market Segmentation: By Region

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

The United States alongside regulatory changes meant to phase out HFCs in favor of more sustainable alternatives, leads the market due to strong demand in the HVAC and refrigeration industries. Although there is a growing change toward alternative refrigerants, rapid industrialization and urbanization in nations like India and China are driving up the need for refrigeration and air conditioning. This makes the Asia-Pacific region the fastest-growing region.

In Europe, the market is driven by strict rules and measures aimed at lowering HFC use, with nations such as Germany and France advocating for the use of low-GWP (Global Warming Potential) refrigerants. Although regulatory structures are still evolving, South America is an emerging market with particular growth potential in Brazil since the need for refrigeration solutions is rising. With an emphasis on transitioning to more environmentally friendly choices, increasing investments in infrastructure and growing temperatures are forecast to drive demand for refrigeration solutions in the MEA region with a smaller market size.

COVID-19 Impact Analysis on the Global HFC Refrigerants Market:

The coronavirus epidemic upset worldwide supply networks, causing raw materials and components vital for producing air conditioning and refrigeration equipment to be in short supply. Commercial spaces saw reduced demand for HVAC systems as a result of lockdowns and lower economic activity. The pharmaceutical industry, on the other hand, saw rising demand for refrigeration to preserve other medical supplies and vaccines. The economy is recovering post-pandemic with more awareness of interior air quality and energy-efficient heating and ventilation systems.

Latest Trends/ Developments:

Under environmental rules, manufacturers are developing and using refrigerants with lower Global Warming Potential (GWP), such as hydrofluoroolefins (HFOs), and natural refrigerants including ammonia and CO₂. With lower GWP, such as hydrofluoroolefins (HFOs) and natural refrigerants including ammonia and CO2, manufacturers are developing and using natural refrigerants. With lower GWP, such as hydrofluoroolefins (HFOs) and natural refrigerants including ammonia and CO2, manufacturers are adopting and using incompatible gases.

Advancements in HVAC technology are concentrating on raising energy efficiency and incorporating smart controls, therefore decreasing general refrigerant use and improving whole system performance.

Retrofitting current HVAC systems to work with low-GWP refrigerants is becoming more popular and provides a cost-effective way of environmental regulation compliance.

The growing use of refrigerants is driven by fast urbanization and industrialization in developing countries as they create demand for air conditioning and refrigeration.

Key Players:

- Daikin Industries Ltd.

- Honeywell International Inc.

- The Chemours Company

- Arkema S.A.

- Dongyue Group

- Asahi Glass Co., Ltd.

- Linde plc

- Sinochem Group

- SRF Limited

- Orbia Advance Corporation

Chapter 1. HFC Refrigerants Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Source

1.5. Secondary Source

Chapter 2. HFC Refrigerants Market – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. HFC Refrigerants Market – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Type Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. HFC Refrigerants Market - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. HFC Refrigerants Market - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. HFC Refrigerants Market – By Product Type

6.1 Introduction/Key Findings

6.2 R-32

6.3 R-125

6.4 R-134a

6.5 R-152a

6.6 Y-O-Y Growth trend Analysis By Product Type :

6.7 Absolute $ Opportunity Analysis By Product Type :, 2025-2030

Chapter 7. HFC Refrigerants Market – By Application

7.1 Introduction/Key Findings

7.2 Microwave

7.3 Ready-to-Eat

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. HFC Refrigerants Market – By End-Use Industry

8.1 Introduction/Key Findings

8.2 Residential

8.3 Commercial

8.4 Industrial

8.5 Automotive

8.6 Y-O-Y Growth trend Analysis End-Use Industry

8.7 Absolute $ Opportunity Analysis End-Use Industry , 2025-2030

Chapter 9. HFC Refrigerants Market, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Application

9.1.3. By End-Use Industry

9.1.4. By Product Type

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Application

9.2.3. By End-Use Industry

9.2.4. By Product Type

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.1. By Country

9.3.1.1. China

9.3.1.2. Japan

9.3.1.3. South Korea

9.3.1.4. India

9.3.1.5. Australia & New Zealand

9.3.1.6. Rest of Asia-Pacific

9.3.2. By Application

9.3.3. By End Use

9.3.4. By Product Type

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.1. By Country

9.4.1.1. Brazil

9.4.1.2. Argentina

9.4.1.3. Colombia

9.4.1.4. Chile

9.4.1.5. Rest of South America

9.4.2. By END USE

9.4.3. By Application

9.4.4. By Product Type

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.1. By Country

9.5.1.1. United Arab Emirates (UAE)

9.5.1.2. Saudi Arabia

9.5.1.3. Qatar

9.5.1.4. Israel

9.5.1.5. South Africa

9.5.1.6. Nigeria

9.5.1.7. Kenya

9.5.1.8. Egypt

9.5.1.9. Rest of MEA

9.5.2. By END USE

9.5.3. By Application

9.5.4. By Product Type

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. HFC Refrigerants Market – Company Profiles – (Overview, Packaging Product Portfolio, Financials, Strategies & Developments)

10.1 Daikin Industries Ltd.

10.2 Honeywell International Inc.

10.3 The Chemours Company

10.4 Arkema S.A.

10.5 Dongyue Group

10.6 Asahi Glass Co., Ltd.

10.7 Linde plc

10.8 Sinochem Group

10.9 SRF Limited

10.10 Orbia Advance Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Particularly in developing countries going through fast urbanization and industrialization, commercial, industrial, and particularly residential sectors, the growth is powered by the rising need for refrigeration and air conditioning.

Strict environmental rules meant to lower greenhouse gas emissions are driving a phase-down of high-GWP HFCs, so encouraging a shift toward low-GWP substitutes and affecting market dynamics.

Options with lower GWP and more environmental friendliness include hydrofluoroolefins (HFOs) and natural refrigerants including ammonia (NH₃), carbon dioxide (CO₂), and hydrocarbons astral propane).

Rapid urbanization, industrialization, and rising use of refrigeration and air conditioning systems in nations like China and India should drive significant growth in the Asia-Pacific region.

More energy-efficient HVAC systems are being created thanks to technological innovations and smart technology is being adopted to minimize environmental effects and maximize refrigerant use.