Hemostats Market Size, Share, & Growth Analysis (2024 - 2030)

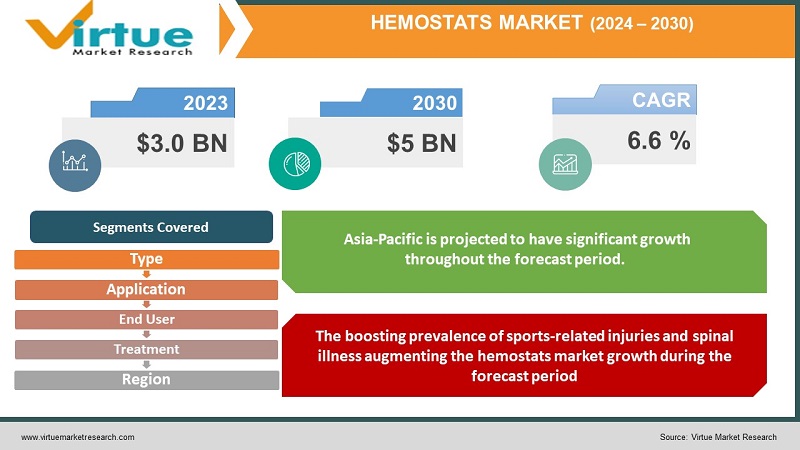

The global hemostats market size was worth USD 3.0 billion in 2023 and is expected to reach USD 5 billion by 2030 with a CAGR of 6.6% during the timeline period 2024 - 2030.

Hemostats are medical devices used to stop bleeding while performing surgeries. Hemostats are used in the early stages of surgery that closes blood vessels. Hemostats are used for both major and minor surgeries, emergencies, and other surgeries.

The novel coronavirus (COVID-19) originated from Wuhan China, in December 2018. The virus has spread globally affecting millions of lives and other businesses. During the pandemic period, hospitals beds were occupied with COVID patients resulting in leaving a negative impact on the hemostats market. During the lockdown, none of them moved out from their homes that have resulted low cases of accidents, injuries and more.

Market Drivers

Factors like rising number of surgical procedures executed, players focusing on research and development activities, and stimulating focus on blood loss management in patients throughout the surgery. The global hemostats market is driven by factors like increasing reimbursement policies and growing discretionary expenses.

The boosting prevalence of sports-related injuries and spinal illness augmenting the hemostats market growth during the forecast period. The number of hospitals number is increasing with the rising number of surgeries and patient population fueling the hemostats market growth globally.

Market Restrains

Factors like low or no knowledge of hemostat, the product cost is expensive, and stringent government regulations hinder the hemostat market growth across the period. The low doctor-patient ratio limits the hemostats market growth during the timeline period. In India, in April 2022, for every 10,189 people, there is only one government doctor, and the nurse:patient ratio is 1:483. The absence of trained and experienced professionals across developed and developing economies limits market growth.

HEMOSTATS MARKET REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 – 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2022 – 2030 |

|

Segments Covered |

By Type, Treatment, Application, End User, and Region |

|

Regions Covered |

North America, APAC, Europe, LATAM, MEA |

CLICK HERE TO DOWNLOAD SAMPLE

Segmentation Analysis

The global hemostats market has been segmented and sub-segmented according to the following categories:

Hemostats Market – By Type

- Active

- Thrombin Based Hemostat

- Bovine Thrombin

- Pooled Human Plasma Thrombin

- Recombinant Thrombin

- Passive

- Collagen Based Hemostats

- Microfibrillar Collagen Hemostat

- Absorbable Collagen Hemostat Sponge

- Oxidized Regenerated Cellulose

- Gelatins

- Polysacchride Hemospheres

- Flowable

- Bovine Gelatin + Pooled Human Thrombin

- Bovine Gelatin + Other Thrombin Products

- Others

- Sealants

- Fibrin Sealants

- Synthetic Sealants

- Others

- Adhesives

- Polyethylene Glycol Hydrogels (PEG)

- PEG + Trilysine Amine

- PEG + Human Serum Albumin

- Liquid Monomers

Hemostats Market - By Treatment

- Cardiac surgery

- Vascular procedures

- Soft tissue reconstructions

- Spinal procedures

- Hepatic resection

- Others

Hemostats Market - By Application

- Orthopedic Surgery

- General Surgery

- Neurological Surgery

- Cardiovascular Surgery

- Reconstructive Surgery

- Gynecological Surgery

- Other Surgeries

Hemostats Market - By End-User

- Hospitals

- Surgery Centres

- Nursing Homes

- Others

Regional Analysis

North America is dominating the hemostats market globally due to the increasing elderly population, and rising number of surgeries implemented in the region. The U.S. is dominating the hemostats market throughout the region. Canadian hemostats market is said to grow with considerable growth during the timeline period. On September 22, 2008, CryoLife Inc. disclosed its Hemostase MPH. The MPH is used to control bleeding during general, cardiac, and vascular surgery. It is mostly distributed in Canada over Sorin Group Canada Inc. For example, as per the American Heart Association 2022Heart Diseases and Stroke Statistics, around 1,016,000 cardiac catheterizations and 3,244 heart transplants were executed in the U.S.

Europe is the second most leading region in the global hemostats market. The region's growth owes to high expenditure on healthcare leads to increasing demand for advanced technological products and a high surge in the number of surgeries performed. Not less than 1.4 million cesarean sections were performed in the EU in 2017, as per the Surgical Operations and Procedure Statistics.

The hemostats market in Asia-Pacific is projected to have significant growth throughout the forecast period. Factors like the hiking patient population, and the growing number of new product launches boost the market growth in the region. The number of government hospitals has increased from 35,416 to 37,725 from 2017 to 2018, as per the Government of India, as per the Ministry of Health and Family Welfare. The hemostats market growth in Japan is owing to using the number of topical hemostats in surgeries.

Latin America is the second region to have quick growth in the hemostats market across the period. The market growth in the region owes to quick product launches together with rising mergers and acquisitions. The Brazilian hemostats market is likely to dominate during the forecast period.

The Middle East & African region for hemostats market is likely to have significant growth in the upcoming years. UAE, Israel, Africa, and the rest of the Middle East and Africa contribute a major share in the hemostats market.

Key Market Players

The major key players operating in the global hemostats market include Johnson & Johnson Services, Inc. (Ethicon LLC), GELITA MEDICAL, Z-Medica, BD, B. Braun Melsungen Ag, Baxter, Pfizer, Inc., Biom’up, Integra Lifesciences Holdings Corporation, LLC, and Teleflex Incorporated.

In 2018, in March, Axio Biosolutions Pvt Ltd has received the U.S FDA approval for Axiostat chitosan hemostatic dressing.

In March 2018, Baxter International closed the acquisition of hemostat and sealant assets from Mallinckrodt Pharmaceuticals.

Recent Market Developments

- On February 08, 2022, Z-Medica was acquired by Teleflex. Z-Medica has helped various sectors like hospitals, militaries, and consumers globally in saving their lives and develops medical results.

- On July 29, 2022, Baxter completed its acquisition of the PerClot Polysaccharide Hemostatic system from CryoLife, Inc.

Global Hemostats Market - Forecast (2024 - 2030)

Chapter 1. Hemostats Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Hemostats Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2024 - 2030

2.3.2. Impact on Supply – Demand

2.3.3. Impact on Production Cost

2.3.4. Impact on Supply Chain

Chapter 3. Hemostats Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Hemostats Market Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Hemostats Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Hemostats Market – By Type

6.1. Active

6.1.1. Thrombin Based Hemostat

6.1.2. Bovine Thrombin

6.1.3. Pooled Human Plasma Thrombin

6.1.4. Recombinant Thrombin

6.2. Passive

6.2.1. Collagen Based Hemostats

6.2.2. Microfibrillar Collagen Hemostat

6.2.3. Absorbable Collagen Hemostat Sponge

6.2.4. Oxidized Regenerated Cellulose

6.2.5. Gelatins

6.2.6. Polysacchride Hemospheres

6.3. Flowable

6.3.1. Bovine Gelatin + Pooled Human Thrombin

6.3.2. Bovine Gelatin + Other Thrombin Products

6.3.3. Others

6.4. Sealants

6.4.1. Fibrin Sealants

6.4.2. Synthetic Sealants

6.4.3. Others

6.5. Adhesives

6.5.1. Polyethylene Glycol Hydrogels (PEG)

6.5.2. PEG + Trilysine Amine

6.5.3. PEG + Human Serum Albumin

6.5.4. Liquid Monomers

Chapter 7. Hemostats Market - By Treatment

7.1. Cardiac surgery

7.1.2. Vascular procedures

7.1.3. Soft tissue reconstructions

7.1.4. Spinal procedures

7.1.5. Hepatic resection

7.1.6. Others

Chapter 9. Hemostats Market - By Application

9.1. Orthopedic Surgery

9.2. General Surgery

9.3. Neurological Surgery

9.4. Cardiovascular Surgery

9.5. Reconstructive Surgery

9.6. Gynecological Surgery

9.7. Other Surgeries

Chapter 10. Hemostats Market - By End-User

10.1. Hospitals

10.2. Surgery Centres

10.3. Nursing Homes

10.4. Others

Chapter 11. Hemostats Market , By Geography – Market Size, Forecast, Trends & Insights

11.1. North America

11.1.1. U.S.A

11.1.2. Canada

11.1.3. Mexico

11.2. Europe

11.2.1. Italy

11.2.2. Spain

11.2.3. Russia

11.2.4. Germany

11.2.5. UK

11.2.6. France

11.2.7. Rest of Europe

11.3. Asia Pacific

11.3.1. Japan

11.3.2. South Korea

11.3.3. China

11.3.4. India

11.3.5. Australia & New Zealand

11.3.6. Rest of Asia-Pacific

11.4. Rest of the World

11.4.1. Middle East

11.4.2. Africa

11.4.3. South America

Chapter 11. Hemostats Market – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

11.1. Company 1

11.2. Company 2

11.3. Company 3

11.4. Company 4

11.5. Company 5

11.6. Company 6

11.7. Company 7

11.8. Company 8

11.9. Company 9

11.10. Company 10

Download Sample

Choose License Type

2500

4250

5250

6900