Hemodynamic Monitoring Systems Market Size (2024 – 2030)

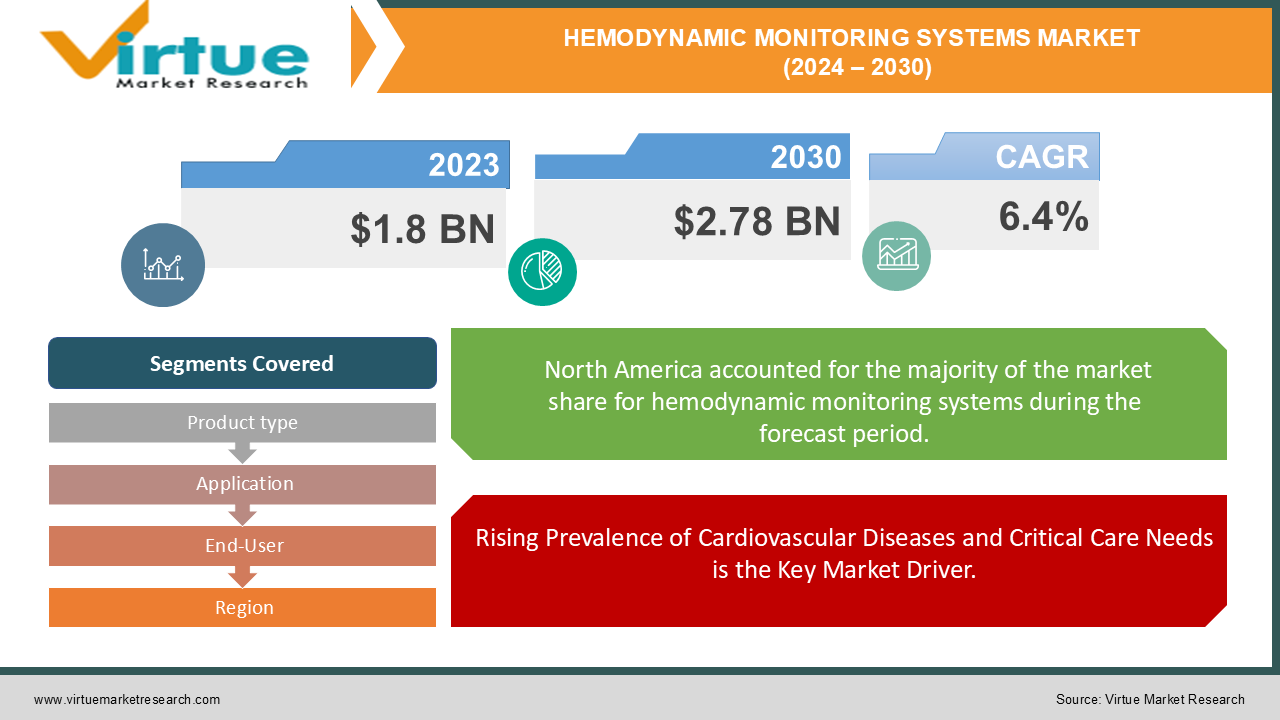

The Global Hemodynamic Monitoring Systems Market was valued at USD 1.8 billion in 2023 and is projected to reach a market size of USD 2.78 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 6.4% between 2024 and 2030.

The Global Hemodynamic Monitoring Systems Market is witnessing significant growth driven by increasing incidences of cardiovascular diseases, rising geriatric populations, and the growing need for critical care. Hemodynamic monitoring systems provide real-time measurements of cardiovascular parameters, enabling healthcare professionals to assess heart function and blood flow dynamics accurately. These systems play a crucial role in managing patients in intensive care units (ICUs), operating rooms, and emergency departments. Technological advancements, including the integration of minimally invasive and non-invasive monitoring techniques, have enhanced the precision and ease of use of these systems. Additionally, the adoption of electronic medical records and telemedicine solutions further supports the demand for remote hemodynamic monitoring. With rising healthcare expenditures and an increasing focus on patient safety, both developed and developing regions are seeing a surge in the utilization of these systems. Moreover, the COVID-19 pandemic has amplified the importance of monitoring critically ill patients, boosting market expansion. As healthcare infrastructure improves globally, the demand for reliable, real-time monitoring devices is expected to grow, positioning the hemodynamic monitoring systems market for sustained growth in the coming years.

Key Market Insights:

-

Non-invasive hemodynamic monitoring systems are expected to witness a growth rate of 7.5% CAGR by 2028.

-

The Asia-Pacific region is anticipated to register the fastest growth at a 9% CAGR, driven by increasing healthcare infrastructure development.

-

Hospitals account for over 60% of the end-user demand in the hemodynamic monitoring systems market.

-

80% of critical care patients require hemodynamic monitoring for effective management.

-

The global prevalence of cardiovascular diseases is contributing to a projected market growth of 6.8% CAGR from 2024 to 2030.

-

Portable monitoring systems are gaining traction, with an estimated annual growth of 8.3% due to rising demand for point-of-care devices.

-

North America holds the largest market share, approximately 35%, due to advanced healthcare infrastructure and high adoption of innovative technologies.

Global Hemodynamic Monitoring Systems Market Drivers:

Rising Prevalence of Cardiovascular Diseases and Critical Care Needs is the Key Market Driver.

The increasing incidence of cardiovascular diseases (CVDs) globally is a key driver of the Global Hemodynamic Monitoring Systems Market. As CVDs remain the leading cause of mortality worldwide, healthcare providers are focusing on improving the management of heart conditions. Hemodynamic monitoring systems provide critical real-time data on blood pressure, cardiac output, and other vital parameters, enabling healthcare professionals to make timely and accurate decisions, particularly in critical care settings such as intensive care units (ICUs) and emergency departments. The growing aging population, which is more susceptible to CVDs and other chronic conditions, is further driving the demand for these systems, emphasizing the need for continuous and precise patient monitoring.

Technological Advancements in Non-Invasive Monitoring Techniques Reevolutionizing the Market Growth.

Technological advancements in non-invasive and minimally invasive hemodynamic monitoring techniques are significantly contributing to market growth. Non-invasive systems offer safer, more comfortable options for patients while providing accurate and continuous data, making them increasingly preferred over traditional invasive methods. These innovations, such as the development of wearable devices and portable hemodynamic monitors, are enabling healthcare professionals to monitor patients more effectively, even in outpatient or remote settings. The integration of artificial intelligence and machine learning in these systems enhances data interpretation, further driving their adoption across hospitals and healthcare facilities globally.

Global Hemodynamic Monitoring Systems Market Restraints and Challenges:

The Global Hemodynamic Monitoring Systems Market faces several restraints and challenges that could hinder its growth trajectory despite its promising potential. One of the primary challenges is the high cost associated with advanced hemodynamic monitoring devices, which can limit their adoption, particularly in developing countries with constrained healthcare budgets. Many hospitals and healthcare facilities, especially in low-income regions, struggle to afford these systems, affecting their widespread use. Additionally, the complexity of operating these systems requires specialized training for healthcare professionals, which adds another layer of cost and may lead to reluctance in adopting these technologies. Furthermore, the risk of infections associated with invasive monitoring techniques presents a significant barrier, particularly in settings with inadequate infection control measures. Regulatory hurdles and stringent approval processes for new technologies also pose challenges for manufacturers, potentially delaying the launch of innovative products. Non-invasive systems, while growing in popularity, still face skepticism from some healthcare professionals regarding their accuracy compared to invasive methods. These factors, combined with concerns over patient safety and the need for continuous technological improvements, contribute to the market's restraints and challenges, which need to be addressed for sustained growth in the coming years.

Global Hemodynamic Monitoring Systems Market Opportunities:

The Global Hemodynamic Monitoring Systems Market presents numerous opportunities for growth, driven by advancements in healthcare technology and the increasing focus on personalized medicine. One of the most significant opportunities lies in the rising adoption of non-invasive and portable monitoring devices. As healthcare providers seek to enhance patient comfort while maintaining accurate data collection, these innovations are gaining traction. The shift towards outpatient and home-based care, particularly for patients with chronic conditions, also offers a promising avenue for expanding the market. Additionally, the integration of artificial intelligence (AI) and machine learning (ML) into hemodynamic monitoring systems is opening doors for improved data analysis and predictive analytics, allowing healthcare professionals to make faster, more informed decisions. Emerging markets, especially in Asia-Pacific and Latin America, are seeing rapid improvements in healthcare infrastructure, creating a favorable environment for the adoption of advanced monitoring technologies. The growing trend towards telemedicine and remote patient monitoring further boosts demand, as real-time hemodynamic data becomes essential in managing patients from a distance. Moreover, increasing awareness of the importance of early detection and monitoring of cardiovascular diseases is expected to drive the market, offering manufacturers and technology providers a significant opportunity for product innovation and market expansion.

HEMODYNAMIC MONITORING SYSTEMS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.4% |

|

Segments Covered |

By Product type, Application, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Edwards Lifesciences Corporation, GE Healthcare, Philips Healthcare, ICU Medical, Inc., Baxter International Inc., Schwarzer Cardiotek GmbH, PULSION Medical Systems SE, LiDCO Group PLC, Deltex Medical Group PLC, CNSystems Medizintechnik AG |

Global Hemodynamic Monitoring Systems Market Segmentation: By Product Type

-

Classic Monitoring

-

Advanced Monitoring

In 2023, based on market segmentation by Product Type, Classic Monitoring had the highest share of the Global Hemodynamic Monitoring Systems Market. Established standards play a crucial role in the Global Hemodynamic Monitoring Systems Market, as healthcare professionals are well-acquainted with traditional methods and trust their reliability. In critical care environments, the detailed data provided by invasive monitoring systems remains indispensable, allowing for precise and immediate insights into patients' cardiovascular status. Although newer technologies may present higher upfront costs, traditional methods often prove to be more cost-effective in the long term due to their established reliability and lower maintenance requirements. However, the market is evolving rapidly, with significant advancements in non-invasive technologies that are gradually gaining traction. As these non-invasive solutions improve in accuracy and affordability, their market share is expected to increase, offering viable alternatives to traditional methods. It's important to note that market dynamics can vary significantly by region and healthcare setting, with some areas seeing faster adoption of innovative technologies due to better infrastructure and funding. As the healthcare industry continues to prioritize patient safety and comfort, the shift towards more advanced monitoring solutions is likely to reshape the landscape of hemodynamic monitoring systems in the coming years.

Global Hemodynamic Monitoring Systems Market Segmentation: By Application

-

Critical Care

-

Cardiology

-

Anesthesiology

In 2023, based on market segmentation by Application, Critical Care had the highest share of the Global Hemodynamic Monitoring Systems Market. Intensive care units (ICUs) often manage patients with complex medical conditions that necessitate close monitoring of hemodynamic parameters, such as blood pressure, heart rate, cardiac output, and oxygenation. The prevalence of critical illnesses like heart failure, sepsis, and respiratory failure is strongly associated with hemodynamic instability, making the use of hemodynamic monitoring systems essential for effective management. These systems provide critical real-time data that help healthcare professionals assess and address the fluctuating conditions of critically ill patients. Recent advancements in hemodynamic monitoring technologies, including more reliable and user-friendly continuous cardiac output (CCO) monitoring systems, have significantly enhanced their utility in critical care settings. These innovations facilitate better patient management by providing accurate, continuous insights into cardiovascular function. While hemodynamic monitoring is also vital in fields such as cardiology and anesthesiology, the critical care setting experiences a higher demand for these systems due to the severity of patient conditions and the necessity for frequent, detailed monitoring. This heightened demand underscores the importance of ongoing technological improvements and the pivotal role of hemodynamic monitoring in managing severe and unstable patient conditions.

Global Hemodynamic Monitoring Systems Market Segmentation: By End-User

-

Hospitals

-

Ambulatory Care Centers

In 2023, based on market segmentation by End-User, Hospitals had the highest share of the Global Hemodynamic Monitoring Systems Market. Hospitals, particularly those equipped with specialized critical care units such as ICUs and emergency departments, experience a high demand for hemodynamic monitoring systems due to the complex and severe conditions of their patients. These units are tasked with managing individuals who require meticulous monitoring of their cardiovascular function to ensure stability and guide treatment decisions. Additionally, hemodynamic monitoring is crucial during various surgical procedures, allowing for real-time assessment of a patient's stability both during and after surgery. Hospitals also utilize these systems for diagnostic procedures, including cardiac catheterization and echocardiograms, to evaluate cardiovascular health comprehensively. The diverse patient populations treated in hospitals, including those with chronic conditions needing continuous monitoring, further drive the need for advanced hemodynamic monitoring solutions. While other healthcare settings, such as ambulatory care centers and home healthcare providers, may also use these systems, hospitals generally exhibit a higher demand due to the complexity of the cases they handle and the extensive range of services they offer. This high demand underscores the essential role of hemodynamic monitoring in providing critical care and supporting complex medical interventions in hospital environments.

Global Hemodynamic Monitoring Systems Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

In 2023, based on market segmentation by Region, North America had the highest share of the Global Hemodynamic Monitoring Systems Market. North America, particularly the United States, holds a dominant position in the Global Hemodynamic Monitoring Systems Market due to several key factors. The region boasts an advanced healthcare infrastructure with numerous hospitals, specialized clinics, and research institutions, which facilitates the widespread adoption and use of hemodynamic monitoring systems. The high prevalence of chronic diseases, such as heart disease, diabetes, and obesity, drives the need for continuous cardiovascular monitoring, further fueling demand for these systems. North America is also at the forefront of technological advancements in the healthcare sector, including the development and integration of innovative hemodynamic monitoring solutions. The supportive regulatory environment in the region, especially in the United States, promotes medical device innovation and facilitates the introduction of new technologies into the market. Although other regions, such as Europe and Asia-Pacific, have also experienced growth in the hemodynamic monitoring market, North America's combination of advanced infrastructure, high disease prevalence, technological leadership, and favorable regulatory conditions significantly contributes to its leading market position. This comprehensive support network ensures that North America remains a key player in the development and deployment of cutting-edge hemodynamic monitoring technologies.

COVID-19 Impact Analysis on the Global Hemodynamic Monitoring Systems Market.

The COVID-19 pandemic had a profound impact on the Global Hemodynamic Monitoring Systems Market, both positively and negatively. On one hand, the pandemic significantly increased the demand for critical care equipment, including hemodynamic monitoring systems, due to the surge in hospitalizations of severely ill patients. COVID-19, known for causing respiratory and cardiovascular complications, heightened the need for real-time cardiovascular monitoring, particularly in intensive care units (ICUs). This led to a rapid adoption of advanced monitoring systems to ensure precise, continuous tracking of patients' heart and blood flow parameters. Additionally, the pandemic accelerated the shift towards remote and non-invasive monitoring solutions as hospitals sought to reduce direct patient contact to minimize infection risks. On the other hand, the pandemic disrupted global supply chains, leading to shortages of medical equipment and delaying the production and delivery of monitoring systems. Healthcare budgets were also strained, with resources being diverted to COVID-related treatments, impacting the procurement of new devices. Moreover, elective procedures and non-emergency healthcare services were postponed, reducing the demand for these systems in non-critical care settings. Overall, while the pandemic boosted short-term demand for hemodynamic monitoring systems, it also highlighted challenges in supply and infrastructure that will need to be addressed in the future.

Latest trends / Developments:

The Global Hemodynamic Monitoring Systems Market is witnessing several emerging trends and developments, primarily driven by advancements in technology and the evolving needs of healthcare systems. A key trend is the growing preference for non-invasive and minimally invasive monitoring techniques, as they offer safer, more comfortable options for patients without compromising accuracy. These technologies are gaining widespread adoption in both hospitals and outpatient settings, particularly as healthcare providers focus on improving patient outcomes while reducing complications associated with invasive procedures. Another major development is the integration of artificial intelligence (AI) and machine learning (ML) into monitoring systems, enabling enhanced data analysis, predictive capabilities, and early detection of critical health issues. AI-driven analytics are helping healthcare professionals make more informed decisions, particularly in critical care environments. Additionally, portable and wearable hemodynamic monitoring devices are gaining popularity, driven by the rise of telemedicine and remote patient monitoring, which became increasingly important during the COVID-19 pandemic. These devices allow for continuous real-time monitoring, even in home-based care settings. Furthermore, the push towards personalized medicine is driving the demand for tailored hemodynamic monitoring solutions, enabling more precise treatment plans based on individual patient data. These trends are shaping the future of the market, positioning it for sustained growth and innovation.

Key Players:

-

Edwards Lifesciences Corporation

-

GE Healthcare

-

Philips Healthcare

-

ICU Medical, Inc.

-

Baxter International Inc.

-

Schwarzer Cardiotek GmbH

-

PULSION Medical Systems SE

-

LiDCO Group PLC

-

Deltex Medical Group PLC

-

CNSystems Medizintechnik AG

Chapter 1. Hemodynamic Monitoring Systems Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Hemodynamic Monitoring Systems Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Hemodynamic Monitoring Systems Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Hemodynamic Monitoring Systems Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Hemodynamic Monitoring Systems Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Hemodynamic Monitoring Systems Market – By Product Type

6.1 Introduction/Key Findings

6.2 Classic Monitoring

6.3 Advanced Monitoring

6.4 Y-O-Y Growth trend Analysis By Product Type

6.5 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Hemodynamic Monitoring Systems Market – By Application

7.1 Introduction/Key Findings

7.2 Critical Care

7.3 Cardiology

7.4 Anesthesiology

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Hemodynamic Monitoring Systems Market – By End-User

8.1 Introduction/Key Findings

8.2 Hospitals

8.3 Ambulatory Care Centers

8.4 Y-O-Y Growth trend Analysis By End-User

8.5 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 9. Hemodynamic Monitoring Systems Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By Application

9.1.4 By End-User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By Application

9.2.4 By End-User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By Application

9.3.4 By End-User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By Application

9.4.4 By End-User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By Application

9.5.4 By End-User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Hemodynamic Monitoring Systems Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Edwards Lifesciences Corporation

10.2 GE Healthcare

10.3 Philips Healthcare

10.4 ICU Medical, Inc.

10.5 Baxter International Inc.

10.6 Schwarzer Cardiotek GmbH

10.7 PULSION Medical Systems SE

10.8 LiDCO Group PLC

10.9 Deltex Medical Group PLC

10.10 CNSystems Medizintechnik AG

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

By 2023, the Global Hemodynamic Monitoring Systems market is expected to be valued at US$ 1.8 billion.

Through 2030, the Global Hemodynamic Monitoring Systems market is expected to grow at a CAGR of 6.4%.

By 2030, the Global Hemodynamic Monitoring Systems Market is expected to grow to a value of US$ 2.78 billion.

North America is predicted to lead the Global Hemodynamic Monitoring Systems market.

The Global Hemodynamic Monitoring Systems Market has segments by product type, end-user, application, and region.