Hemodialysis Market Size (2024 –2030)

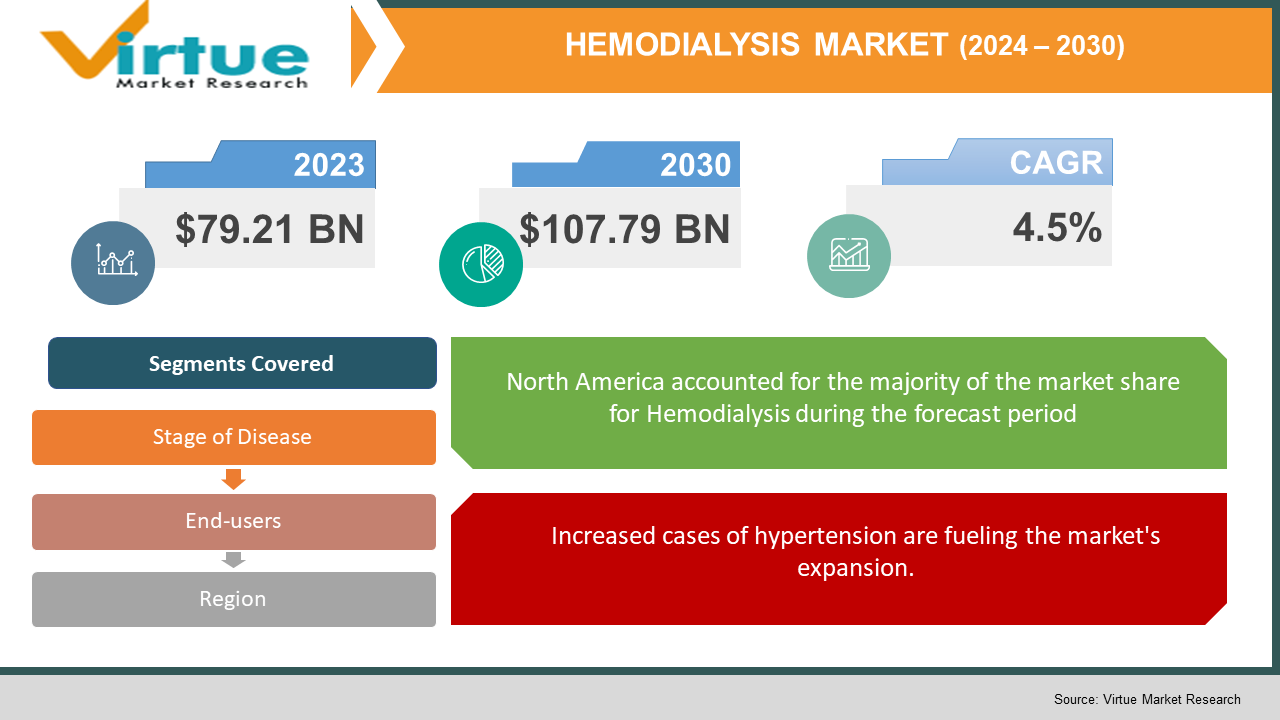

The Global Hemodialysis Market was valued at USD 79.21 Billion in 2023 and is projected to reach a market size of USD 107.79 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.5%.

Because more people are experiencing kidney problems as a result of diseases like diabetes and high blood pressure, the global hemodialysis market is expanding. When the kidneys are unable to adequately filter a patient's blood, hemodialysis is a treatment that can help. For many patients with severe kidney problems, hemodialysis is essential because there aren't enough donor kidneys available. Hemodialysis is a useful treatment, but there are drawbacks as well, such as fatigue in patients, excessive expenses, and side effects. Innovative and more efficient hemodialysis techniques are being developed to address these problems. Traditional hemodialysis techniques and the treatment of chronic kidney disease (CKD) account for the majority of the market. However, there's also an increasingly common trend of hemodialysis being done at home. In this market, North America is at the forefront, but the Asia-Pacific area is rapidly catching up. The COVID-19 pandemic has altered the way things are done, encouraging more people to use telehealth services and driving a more digital transformation in the hemodialysis industry. Because more people are experiencing kidney problems as a result of diseases like diabetes and high blood pressure, the global hemodialysis market is expanding. If left untreated, these illnesses can harm the kidneys and necessitate hemodialysis or other forms of treatment. Hemodialysis is required in large part due to End-Stage Renal Disease (ESRD), a condition in which the kidneys fail totally. Hemodialysis is an essential treatment to keep patients alive while they wait for a transplant because there aren't enough donor kidneys available for transplants. Although hemodialysis is effective, there are drawbacks. Patients may be at risk for infections or have adverse effects such as low blood pressure. It's also pricey, coming in at roughly $72,000 annually. Therefore, more effective and reasonably priced hemodialysis methods are required. Hemodialysis is becoming more efficient thanks to technology, but not everyone can always take advantage of these developments. Therefore, it's critical to find ways to increase the accessibility of these new technologies for hemodialysis in the future.

Key Market Insights:

- The global hemodialysis market is estimated to be around $79 billion in value, driven by the increasing prevalence of chronic kidney diseases and the growing aging population.

- North America accounts for nearly 35% of the global hemodialysis market share, attributed to the well-established healthcare infrastructure, high healthcare expenditure, and the presence of major market players in the region.

- The hemodialysis products segment holds a market share of over 60% in the hemodialysis market, which includes dialysis machines, dialyzers, bloodlines, and other consumables.

- The in-center hemodialysis services segment contributes to around 55% of the overall hemodialysis market, driven by the availability of specialized facilities and trained medical personnel.

- The home hemodialysis segment is expected to grow at a rate of around 8% annually, driven by the increasing preference for home-based treatments, cost-effectiveness, and the development of user-friendly dialysis systems.

Global Hemodialysis Market Drivers:

Increased cases of hypertension are fueling the market's expansion.

An increasing number of people are developing high blood pressure, particularly renal hypertension, which damages the kidneys. A narrowing of the arteries that supply the kidneys causes an increase in blood pressure. This increases the strain on the kidneys, increasing the need for hemodialysis and other treatments.

Diabetes prevalence is driving market growth.

If diabetes is not properly controlled, it can damage the kidneys' blood vessels, which can cause high blood pressure and kidney problems. Hemodialysis, a treatment for kidney problems, is becoming more and more necessary as diabetes affects more people worldwide.

Hemodialysis Services are Persistently Driven by End-Stage Renal Disease (ESRD).

The condition known as end-stage renal disease (ESRD) occurs when the kidneys fail totally. Many people with end-stage renal disease (ESRD) depend on long-term dialysis or kidney transplants to survive. This is the reason why hemodialysis, which treats kidney issues, is becoming more and more necessary.

The market is expanding in part because of the scarcity of kidney transplants.

Hemodialysis is crucial because there aren't enough donor kidneys available to meet the needs of everyone who needs one. There is a shortage of kidney donors despite the high demand for transplants. Hemodialysis thus aids in these patients' survival while they await a transplant.

Hemodialysis Market Challenges and Restraints:

Although hemodialysis is a useful treatment, there are issues with it. Patients may experience fatigue, infections, or joint and bone pain. It's also pricey; in the US, it costs roughly $72,000 annually. Both patients and healthcare systems may bear a heavy burden from this expense. The difficulties are increased by the fact that many patients experience fatigue and discomfort following hemodialysis sessions. Of the patients, about 43% say they are tired. It's critical to identify strategies for raising their standard of living and facilitating more comfortable treatment. While new technologies such as Remote Patient Management (RPM) have the potential to improve care, accessibility must be ensured. The hemodialysis market must overcome the challenge of striking a balance between utilizing new technology and making it available to everyone.

Hemodialysis Market Opportunities:

The hemodialysis market offers numerous chances for expansion and enhancement. Technological developments can result in improved kidney disease treatment machines and equipment, which will facilitate patient access to care. There is an opportunity to develop smaller, more user-friendly hemodialysis equipment because more people are opting to perform their treatments at home. Customizing treatment regimens to meet the specific needs of each patient can also have a significant impact on their outcome. Early detection of kidney problems is crucial, so tools and programs that support this process have a place. More people can receive the care they require with the aid of telemedicine, particularly in areas where access to medical professionals is limited. Expanding into new markets and providing more options for hemodialysis is a possibility for companies. Increasing the supply chain's efficiency can help ensure that there is an adequate supply of supplies and equipment. Patient care can be enhanced by integrating digital health tools and lowering the cost of hemodialysis. Lastly, collaborating with various businesses and organizations can advance work and generate fresh perspectives.

HEMODIALYSIS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.5% |

|

Segments Covered |

By Stage of Disease, End-users, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Fresenius, DaVita Inc, Baxter & Gambro, B. Braun, Dickinson and Company, NxStage, Nikkiso, Cantel Medical Corp, Toray, Nipro Inc. |

Global Hemodialysis Market Segmentation: By Stage of Disease

-

Chronic Kidney Disease (CKD)

-

End-Stage Renal Disease (ESRD)

-

Others

Hemodialysis patients with Chronic Kidney Disease (CKD) make up the majority of the market. This is because hemodialysis can help patients with early-stage kidney problems by delaying the progression of their illness, which is a common condition. More people are taking action to identify kidney health issues early on and are becoming aware of them. In this market, end-stage renal disease (ESRD) is becoming more common. This is due to the fact that severe kidney problems are becoming more common, particularly in older adults. Treatments such as kidney transplants or long-term dialysis are therefore more necessary. As more people become aware of the significance of treating advanced kidney problems, this segment of the market is expanding.

Global Hemodialysis Market Segmentation: By End-users

-

Conventional Hemodialysis (In-center Hemodialysis)

-

Home Hemodialysis

-

Others

Conventional Hemodialysis is the type of hemodialysis that is typically provided at specialized centers. This is because patients trust the professionals at these centers to take care of them, and it's the standard method of administering hemodialysis. However, home hemodialysis—hemodialysis performed at home—is gaining popularity. This is a result of people's preference for the more flexible and convenient setting of receiving treatment at home. Thus, the market for this kind of hemodialysis is expanding swiftly.

Global Hemodialysis Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

An enormous portion of the global hemodialysis market is based in North America, particularly in the United States. This is a result of their robust healthcare system, high kidney disease prevalence, and heavy investment in advanced medical technology. The global hemodialysis market is shaped in large part by the United States. India in particular is experiencing rapid growth in the hemodialysis market in the Asia-Pacific region. This is a result of increased population and growing awareness of kidney health. Additionally, as the economy grows and the healthcare system improves, more people will be able to afford hemodialysis treatment.

COVID-19 Impact on the Global Hemodialysis Market:

The COVID-19 pandemic altered hemodialysis's functioning. People missed appointments because they were afraid to visit hospitals. To assist, physicians began to monitor patients remotely through telehealth. Hemodialysis at home has also become more popular as an alternative to hospitals. Companies produced simpler-to-use devices for household use in response to this demand. Lockdowns and transportation problems also made it difficult to obtain supplies. Companies started looking for new suppliers and producing goods locally to address this. Governments supported healthcare systems and provided patients with financial aid. Another benefit of telemedicine was that it lessened the need for expensive hospital stays. The pandemic increased digitalization in healthcare. To better care for their patients, doctors began utilizing digital tools and remote monitoring. This will probably remain the same, giving patients easier access to and management of hemodialysis.

Latest Trend/Development:

These days, hemodialysis providers are putting more of an emphasis on customizing treatments and making them patient-centered. This indicates that they are taking into account the patient's preferences for their course of care as well as their lifestyle and any other potential health concerns. Ensuring that patients achieve better outcomes, adhere to their treatment plans, and are satisfied with the care they receive are the main objectives. The practice of hemodialysis is also evolving due to new technologies. For instance, doctors can now use gadgets to remotely monitor their patient's health in real-time from the comfort of their own homes. This enables them to swiftly modify treatment plans to better suit the needs of each patient. Additionally, there's a trend toward early detection of kidney issues and stopping their progression. This entails detecting and treating kidney problems before they worsen. Patients' lives are improved and the strain on healthcare systems is reduced as a result. More healthcare providers are utilizing telehealth as a result of COVID-19. This implies that patients won't need to visit the hospital to schedule checkups and appointments with their physicians. It ensures that patients receive the necessary care while also helping to keep them safe.

Key Players:

-

Fresenius

-

DaVita Inc

-

Baxter & Gambro

-

B. Braun

-

Dickinson and Company

-

NxStage

-

Nikkiso

-

Cantel Medical Corp

-

Toray

-

Nipro Inc.

Market News:

-

In April 2023, M42, an Abu Dhabi-based company that leverages technology to enhance healthcare, acquired Diaverum, a large healthcare organization. With this transaction, M42 became the largest healthcare provider in the Middle East.

-

A different healthcare business called Rockwell Medical, Inc. purchased a portion of Evoqua Water Technologies in July 2023. The company produces supplies for hemodialysis, a treatment for kidney issues.

Chapter 1. Hemodialysis Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Hemodialysis Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Hemodialysis Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Hemodialysis Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Hemodialysis Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Hemodialysis Market – By Stage of Disease

6.1 Introduction/Key Findings

6.2 Chronic Kidney Disease (CKD)

6.3 End-Stage Renal Disease (ESRD)

6.4 Others

6.5 Y-O-Y Growth trend Analysis By Stage of Disease

6.6 Absolute $ Opportunity Analysis By Stage of Disease, 2024-2030

Chapter 7. Hemodialysis Market – By End-users

7.1 Introduction/Key Findings

7.2 Conventional Hemodialysis (In-center Hemodialysis)

7.3 Home Hemodialysis

7.4 Others

7.5 Y-O-Y Growth trend Analysis By End-users

7.6 Absolute $ Opportunity Analysis By End-users, 2024-2030

Chapter 8. Hemodialysis Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Stage of Disease

8.1.3 By End-users

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Stage of Disease

8.2.3 By End-users

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Stage of Disease

8.3.3 By End-users

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Stage of Disease

8.4.3 By End-users

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Stage of Disease

8.5.3 By End-users

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Hemodialysis Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Fresenius

9.2 DaVita Inc

9.3 Baxter & Gambro

9.4 B. Braun

9.5 Dickinson and Company

9.6 NxStage

9.7 Nikkiso

9.8 Cantel Medical Corp

9.9 Toray

9.10 Nipro Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Hemodialysis Market was valued at USD 79.21 billion in 2023 and is projected to reach a market size of USD 107.79 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.5%.

The Global Hemodialysis Market is primarily driven by the rising cases of hypertension, the prevalence of diabetes, the persistent demand stemming from End-Stage Renal Disorder (ESRD), and the shortage of available kidney transplants.

The segments under the Global Hemodialysis Market By End Users include Conventional Hemodialysis (In-center Hemodialysis), Home Hemodialysis, and Others.

North America is the most dominant region for the Global Hemodialysis Market.

The leading players in the Global Hemodialysis Market include Fresenius, DaVita Inc., Baxter & Gambro, B. Braun, Dickinson and Company, NxStage, Nikkiso, Cantel Medical Corp, Toray, and Nipro Inc.