Heavy Payload Robotic Arm Market Size (2024 – 2030)

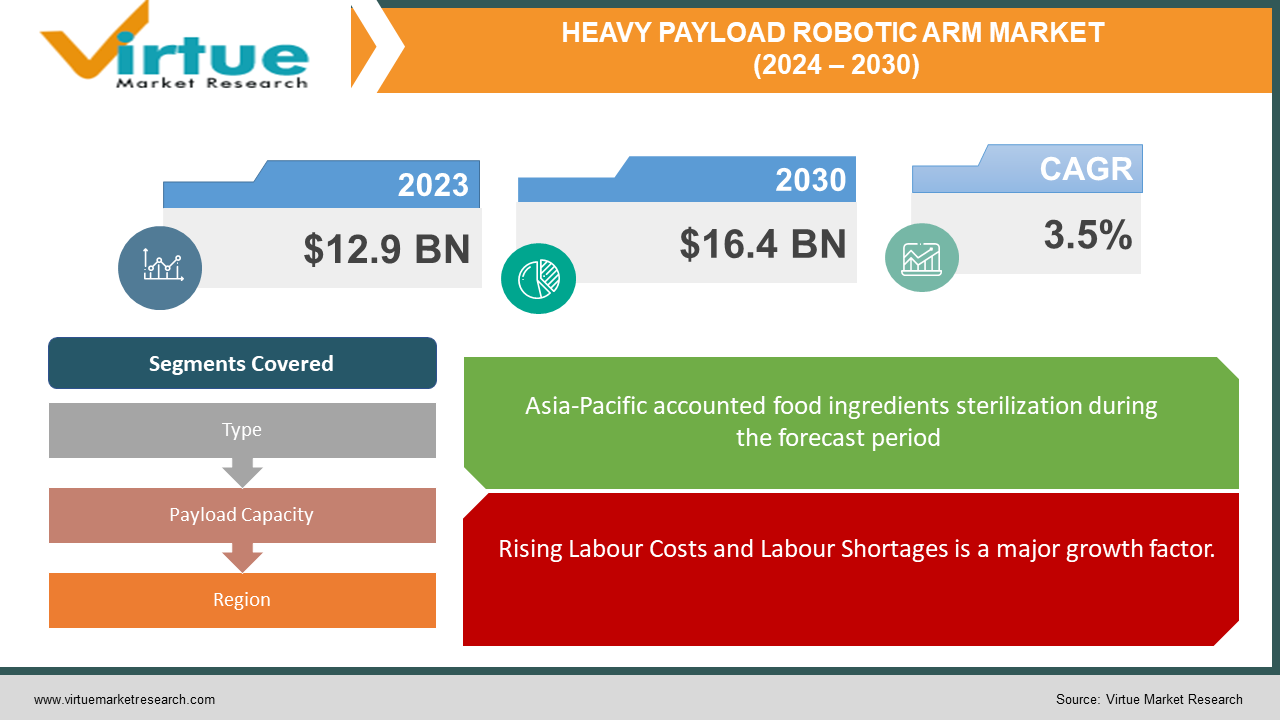

The Global Heavy Payload Robotic Arm Market was valued at USD 12.9 billion in 2023 and is projected to reach a market size of USD 16.4 billion by the end of 2030. Over the forecast period of 2024-2030, the market is expected to grow at a CAGR of 3.5%.

Key Market Insights:

According to region, the Asia Pacific region is expected to remain the dominant market for heavy payload robotic arms throughout the forecast period. This is primarily due to the rapid industrialization and growth of the automotive and manufacturing sectors in countries like China, India, and Japan. This growth is further fuelled by government initiatives promoting automation and robotics in these countries.

The market is witnessing advancements in technologies like lightweight materials, improved sensor integration, and enhanced control systems. These advancements are leading to the development of more efficient, versatile, and user-friendly heavy payload robotic arms. Additionally, the integration of Artificial Intelligence (AI) is enabling these robots to perform more complex tasks with greater precision and autonomy. This trend is expected to further accelerate the adoption of heavy payload robotic arms across various industries.

Market Drivers:

Rising Labour Costs and Labour Shortages is a major growth factor.

Manufacturing and other industries utilizing heavy payload tasks are facing increasing labor costs and difficulty finding skilled workers. Heavy payload robotic arms offer a solution by automating these tasks, reducing reliance on human labor and associated costs.

Growing Focus on Safety and Worker Wellbeing is driving the market growth

Heavy payload manipulation can be dangerous and lead to worker injuries. Heavy payload robotic arms can take over these tasks, improving workplace safety and reducing the risk of injuries. The market growth is driven by the need for improved worker safety, alongside factors like increasing automation.

E-commerce Boom and Demand for Efficient Logistics is giving market a boost.

The e-commerce industry's rapid growth necessitates efficient and fast-paced logistics operations. Heavy payload robotic arms are increasingly deployed in warehouses and distribution centers for tasks like palletizing, loading, and unloading goods. The rising demand for service robots in logistics due to e-commerce growth is a significant driver for the market.

Market Restraints and Challenges:

High Initial Investment Costs is a challenge for the market

Heavy payload robotic arms are complex machines requiring advanced materials and engineering. This translates to a significant initial investment cost for companies considering deploying them. The high initial cost is a major restraining factor for the wider adoption of heavy payload robotic arms, particularly for small and medium-sized enterprises (SMEs).

Integration and Programming Complexity is a major challenge

Implementing heavy payload robotic arms requires integration with existing infrastructure and programming for specific tasks. This process can be complex and require specialized expertise, posing a challenge for companies lacking the in-house knowledge or resources. This as a hurdle, highlighting the need for user-friendly programming interfaces and simplified integration processes for broader market acceptance.

Safety Concerns and Regulations is restricting the market growth

The deployment of heavy payload robotic arms necessitates strict safety measures to prevent accidents and injuries. Furthermore, evolving safety regulations need to be constantly monitored and adhered to. Complying with safety regulations and ensuring worker safety during operation remain significant challenges for the heavy payload robotic arm market.

Market Opportunities:

Collaboration with Robotics-as-a-Service (RaaS) Providers is opening new doors for the market

The high upfront cost of heavy payload robotic arms can be a barrier for some companies. The emergence of Robotics-as-a-Service (RaaS) models presents a significant opportunity. RaaS providers offer subscription-based access to robotic equipment, including heavy payload arms. This allows companies to leverage the benefits of automation without a large upfront investment. Heavy payload robots will witness a significant growth due to their increasing affordability through this model.

Focus on Niche Applications and Customization is a major opportunity

While heavy payload robotic arms are finding use in established industries like automotive and manufacturing, there's potential for growth in specialized applications. Industries like renewable energy, construction, and shipbuilding can benefit from customized heavy payload robotic solutions designed for their specific needs. By focusing on niche applications and customization, robotic arm manufacturers can tap into new markets and drive further growth.

HEAVY PAYLOAD ROBOTIC ARM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.5% |

|

Segments Covered |

By Type, Payload Capacity, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

The ABB Ltd., Ellison Technologies Inc. (Mitsui & Co., Ltd.), FANUC Corporation, Kawasaki Heavy Industries Ltd., KUKA AG (Midea Group), Nachi-Fujikoshi Corp., Stellantis N.V., Vulcan Engineering Co., Yaskawa Electric Corporation |

Heavy Payload Robotic Arm Market Segmentation: By Type

-

Articulated

-

Cartesian

-

SCARA

-

Cylindrical

-

Others

Articulated robots are anticipated to hold the dominant position within the heavy payload robotic arm market due to their versatility and ability to manoeuvre along multiple axes. This allows them to perform a wide range of tasks, from complex assembly lines in automotive manufacturing to material handling in construction. This dominance is further bolstered by continuous advancements in joint technologies and lightweight materials, making articulated robots more efficient and easier to integrate.

However, other segments are also experiencing significant growth. Cartesian robots, known for their precision and linear movements, are finding favour in applications like machine loading and palletizing within the logistics industry. SCARA robots, with their selective compliance articulated robot arm structure, are ideal for high-speed pick-and-place tasks commonly seen in electronics assembly. Cylindrical robots, offering a good balance between reach and payload capacity, are gaining traction in welding and painting applications. The "Others" segment encompasses emerging technologies like cobots (collaborative robots) designed for safe human-robot interaction, a trend with promising potential in various industries. This diversification in types of heavy payload robotic arms caters to the specific needs of various end-user industries, propelling the overall market growth.

Heavy Payload Robotic Arm Market Segmentation: By Payload Capacity

-

Retail 500-700 Kg

-

701-1,000 Kg

-

1,001-3,000 Kg

-

3,001 Kg and Above

The heavy payload robotic arm market is segmented by payload capacity, with each segment catering to distinct application needs. The 1,001-3,000 Kg segment is expected to witness significant growth, driven by the increasing demand for automation in heavy-duty industries like automotive manufacturing and metal processing. This growth is fuelled by the need to handle bulky and heavy components efficiently and safely. Advancements in material science are enabling the development of lighter yet stronger robotic arms, allowing for increased payload capacities without compromising on manoeuvrability.

Looking ahead, the 3,001 Kg and above segment holds immense potential for growth, particularly in sectors like construction and shipbuilding. These massive robotic arms can handle colossal structures and components, revolutionizing these industries. While the current market share of this segment is relatively low, ongoing technological advancements and growing demand for automation in large-scale construction projects are expected to propel its future growth. However, challenges like ensuring stability, safety protocols for handling extreme payloads, and the high costs associated with these heavy-duty robots need to be addressed for wider adoption.

Heavy Payload Robotic Arm Market Segmentation: By End User

-

Automotive

-

Machinery

-

Mining

-

Others

The automotive industry is currently the leading end-user of heavy payload robotic arms, and this dominance is expected to continue. This prevalence is driven by the need for automation in car assembly lines, particularly for tasks like welding, painting, and material handling of heavy car parts. Advancements in robot programming and integration with existing manufacturing systems are further solidifying the position of heavy payload robotic arms in the automotive industry.

However, other end-user segments are experiencing significant growth. The machinery industry is increasingly deploying heavy payload robots for machine tending, material handling, and heavy part assembly. The mining sector is leveraging these robots for tasks like part manipulation, sorting, and hazardous material handling, contributing to improved safety and efficiency. The "Others" segment encompasses a diverse range of industries, including aerospace, construction, and shipbuilding. These industries are realizing the benefits of heavy payload robotic arms for tasks requiring high precision, strength, and handling of bulky materials. This diversification in end-user applications is a significant growth driver for the heavy payload robotic arm market, as these robots cater to the specific needs of various sectors.

Heavy Payload Robotic Arm Market Segmentation: By Region

-

Asia-Pacific

-

North America

-

Europe

-

South America

-

Middle East and Africa

The Asia-Pacific region is anticipated to remain the dominant market for heavy payload robotic arms throughout the forecast period. This leadership is primarily attributed to the rapid industrialization and automation advancements in countries like China, Japan, and South Korea. Government initiatives promoting automation and robotics in these countries, coupled with a growing focus on increasing productivity and worker safety, are further propelling the market growth in this region.

However, other regions are also witnessing significant market expansion. North America and Europe possess established industrial sectors with a strong presence of leading robotic arm manufacturers. These regions are experiencing a growing demand for heavy payload robots in automotive, aerospace, and machinery industries. Furthermore, rising labor costs and a skilled labor shortage are incentivizing companies to adopt automation solutions, creating lucrative opportunities for the heavy payload robotic arm market in these regions. South America and the Middle East and Africa hold promising potential for future growth, driven by increasing investments in infrastructure development and industrial automation initiatives. The growing awareness of the benefits of heavy payload robotic arms, along with advancements in technology and affordability, is expected to fuel market expansion in these regions in the coming years.

COVID-19 Impact Analysis on the Global Heavy Payload Robotic Arm Market:

The COVID-19 pandemic caused a temporary disruption to the heavy payload robotic arm market. The initial lockdowns and restrictions on manufacturing activities led to a decline in demand for new robotic arm installations. Supply chains were also hampered, affecting the production and delivery of these machines.

However, the impact proved to be short-lived. As industries gradually resumed operations and adapted to the new normal, the market for heavy payload robotic arms exhibited signs of recovery. The pandemic, in fact, has inadvertently highlighted the importance of automation and labour flexibility. Companies are increasingly recognizing the benefits of heavy payload robots in ensuring operational continuity and worker safety in a post-pandemic world. This renewed focus on automation, coupled with government initiatives to revive manufacturing sectors, is expected to propel the heavy payload robotic arm market forward in the long run.

Latest Trends/Developments:

Cobots Integration for Enhanced Human-Robot Collaboration:

The heavy payload robotic arm market is witnessing a growing trend of integrating Collaborative robots (cobots) designed for safe interaction with humans. This allows for a more flexible and efficient production environment where robots handle heavy lifting and repetitive tasks, while human workers focus on tasks requiring dexterity, decision-making, and creativity. Advancements in sensor technology and safety features are making cobots increasingly suitable for working alongside humans in heavy payload handling scenarios.

AI-powered Intelligence and Machine Learning for Advanced Functionality:

The incorporation of Artificial Intelligence (AI) and Machine Learning (ML) is transforming the capabilities of heavy payload robotic arms. AI-powered vision systems enable robots to perceive their surroundings and adapt to changes in the environment, while ML algorithms allow them to learn from experience and continuously improve their performance. This trend is leading to the development of intelligent robots capable of handling complex tasks with greater autonomy and precision.

Cloud-based Robotics and Remote Monitoring for Improved Efficiency and Scalability:

Cloud-based robotics solutions are gaining traction in the heavy payload robotic arm market. These solutions allow for remote monitoring, control, and maintenance of robots, facilitating centralized management and optimizing resource allocation. Additionally, cloud platforms enable real-time data collection and analytics, providing valuable insights for improving operational efficiency and robot performance. This trend is expected to contribute to the wider adoption of heavy payload robots, particularly for geographically dispersed operations.

Key Players:

-

The ABB Ltd.

-

Ellison Technologies Inc. (Mitsui & Co., Ltd.)

-

FANUC Corporation

-

Kawasaki Heavy Industries Ltd.

-

KUKA AG (Midea Group)

-

Nachi-Fujikoshi Corp.

-

Stellantis N.V.

-

Vulcan Engineering Co.

-

Yaskawa Electric Corporation

Chapter 1. HEAVY PAYLOAD ROBOTIC ARM MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. HEAVY PAYLOAD ROBOTIC ARM MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. HEAVY PAYLOAD ROBOTIC ARM MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. HEAVY PAYLOAD ROBOTIC ARM MARKET Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. HEAVY PAYLOAD ROBOTIC ARM MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. HEAVY PAYLOAD ROBOTIC ARM MARKET – By Type

6.1 Introduction/Key Findings

6.2 Articulated

6.3 Cartesian

6.4 SCARA

6.5 Cylindrical

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. HEAVY PAYLOAD ROBOTIC ARM MARKET – By Payload Capacity

7.1 Introduction/Key Findings

7.2 Retail 500-700 Kg

7.3 701-1,000 Kg

7.4 1,001-3,000 Kg

7.5 3,001 Kg and Above

7.6 Y-O-Y Growth trend Analysis By Payload Capacity

7.7 Absolute $ Opportunity Analysis By Payload Capacity, 2024-2030

Chapter 8. HEAVY PAYLOAD ROBOTIC ARM MARKET – By End User

8.1 Introduction/Key Findings

8.2 Automotive

8.3 Machinery

8.4 Mining

8.5 Others

8.6 Y-O-Y Growth trend Analysis By End User

8.7 Absolute $ Opportunity Analysis By End User, 2024-2030

Chapter 9. HEAVY PAYLOAD ROBOTIC ARM MARKET , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By Payload Capacity

9.1.4 By End User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By Payload Capacity

9.2.4 By End User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By Payload Capacity

9.3.4 By End User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By Payload Capacity

9.4.4 By End User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By Payload Capacity

9.5.4 By End User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. HEAVY PAYLOAD ROBOTIC ARM MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 The ABB Ltd.

10.2 Ellison Technologies Inc. (Mitsui & Co., Ltd.)

10.3 FANUC Corporation

10.4 Kawasaki Heavy Industries Ltd.

10.5 KUKA AG (Midea Group)

10.6 Nachi-Fujikoshi Corp.

10.7 Stellantis N.V.

10.8 Vulcan Engineering Co.

10.9 Yaskawa Electric Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Heavy Payload Robotic Arm Market was valued at USD 12.9 billion in 2023 and is projected to reach a market size of USD 16.4 billion by the end of 2030. Over the forecast period of 2024-2030, the market is expected to grow at a CAGR of 3.5%.

Key drivers include the Rising Labor Costs and Labor Shortages, Growing Focus on Safety and Worker Wellbeing, E-commerce Boom and Demand for Efficient Logistics.

Asia-Pacific dominates the market with a significant share of over 40%.

ABB Ltd., Ellison Technologies Inc. (Mitsui & Co., Ltd.), FANUC Corporation, Kawasaki Heavy Industries Ltd., KUKA AG (Midea Group), Nachi-Fujikoshi Corp., Stellantis N.V., Vulcan Engineering Co., and Yaskawa Electric Corporation are some leading players in the Global Heavy Payload Robotic Arm Market.

Implementing heavy payload robotic arms requires integration with existing infrastructure and programming for specific tasks. This process can be complex and require specialized expertise, posing a challenge for companies lacking the in-house knowledge or resources.