Heavy-Duty Connector Market Size (2024 – 2030)

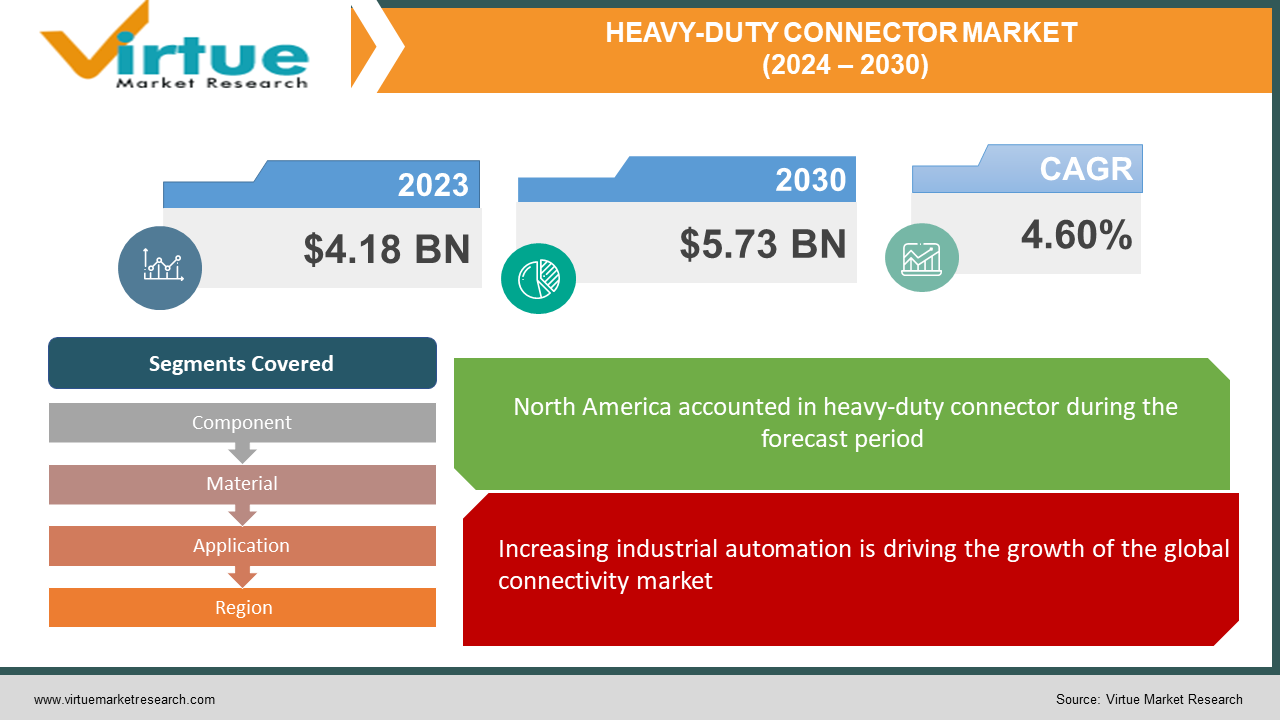

The Heavy-Duty Connector market was valued at USD 4.18 billion in 2023 and is projected to reach a market size of USD 5.73 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.60%.

Heavy-duty connectors are electrical connectors designed for use in basic industrial applications. They are also called multiple bonds or corporate bonds. In places with harsh conditions, including high temperature, humidity, vibration, and stress at work, they are used to provide a safe and stable electrical connection. Heavy-duty connectors are usually larger and more reliable than standard connectors. With their durable construction, strong materials, and effective coating system, they protect against dust, water, chemicals, and other impurities. These connectors can withstand high currents and voltages, making them ideal for power transmission applications.

Key Market Insights:

A key driving factor is the growing adoption of strong connectivity in the automotive and transportation sectors, which is fueling the electric power system and the need for higher load capacity now. It is expected that this segment will see significant growth of 10%, and the production of electric vehicles (EV) is expected to increase rapidly in the coming years by 30 percent.

Heavy-Duty Connector Market Drivers:

Increasing industrial automation is driving the growth of the global connectivity market. Many industries are moving towards automation and require strong and efficient electrical connections. Rigid connectors are designed to provide a secure, durable connection for automation equipment such as robots, control systems, and sensors. Because of this, the demand for strong connections is increasing. Strong connections reduce the chance of electrical failure or accidents, which can be costly and harmful. Because they emphasize job security and want to reduce downtime caused by faulty connections, companies take these connections very seriously. By using strong connections, they can maintain a reliable and secure electrical system and reduce the risks associated with bad connections. These benefits of strong affiliate links increase the number of sales. The demand for high-power applications drives the need to use strong connections that can carry more electricity. These connections improve the performance of machines such as motors, drives, and power distribution systems and ensure efficient power transmission. As industries such as renewable energy, electric vehicles, and smart devices grow, they need strong, reliable electrical connections, creating opportunities for strong connection manufacturers to meet their needs. special needs and become suppliers in these fast-growing areas. As heavy-duty connector technology continues to advance, with improvements in materials and improved signal strength, new opportunities appear for the development of efficient and compact heavy-duty connectors. Manufacturers can take advantage of these advances to create new solutions that meet customer requirements and specifications.

Heavy-Duty Connector Market Restraints and Challenges:

Heavy-duty connectors can be more expensive than standard connectors due to their unique design, material, and features. This high cost hinders some companies, especially those with small budgets or markets that support expensive solutions, resulting in high demand for a strong connection market. The installation and configuration of negative connectors can be more complicated than standard connectors due to their modular design and configuration. This complication may result in longer installation times and may require additional work, which may affect overall performance.

Heavy-Duty Connector Market Opportunities:

A strong connection market provides a fertile ground for innovation and growth. As companies increasingly rely on robust connectivity solutions, the demand for robust connectivity continues to increase. From the automotive and transportation sectors to industrial machinery and renewable energy applications, the need for reliable and sustainable connections is paramount. With the advent of technologies such as IoT and Industry 4.0, the range of advanced connectivity solutions in smart and automated manufacturing is expanding rapidly. In addition, energy efficiency trends in the automotive and transportation sectors are increasing the demand for high-performance interconnects that can handle demanding applications. In addition, the rise of renewable energy projects, such as wind and solar farms, requires flexible connections to withstand harsh environmental conditions. The dynamic link market offers great opportunities for companies to innovate, respond to changing industry needs, and establish themselves as key players in this dynamic field.

HEAVY-DUTY CONNECTOR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.60% |

|

Segments Covered |

By Component, Material, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Toyota Industries, KION Group, Hyster-Yale Material Handling, Oshkosh, Linamar, Nagase ChemteX Corporation, ODU GmbH & Co. KG, Phoenix Contact, Schaltbau GmbH, Smith’s Interconnect, TE Connectivity Ltd., Walther Electric, Inc., Weald Electronics Ltd., Weidmuller Interface GmbH & Co. KG and Weisscam GmbH. |

Heavy-Duty Connector Market Segmentation: By Component

-

Hoods and Housings

-

Insert and Contact

-

Accessories

In 2023, The input and contact technology plays an important role in the performance of strong connections, affecting their reliability and performance. The global networking market is experiencing tremendous growth, for many reasons. First, the increasing adoption of automation and smart manufacturing practices across various industries requires well-integrated connections and contact features to ensure seamless data transmission and power transmission. In addition, the increasing demand for strong connections in industries such as automobiles, aerospace, and renewable energy makes it necessary to invest in strong contact technology to cope with difficult operating conditions. In addition, the emergence of electric vehicles and the expansion of renewable energy projects increase the demand for high-quality connectors with high input and contact characteristics. Therefore, manufacturers are investing in research and development to develop contact technology solutions, thereby influencing the global connectivity market by meeting the changing industry needs and technological advancements. and noise.

The Hoods and housing and its components play an important role in the rigid connector market, serving as a protective layer for sensitive electrical connections. The demand for these resources is due to many factors, including the rapid expansion of industrial automation, the increase in electric vehicles, and the increase in renewable energy resources. As companies continue to adopt advanced manufacturing methods and smart technologies, the need for strong, reliable connections to sustainable buildings is becoming more and more apparent. In addition, the increased focus on security and regulatory compliance is driving the demand for advanced insurance and insurance solutions. The impact of these components on the global interconnection market is critical as they contribute to the overall reliability, efficiency, and longevity of electrical systems across various industries. Additionally, as the interconnect market continues to grow, it is expected that the demand for insulation and compatible housing will increase, creating significant opportunities for manufacturers and suppliers. all over the world.

Heavy-Duty Connector Market Segmentation: By Material

-

Metal

-

Plastic

In 2023, Metal, the main component of the solid-state bond market, plays a key role in shaping its position. The growth of the company is linked to the progress of the steel production process, which makes the production of strong and long-term connections. Factors such as urbanization, industrialization, and infrastructure development all over the world are driving the demand for strong connections as they form the backbone of critical systems across various industries. In addition, the growing automotive and transportation sector, along with the increasing adoption of renewable energy sources, is driving increasing demand for strong connections made from metals such as aluminum, copper, and stainless steel. rust. However, challenges such as fluctuating steel prices and environmental concerns related to mining and manufacturing processes pose potential obstacles. Despite these challenges, the flexibility and reliability of computer-based connections continue to support their importance in the global connectivity market, ensuring continued growth and innovation. forward.

Metal, the main component of the solid-state bond market, plays a key role in shaping its position. The growth of the company is linked to the progress of the steel production process, which makes the production of strong and long-term connections. Factors such as urbanization, industrialization, and infrastructure development all over the world are driving the demand for strong connections as they form the backbone of critical systems across various industries. In addition, the growing automotive and transportation sector, along with the increasing adoption of renewable energy sources, is driving increasing demand for strong connections made from metals such as aluminum, copper, and stainless steel. rust. However, challenges such as fluctuating steel prices and environmental concerns related to mining and manufacturing processes pose potential obstacles. Despite these challenges, the flexibility and reliability of computer-based connections continue to support their importance in the global connectivity market, ensuring continued growth and innovation. forward.

Heavy-Duty Connector Market Segmentation: By Application

-

Manufacturing

-

Power

-

Rail

-

Oil and Gas

-

Construction

-

Others

The manufacturing sector is the cornerstone of industrial development, driving economic growth and technological progress around the world. As the manufacturing process evolves through automation, robotics, and digitalization, the demand for strong connections is increasing exponentially. These connections play a critical role in improving and facilitating the efficient operation of machinery and equipment in various manufacturing sectors, including automotive, aerospace, electronics, and metal manufacturing. The growing progress in intelligent industries and the 4.0 strategy make it more important for reliable, high-performance connections that can support data transmission, power distribution, and stability. Good things in the industrial environment. In addition, as manufacturers increase workloads, productivity, and durability, the adoption of robust connections becomes essential to ensure uninterrupted operations and reduce downtime. Thus, the growth of the manufacturing sector acts as a catalyst for the expansion of the global connectivity market, driving innovations and technological advancements to meet the changing needs of the industry.

The energy sector includes many different industries, each with unique needs and challenges. Factors such as urban development, industrialization, and the transition to renewable energy sources are contributing to the growing demand for electricity around the world. The increase in power demand requires robust infrastructure and reliable connectivity solutions, which drives the demand for robust connectivity. As the global connector market grows to meet these needs, there is a need for innovative connector manufacturers that can withstand high voltages, high temperatures, and harsh environmental conditions. In addition, the combination of smart technology and the advent of electric vehicles increases the need for permanent connections to support the efficient transmission and distribution of energy. Finally, developments in the energy sector are having a major impact on the power connector market, driving innovation and shaping the industry's position as it strives to meet the demands of a rapidly changing global environment. application.

Heavy-Duty Connector Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The growing industrial environment and technological advancement of North America are the main factors behind the growth of the global connectivity market. The region's strong manufacturing sector, along with growing investment in automation & smart infrastructure, creates fertile ground for the adoption of heavy-duty connectors. In addition, strict regulations that emphasize security and reliability across industries are increasing the demand for sustainable connectivity solutions. In addition, the rapid expansion of renewable energy projects, particularly in the United States and Canada, is contributing to market growth as these projects require reliable connections for efficient power transmission. Also, the emergence of electric vehicles and the continued improvement of transportation infrastructure makes it more important for high-quality connections that can cope with demanding operating conditions. Primarily, North America's strong industrial landscape and technological advancements are playing an important role in shaping the trajectory of the global connectivity market.

The Asia Pacific region serves as a strong location for the dynamic link market, with many growing factors affecting the global manufacturing sector. With recent industrialization, rapid urbanization, and infrastructure development in countries such as China, India, Japan, and South Korea, the demand for strong connectivity has seen a significant increase. In addition, the increasing adoption of automation, robotics, and smart manufacturing processes across various industries reinforces the need for reliable connectivity solutions. In addition, the region's focus on renewable energy initiatives, such as solar and wind power projects, is fueling the demand for sustainable interconnections that can withstand harsh environmental conditions. In addition, the rise of electric vehicles in countries such as China is driving an increase in demand for strong connections to support charging equipment and vehicle electronics. Thus, the Asia Pacific region serves as a dynamic and dynamic area of the global connectivity market with a dynamic and growing opportunity.

COVID-19 Impact Analysis on the Heavy-Duty Connector Market:

COVID-19 has had a major impact on the hard link market. During the pandemic, the healthcare sector has developed, which has increased the demand for strong connections for medical devices and equipment. In addition, the increasing adoption of automation and digitalization across industries has allowed for stronger integration. However, the supply chain has posed challenges for the interconnected market during the pandemic due to restrictions on international trade and travel. Therefore, the production and delivery of the link is delayed. Also, job cuts and delays have been observed in sectors such as automotive, manufacturing, and construction, which has reduced demand for the strong connectivity market.

Latest Trends/ Developments:

In recent years, the dynamic link market has seen significant growth and change. What is known is the combination of high-quality materials and designs to improve the durability and performance of the connection, thus meeting the requirements of the harsh environment and various industries. In addition, there is an increased emphasis on miniaturization without compromising performance, driven by the need for space-saving and compact machines and electronic devices. In addition, the rise of automation and Industry 4.0 has fueled the development of connections that can support high-speed data transmission and seamless integration into smart manufacturing systems. In addition, sustainability has become a priority, leading to the availability of eco-friendly materials and efficient designs with strong connections. As the market continues to grow, these trends reflect the need to innovate and adapt to meet the changing needs of modern businesses.

Key Players:

-

Toyota Industries

-

KION Group

-

Hyster-Yale Material Handling

-

Oshkosh

-

Linamar

-

Nagase ChemteX Corporation

-

ODU GmbH & Co. KG.

-

Phoenix Contact

-

Schaltbau GmbH

-

Smith’s Interconnect

-

TE Connectivity Ltd.

-

Walther Electric, Inc.

-

Weald Electronics Ltd.

-

Weidmuller Interface GmbH & Co. KG and Weisscam GmbH.

-

In December 2023, a leading specialist distributor of electrical components, TTI, Inc., stocked Amphenol Industrial's CHD (Circular Heavy Duty) connectors. The robust, high-performance CHD14 series is designed for use in demanding commercial and off-road vehicle applications such as EV battery packs, inverters, and power distribution systems, where electrical connections need to be dependable and weather-resistant.

-

In July 2023, with its Harnessflex EVOTM Connector Interfaces, ABB Installation Products invented the first complete line of hinged high voltage connector backshells for heavy-duty EVs, protecting and stabilizing these connectors.

Chapter 1. Heavy-Duty Connector Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Heavy-Duty Connector Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Heavy-Duty Connector Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Heavy-Duty Connector Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Heavy-Duty Connector Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Heavy-Duty Connector Market – By Component

6.1 Introduction/Key Findings

6.2 Hoods and Housings

6.3 Insert and Contact

6.4 Accessories

6.5 Y-O-Y Growth trend Analysis By Component

6.6 Absolute $ Opportunity Analysis By Component, 2024-2030

Chapter 7. Heavy-Duty Connector Market – By Material

7.1 Introduction/Key Findings

7.2 Metal

7.3 Plastic

7.4 Y-O-Y Growth trend Analysis By Material

7.5 Absolute $ Opportunity Analysis By Material, 2024-2030

Chapter 8. Heavy-Duty Connector Market – By Application

8.1 Introduction/Key Findings

8.2 Manufacturing

8.3 Power

8.4 Rail

8.5 Oil and Gas

8.6 Construction

8.7 Others

8.8 Y-O-Y Growth trend Analysis By Application

8.9 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Heavy-Duty Connector Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Component

9.1.3 By Material

9.1.4 By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Component

9.2.3 By Material

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Component

9.3.3 By Material

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Component

9.4.3 By Material

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Component

9.5.3 By Material

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Heavy-Duty Connector Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Toyota Industries

10.2 KION Group

10.3 Hyster-Yale Material Handling

10.4 Oshkosh

10.5 Linamar

10.6 Nagase ChemteX Corporation

10.7 ODU GmbH & Co. KG.

10.8 Phoenix Contact

10.9 Schaltbau GmbH

10.10 Smith’s Interconnect

10.11 TE Connectivity Ltd.

10.12 Walther Electric, Inc.

10.13 Weald Electronics Ltd.

10.14 Weidmuller Interface GmbH & Co. KG and Weisscam GmbH.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Heavy-Duty Connector market was valued at USD 4.18 billion in 2023 and is projected to reach a market size of USD 5.73 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.60%.

The growing adoption of automation in various industries is a significant driver for the Heavy-Duty Connector Market. As industries strive for enhanced efficiency and productivity, heavy-duty connectors play a pivotal role in ensuring secure and reliable electrical connections in automated systems, thereby driving market growth.

Based on Material, the Heavy-Duty Connector market is segmented into Metal and Plastic.

North America is the most dominant region for the Heavy-Duty Connector market.

Amphenol Sine Systems, Bulgin, China Utility Electrical Co. Ltd., Degson Electronics Co., Ltd., Harting Technology Group, Indo Electricals, ITT Cannon, Lapp Holding AG, Molex LLC, Ningbo Oukerui Connector Co, Ltd., ODU GmbH & Co. KG., Phoenix Contact, Schaltbau GmbH, Smiths Interconnect, TE Connectivity Ltd., Walther Electric, Inc., Weald Electronics Ltd., Weidmuller Interface GmbH & Co. KG and Weisscam GmbH.