Heavy Aromatic Solvents Market Size (2024 – 2030)

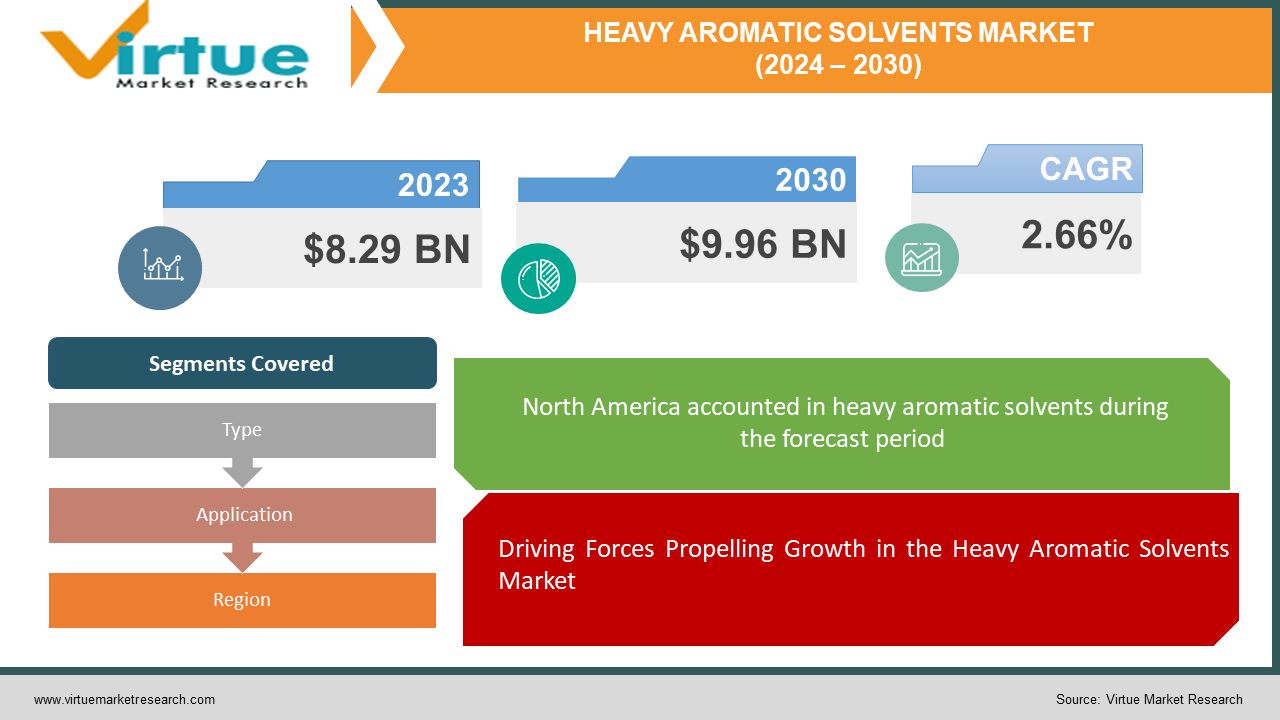

The Heavy Aromatic Solvents Market was valued at USD 8.29 billion in 2023 and is projected to reach a market size of USD 9.96 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 2.66%.

The fragrances market is an important part of the global chemical industry, with significant influence in a variety of areas including paints and coatings, adhesives, and plastic processing. These solvents, derived from the oil refining process, have high aromatic and special solvent properties, making them useful in many applications. Market growth is driven by the increasing use of these solvents in the construction and automotive sectors, driven by urbanization and global infrastructure development. Additionally, stringent environmental regulations have led to a shift towards environmentally friendly solvents, driving innovation and technological advancements in the heavy-duty solvents market. Geographically, Asia-Pacific dominates the market due to rising industrial activity in countries such as China and India. However, North America and Europe also hold the market share, which is driven by continuous research and development initiatives to improve product productivity and durability. Overall, the heavy solvent market is poised for continued expansion, driven by changing industry needs and trends.

Key Market Insights:

The fragrance solvent market is witnessing significant growth and evolution, driven by industry requirements and technological advancements. Key market insights reveal a growing demand for these solvents in various sectors such as paints and coatings, adhesives, plastic processing, and pharmaceuticals.

Geographically, regions such as Asia-Pacific are emerging as important consumption areas, driven by rapid manufacturing and infrastructure development. Regulatory initiatives that promote the use of low VOC (volatile organic compounds) are increasing market share. In addition, it is expected that innovation in product design and manufacturing processes will improve product quality and expand application areas.

Heavy Aromatic Solvents Market Drivers:

Driving Forces Propelling Growth in the Heavy Aromatic Solvents Market.

The heavy-duty solvent market is driven by a combination of key factors, paving the way for growth and innovation. One important factor is the growing need in various industries such as paints and coatings, adhesives, and rubber processing. These solvents play a critical role in the production of high-performance products, leading to their widespread acceptance. In addition, the growing attention to sustainable practices has led to an increase in the demand for more environmentally friendly products, thereby increasing the market. Also, the expansion of end-user companies in emerging economies creates lucrative opportunities for marketers to expand their operations and access new markets. Also, technological advancements and innovations aimed at improving the efficiency and effectiveness of heavy-duty perfumes are driving market growth. Overall, with these strong drivers in play, the fragrance solvent market is poised for expansion in the foreseeable future.

The growing demand for phosphatidylserine to increase nutritional value is driving the market growth

In the ever-evolving chemical industry landscape, the heavy fragrances market is a central force, driven by multi-faceted drivers shaping its position. One important thing is the increasing demand for good solutions in the environment in different areas. As the industry becomes more involved in sustainability, heavy aromatic solvents are emerging as important ingredients, providing faster and less environmental impact. In addition, technological progress and innovation make the limits of these things soluble and can be achieved, making the climate continue to change. In addition, geopolitical factors such as changes in global trade and regulatory changes play an important role in influencing market trends and motivating manufacturers and those involved in design and production. The resilience and flexibility of the market, as well as its critical role in industries ranging from paints and coatings to pharmaceuticals, demonstrate its importance as a catalyst for the global economy.

Heavy Aromatic Solvents Market Restraints and Challenges:

Challenges and Opportunities in the Heavy Aromatic Solvents Market

Despite its promising prospects, the Heavy Aromatic Solvents Market faces several restraints and challenges. One significant challenge is environmental concerns, as these solvents are often associated with emissions of volatile organic compounds (VOCs), contributing to air pollution and potential health hazards. Regulatory bodies are increasingly enforcing stricter regulations on VOC emissions, posing compliance challenges for manufacturers and users of heavy aromatic solvents.

Moreover, volatility in crude oil prices directly impacts the cost of production for heavy aromatic solvents, making pricing unpredictable and affecting profit margins. Supply chain disruptions, geopolitical tensions, and economic uncertainties further exacerbate market challenges, leading to instability in supply and demand dynamics.

Additionally, the transition towards sustainable alternatives poses a threat to the heavy aromatic solvents market, as industries increasingly seek eco-friendly substitutes to reduce their environmental footprint. Adapting to these evolving market dynamics while addressing regulatory compliance and sustainability concerns remains imperative for stakeholders in the heavy aromatic solvents industry to ensure long-term viability and competitiveness.

Exploring Opportunities and Advancements in Heavy Aromatic Solvents:

And always appear in the chemical of chemicals like a fire like a fireplace, giving a form of growth and new things. Although global desire increases for a solution and staying, these specialties have different boxes for different applications. From coatings and paints to adhesives and coatings, their unique properties enable manufacturers to improve the performance of their products while meeting strict environmental standards. In addition, expanding automotive and construction sectors are increasing, making the heavy-duty perfume market an unexplored area of opportunity. Opportunities abound not only in traditional applications but also in emerging sectors such as renewable energy and electronics, where these solvents demonstrate remarkable potential for advancement. Additionally, ongoing research and development efforts continue to unveil new formulations and applications, fostering a dynamic environment for investment and collaboration. As companies around the world are looking for sustainable and efficient solutions, Heavy Aromatic Solvents is ready to take advantage of these opportunities and lead a bright future.

HEAVY AROMATIC SOLVENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

2.66% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Exxon Chemical, Haltermann Carless, Redox, ORG CHEM, Nippon Chemical Texas Inc, Royal Dutch Shell, Total S.A, Chevron Phillips, BP, SK Global Chemical, Calumet, Idemitsu, Ganga Rasayanie |

Heavy Aromatic Solvents Market Segmentation: By Type

-

Low Naphthalene

-

Extra Low Naphthalene

In 2023, Low-grade naphthalene, an important segment of the aromatic solvents market, is witnessing significant growth driven by several key factors. Primarily, increasing environmental and stringent air quality standards have prompted companies to obtain reduced naphthalene solvents. This shift to more environmentally friendly alternatives coincides with global pressure for sustainable practices, requiring lower naphthalene solvents.

In addition, technological advances in solvent extraction and purification processes have enabled the production of low-grade naphthalene with better performance characteristics. Industries such as paints, coatings, and adhesives are increasingly turning to these solvents due to their nutritional properties and low environmental impact. As a result, the global market for fragrances has a significant impact, with less naphthalene becoming a key driver of growth and innovation. Going forward, the continued focus on compliance and regulatory compliance is expected to drive the adoption of low naphthalene solvents, thus shaping the market landscape.

Lower-grade naphthalene, a popular offering in the heavy solvent market, is seeing rapid growth in demand for several reasons. Its exceptional purity, characterized by low naphthalene content, has promoted its acceptance in various industries, including paints, coatings, and adhesives. The desired increase can be achieved with the increasing emphasis on environmentally sustainable solutions, while low-grade naphthalene additives are emerging as the preferred option due to the reduced environmental footprint.

In addition, stricter regulations regarding volatile organic compounds (VOCs) have prompted a shift to cleaner alternatives, thereby reducing the market's low-cost naphthalene market. As companies around the world strive to meet their sustainability goals, the demand for environmentally friendly solvents such as ultra-low naphthalene is poised for significant growth.

This growing demand for low-grade naphthalene is expected to have a significant impact on the global fragrance market, innovating and shaping market trends to comply with environmental regulations.

Heavy Aromatic Solvents Market Segmentation: By Application

-

Agriculture

-

Construction

In 2023, Agriculture, as a cornerstone of global livelihoods, is still closely linked to the heavy solvent market. Factors such as population growth, urbanization, and changing food preferences are leading to the expansion of agriculture. The demand for aromatic solvents in this region stems from their important role in the production of pesticides, crop protection, and fertilizer production.

In addition, the transition to sustainable agriculture and other bio-based systems requires new solutions, which stimulate the demand for heavy solvents. However, regional agricultural labeling raises concerns about the use of traditional solvents, resulting in increased regulatory scrutiny and increased enforcement.

In response, the market is witnessing an increase in research and development efforts to develop environmentally friendly solvent systems suitable for agricultural applications. This combination of agricultural growth and environmental awareness is not only shaping the growth of the heavy spice market but also highlighting the need for sustainable agriculture practices to ensure long-term sustainability.

The construction sector is a key driver of the world economy, showing continued growth driven by urbanization, infrastructure development, and population expansion. As cities grow and improve, the demand for heavy-duty construction-related solvents such as paving, sealants, and adhesives increases accordingly. These solvents play an important role in improving the durability and performance of building materials, thereby increasing the longevity and durability of various materials.

In addition, with a strong commitment to sustainable construction methods, there is a marked shift towards environmentally friendly solutions, including lightweight fragrances with low emissions and environmental impact. This change is reshaping the global fragrance market, prompting manufacturers to innovate and develop greener alternatives to meet stringent regulatory requirements. Therefore, as the construction industry continues to grow, its impact on the global fragrance market is increasing, thus resulting in innovation and sustainability.

Heavy Aromatic Solvents Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America is a major player in the global fragrance market with many growing factors having a significant impact on the global industry. The region's strong industrial infrastructure, along with growing investment in the construction, automotive, and manufacturing sectors, is fueling demand for heavy metals. In addition, strict regulations promote the use of environmentally friendly solvents with low organic compound (VOC) content leading to the adoption of heavy-duty solvents known for their low environmental impact.

In addition, the thriving shale gas industry in North America provides a stable and cost-effective resource base for solvent production, thereby increasing market growth. Furthermore, the region's desire for new technologies and sustainable practices supports research and development initiatives, leading to the introduction of advanced processes and applications in heavy metals.

As North America continues to experience continued economic growth and industrial expansion, its role in the global fragrance market is poised to continue to influence, and -shape industry trends and changes around the world.

The Asia Pacific region is the driving force behind the global fragrance market, with increasing factors determining its growth path. Rapid industrialization, along with urban development and infrastructure development, is driving the demand for heavy metals in various sectors such as construction, automotive, and manufacturing. In addition, the growing population in the region and the increase in disposable income are contributing to the increase in the demand for heavy solvent products.

Furthermore, the Asia Pacific region's approach to environmental sustainability is driving the adoption of environmentally friendly alternative solvents, thereby shaping the market trends. In addition, government initiatives ranging from promoting industry growth and investing in research and development are driving the market forward.

The influence of the Asia-Pacific region on the global perfume market is very significant, as it not only represents a large number of consumers but also serves as a location for production and new. As the region continues to expand and expand, its impact on the trajectory of the global fragrance market is expected to intensify.

COVID-19 Impact Analysis on the Heavy Aromatic Solvents Market:

The COVID-19 pandemic has had a significant impact on the fragrance solvent market, causing both short-term disruption and long-term structural changes. In the early stages of the pandemic, tight control measures and disruptions in the supply chain led to reduced production across industries, thereby affecting the demand for heavy metals. Also, the decline in automobile production, construction work, and manufacturing activity slowed down the market.

However, as the economy slowly recovers and vaccination efforts intensify, the market is seeing signs of recovery. Companies are adapting to innovation by implementing security standards and investing in digitalization to ensure business continuity. In addition, more attention to cleanliness and hygiene makes people look for antiseptics and nutrients, the main ingredients of which are aromatic solvents. Additionally, the market is seeing an increase in investment in more flexible and sustainable alternatives, reflecting a wider shift towards environmental awareness and resilience in the post-pandemic era.

Latest Trends/ Developments:

In the dynamic landscape of the fragrance solvent market, several notable trends and developments have emerged, indicating a shift in innovation and sustainability. A notable trend is the growing emphasis on bio-based alternatives and renewables, driven by growing environmental pressures and strict regulations. Manufacturers are investing in research and development to find green solvents from renewable resources, reducing dependence on fossil fuels and reducing environmental impact.

In addition, there is a marked increase in the demand for low VOC (volatile organic compounds) systems, especially in the coatings, paints, and adhesives industry. This trend is fueled by consumer preference for environmentally friendly products and legislation to reduce air pollution. Therefore, companies are investing in advanced technology to create fragrances that reduce VOC emissions without compromising performance. Additionally, there is an increasing focus on improving the efficiency and versatility of products to meet various industrial applications. Innovations such as ultra-low naphthalene variants and tailored solvent blends are gaining ground, providing improved solvency power and compatibility with various substrates. These integrated processes reflect the company's commitment to sustainability, innovation, and meeting changing customer needs.

Key Players:

-

Exxon Chemical

-

Haltermann Carless

-

Redox, ORG CHEM

-

Nippon Chemical Texas Inc

-

Royal Dutch Shell

-

Total S.A

-

Chevron Phillips

-

BP

-

SK Global Chemical

-

Calumet

-

Idemitsu

-

Ganga Rasayanie

Chapter 1. Heavy Aromatic Solvents Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Heavy Aromatic Solvents Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Heavy Aromatic Solvents Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Heavy Aromatic Solvents Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Heavy Aromatic Solvents Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Heavy Aromatic Solvents Market – By Type

6.1 Introduction/Key Findings

6.2 Low Naphthalene

6.3 Extra Low Naphthalene

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Heavy Aromatic Solvents Market – By Application

7.1 Introduction/Key Findings

7.2 Agriculture

7.3 Construction

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Heavy Aromatic Solvents Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Heavy Aromatic Solvents Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Exxon Chemical

9.2 Haltermann Carless

9.3 Redox, ORG CHEM

9.4 Nippon Chemical Texas Inc

9.5 Royal Dutch Shell

9.6 Total S.A

9.7 Chevron Phillips

9.8 BP

9.9 SK Global Chemical

9.10 Calumet

9.11 Idemitsu

9.12 Ganga Rasayanie

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Heavy Aromatic Solvents Market was valued at USD 8.29 billion and is projected to reach a market size of USD 9.96 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 2.66%.

Escalating demand across various industries such as paints and coatings, adhesives, and rubber processing.

Based on Application, the Heavy Aromatic Solvents Market is segmented into Agriculture and Construction.

North America is the most dominant region for the Heavy Aromatic Solvents Market.

Exxon Chemical, Haltermann Carless, Redox, ORG CHEM, Nippon Chemical Texas Inc, Royal Dutch Shell, Total S.A., Chevron Phillips, BP, SK Global Chemical, Calumet, Idemitsu, Ganga Rasayanie, Gulf Chemicals and Industrial Oils, Jiangsu Hualun, Changshu Alliance Chemical, Arham Petrochem, Giant Aromatics