Healthcare Equipment Market Size (2025 –2030)

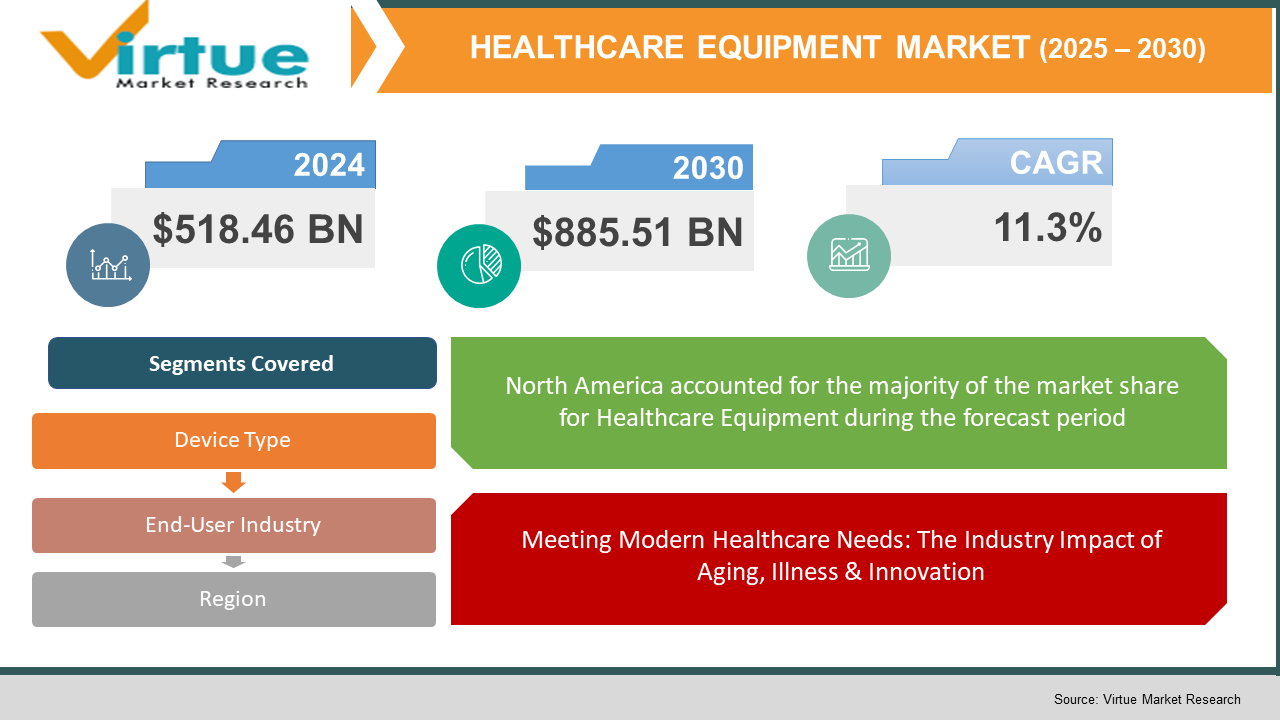

The Healthcare Equipment Market was valued at $518.46 billion and is projected to reach a market size of $885.51 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 11.3%.

The worldwide market for medical devices is growing exponentially due to several reasons, including the rising number of chronic conditions such as diabetes and cancer, thus increasing the demand for diagnostic and surgical interventions. This is further boosted by increased patient awareness about the available treatment options. In parallel, there's a significant increase in inpatient procedures and surgeries, such as orthopedic, cardiac, and neurological interventions, which fuel the demand for both consumables and capital equipment in both developed and emerging markets. In answer, top-ranked medical technology players are stepping up their research and development spending to launch technologically sophisticated devices that will help fulfill the growing need for advanced healthcare solutions. Enabling regulatory settings has also encouraged the commercialization and approval of these developments. The medical devices sector today consists of an extremely broad range of instruments and technologies used in the diagnosis, treatment, monitoring, and prevention, varying from relatively straightforward devices like tongue depressors to highly advanced implants like pacemakers. As reported by the World Health Organization, there are roughly 2 million kinds of medical devices around the world, grouped into more than 7,000 generic categories. These devices are an integral part of all different healthcare environments, such as home care, remote clinics, and sophisticated medical centers, highlighting their central role in improving patient care and fostering general well-being.

Key Market Insights:

- In mid-2024, top medical technology firms launched breakthrough products to advance patient care. In June, DePuy Synthes of Johnson & Johnson won FDA approval for the VELYS™ Robotic-Assisted Solution, intended to enhance precision in unicompartmental knee arthroplasty surgeries. In August, Philips demonstrated clinically validated technologies to enhance stroke and cardiac care at the Heart Rhythm Society annual meeting in Boston.

- Chronic obstructive pulmonary disease (COPD) continues to be a major health issue in the United States. In 2021, there were about 14.2 million U.S. adults with COPD, a number that has been stable since 2011.

- Wearable health devices are becoming increasingly popular among American adults. According to a study by the American Heart Association, 29% of adults wear these devices. Significantly, 33% of those with cardiovascular disease between ages 18 to 49 claimed to use wearables, followed by 17% of the 50 to 64 years age group, and just 12% among those above age 65.

Healthcare Equipment Market Key Drivers:

Meeting Modern Healthcare Needs: The Industry Impact of Aging, Illness & Innovation

Increasing Incidence of Chronic Diseases: The rising prevalence of chronic diseases like cardiovascular diseases, diabetes, and respiratory disease is a major trend driver for the healthcare equipment industry. These conditions need to be constantly monitored and treated, hence greater demand for medical equipment and devices. The U.S. home medical equipment industry, for example, has experienced significant growth owing to the need for long-term monitoring solutions for chronic diseases.

Aging Global Population: A graying population makes significant contributions to market growth. Older people are more likely to have chronic illness, which requires regular medical attention and prolonged therapies. This population change raises the healthcare demand for different medical devices, such as diagnostic equipment and devices, such as diagnostic equipment and therapy apparatus, to satisfy the medical requirements of the elderly.

Medical Device Technology Improvements: Ongoing advances in medical technology, including robotics, artificial intelligence (AI), and the Internet of Things (IoT), are transforming the healthcare equipment industry. Robotic surgeries, AI-based diagnostics, and IoT-based monitoring equipment improve the accuracy, efficiency, and accessibility of healthcare services. These are not just enhancing patient outcomes but also propelling the usage of advanced medical equipment in different healthcare facilities.

Healthcare Equipment Market Restraints and Challenges:

The healthcare equipment industry is confronted with several key restraints and challenges that affect its innovation and growth. A major challenge is the strict regulatory needs, where companies must go through intricate approval processes that can be time-consuming and expensive, thus potentially slowing the release of new devices. Furthermore, supply chain weaknesses have been brought to light, with key issues including shortages of raw materials and logistics disruptions that contribute to delays and added expense. The swift progression of technology brings with it cybersecurity issues as interconnected medical equipment becomes the target for cyberattacks, which calls for strong security to safeguard patient information and device performance. Financial pressures in the form of tariffs and trade bans also complicate the picture by elevating production costs and influencing pricing strategies. Additionally, the expensive production caused by the imperative of using up-to-date technology and meeting regulations can restrict access to advanced health equipment. These conditions establish a difficult arena for manufacturers of healthcare equipment with the need to plan strategically and be flexible enough to overcome the challenges.

Healthcare Equipment Market Opportunities:

The market for healthcare equipment is set to experience substantial growth, fueled by several emerging opportunities. The incorporation of artificial intelligence (AI) and machine learning in medical devices is transforming diagnostics and patient care by providing more accurate and efficient healthcare solutions. Growth in telemedicine and remote monitoring of patients is boosting the need for devices used in virtual consultations and ongoing health monitoring, particularly in the treatment of chronic conditions. Technological improvements in wearable devices are enabling people to track their health in real-time, supporting proactive management of their healthcare. On a broader scale, the worldwide focus on personalized medicine is driving the creation of bespoke equipment to meet the specifications of individual patients, optimizing the effectiveness of treatment. In combination, these are building a vibrant marketplace full of potential for growth and innovation in the healthcare equipment market.

HEALTHCARE EQUIPMENT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

11.3% |

|

Segments Covered |

By Device Type, end ser industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Medtronic, Johnson & Johnson MedTech, Siemens Healthineers, Stryker, Philips, GE HealthCare, Abbott, Becton, Dickinson and Company (BD), Boston Scientific, Baxter International |

Healthcare Equipment Market Segmentation:

Healthcare Equipment Market segmentation By Device Type:

- In-vitro diagnostics (IVD)

- Orthopedic Devices

- Cardiovascular Devices

- Diagnostic Imaging Equipment

- Minimally Invasive Surgery (MIS) Devices

- Wound Management Devices

- Diabetes Care Devices

- Ophthalmic Devices

- Dental Devices

- Nephrology Devices

- General Surgery Devices

- Hearing Aid Devices

- Drug Delivery Devices

- Respiratory Care Devices

- Patient Monitoring Devices

In the medical equipment sector, In-Vitro Diagnostics (IVD) is a leading segment, commanding a large share of 19.3% in the international market as of 2024. This is due to the growing need for diagnostic testing and improvements in diagnostic technologies. The Cardiovascular Devices segment also exhibited high growth, which can be attributed to the rising incidence of cardiovascular diseases across the world. Concurrently, Minimally Invasive Surgery (MIS) Devices are growing at a fast pace. This is driven by patient demand for less invasive treatments with lower complication rates and shorter recovery times. Together, these segments highlight the dynamic nature of the evolution of the healthcare equipment market, fueled by advances in technology and changing paradigms in patient care.

Healthcare Equipment Market segmentation By End-User Industry:

- Hospitals and Ambulatory Surgical Centers (ASCs)

- Clinics

- Homecare Settings

- Diagnostic Centers

In the healthcare equipment industry, clinics and hospitals are the leading end-user segment, contributing to a large share of overall revenue. This is due to the growing number of inpatient and outpatient procedures, improvement in healthcare infrastructure, and positive reimbursement policies. At the same time, diagnostic centers are becoming the fastest-growing segment with a high compound annual growth rate (CAGR). This swift growth is fueled by the increasing demand for early and precise disease diagnosis, advances in diagnostic technology equipment, and increased focus on preventive care. Although homecare facilities and ambulatory surgical facilities also drive growth in the market, their relative impact is weaker.

Healthcare Equipment Market Regional Analysis:

The global healthcare equipment market has unique regional characteristics, with North America being the leader at 38% market share, followed by Europe at about 30%, and the Asia-Pacific region at 24%. Latin America and the Middle East & Africa regions have lower shares of about 5% and 3%, respectively. These differences are driven by aspects like the prevalence of chronic diseases, healthcare infrastructure, technology levels, and economic conditions.

COVID-19 Impact Analysis on the Healthcare Equipment Market:

The COVID-19 pandemic profoundly impacted the healthcare equipment market, leading to both surges in demand and significant disruptions. There was an unprecedented need for personal protective equipment (PPE), ventilators, and diagnostic tests, resulting in global shortages and supply chain challenges. Manufacturers faced obstacles such as raw material scarcities, logistical constraints, and the necessity to rapidly scale production. Additionally, the postponement of elective procedures caused a temporary decline in demand for non-essential medical devices. These factors collectively reshaped the market, underscoring the importance of supply chain resilience and adaptability in the healthcare equipment industry.

Recent Trends/Developments:

The medical equipment industry is undergoing major changes fueled by technology and changing patient requirements. The major trends are the adoption of artificial intelligence (AI) and machine learning, which improve diagnostics and individualize patient treatment. Wearable devices and biometric sensors are becoming popular, allowing real-time monitoring of health and facilitating the transition towards preventive care. Digital therapeutics and home-based diagnosis equipment have proliferated, embodying a trend toward patient-empowered health solutions. In addition, advancements in telemedicine have boosted off-site patient monitoring equipment demand for virtual consultations and ongoing health surveillance. These breakthroughs all tend to make a more efficient, accessible healthcare system.

Key Players in the Healthcare Equipment Market:

- Medtronic

- Johnson & Johnson MedTech

- Siemens Healthineers

- Stryker

- Philips

- GE HealthCare

- Abbott

- Becton, Dickinson and Company (BD)

- Boston Scientific

- Baxter International

Chapter 1. HEALTHCARE EQUIPMENT MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. HEALTHCARE EQUIPMENT MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. HEALTHCARE EQUIPMENT MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. HEALTHCARE EQUIPMENT MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. HEALTHCARE EQUIPMENT MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. HEALTHCARE EQUIPMENT MARKET – By Device Type

6.1 Introduction/Key Findings

6.2 In-vitro diagnostics (IVD)

6.3 Orthopedic Devices

6.4 Cardiovascular Devices

6.5 Diagnostic Imaging Equipment

6.6 Minimally Invasive Surgery (MIS) Devices

6.7 Wound Management Devices

6.8 Diabetes Care Devices

6.9 Ophthalmic Devices

6.10 Dental Devices

6.11 Nephrology Devices

6.12 General Surgery Devices

6.13 Hearing Aid Devices

6.14 Drug Delivery Devices

6.15 Respiratory Care Devices

6.16 Patient Monitoring Devices

6.17 Y-O-Y Growth trend Analysis By Device Type

6.18 Absolute $ Opportunity Analysis By Device Type , 2025-2030

Chapter 7. HEALTHCARE EQUIPMENT MARKET – By End-User Industry

7.1 Introduction/Key Findings

7.2 Hospitals and Ambulatory Surgical Centers (ASCs)

7.3 Clinics

7.4 Homecare Settings

7.5 Diagnostic Centers

7.6 Y-O-Y Growth trend Analysis By End-User Industry

7.7 Absolute $ Opportunity Analysis By End-User Industry , 2025-2030

Chapter 8. HEALTHCARE EQUIPMENT MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By End-User Industry

8.1.3. By Device Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Device Type

8.2.3. By End-User Industry

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Device Type

8.3.3. By End-User Industry

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Device Type

8.4.3. By End-User Industry

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Device Type

8.5.3. By End-User Industry

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. HEALTHCARE EQUIPMENT MARKET – Company Profiles – (Overview, Packaging End-User Industry , Portfolio, Financials, Strategies & Developments)

9.1 Medtronic

9.2 Johnson & Johnson MedTech

9.3 Siemens Healthineers

9.4 Stryker

9.5 Philips

9.6 GE HealthCare

9.7 Abbott

9.8 Becton, Dickinson and Company (BD)

9.9 Boston Scientific

9.10 Baxter International

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market is expected to grow from $518.46 billion in 2025 to $885.51 billion by 2030, at a CAGR of 11.3%.

Healthcare equipment encompasses a broad range of medical devices designed for diagnosing, monitoring, and treating various health conditions. This includes instruments, machines, implants, and in vitro reagents used in medical settings.

Key drivers include an aging global population, increasing prevalence of chronic diseases, and continuous technological advancements leading to innovative medical devices.

Manufacturers must comply with regulations such as establishment registration, device listing, premarket notification [510(k)], premarket approval (PMA), and adherence to Quality System Regulations (QSR) to ensure safety and efficacy.

The FDA defines a medical device as an instrument, apparatus, implement, machine, contrivance, implant, in vitro reagent, or other similar or related article intended for use in diagnosing, curing, mitigating, treating, or preventing disease, which does not achieve its primary intended purposes through chemical action within or on the body