Healthcare E-Commerce Market Size (2025 – 2030)

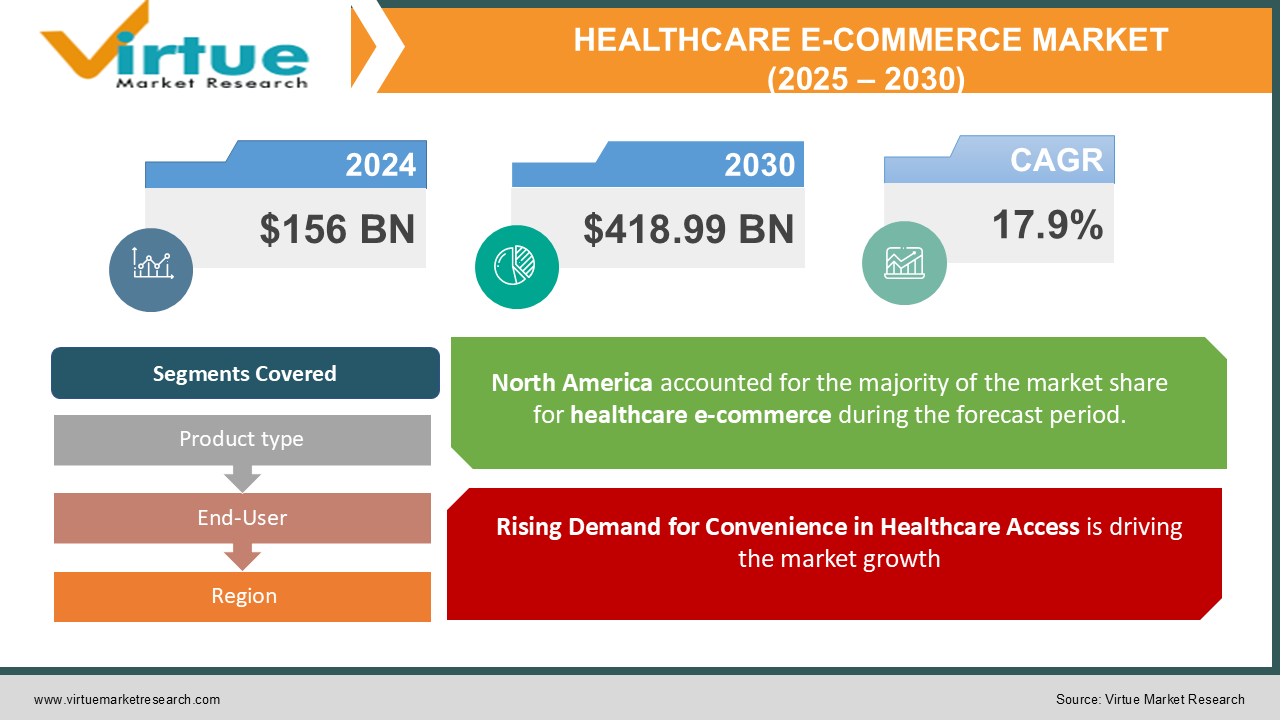

The Global Healthcare E-Commerce Market was valued at USD 156 billion in 2024 and is projected to reach USD 418.99 billion by 2030, growing at a CAGR of 17.9% during the forecast period.

This robust growth is driven by the increasing adoption of digital platforms for purchasing healthcare products and services, rising smartphone penetration, and the demand for convenience in accessing healthcare solutions.

The shift from traditional brick-and-mortar retail to online platforms has transformed the healthcare landscape, offering a wide range of products such as pharmaceuticals, medical devices, and health supplements. Factors such as aging populations, advancements in telemedicine, and increased consumer awareness about online healthcare services are further fueling market expansion.

Key Market Insights

-

Pharmaceuticals is the largest segment in the product type category, accounting for over 50% of the market share in 2024, due to high demand for prescription and over-the-counter (OTC) drugs online.

-

The homecare settings segment in the end-user category is growing rapidly, supported by the increasing preference for home delivery of healthcare products.

-

North America held the largest regional market share in 2024, contributing to over 40% of the global revenue, driven by the presence of established e-commerce platforms and high internet penetration.

Global Healthcare E-Commerce Market Drivers

1. Rising Demand for Convenience in Healthcare Access is driving the market growth

The healthcare industry is witnessing a paradigm shift, with consumers increasingly prioritizing convenience and accessibility. E-commerce platforms enable users to purchase medicines, medical devices, and supplements from the comfort of their homes, eliminating the need to visit physical stores.

This demand is particularly evident among the elderly and patients with chronic illnesses, who benefit from the availability of subscription-based delivery services. Furthermore, the integration of telemedicine with e-commerce platforms has enhanced access to healthcare products and services, driving market growth.

2. Technological Advancements in E-Commerce Platforms is driving the market growth

The incorporation of advanced technologies like AI, machine learning, and blockchain is revolutionizing healthcare e-commerce platforms. AI-powered tools provide personalized product recommendations, while blockchain ensures secure and transparent transactions.

Additionally, advancements in logistics, such as same-day delivery and temperature-controlled packaging, have improved the reliability of e-commerce platforms in delivering sensitive healthcare products. These innovations are attracting more consumers and driving market expansion.

3. Increasing Internet Penetration and Smartphone Usage is driving the market growth

The proliferation of smartphones and high-speed internet has played a pivotal role in the growth of healthcare e-commerce. Mobile-friendly platforms and user-friendly apps have made it easier for consumers to access healthcare products online.

In developing regions, where healthcare infrastructure may be limited, e-commerce platforms bridge the gap by offering access to a wide range of products and services. This trend is expected to continue, supported by government initiatives promoting digital transformation.

Global Healthcare E-Commerce Market Challenges and Restraints

1. Regulatory and Data Privacy Concerns is restricting the market growth

The healthcare e-commerce market is subject to stringent regulations concerning the sale of pharmaceuticals, medical devices, and other healthcare products. Compliance with these regulations can be complex and varies across regions, posing challenges for global e-commerce platforms.

Additionally, data privacy concerns remain a significant barrier, as consumers are often reluctant to share sensitive health information online. Companies must invest in robust cybersecurity measures and comply with privacy regulations such as GDPR to build consumer trust.

2. Competition from Traditional Retail Channels is restricting the market growth

Despite the growing popularity of e-commerce platforms, traditional retail pharmacies and stores remain a strong competitor. Many consumers prefer physical stores for immediate access to products and face-to-face interactions with pharmacists.

The lack of digital literacy among certain demographics, such as the elderly in rural areas, further limits the adoption of e-commerce solutions. Overcoming this challenge requires targeted marketing efforts and user education initiatives by market players.

Market Opportunities

The Global Healthcare E-Commerce Market presents a landscape brimming with significant growth opportunities, fueled by a confluence of evolving consumer preferences, rapid technological advancements, and the untapped potential of emerging regional markets. Developing economies in Asia-Pacific, Latin America, and Africa offer immense growth potential, as rising disposable incomes and increasing internet penetration drive a surge in consumer adoption of e-commerce platforms. Government initiatives aimed at enhancing digital infrastructure further accelerate this trend. E-commerce platforms can capitalize on this growth by leveraging subscription-based models to offer regular deliveries of medicines, supplements, and other healthcare products. This recurring revenue model not only enhances customer retention but also significantly increases customer lifetime value. The integration of telemedicine services with e-commerce platforms creates a comprehensive solution for consumers, enabling them to seamlessly consult with doctors and subsequently order prescribed products online. This integrated approach is particularly beneficial for individuals residing in remote and underserved regions, enhancing access to quality healthcare. Furthermore, the adoption of sustainable practices, such as eco-friendly packaging and carbon-neutral delivery options, can attract environmentally conscious consumers, creating a niche market for sustainable healthcare e-commerce. Finally, the integration of AI-driven innovations, including personalized shopping experiences, virtual assistants, and predictive analytics, can significantly enhance customer engagement and satisfaction. These AI-powered features can personalize product recommendations, anticipate customer needs, and provide proactive support, fostering platform loyalty and driving long-term growth within the dynamic healthcare e-commerce market.

HEALTHCARE E-COMMERCE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

17.9% |

|

Segments Covered |

By Product type, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Amazon Pharmacy, Alibaba Health Information Technology, CVS Health Corporation, Walgreens Boots Alliance, Medlife International Pvt. Ltd., Netmeds Marketplace Limited, Walmart Health, Flipkart Health+, OptumRx, Inc., LloydsPharmacy |

Healthcare E-Commerce Market Segmentation - By Product Type

-

Pharmaceuticals

-

Medical Devices

-

Health Supplements

The pharmaceuticals segment undeniably dominates the healthcare e-commerce market, driven by the consistently high demand for both prescription medications and over-the-counter (OTC) drugs. The convenience of online platforms allows patients to easily order medications from the comfort of their homes, eliminating the need for physical visits to pharmacies. This is particularly beneficial for individuals with chronic conditions who require regular medication refills, as well as those living in remote areas with limited access to physical pharmacies. Furthermore, online platforms often offer competitive pricing and access to a wider range of medications, providing patients with greater choice and affordability. The growing prevalence of chronic diseases and the increasing aging population further contribute to the significant demand for prescription medications, solidifying the dominance of this segment within the healthcare e-commerce market.

Healthcare E-Commerce Market Segmentation - By End-User

-

Hospitals

-

Clinics

-

Homecare Settings

The homecare settings segment within the healthcare e-commerce market is experiencing rapid growth, driven by a confluence of factors. The increasing adoption of online platforms provides patients and caregivers with convenient access to a wide array of healthcare products, from medical supplies and equipment to over-the-counter medications and personal care items. This accessibility fosters greater independence for patients, allowing them to manage their healthcare needs from the comfort of their homes. Furthermore, the growing preference for home-based care, driven by factors such as an aging population, the rising prevalence of chronic diseases, and a desire for personalized care, significantly contributes to the growth of this segment. Online platforms offer a convenient and efficient channel for procuring necessary medical supplies and equipment, streamlining the process and reducing the burden on patients and caregivers. Additionally, advancements in telemedicine and remote patient monitoring technologies are further fueling the growth of homecare settings by enabling continuous care and support, even for patients with complex medical conditions.

Healthcare E-Commerce Market Segmentation - By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

North America currently dominates the healthcare e-commerce market in 2024. This leadership is attributed to the presence of well-established e-commerce platforms, high internet penetration rates, and a robust healthcare infrastructure. The United States, in particular, is the largest contributor, driven by high consumer adoption of online platforms and supportive regulatory frameworks. Asia-Pacific is emerging as the fastest-growing region, boasting a CAGR of 20.1% during the forecast period. Rapid urbanization, a burgeoning internet user base, and government initiatives aimed at promoting digital healthcare are key drivers of market growth in countries like China and India. Europe represents a mature market characterized by high consumer awareness and the widespread availability of e-commerce platforms.

COVID-19 Impact Analysis

The COVID-19 pandemic served as a catalyst for the Global Healthcare E-Commerce Market, accelerating its growth trajectory. Lockdown measures, social distancing norms, and the fear of visiting physical stores pushed consumers towards online platforms for purchasing healthcare products. The pandemic also highlighted the importance of robust supply chain management and last-mile delivery in ensuring timely access to essential medicines and medical devices. E-commerce platforms adapted quickly, expanding their product offerings and investing in advanced logistics solutions. Post-pandemic, the market is expected to sustain its growth momentum, as consumers continue to prioritize convenience and safety in accessing healthcare products. The integration of telemedicine and e-commerce platforms further strengthens this trend.

Latest Trends/Developments

The healthcare e-commerce landscape is undergoing a significant transformation, driven by several key trends. E-commerce platforms are increasingly leveraging AI-powered chatbots to enhance customer service, providing personalized recommendations for products and services, and even assisting with prescription refills, streamlining the patient experience. Blockchain technology is gaining traction, offering enhanced transparency, security, and traceability throughout the healthcare supply chain, ensuring the authenticity and integrity of medications and medical devices. Furthermore, logistics innovations, such as same-day delivery and the emergence of drone-based deliveries, are reshaping the industry by providing patients with greater convenience and access to healthcare products and services. This rapid evolution is further fueled by global partnerships between healthcare providers, e-commerce platforms, and logistics companies, fostering innovation and expanding market reach. Finally, a strong emphasis on user experience is driving platforms to invest in intuitive interfaces, user-friendly mobile apps, and voice-activated search capabilities, creating a seamless and personalized experience for patients and consumers.

Key Players

-

Amazon Pharmacy

-

Alibaba Health Information Technology

-

CVS Health Corporation

-

Walgreens Boots Alliance

-

Medlife International Pvt. Ltd.

-

Netmeds Marketplace Limited

-

Walmart Health

-

Flipkart Health+

-

OptumRx, Inc.

-

LloydsPharmacy

Chapter 1. Healthcare E-Commerce Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Healthcare E-Commerce Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Healthcare E-Commerce Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Healthcare E-Commerce Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Healthcare E-Commerce Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Healthcare E-Commerce Market – By Product Type

6.1 Introduction/Key Findings

6.2 Pharmaceuticals

6.3 Medical Devices

6.4 Health Supplements

6.5 Y-O-Y Growth trend Analysis By Product Type

6.6 Absolute $ Opportunity Analysis By Product Type, 2025-2030

Chapter 7. Healthcare E-Commerce Market – By End-User

7.1 Introduction/Key Findings

7.2 Hospitals

7.3 Clinics

7.4 Homecare Settings

7.5 Y-O-Y Growth trend Analysis By End-User

7.6 Absolute $ Opportunity Analysis By End-User, 2025-2030

Chapter 8. Healthcare E-Commerce Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product Type

8.1.3 By End-User

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product Type

8.2.3 By End-User

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product Type

8.3.3 By End-User

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product Type

8.4.3 By End-User

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product Type

8.5.3 By End-User

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Healthcare E-Commerce Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Amazon Pharmacy

9.2 Alibaba Health Information Technology

9.3 CVS Health Corporation

9.4 Walgreens Boots Alliance

9.5 Medlife International Pvt. Ltd.

9.6 Netmeds Marketplace Limited

9.7 Walmart Health

9.8 Flipkart Health+

9.9 OptumRx, Inc.

9.10 LloydsPharmacy

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Healthcare E-Commerce Market was valued at USD 156 billion in 2024 and is projected to reach USD 418.99 billion by 2030, growing at a CAGR of 17.9% during the forecast period.

Key drivers include rising demand for convenience in healthcare access, advancements in e-commerce technologies, and increasing internet penetration and smartphone usage.

Segments include Product Type (Pharmaceuticals, Medical Devices, Health Supplements), End-User (Hospitals, Clinics, Homecare Settings), and Region (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa).

North America dominates the market, holding over 40% of the global share, driven by high internet penetration and established e-commerce platforms.

Key players include Amazon Pharmacy, Alibaba Health Information Technology, CVS Health Corporation, Walgreens Boots Alliance, and Medlife International Pvt. Ltd.