Healthcare Analytics Market Size (2025 – 2030)

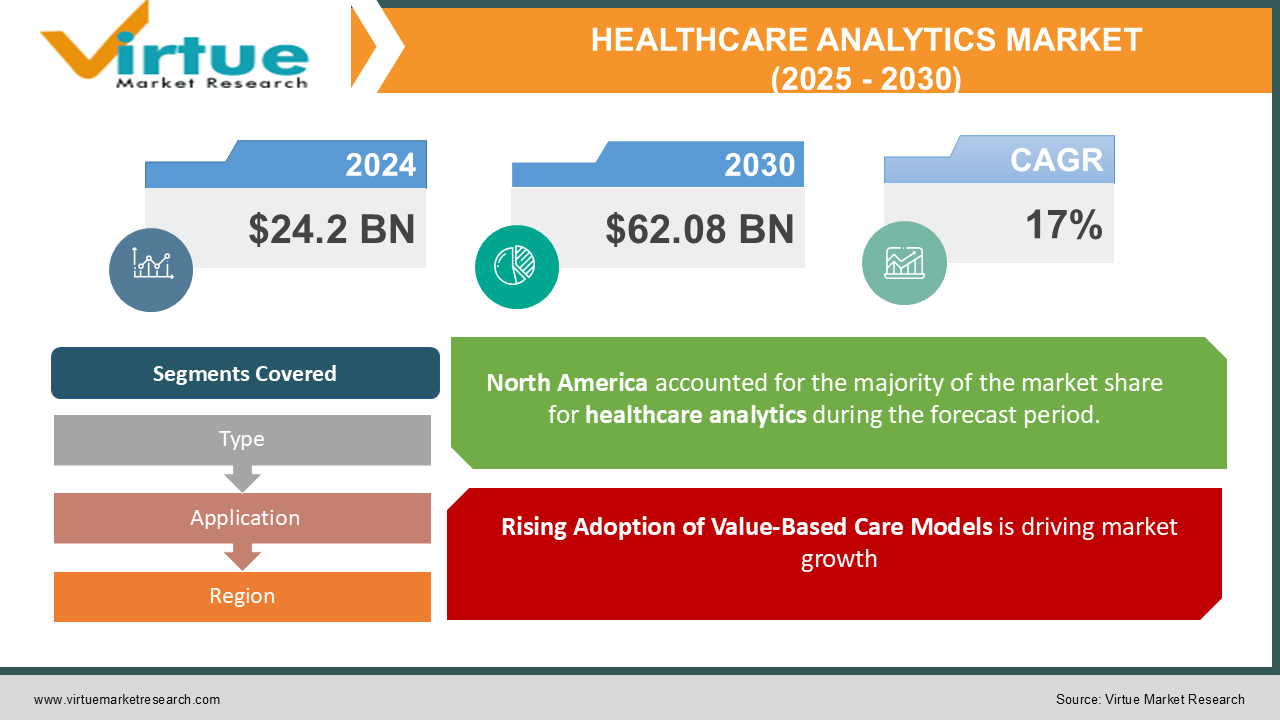

The Global Healthcare Analytics Market was valued at USD 24.2 billion in 2024 and will grow at a CAGR of 17% from 2025 to 2030. The market is expected to reach USD 62.08 billion by 2030.

Healthcare Analytics involves the use of data analysis tools and techniques to extract actionable insights from healthcare data, improving patient care, optimizing operational efficiency, and aiding strategic decision-making. The growing adoption of electronic health records (EHRs), the proliferation of wearable devices, and the emphasis on value-based care are driving the expansion of this market. These solutions empower healthcare providers with predictive capabilities, enabling proactive interventions and better resource management.

Key Market Insights

-

The implementation of value-based care models has fueled demand for healthcare analytics, as providers strive to improve patient outcomes while reducing costs.

-

Cloud-based analytics solutions are gaining popularity due to their scalability and cost-effectiveness, with a growing number of healthcare institutions adopting these platforms.

-

The U.S. accounts for a significant share of the market due to high healthcare expenditure and widespread adoption of advanced analytics technologies.

-

Population health management is one of the fastest-growing applications, driven by the need to address chronic diseases and aging populations effectively.

-

The integration of artificial intelligence (AI) and machine learning (ML) into analytics platforms is enhancing predictive and prescriptive capabilities.

-

Data security and privacy concerns remain a significant challenge, particularly with the increasing use of third-party platforms and cloud solutions.

-

Emerging markets, especially in Asia-Pacific, present lucrative opportunities due to growing healthcare digitization and supportive government initiatives.

-

Real-time analytics is becoming critical in emergency care scenarios, enabling faster response times and improved patient outcomes.

Global Healthcare Analytics Market Drivers

Rising Adoption of Value-Based Care Models is driving market growth:

Value-based care models emphasize improving patient outcomes while controlling costs, a significant shift from traditional fee-for-service models. Healthcare analytics solutions support this transition by enabling healthcare providers to analyze large volumes of clinical and operational data. These insights facilitate better decision-making, from identifying at-risk patients to optimizing treatment plans. For example, predictive analytics helps prevent hospital readmissions by identifying patients who are likely to require follow-up care. As governments and payers increasingly link reimbursements to patient outcomes, the demand for analytics solutions will continue to surge. The introduction of bundled payment models and Accountable Care Organizations (ACOs) has further propelled the use of analytics in care coordination and cost reduction.

Technological Advancements in Data Analytics Tools is driving market growth:

The rapid evolution of data analytics tools, particularly AI and ML, is a key driver of the healthcare analytics market. These technologies enable advanced capabilities such as natural language processing (NLP), real-time decision-making, and predictive analytics. AI-powered platforms can process unstructured data from sources such as EHRs, clinical notes, and imaging systems, providing actionable insights. For example, NLP algorithms can analyze physician notes to identify undiagnosed conditions. The rise of edge computing and IoT devices has further enhanced the utility of real-time analytics, particularly in critical care settings. These technological advancements are enabling providers to extract maximum value from their data assets.

Increased Focus on Personalized Medicine is driving market growth:

Personalized medicine aims to tailor treatment plans based on individual patient characteristics, including genetics, lifestyle, and environmental factors. Analytics plays a crucial role in this approach, enabling the analysis of diverse data sets to identify patterns and predict treatment responses. For instance, genomic data analytics can identify genetic markers associated with certain diseases, enabling early interventions. Similarly, wearable devices and mobile health apps generate real-time patient data, which analytics platforms can process to provide personalized recommendations. This growing emphasis on patient-centric care has accelerated the adoption of analytics in areas such as oncology, cardiology, and chronic disease management.

Global Healthcare Analytics Market Challenges and Restraints

Data Privacy and Security Concerns is restricting market growth:

The healthcare sector generates vast amounts of sensitive data, including patient records and clinical information, making it a prime target for cyberattacks. Data breaches can result in severe consequences, including financial penalties, reputational damage, and legal liabilities. Despite advancements in cybersecurity, the risk of unauthorized access to analytics platforms persists, particularly in cloud-based environments. Compliance with data protection regulations such as GDPR and HIPAA adds to the complexity, requiring providers to implement robust safeguards. Additionally, interoperability challenges between disparate systems can create vulnerabilities, hindering the seamless exchange of data and slowing market adoption.

High Implementation Costs and Resource Constraints is restricting market growth:

The initial investment required to implement healthcare analytics solutions can be prohibitive for smaller providers, particularly in emerging markets. These costs include purchasing software licenses, upgrading IT infrastructure, and training staff. The lack of skilled professionals capable of managing complex analytics systems further exacerbates the challenge. Many organizations struggle to justify the ROI of analytics solutions, particularly when short-term financial pressures take precedence. Additionally, legacy systems and outdated workflows can create barriers to adoption, requiring significant efforts to modernize and integrate analytics tools effectively.

Market Opportunities

The rising prevalence of chronic diseases such as diabetes, cardiovascular conditions, and cancer presents significant growth opportunities for healthcare analytics. These conditions often require long-term management, making data-driven insights critical for optimizing treatment plans and improving patient outcomes. The proliferation of wearable devices and telehealth platforms is generating unprecedented volumes of real-time data, creating opportunities for advanced analytics applications. Furthermore, the global shift toward healthcare digitization, particularly in emerging economies, is opening new avenues for market expansion. Government initiatives to promote EHR adoption and invest in healthcare IT infrastructure further support this trend. Additionally, partnerships between healthcare providers, technology companies, and research institutions are fostering innovation, driving the development of next-generation analytics solutions tailored to diverse healthcare needs.

HEALTHCARE ANALYTICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

17% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Optum, IBM, Cerner, Allscripts, McKesson, Oracle SAS Institute, Inovalon, Health Catalyst, Epic Systems |

Healthcare Analytics Market Segmentation - By Type

-

Descriptive Analytics

-

Predictive Analytics

-

Prescriptive Analytics

Predictive Analytics leads the market, as its ability to forecast patient outcomes and resource needs is instrumental in improving operational efficiency and care quality.

Healthcare Analytics Market Segmentation - By Application

-

Population Health Management

-

Clinical Analytics

-

Operational and Administrative Analytics

-

Financial Analytics

Population Health Management is the dominant segment, driven by its role in addressing chronic disease management and enhancing preventive care strategies.

Healthcare Analytics Market Segmentation - By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America is the most dominant region in the global healthcare analytics market. The region benefits from advanced healthcare infrastructure, high adoption rates of analytics solutions, and supportive government policies. For instance, the U.S. has implemented numerous initiatives to promote EHR adoption and value-based care models, creating a favorable environment for analytics growth. Additionally, the presence of leading technology companies and research institutions has accelerated innovation in analytics platforms. The region's focus on addressing rising healthcare costs and improving patient outcomes further drives market dominance.

COVID-19 Impact Analysis on the Healthcare Analytics Market

The COVID-19 pandemic drastically accelerated the adoption of healthcare analytics, as healthcare providers urgently sought data-driven solutions to navigate the crisis. Analytics platforms became vital tools for tracking the virus's spread, predicting hospitalization rates, and optimizing resource allocation, such as ICU beds and ventilators. By utilizing real-time analytics, healthcare organizations and governments could efficiently monitor vaccination progress and quickly identify underserved populations, ensuring resources were directed where most needed. The pandemic also underscored the importance of interoperability and data sharing across different healthcare systems. As healthcare organizations scrambled to manage the overwhelming demand, the ability to integrate and share data became crucial for timely decision-making and resource management. This realization led to increased investments in advanced analytics tools designed to enhance data exchange, streamline operations, and improve overall healthcare delivery. However, the rapid implementation of analytics solutions during the pandemic also revealed significant challenges. Data privacy concerns emerged as sensitive health information was shared more widely across platforms. Additionally, issues related to system integration surfaced, as many healthcare organizations relied on disparate technologies that lacked seamless communication with one another. These challenges highlighted the critical need for robust governance frameworks to protect patient data, ensure compliance with privacy regulations, and establish clear protocols for data sharing. In summary, while the pandemic accelerated the use of healthcare analytics, it also exposed gaps in data privacy, system integration, and governance. Addressing these challenges will be essential for building a more resilient and efficient healthcare system in the post-pandemic world, ensuring that healthcare analytics can continue to support better decision-making, resource management, and patient care.

Latest Trends/Developments

Several key trends are currently shaping the healthcare analytics market, driving significant advancements in the field. One of the most impactful developments is the integration of Artificial Intelligence (AI) and Machine Learning (ML) into analytics platforms. These technologies are enhancing the predictive and prescriptive capabilities of healthcare systems, allowing for more accurate forecasts and personalized care recommendations. By leveraging AI and ML, providers can optimize treatment plans, reduce errors, and improve patient outcomes with greater precision. Another growing trend is the adoption of Natural Language Processing (NLP), particularly for analyzing unstructured data such as physician notes, medical literature, and clinical reports. This technology enables healthcare organizations to extract meaningful insights from vast amounts of text-based data, which was previously challenging to analyze. NLP is thus playing a critical role in improving the efficiency and accuracy of decision-making in healthcare settings. Real-time analytics is also gaining momentum, particularly in critical care environments. By providing up-to-the-minute data, real-time analytics facilitates faster, more informed decision-making, which is crucial for improving patient outcomes in high-stakes situations. This capability is increasingly being used to monitor vital signs, anticipate complications, and optimize treatment protocols, ensuring timely interventions. Furthermore, there is a growing emphasis on addressing Social Determinants of Health (SDOH), which considers socioeconomic and environmental factors that influence health outcomes. Healthcare analytics solutions are now incorporating SDOH data to create a more holistic view of patient health, leading to better-targeted interventions and resource allocation. Finally, collaborations between technology companies and healthcare providers are driving innovation, particularly in areas like telehealth analytics and population health management. These partnerships are paving the way for the development of new solutions that enhance patient care, improve operational efficiency, and support proactive health management.

Key Players

-

Optum

-

IBM

-

Cerner

-

Allscripts

-

McKesson

-

Oracle

-

SAS Institute

-

Inovalon

-

Health Catalyst

-

Epic Systems

Chapter 1. Healthcare Analytics Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Healthcare Analytics Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Healthcare Analytics Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Healthcare Analytics Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Healthcare Analytics Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Healthcare Analytics Market – By Type

6.1 Introduction/Key Findings

6.2 Descriptive Analytics

6.3 Predictive Analytics

6.4 Prescriptive Analytics

6.5 Y-O-Y Growth trend Analysis By Type

6.6 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Healthcare Analytics Market – By Application

7.1 Introduction/Key Findings

7.2 Population Health Management

7.3 Clinical Analytics

7.4 Operational and Administrative Analytics

7.5 Financial Analytics

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Healthcare Analytics Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Healthcare Analytics Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Optum

9.2 IBM

9.3 Cerner

9.4 Allscripts

9.5 McKesson

9.6 Oracle

9.7 SAS Institute

9.8 Inovalon

9.9 Health Catalyst

9.10 Epic Systems

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Healthcare Analytics Market was valued at USD 24.2 billion in 2024 and will grow at a CAGR of 17% from 2025 to 2030. The market is expected to reach USD 62.08 billion by 2030.

Key drivers include the rising adoption of value-based care models, advancements in data analytics technologies, and the increasing focus on personalized medicine.

The market is segmented by type (descriptive, predictive, and prescriptive analytics) and by application (population health management, clinical analytics, operational and administrative analytics, and financial analytics).

North America is the most dominant region, driven by advanced healthcare infrastructure and widespread adoption of analytics solutions.

Leading players include Optum, IBM, Cerner, Allscripts, McKesson, Oracle, SAS Institute, Inovalon, Health Catalyst, and Epic Systems.