HD Map for Autonomous Vehicles Market Size (2025-2030)

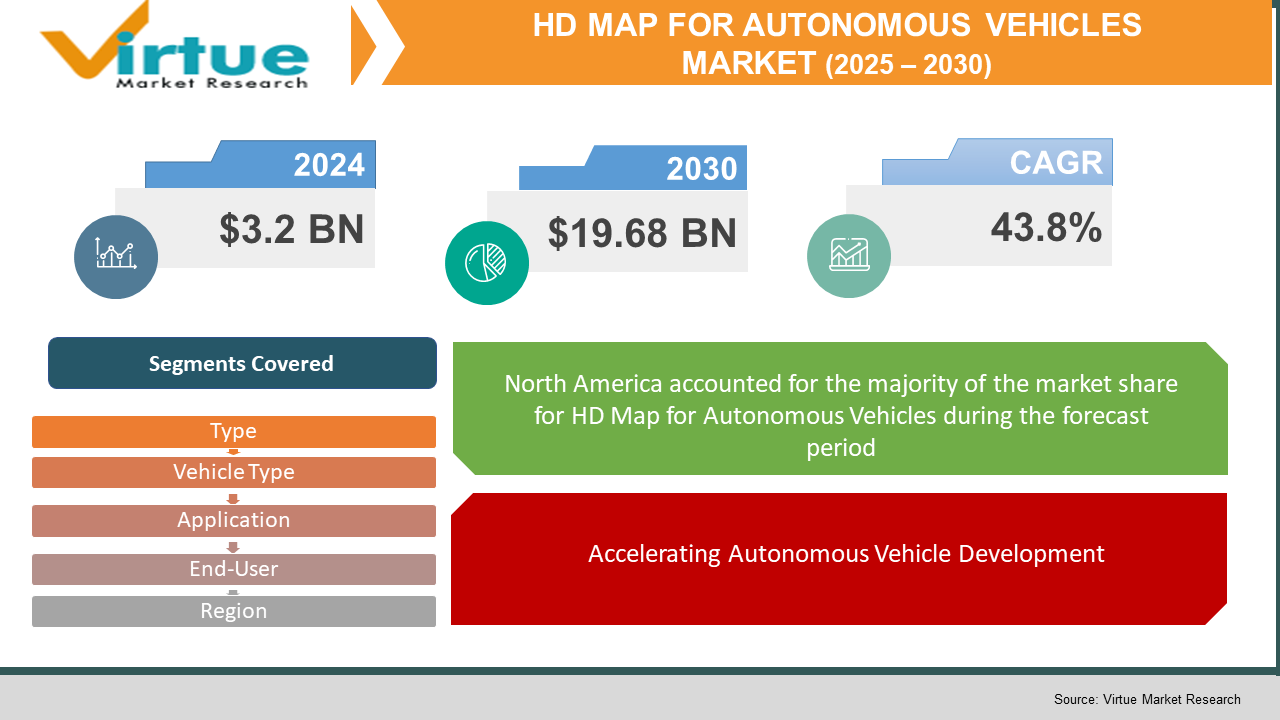

The HD Map for Autonomous Vehicles Market was valued at USD 3.2 billion in 2024 and is projected to reach a market size of USD 19.68 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 43.8%.

The HD Map for Autonomous Vehicles Market represents a revolutionary transformation in digital cartography, serving as the foundational infrastructure for next-generation transportation systems. High-definition maps are precision-engineered digital representations of road networks that provide centimeter-level accuracy, incorporating intricate details about lane markings, traffic signals, road signs, elevation changes, and environmental features that traditional GPS navigation systems cannot capture. These sophisticated mapping solutions function as the digital nervous system for autonomous vehicles, enabling them to perceive, understand, and navigate complex urban environments with unprecedented precision and safety. The market encompasses a comprehensive ecosystem of technologies including advanced sensor fusion, machine learning algorithms, real-time data processing, and cloud-based infrastructure that collectively create dynamic, continuously updated mapping platforms. Unlike conventional navigation maps that focus primarily on routing, HD maps serve as comprehensive spatial databases containing millions of data points per kilometer, including precise geometric information, semantic annotations, and contextual intelligence about driving conditions, traffic patterns, and environmental hazards. The current market landscape features an intricate network of automotive manufacturers, technology giants, specialized mapping companies, and emerging startups all competing to establish dominance in this critical component of autonomous driving infrastructure. The technology's sophistication extends beyond simple road mapping to encompass predictive analytics, behavioral modeling, and integration with vehicle-to-everything (V2X) communication systems that enable vehicles to anticipate and respond to changing road conditions in real-time.

The long-term vision extends beyond individual vehicle navigation to encompass smart city infrastructure, where HD maps become integral components of urban planning, traffic management, and public safety systems. This transformation promises to reshape transportation economics, reduce accident rates, optimize traffic flow, and create new business models around location-based services and mobility-as-a-service platforms.

Key Market Insights:

- The HD map market demonstrates remarkable consistency in valuation methodologies, with 2024 estimates converging around USD 3.2 billion, indicating mature analytical frameworks and standardized assessment criteria across industry research organizations.

- Approximately 78% of current HD map development efforts focus on direct automotive integration, with embedded systems representing the primary deployment model for autonomous vehicle manufacturers.

- HD mapping systems process an average of 2.5 terabytes of sensor data per vehicle per day, requiring sophisticated compression algorithms and edge computing solutions to maintain real-time performance capabilities.

- Current HD maps achieve positional accuracy within 10-20 centimeters, with next-generation systems targeting sub-5-centimeter precision through enhanced sensor fusion and machine learning optimization techniques.

- Real-time HD maps require continuous updates every 30-60 seconds for dynamic elements like traffic conditions, with static infrastructure updates occurring weekly to maintain optimal navigation performance.

- HD mapping coverage expanded by 340% in major metropolitan areas during 2024, with approximately 2.8 million kilometers of roadways now mapped at high-definition standards globally.

- HD map production costs decreased by 45% in 2024 compared to previous year, driven by automated data collection systems and AI-powered processing workflows that reduce manual intervention requirements.

- Modern HD mapping systems integrate data from 15-20 different sensor types, including LiDAR, cameras, radar, GPS, and inertial measurement units to create comprehensive environmental understanding.

- HD maps for commercial vehicle applications grew by 67% in 2024, driven by logistics companies seeking to optimize delivery routes and reduce operational costs through precise navigation systems.

Market Drivers:

Accelerating Autonomous Vehicle Development

The exponential growth in autonomous vehicle research and development serves as the primary catalyst for HD map market expansion. As automotive manufacturers and technology companies invest billions in self-driving capabilities, the demand for precise, reliable mapping infrastructure has become paramount. HD maps provide the foundational layer of environmental understanding that enables autonomous systems to navigate complex scenarios, interpret road conditions, and make real-time decisions with human-level precision. The technology addresses critical safety requirements by providing redundant navigation systems that complement sensor-based perception, creating multiple layers of situational awareness that significantly reduce the risk of accidents and system failures in autonomous driving scenarios.

Regulatory Pressure and Safety Standards

Increasingly stringent safety regulations and governmental mandates for advanced driver assistance systems are driving substantial investment in HD mapping technologies. Regulatory bodies worldwide are establishing new standards for autonomous vehicle safety that require comprehensive environmental awareness and predictive capabilities that only high-definition maps can provide. The technology enables compliance with emerging safety frameworks by providing verified, continuously updated information about road conditions, traffic patterns, and potential hazards that enhance decision-making capabilities in autonomous systems and reduce liability risks for manufacturers and operators.

Market Restraints and Challenges:

The HD map market faces significant challenges related to the massive computational requirements for processing and maintaining real-time mapping data, creating substantial infrastructure costs and energy consumption concerns. Data privacy and security issues present ongoing challenges as HD maps collect and store detailed information about vehicle movements and locations. Additionally, the lack of standardized protocols for map data formats and interoperability between different manufacturers creates fragmentation issues that limit market growth and increase development costs. Ensuring the map's fidelity in near real-time on a global scale is a monumental logistical and financial challenge. Furthermore, the lack of a universal industry standard for map data format leads to a fragmented ecosystem, hindering interoperability and slowing down widespread adoption.

Market Opportunities:

Substantial opportunities exist in developing HD mapping solutions for emerging markets and developing economies where autonomous vehicle adoption is accelerating rapidly. The integration of HD maps with smart city infrastructure presents significant revenue potential through public-private partnerships and government contracts for traffic management and urban planning applications. Furthermore, the expansion of HD mapping into adjacent industries such as robotics, drone delivery, and augmented reality navigation creates new market segments with substantial growth potential and diversified revenue streams. A significant opportunity lies in the monetization of map data beyond core autonomous driving. This rich geospatial information can fuel a new generation of location-based services, urban planning analytics, infrastructure monitoring for smart cities, and enhanced augmented reality navigation for human drivers.

HD MAP FOR AUTONOMOUS VEHICLES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

43.8% |

|

Segments Covered |

By Type, vehicle type, application, end user, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

HERE Technologies, TomTom, Waymo, Baidu, NVIDIA, Mobileye, DeepMap, Civil Maps, Carmera, Mapbox, ESRI, Google Maps, Apple Maps, Tesla, and Aurora Innovation |

HD Map for Autonomous Vehicles Market Segmentation:

HD Map for Autonomous Vehicles Market Segmentation by Type:

- 3D Point Cloud Maps

- Vector Maps

- Hybrid Maps

- Semantic Maps

Semantic maps represent the fastest-growing segment, driven by advanced AI capabilities that enable contextual understanding of driving environments. These maps incorporate machine learning algorithms that can interpret complex scenarios, predict traffic patterns, and provide intelligent routing recommendations that adapt to changing conditions in real-time.

Vector maps maintain market dominance due to their computational efficiency and compatibility with existing automotive systems. Their mathematical precision and compact data structure make them ideal for real-time navigation applications where processing speed and storage optimization are critical performance factors.

HD Map for Autonomous Vehicles Market Segmentation by Vehicle Type:

- Passenger Vehicles

- Commercial Vehicles

- Delivery Vehicles

- Public Transportation

Delivery vehicles represent the fastest-growing segment as e-commerce expansion drives demand for optimized last-mile delivery solutions. HD maps enable precise navigation in complex urban environments, improving delivery efficiency and reducing operational costs for logistics companies.

Passenger vehicles dominate the market due to the large consumer automotive market and widespread adoption of advanced driver assistance systems. The segment benefits from continuous technological advancement and consumer demand for enhanced safety features and navigation capabilities.

HD Map for Autonomous Vehicles Market Segmentation by Application:

- Navigation Systems

- ADAS (Advanced Driver Assistance Systems)

- Fully Autonomous Driving

- Fleet Management

Fully autonomous driving applications show the highest growth rate as technology companies and automotive manufacturers accelerate development of self-driving capabilities.

ADAS applications currently dominate the market as they represent the most commercially viable and widely deployed use of HD mapping technology. These systems provide immediate safety benefits and are increasingly standard in new vehicle models.

HD Map for Autonomous Vehicles Market Segmentation by End-User:

- Automotive OEMs

- Technology Companies

- Mapping Service Providers

- Government Agencies

Technology companies represent the fastest-growing end-user segment as major tech firms invest heavily in autonomous vehicle development and seek to establish platform dominance in the emerging mobility ecosystem.

Automotive OEMs remain the dominant end-user segment due to their direct integration of HD mapping technologies into vehicle systems and their substantial purchasing power in the automotive supply chain.

HD Map for Autonomous Vehicles Market Segmentation: Regional Analysis:

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- South America

North America dominates with a 42% market share, driven by significant investments from major technology companies, supportive regulatory frameworks, and extensive testing programs for autonomous vehicles. The region benefits from advanced infrastructure and strong partnerships between automotive manufacturers and technology providers.

Asia-Pacific demonstrates the highest growth rate, fueled by massive government investments in smart city initiatives, rapid urbanization, and aggressive autonomous vehicle development programs in countries like China, Japan, and South Korea that prioritize technological advancement and infrastructure modernization.

COVID-19 Impact Analysis:

The COVID-19 pandemic initially disrupted HD map development through supply chain interruptions and reduced automotive production. However, the crisis accelerated long-term adoption by highlighting the importance of contactless delivery systems and autonomous logistics solutions. The pandemic drove increased investment in delivery vehicle automation and contactless transportation systems, ultimately strengthening the market's growth trajectory through expanded applications in essential services and last-mile delivery solutions. The crisis reinforced the long-term strategic importance of automating supply chains, thereby bolstering the business case for developing and deploying the underlying mapping technology.

Latest Trends and Developments:

Current market trends focus on real-time collaborative mapping where multiple vehicles contribute to dynamic map updates, creating continuously improving navigation systems. Edge computing integration is becoming standard to reduce latency and enable real-time decision-making capabilities. There's also significant development in multi-modal mapping that integrates pedestrian, cyclist, and public transportation data to create comprehensive urban mobility solutions that support diverse transportation needs and smart city initiatives. Furthermore, standardization efforts are gaining momentum, with consortiums forming to create common data formats that will enhance interoperability between different automakers and map providers.

Key Players in the Market:

- NVIDIA Corporation

- HERE Technologies

- TomTom N.V.

- Waymo

- Mobileye (an Intel company)

- Baidu, Inc.

- Zenrin Co., Ltd.

- DeepMap, Inc. (NVIDIA)

- NavInfo Co., Ltd.

Chapter 1. HD Map for Autonomous Vehicles Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources`

1.5. Secondary Sources

Chapter 2. HD Map for Autonomous Vehicles Market– Executive Summary

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. HD Map for Autonomous Vehicles Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. HD Map for Autonomous Vehicles Market- Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. HD Map for Autonomous Vehicles Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. HD Map for Autonomous Vehicles Market– By Type

6.1 Introduction/Key Findings

6.2 3D Point Cloud Maps

6.3 Vector Maps

6.4 Hybrid Maps

6.5 Semantic Maps

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type , 2025-2030

Chapter 7. HD Map for Autonomous Vehicles Market– By End-User

7.1 Introduction/Key Findings

7.2 Automotive OEMs

7.3 Technology Companies

7.4 Mapping Service Providers

7.5 Government Agencies

7.6 Y-O-Y Growth trend Analysis By End-User

7.7 Absolute $ Opportunity Analysis By End-User, 2025-2030

Chapter 8. HD Map for Autonomous Vehicles Market– By Vehicle Type

8.1 Introduction/Key Findings

8.2 Passenger Vehicles

8.3 Commercial Vehicles

8.4 Delivery Vehicles

8.5 Public Transportation

8.6 Y-O-Y Growth trend Analysis Vehicle Type

8.7 Absolute $ Opportunity Analysis Vehicle Type , 2025-2030

Chapter 9. HD Map for Autonomous Vehicles Market– By Application

9.1 Introduction/Key Findings

9.2 Navigation Systems

9.3 ADAS (Advanced Driver Assistance Systems)

9.4 Fully Autonomous Driving

9.5 Fleet Management

9.6 Y-O-Y Growth trend Analysis Application

9.7 Absolute $ Opportunity Analysis Application , 2025-2030

Chapter 10. HD Map for Autonomous Vehicles Market, By Geography – Market Size, Forecast, Trends & Insights

10.1. North America

10.1.1. By Country

10.1.1.1. U.S.A.

10.1.1.2. Canada

10.1.1.3. Mexico

10.1.2. By Type

10.1.3. By Vehicle Type

10.1.4. By End-User

10.1.5. Application

10.1.6. Countries & Segments - Market Attractiveness Analysis

10.2. Europe

10.2.1. By Country

10.2.1.1. U.K.

10.2.1.2. Germany

10.2.1.3. France

10.2.1.4. Italy

10.2.1.5. Spain

10.2.1.6. Rest of Europe

10.2.2. By Type

10.2.3. By Vehicle Type

10.2.4. By End-User

10.2.5. Application

10.2.6. Countries & Segments - Market Attractiveness Analysis

10.3. Asia Pacific

10.3.1. By Country

10.3.1.2. China

10.3.1.2. Japan

10.3.1.3. South Korea

10.3.1.4. India

10.3.1.5. Australia & New Zealand

10.3.1.6. Rest of Asia-Pacific

10.3.2. By Type

10.3.3. By Application

10.3.4. By End-User

10.3.5. Vehicle Type

10.3.6. Countries & Segments - Market Attractiveness Analysis

10.4. South America

10.4.1. By Country

10.4.1.1. Brazil

10.4.1.2. Argentina

10.4.1.3. Colombia

10.4.1.4. Chile

10.4.1.5. Rest of South America

10.4.2. By Application

10.4.3. By End-User

10.4.4. By Type

10.4.5. Vehicle Type

10.4.6. Countries & Segments - Market Attractiveness Analysis

10.5. Middle East & Africa

10.5.1. By Country

10.5.1.4. United Arab Emirates (UAE)

10.5.1.2. Saudi Arabia

10.5.1.3. Qatar

10.5.1.4. Israel

10.5.1.5. South Africa

10.5.1.6. Nigeria

10.5.1.7. Kenya

10.5.1.10. Egypt

10.5.1.10. Rest of MEA

10.5.2. By Vehicle Type

10.5.3. By Application

10.5.4. By End-User

10.5.5. Type

10.5.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. HD MAP FOR AUTONOMOUS VEHICLES MARKET– Company Profiles – (Overview, Portfolio, Financials, Strategies & Developments)

11.1 Google

11.2 NVIDIA Corporation

11.3 HERE Technologies

11.4 TomTom N.V.

11.5 Waymo

11.6 Mobileye (an Intel company)

11.7 Baidu, Inc.

11.8 Zenrin Co., Ltd.

11.9 DeepMap, Inc. (NVIDIA)

11.10 NavInfo Co., Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The primary drivers include the rapid advancement of autonomous vehicle technology requiring precise navigation systems, increasingly stringent safety regulations mandating enhanced environmental awareness, and the growing adoption of advanced driver assistance systems across the automotive industry that create demand for high-precision mapping solutions

Major concerns include the substantial computational and infrastructure costs associated with processing and maintaining real-time mapping data, data privacy and security issues related to location tracking and vehicle behavior monitoring, and the lack of standardized protocols that create interoperability challenges between different manufacturers and systems.

Key players include HERE Technologies, TomTom, Waymo, Baidu, NVIDIA, Mobileye, DeepMap, Civil Maps, Carmera, Mapbox, ESRI, Google Maps, Apple Maps, Tesla, and Aurora Innovation, representing a mix of traditional mapping companies, technology giants, and specialized autonomous vehicle developers.

North America currently holds the largest market share at approximately 42%, driven by significant investments from major technology companies, supportive regulatory frameworks for autonomous vehicle testing, and strong partnerships between automotive manufacturers and technology providers in the region.

The Asia-Pacific region demonstrates the fastest growth rate, driven by massive government investments in smart city initiatives, rapid urbanization requiring advanced transportation solutions, and aggressive autonomous vehicle development programs in countries like China, Japan, and South Korea that prioritize technological advancement and infrastructure modernization.