Global Hazardous Chemicals Packaging Market Size (2023 – 2030)

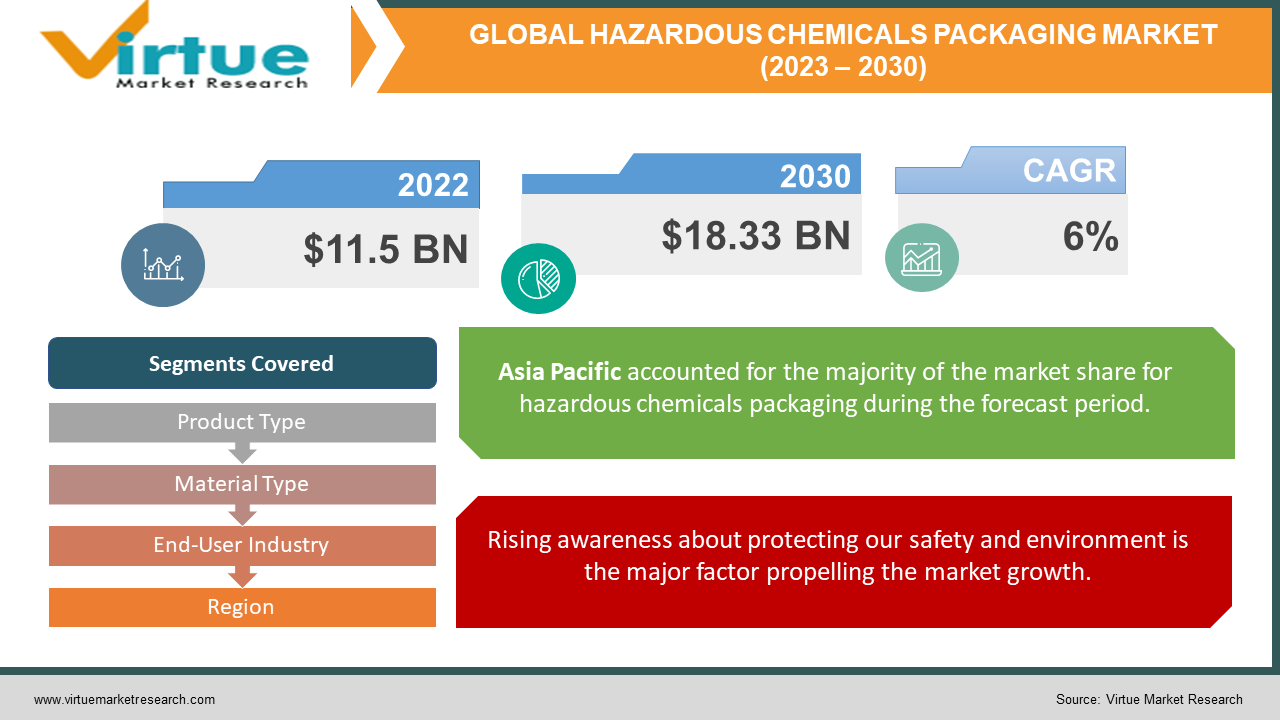

The Global Hazardous Chemicals Packaging Market was valued at USD 11.5 billion and is projected to reach a market size of USD 18.33 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 6%.

Packaging of hazardous chemicals is crucial to ensure that chemicals are stored and disposed of safely. In the past, packaging was confined to using glass and metal. Currently, with the advent of advanced materials like composites and coatings, technological integrations, and various regulations the market has sorted efficiently. In the future, with a focus on sustainability and bio-based materials, this market is projected to reach new heights. During the forecast period, this market will show notable growth.

Key Market Insights:

According to the WHO's recommended vaccination schedule, 70% of the organization's vaccinations come from India. This further helps the packaging and generates profits for this market. In the hazardous chemicals packaging industry, approximately 30% of firms have included sustainability practices in their packaging solutions, such as the use of recyclable materials and eco-friendly designs. Smart packaging capabilities such as real-time tracking and temperature monitoring are included in around 50% of hazardous chemical packaging solutions. An increase of around 8% in R&D activities was seen in the last couple of years. Compatibility of the packaging material is a challenge which is faced by industries like chemical, pharmaceutical, oil & gas, etc. To address this, material selection and testing have increased by 2X times.

Hazardous Chemicals Packaging Market Drivers:

Rising awareness about protecting our safety and environment is the major factor propelling the market growth.

Environmental effects can be as devastating: killing creatures in a lake or river, destroying animals and plants in a polluted region, creating serious reproductive issues in animals, or generally limiting an ecosystem's capacity to thrive. Any leaks and spills can affect humans causing behavioral abnormalities, cancer, genetic mutations, and physiological malfunctions like reproductive impairment, kidney failure, etc., physical deformations, and birth defects. There are a lot of rules and regulations regarding the selling, manufacture, packaging, and handling of these chemicals which the public needs to adhere to. These concerns and issues have made it mandatory for chemical-based companies to implement various materials and composites for packaging these hazardous chemicals. Furthermore, the expanding e-commerce business, a trend towards standardized, adaptable, and sustainable packaging alternatives, and rising demand for eco-friendly packaging solutions are all contributing to market expansion

An increase in local and overseas shipments aids the market expansion.

Over the years a lot of improvements have been made in transportation which facilitate import-export trade. Globalization has been a boon. The deficit countries in certain chemicals as well as the abundant countries in these chemicals benefitted by cross-border trade activities. This helps to improve the economy of a country, provide employment opportunities to many, and improve relations with neighboring countries. This calls for the need for proper packaging to prevent serious repercussions to many lives like humans, animals, plants, and many more. Packaging ensures safety, sits well with various compliances and regulations of countries, prevents any cross-chemical reactions, the integrity of the product, prevents spills, etc. All these factors make it extremely important to ensure proper packaging is done for these hazardous chemicals.

Hazardous Chemicals Packaging Market Restraints and Challenges:

Rules & and regulations, testing & and certifications, investments, and technology are the main issues that the market is facing.

While different regulatory rules & and regulations are crucial, they can often be neglected due to their complexity and strictness. Secondly, testing and certifications take an enormous time which can demotivate the manufacturing units. The overall cost associated is very expensive which can be a barrier. Moreover, many companies find it difficult to implement sustainable packaging while maintaining safety. Furthermore, technological integration is a concern because it requires proper knowledge and training from the personnel.

Hazardous Chemicals Packaging Market Opportunities:

Prominence is being given to develop sustainable packaging options in the market. R&D activities are being focused on developing advanced materials and composites. Manufacturing processes and designs are being alerted to generate more revenue. Government involvement through rules, actions, and investments is helping in the progress. Improvements and innovations in high-performance materials that are resistant to temperature, chemical reactions, and physical hazards are being undertaken. Smart packing technologies are expected to provide the market with an ample number of opportunities.

HAZARDOUS CHEMICALS PACKAGING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

6.1% |

|

Segments Covered |

By Product Type, Material Type, End-User Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Mauser Group, Schütz GmbH & Co. KGaA, Greif, Inc., Berry Global Group, Inc., BWAY Corporation, Honeywell International Inc., Thermo Fisher Scientific Inc., Ardagh Group, Rigid Containers Ltd., Nefab Group |

Hazardous Chemicals Packaging Market Segmentation: By Product Type

-

Drums

-

Intermediate bulk containers (IBCs)

-

Pails

-

Bottles

-

Others

Based on product type, drums are the largest growing segment in this market. This is commonly used in industries like pharmaceutical, oil & gas, chemical, etc. They are easy to transport, robust, and can hold up to 200 liters. Drums are made of different materials like steel, plastic, and other fibers. Properties like durability, strength, ease of handling, versatility, chemical resistance, tight sealing, and protection from environmental factors like dust, temperature, and UV, make it a popular choice. Besides, they have been used for centuries making it a go-to choice. They are estimated to hold around 30% to 40% of the total market share. Intermediate bulk containers (IBCs) are the fastest growing holding a share of around 20% to 30%. This is because they take less space, offer bulkiness, are reusable, have safety features, and require less manual interference. Additionally, they do not promote any chemical reactions and offer great storage space for many chemicals.

Hazardous Chemicals Packaging Market Segmentation: By Material Type:

-

Plastics

-

Metal

-

Corrugated

Based on material type, the plastic segment is the largest growing. As per a report, they are projected to grow at a CAGR of 5.6% from 2022 to 2031. This is because of wider availability and access. Moreover, plastics are made recyclable for reusing them. This promotes the idea of sustainable living and is environment-friendly. Advantages like chemical resistance, cost-effectiveness, corrosion resistance, and easy handling make it an apt choice for many end-user industries. They are estimated to approximately hold a share of 55%. Metals are the fastest growing segment having a share of around 42%. Steel and Aluminum are the most commonly used ones. They offer pressure and fire resistance, have recycling properties, longevity, strength, durability, efficiency, and protect environmental factors.

Hazardous Chemicals Packaging Market Segmentation: By End-User Industry:

-

Chemicals

-

Pharmaceuticals

-

Automotive

-

Oil and Gas

-

Others

Based on the end-user industry, chemical is the largest growing segment. This is due to the increased scale of production over the years due to demand. Different types of chemicals like flammable, toxic, and corrosive are manufactured due to their applications in different sectors. Petroleum is one of the major contributors. As per a report, from the International Energy Agency, petrochemicals are expected to account for more than a third of the increase in oil consumption through 2030 and almost half through 2050, outpacing trucks, aircraft, and shipping. Moreover, alternatives are being developed to reduce environmental impact, preserve existing ones, and for future potential applications. This usage drives the success of this market. They hold a share of around 40% in this market. The pharmaceutical industry is the fastest-growing end user. This is because of an increase in research and developmental activities, bulk vaccine production, ensuring safety, and various regulations that are enforced on storage conditions and marketing. They hold a share exceeding 20%.

Hazardous Chemicals Packaging Market Segmentation: Regional Analysis:

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Based on region, Asia Pacific is the largest growing region. As per a report, they are projected to grow at a CAGR of 5.7% from 2022 to 2031. They hold a share of around 36%. Countries like China, India, and South Korea are at the forefront. This region's prominence stems from elements such as demand, extensive usage in many end-user sectors, the presence of important players, R&D activity, industrialization, growing affluence, raw material availability, and higher consumption. North America is the fastest-growing region, accounting for around 29% of the overall market share. This is due to the established economy, technological advancements, and the existence of key actors, investments, and cash. Furthermore, end-user demand and rising awareness about sustainable products are the major drivers of the market's big share. The United States and Canada are at the top leading countries.

COVID-19 Impact Analysis on the Global Hazardous Chemicals Packaging Market:

The COVID-19 launch had a detrimental influence on the market. It resulted in tighter restrictions in almost all locations to prevent the virus from spreading. Lockdowns, social isolation, and movement limitations became the new normal. The supply chain, manufacturing schedules, logistics, and import-export trade were all interrupted, resulting in an economic depression. Approximately 85% of enterprises had supply chain disruptions. The shutdown of factories and industries was a setback. In addition, a lack of people delayed the execution of various initiatives. Following the epidemic, however, the industry is gradually gaining up, with regulatory relaxations and lockdowns being eased.

Latest Trends/ Developments:

Companies in this industry are motivated to increase their market share by various tactics such as acquisitions, partnerships, and investments. Companies are also investing a lot of money in developing better products and greener alternatives while keeping competitive pricing. This has led to increasing government involvement and subsequent expansion.

Recent trends regarding recycled and reusable packaging material, advanced safety features, and technological milestones will provide a lot of scope to this market. The demand for developing sustainable alternatives with little or no environmental effect is expected to extend the applications. Furthermore, emphasis is being placed on R&D initiatives to broaden human understanding.

Key Players:

-

Mauser Group

-

Schütz GmbH & Co. KGaA

-

Greif, Inc.

-

Berry Global Group, Inc.

-

BWAY Corporation

-

Honeywell International Inc.

-

Thermo Fisher Scientific Inc.

-

Ardagh Group

-

Rigid Containers Ltd.

-

Nefab Group

In April 2021, SK Capital Partners closed the acquisition of IPACKCHEM. The specialty chemicals expertise, functional and operating resources, and extensive M&A capabilities were instrumental in building existing strong market positions.

In April 2020, Greif, Inc. bought a minority position in Centurion Container to extend its Intermediate Bulk Container (IBC) service network in North America. This investment will help the company's IBC and IBC reconditioning operations.

Chapter 1. Hazardous Chemicals Packaging Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Hazardous Chemicals Packaging Market – Executive Summary

2.1 Market Size & Forecast – (2022 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Hazardous Chemicals Packaging Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Hazardous Chemicals Packaging Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Hazardous Chemicals Packaging Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Hazardous Chemicals Packaging Market – By Product Type

6.1 Introduction/Key Findings

6.2 Drums

6.3 Intermediate bulk containers (IBCs)

6.4 Pails

6.5 Bottles

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Product Type

6.8 Absolute $ Opportunity Analysis By Product Type, 2023-2030

Chapter 7. Hazardous Chemicals Packaging Market – By Material Type

7.1 Introduction/Key Findings

7.2 Plastics

7.3 Metal

7.4 Corrugated

7.5 Y-O-Y Growth trend Analysis By Material Type

7.6 Absolute $ Opportunity Analysis By Material Type, 2023-2030

Chapter 8. Hazardous Chemicals Packaging Market – By End-User Industry

8.1 Introduction/Key Findings

8.2 Chemicals

8.3 Pharmaceuticals

8.4 Automotive

8.5 Oil and Gas

8.6 Others

8.7 Y-O-Y Growth trend Analysis By End-User Industry

8.8 Absolute $ Opportunity Analysis By End-User Industry, 2023-2030

Chapter 9. Hazardous Chemicals Packaging Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By Material Type

9.1.4 By End-User Industry

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By Material Type

9.2.4 By End-User Industry

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By Material Type

9.3.4 By End-User Industry

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By Material Type

9.4.4 By End-User Industry

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By Material Type

9.5.4 By End-User Industry

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Hazardous Chemicals Packaging Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Mauser Group

10.2 Schütz GmbH & Co. KGaA

10.3 Greif, Inc.

10.4 Berry Global Group, Inc.

10.5 BWAY Corporation

10.6 Honeywell International Inc.

10.7 Thermo Fisher Scientific Inc.

10.8 Ardagh Group

10.9 Rigid Containers Ltd.

10.10 Nefab Group

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Hazardous Chemicals Packaging Market was valued at USD 11.5 billion and is projected to reach a market size of USD 18.33 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 6%.

Rising awareness about protecting our safety and environment and an increase in local and overseas shipments are the main reasons driving the Global Hazardous Chemicals Packaging Market.

Based on Material Type, the Global Hazardous Chemicals Packaging Market is segmented into Plastics, Metal, and Corrugated.

Asia Pacific is the most dominant region for the Global Hazardous Chemicals Packaging Market

Mauser Group, Schütz GmbH & Co. KGaA, and Greif, Inc. are the key players operating in the Global Hazardous Chemicals Packaging Market.