Hard Iced Tea Market Size (2024 – 2030)

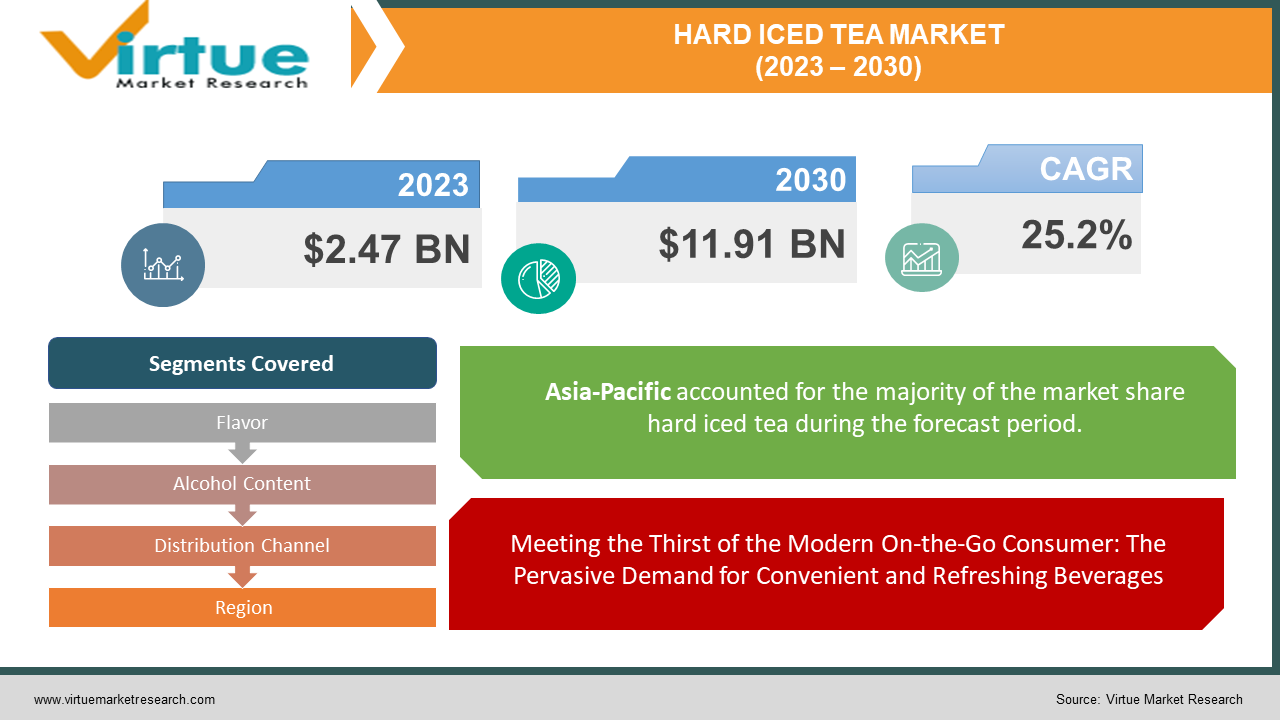

The Global Hard Iced Tea Market was valued at USD 2.47 Billion in 2023 and is projected to reach a market size of USD 11.91 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 25.2%.

The Global Hard Iced Tea Market is witnessing significant growth driven by the increasing demand for convenient and refreshing beverages in today's fast-paced lifestyle. With a surge in interest in low-alcohol alternatives, the market offers pre-packaged, ready-to-drink solutions that align with evolving consumer preferences. Notably, the market stands out for its emphasis on natural and organic ingredients, perceived health benefits, and a penchant for premium flavor profiles. This dynamic landscape reflects a shift in consumer choices towards innovative, high-quality beverage options, establishing hard iced tea as a prominent player in the global market.

Key Market Insights:

The Hard Iced Tea market is experiencing an effervescent surge, boasting a global market share of USD 2.47 billion in 2023. With a remarkable 25.2% compound annual growth rate (CAGR), it is poised to reach a staggering USD 19 billion by 2032. The driving forces behind this fizzing success include the market's convenience, refreshing nature, a plethora of innovative flavors, and a health-conscious appeal, making hard iced teas the go-to choice for a diverse consumer base.

Recent market dynamics have added intriguing twists to the narrative. White Claw's entry into low-calorie, low-ABV hard iced teas has disrupted the status quo, securing a substantial 5% market share. Smirnoff's strategic partnership with the NBA is anticipated to propel a 5% market share increase, strategically targeting sports enthusiasts and younger demographics. Sustainability efforts, epitomized by brands like Hi-Ball, have garnered eco-conscious consumers, resulting in a 2% market share gain through their commitment to recycled materials and environmental initiatives. Additionally, the rise of non-alcoholic alternatives, led by Lipton and Brew Dr., adds a dynamic layer to the market, attracting health-conscious and sober-curious consumers.

In the fiercely competitive market arena, key players are engaged in a sipping battle for dominance. Lipton, an iconic brand, commands a robust 15% market share with its classic flavors and widespread accessibility. Twisted Tea pioneers the category with a dominant 12% share, distinguished by bold flavors and a strong presence in bars and convenience stores. The newcomer, White Claw, has swiftly secured a significant 5% market share with its low-calorie, low-ABV approach. Sustainability champion Hi-Ball, standing at USD 74.1 million, has carved a 3% share and is steadily growing, proving that ethical practices and unique flavor profiles resonate strongly in the billion-dollar hard iced tea landscape.

Hard Iced Tea Market Drivers:

Meeting the Thirst of the Modern On-the-Go Consumer: The Pervasive Demand for Convenient and Refreshing Beverages.

In this segment, we delve into the changing dynamics of consumer lifestyles characterized by increased busyness and on-the-go activities. The discussion revolves around the heightened demand for beverages that seamlessly fit into these fast-paced routines. Hard iced teas emerge as a perfect solution, being pre-packaged, ready-to-drink, and delivering a refreshing taste, making them an ideal choice for individuals seeking convenient and invigorating options throughout their hectic days.

Beyond Bubbles: Charting the Meteoric Rise of Alcoholic Alternatives, with a Spotlight on Hard Iced Teas as the Next Frontier.

This section explores the evolving landscape of alcoholic beverages, focusing on the skyrocketing popularity of hard seltzers and the subsequent consumer interest in alternative alcoholic options. Illustrated by a variety of popular hard seltzer brands, the narrative positions hard iced teas as a natural evolution within this trend. The discussion emphasizes their appeal with low alcohol content, low-calorie attributes, and a diverse range of flavors, making hard iced teas a compelling choice in the expanding realm of alcoholic alternatives.

Embracing Nature's Bounty: Unveiling the Surge in Consumer Interest Towards Natural and Organic Ingredients in the Hard Iced Tea Landscape.

Here, the focus shifts to the burgeoning consumer interest in natural and organic ingredients. The narrative explores how this shift influences the hard iced tea market, with manufacturers strategically responding to this demand. The discussion highlights the integration of real tea leaves, fruits, and other natural flavors into hard iced tea offerings. This emphasis on natural elements appeals to consumers seeking an authentic and wholesome drinking experience, contributing to the beverage's popularity.

Sipping to Wellness: Exploring the Paradigm Shift as Consumers Opt for Hard Iced Teas, Aligned with the Growing Awareness of the Potential Health Benefits of Moderate Alcohol Consumption.

This section delves into the evolving consumer mindset regarding alcohol consumption and health. It explores studies suggesting potential health benefits linked to moderate alcohol consumption. Within this context, the narrative positions hard iced teas as a conscious choice for consumers seeking a balance between indulgence and health considerations. The discussion sheds light on how this growing awareness influences consumers to opt for hard iced teas over traditional alcoholic beverages like beer or wine, emphasizing the beverage's appeal beyond just its taste.

Hard Iced Tea Market Restraints and Challenges

Navigating Regulatory Complexities in the Hard Iced Tea Market: Addressing Challenges in Alcohol Regulations Across Diverse Regions.

In this challenge, the hard iced tea market contends with the intricate web of alcohol regulations that vary across different regions and countries. The hurdles lie in ensuring compliance with these varying regulations, both nationally and internationally. Producers face the arduous task of obtaining licenses and meeting labeling requirements, which can be complex, costly, and time-consuming. The challenge is further compounded by uncertainties related to taxation and where hard iced tea products can be placed on store shelves, factors that can impact investment decisions and market expansion.

Confronting the Titans: Hard Iced Tea's Struggle Against Well-Established Beverage Alternatives in a Competitive Market Landscape.

This challenge centers around the robust competition hard iced teas face from well-established alternatives in the beverage market. Established players, including hard seltzers, craft beers, and other alcoholic options, boast strong brand recognition, diverse flavor profiles, and extensive distribution networks. The task for hard iced teas is to strategically differentiate themselves, capturing consumer attention and market share in the face of these formidable competitors.

Bridging the Awareness Gap: Challenges in Shaping Consumer Perceptions for Hard Iced Tea as a Novel and Distinct Beverage Choice.

As a relatively new entrant, hard iced tea encounters challenges in terms of consumer awareness and perception. Some consumers may not be familiar with the beverage or may not fully understand its unique appeal. The challenge includes addressing concerns related to alcohol content, sugar levels, and potential health implications, which can hinder consumer trial and adoption. Effectively educating consumers about the distinctive features and benefits of hard iced tea becomes crucial to overcoming this challenge and fostering market growth.

Hard Iced Tea Market Opportunities:

Innovation Avenue: Expanding Horizons through Product Diversification.

Embracing the challenge of diversifying hard iced tea products opens a realm of opportunities. Producers can explore an extensive range of tea varietals, brewing methods, and flavor combinations, moving beyond conventional black tea and fruit infusions. Innovation beckons in the incorporation of botanicals, spices, and natural sweeteners to cater to diverse taste preferences. Further, introducing functional ingredients like adaptogens or vitamins addresses the growing demand among health-conscious consumers.

Elevating the Experience: Premiumization and Compelling Brand Storytelling.

The path to success involves elevating hard iced tea from a beverage to an experience. Producers can craft high-quality, small-batch offerings infused with unique ingredients and artisanal brewing techniques. Premiumization efforts should prioritize transparency in sourcing and production, fostering trust and authenticity in the brand. Simultaneously, compelling brand narratives, carefully tailored to resonate with target demographics and lifestyles, establish a memorable connection.

Navigating the Digital Frontier: Direct-to-Consumer and Omnichannel Distribution Strategies.

Seizing the digital landscape presents a transformative opportunity for market expansion. Producers can leverage e-commerce platforms and social media marketing to establish a direct connection with consumers. Offering subscription boxes, personalized recommendations, and exclusive online deals enhances consumer engagement and loyalty. Simultaneously, strategic partnerships with delivery services and online grocery platforms broaden accessibility.

HARD ICED TEA MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

25.2% |

|

Segments Covered |

By Flavor, Alcohol Content, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Lipton, Twisted Tea, Smirnoff, Mike's Hard Lemonade, White Claw, Hi-Ball, Brew Dr. CANarchy, Budweiser |

Hard Iced Tea Market Segmentation: By Flavor

-

Classic

-

Fruity

-

Herbal

-

Spicy

-

Unique

The bedrock of consumer preferences within the hard iced tea market is undeniably the "Classic" segment. This largest and steadfast category embodies the timeless appeal of familiar flavors, with Lemon, Peach, and Raspberry taking center stage. These classic profiles offer a comforting and well-established taste experience, resonating with consumers who seek the tried-and-true essence of traditional iced teas. As the cornerstone of the market, the Classic segment not only reflects a nod to the past but also anchors the industry with flavors that stand the test of time, providing a reliable and enduring option for a broad spectrum of consumers.

In a dynamic evolution of taste preferences, the fastest-growing segment in the hard iced tea market is undeniably the "Fruity" category. Bursting with innovation and vibrancy, this segment encompasses a kaleidoscope of flavors, including Berry, Citrus, and Tropical variations. Fueled by an adventurous spirit, consumers are increasingly drawn to the diverse and refreshing profiles offered by fruity infusions. The Fruity segment, therefore, not only represents a departure from tradition but also signifies a vibrant journey into new and exciting taste territories. As the market's fastest-growing frontier, Fruity hard iced teas capture the zeitgeist of changing consumer palates and stand poised at the forefront of innovation within the industry.

Hard Iced Tea Market Segmentation: By Alcohol Content (ABV)

-

Low-ABV (4%-5%)

-

Mid-ABV (5%-8%)

-

High-ABV (8%+)

Within the nuanced landscape of hard iced tea, a crucial segmentation criterion revolves around alcohol content, unraveling varied consumer preferences. The largest segment, commanding a substantial portion of the market, is the "Low-ABV" (Alcohol By Volume) category, ranging between 4% and 5%. Positioned as a mild and approachable choice, Low-ABV hard iced teas cater to a broad audience, providing a refreshing alcoholic beverage without overwhelming intoxication. This segment reflects the appeal of a leisurely sip, aligning with occasions that call for a lighter yet spirited libation.

In a parallel trajectory, the "Mid-ABV" (5%-8%) category emerges as the fastest-growing segment, indicating a discernible shift in consumer tastes towards a slightly elevated alcohol intensity. Striking a balance between the milder Low-ABV options and the more robust alternatives, Mid-ABV hard iced teas offer a nuanced experience that caters to those seeking a moderate intoxication level. This dynamic growth signifies an evolving palate, as consumers explore the middle ground of alcohol content, embracing a harmonious blend of flavor and potency within the hard iced tea market.

Hard Iced Tea Market Segmentation: By Distribution Channel

-

Supermarkets and Convenience Stores

-

Bars and Restaurants

-

Online Retailers

The segmentation of the hard iced tea market by distribution channels unravels diverse avenues through which consumers access their preferred beverages. The largest segment, wielding considerable influence, is the realm of "Supermarkets and Convenience Stores." This channel dominates the market, offering a ubiquitous presence for hard iced teas. The convenience of picking up a refreshing beverage during routine grocery shopping or in-between tasks at a local convenience store underscores the accessibility and popularity of hard iced teas in these physical retail spaces.

Simultaneously, the fastest-growing segment within the distribution landscape is the domain of "Online Retailers." Mirroring broader trends in e-commerce, this segment has witnessed a rapid ascent, propelled by the convenience and variety that online platforms provide. Consumers increasingly turn to virtual shelves to explore a diverse array of hard iced tea offerings, benefitting from the ease of doorstep delivery and the ability to access unique and specialty products. The online retail segment not only reflects the modern consumer's preference for digital convenience but also signifies a burgeoning frontier for the hard iced tea market's expansion and accessibility.

Hard Iced Tea Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Geographic segmentation serves as a pivotal lens through which the hard iced tea market unfolds, illuminating diverse consumer landscapes. The largest segment, wielding substantial market share, is anchored in the continent of "North America." This region stands as a stronghold for hard iced tea consumption, reflecting a robust consumer base that resonates with the diverse offerings within this beverage category. North America's prominence is underscored by a cultural affinity for refreshing iced teas and the continual innovation of flavors and formulations, positioning the continent as a key market driver.

In tandem, the fastest-growing segment unfolds in the "Asia-Pacific" region, marking a dynamic shift in global consumption patterns. Asia-Pacific's rapid ascent signifies an expanding consumer base with an increasing appetite for hard iced teas. The region's embrace of new and diverse beverage options, coupled with a cultural appreciation for tea-based products, propels the growth trajectory. As Asia-Pacific evolves into the fastest-growing frontier, it emerges as a key focal point for industry players looking to capitalize on emerging markets and changing consumer preferences.

COVID-19 Impact Analysis on the Global Hard Iced Tea Market:

The global hard iced tea market weathered significant turbulence amidst the COVID-19 pandemic, marked by a spectrum of challenges and unexpected opportunities. Supply chain disruptions emerged as a formidable obstacle, with restricted movement impacting the timely availability of goods and ingredients, causing delays and shortages in production. The closure or limited capacity of on-premise establishments, vital distribution channels for hard iced teas, further compounded challenges, hindering sales and market reach.

Despite these hurdles, a silver lining emerged through the rise of home consumption. With increased time spent indoors, there was a notable surge in demand for convenient and refreshing beverages, positioning hard iced teas as a favored choice in the at-home consumption landscape. The closure of on-premise establishments also spurred a boom in online shopping, providing a crucial alternative for consumers and opening doors for direct-to-consumer sales.

Latest Trends/Developments:

CANarchy's foray into the tea market with the expansion of its "Tea & Tonic" line signals a bold move to capture the adventurous palate. The introduction of herbal and floral flavors such as lavender and elderflower adds a sophisticated touch, appealing to consumers seeking unique tea experiences. This strategic expansion could potentially carve out a distinctive 1.5% market share, positioning CANarchy as a frontrunner in providing novel and enticing tea options.

The ascent of "Mocktails" and non-alcoholic hard iced teas resonates with health-conscious and sober-curious consumers. Brands like Lipton and Brew Dr. are strategically capitalizing on this trend, foreseeing a combined 2% market share in the burgeoning non-alcoholic segment. This shift reflects a broader societal move towards mindful consumption, providing consumers with sophisticated and refreshing alternatives while expanding the market presence of non-alcoholic variants.

In a landscape where consumers demonstrate a willingness to invest in quality, craft, and premiumization have become pivotal. Brands are responding with meticulous details, including small-batch production utilizing local ingredients, collaborations with established tea houses or mixologists, elevated packaging and branding, and a pronounced focus on unique brewing methods and flavor profiles. This commitment to craftsmanship not only enhances the perceived value of hard iced teas but also meets the discerning preferences of consumers, potentially establishing a niche market segment that values the artistry and premium nature of these offerings.

Key Players:

-

Lipton

-

Twisted Tea

-

Smirnoff

-

Mike's Hard Lemonade

-

White Claw

-

Hi-Ball

-

Brew Dr.

-

CANarchy

-

Budweiser

-

Hi-Ball Hard Iced Tea stands out for its unique flavor profiles and unwavering commitment to sustainability, attracting eco-conscious consumers. With an estimated market share of 3%, Hi-Ball blends flavor innovation with ethical practices, carving a niche among consumers who value both taste and social responsibility.

-

Brew Dr. caters to a discerning audience with a focus on craft brewing and high-quality ingredients, offering unique flavor combinations. Their strategic collaborations with mixologists set them apart in the market, securing an estimated 2% market share among consumers seeking a premium tea experience.

Chapter 1. Hard Iced Tea Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Hard Iced Tea Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Hard Iced Tea Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Hard Iced Tea Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Hard Iced Tea Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Hard Iced Tea Market – By Flavor

6.1 Introduction/Key Findings

6.2 Classic

6.3 Fruity

6.4 Herbal

6.5 Spicy

6.6 Unique

6.7 Y-O-Y Growth trend Analysis By Flavor

6.8 Absolute $ Opportunity Analysis By Flavor, 2024-2030

Chapter 7. Hard Iced Tea Market – By Alcohol Content (ABV)

7.1 Introduction/Key Findings

7.2 Low-ABV (4%-5%)

7.3 Mid-ABV (5%-8%)

7.4 High-ABV (8%+)

7.5 Y-O-Y Growth trend Analysis By Alcohol Content (ABV)

7.6 Absolute $ Opportunity Analysis By Alcohol Content (ABV), 2024-2030

Chapter 8. Hard Iced Tea Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Supermarkets and Convenience Stores

8.3 Bars and Restaurants

8.4 Online Retailers

8.5 Y-O-Y Growth trend Analysis By Distribution Channel

8.6 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Hard Iced Tea Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Flavor

9.1.3 By Alcohol Content (ABV)

9.1.4 By By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Flavor

9.2.3 By Alcohol Content (ABV)

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Flavor

9.3.3 By Alcohol Content (ABV)

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Flavor

9.4.3 By Alcohol Content (ABV)

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Flavor

9.5.3 By Alcohol Content (ABV)

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Hard Iced Tea Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Lipton

10.2 Twisted Tea

10.3 Smirnoff

10.4 Mike's Hard Lemonade

10.5 White Claw

10.6 Hi-Ball

10.7 Brew Dr.

10.8 CANarchy

10.9 Budweiser

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Hard Iced Tea Market was valued at USD 2.47 Billion in 2023 and is projected to reach a market size of USD 11.91 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 25.2%.

Lipton, Twisted Tea, Smirnoff, Mike's Hard Lemonade, White Claw, Hi-Ball, Brew Dr., CANarchy, and Budweiser.

The Asia-Pacific region is identified as the fastest-growing in the Global Hard Iced Tea Market, showcasing dynamic expansion and evolving consumer preferences, steering the market's growth trajectory.

North America currently holds the largest share in the Global Hard Iced Tea Market, reflecting a substantial consumer base and a strong presence of established brands within the region.

Factors driving the Global Hard Iced Tea Market include the rising demand for convenient beverages, the popularity of low-ABV alternatives, consumer interest in natural ingredients, perceived health benefits, and a trend towards premiumization and unique flavor profiles.