Halocarbons Refrigerant Market Size (2024-2030)

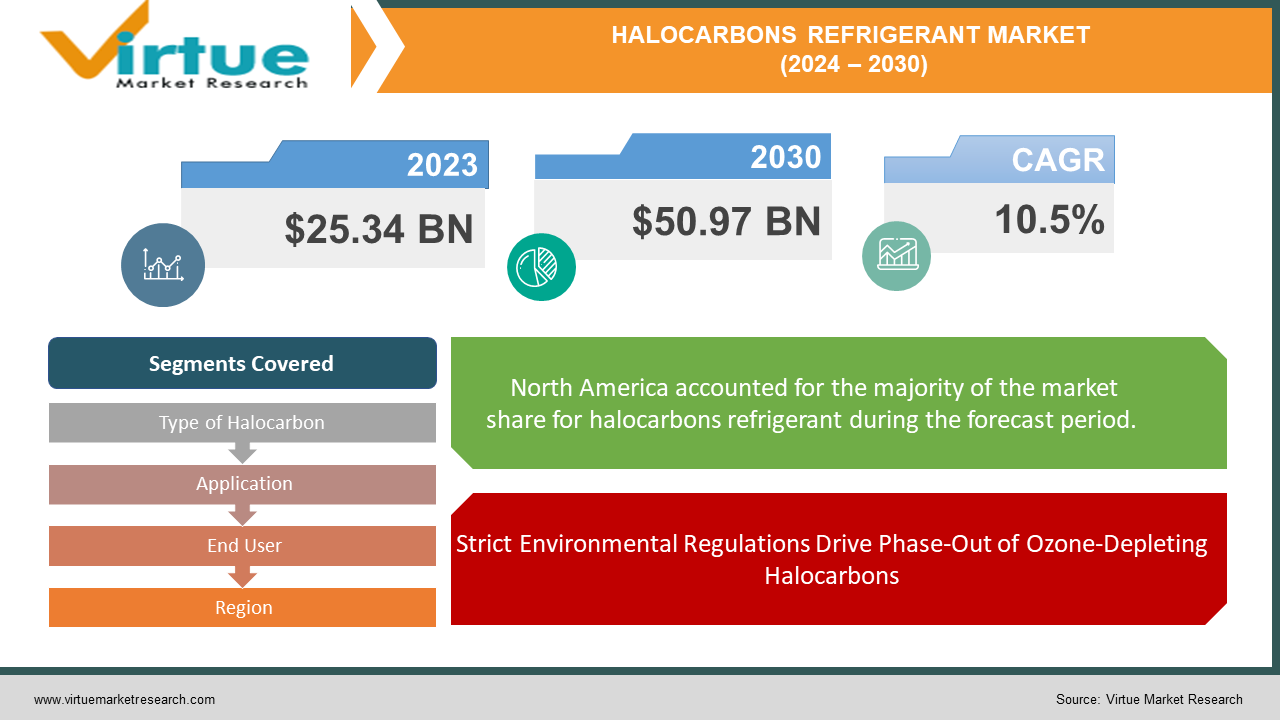

The Halocarbons Refrigerant Market was valued at USD 25.34 billion in 2023 and is projected to reach a market size of USD 50.97 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 10.5%.

The halocarbon segment has been a longstanding leader in the refrigerant market, keeping our homes and businesses cool. These chemicals, including Hydrofluorocarbons (HFCs), Hydrochlorofluorocarbons (HCFCs), and Chlorofluorocarbons (CFCs), have been essential for refrigeration and air conditioning. However, their impact on the environment has become a major concern. CFCs are being phased out entirely due to their role in ozone depletion, and HCFCs are facing increasing regulations as well.

Key Market Insights:

The push for sustainability is reflected in the projected decline of the halocarbon market. While specific data for halocarbons is limited, the overall refrigerant market is estimated to have reached $25.34 billion in 2023, with halocarbons likely holding a majority share that's expected to decrease. Regulations and a growing demand for eco-friendly solutions are driving this shift towards alternative refrigerants. The future of refrigeration lies in the development and adoption of sustainable options like ammonia, carbon dioxide, and hydrocarbons. However, a significant hurdle remains the vast amount of existing equipment reliant on halocarbons. Replacing this infrastructure will be a gradual process, highlighting the need for innovation in safer and more efficient sustainable refrigerants to complete the transition away from halocarbons entirely.

The Halocarbons Refrigerant Market Drivers:

Strict Environmental Regulations Drive Phase-Out of Ozone-Depleting Halocarbons

International agreements like the Montreal Protocol have become a powerful driver. This landmark treaty mandated a near-complete phase-out of Chlorofluorocarbons (CFCs) due to their detrimental impact on the ozone layer, which protects us from harmful ultraviolet radiation. Similarly, Hydrochlorofluorocarbons (HCFCs) are facing increasingly stringent regulations to curb their ozone-depleting effects. Even though Hydrofluorocarbons (HFCs) don't harm the ozone layer, they contribute significantly to greenhouse gas emissions, and regulations are likely to tighten to address this growing concern.

Public Demand for Sustainable Cooling Fuels Development of Eco-Friendly Alternatives

Public awareness of climate change and its far-reaching consequences is fueling a strong demand for eco-friendly alternatives in the cooling sector. Consumers, businesses, and governments are all increasingly seeking sustainable solutions to minimize environmental impact. This demand is driving research and development efforts toward more sustainable refrigerants like ammonia, carbon dioxide, and hydrocarbons. These alternatives offer the potential to reduce greenhouse gas emissions and create a more environmentally responsible cooling industry.

Rising Costs of Compliance with Regulations Incentivize Shift Away from Halocarbons

As environmental regulations become stricter, the cost of using halocarbons is expected to rise significantly. This increase will be driven by factors like phase-out requirements, potential penalties for non-compliance, and limitations on the availability of halocarbon refrigerants. These rising costs will incentivize companies and organizations to switch to compliant alternatives sooner rather than later, accelerating the transition away from halocarbons.

Advancements in Sustainable Refrigerant Technology Offer More Viable Eco-Friendly Options

The development of new, safer, and more efficient sustainable refrigerants is crucial for a complete transition away from halocarbons. Researchers are constantly innovating to create next-generation cooling solutions that offer comparable performance to traditional halocarbons but with a significantly reduced environmental footprint. Advancements in areas like material science, thermodynamics, and system design are paving the way for these sustainable alternatives to become more commercially viable and attractive to the wider market.

The Halocarbons Refrigerant Market Restraints and Challenges:

The decline of the halocarbon refrigerant market, driven by environmental regulations, is not without its challenges. Several hurdles must be overcome to ensure a smooth transition to sustainable alternatives. Technical limitations exist with some eco-friendly options. Ammonia, for instance, while attractive, can be toxic and corrosive. Similarly, hydrocarbons are flammable, and carbon dioxide requires higher operating pressures for efficient cooling. These characteristics necessitate redesigning existing cooling systems to accommodate these alternatives safely and efficiently.

Cost is another hurdle. Developing, manufacturing, and installing new sustainable refrigerant technologies can be more expensive than traditional halocarbon systems. Additionally, technicians may require specialized training to service these new systems, further increasing overall costs. Furthermore, the availability of eco-friendly refrigerants might be limited in some regions, particularly developing countries. This limited access can hinder widespread adoption and slow down the shift away from halocarbons.

Another challenge is infrastructure compatibility. Existing refrigeration infrastructure, especially in buildings and industrial facilities, is specifically designed for halocarbons. Replacing these systems entirely with new ones compatible with sustainable refrigerants can be a significant undertaking in terms of time and resources. Finally, the flammability or toxicity of some sustainable refrigerants raises safety concerns for technicians and building occupants. Addressing these concerns requires implementing proper safety protocols and training personnel who handle these refrigerants. Overcoming these challenges will be crucial in ensuring a successful transition towards a more sustainable cooling future.

The Halocarbons Refrigerant Market Opportunities:

While the decline of the halocarbon market is driven by environmental concerns, it also presents exciting opportunities. The demand for eco-friendly alternatives like ammonia, carbon dioxide, and hydrocarbon-based refrigerants opens doors for companies developing and manufacturing these green technologies. Research and innovation will be key to creating efficient, safe, and cost-effective solutions in this space.

The transition to new refrigerants also creates a market for specialized services. Companies with expertise in designing, installing, and maintaining these systems will be in high demand. They can offer consulting services, training programs for technicians, and even retrofitting existing infrastructure to make it compatible with sustainable refrigerants. Additionally, some of these new refrigerants boast improved energy efficiency compared to traditional options.

Furthermore, government policies promoting sustainable refrigerants, such as financial incentives, tax breaks, or stricter regulations on halocarbons, are likely to emerge. This creates opportunities for companies that can demonstrate compliance with these evolving regulations and offer solutions that meet the new standards. Finally, companies that embrace sustainable practices and adopt eco-friendly refrigerants can enhance their brand image and reputation for environmental responsibility.

HALOCARBONS REFRIGERANT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10.5% |

|

Segments Covered |

By Type of Halocarbon, Application, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Honeywell International Inc., The Chemours Company, The Linde Group, Air Liquide, Daikin Industries Ltd., Arkema, Mexichem, Dongyue Group, Navin Fluorine International Limited, Sinochem Group, SRF Limited |

Halocarbons Refrigerant Market Segmentation: By Type of Halocarbon

-

Chlorofluorocarbons (CFCs)

-

Hydrochlorofluorocarbons (HCFCs)

-

Hydrofluorocarbons (HFCs)

The most dominant segment by Type of Halocarbon is Hydrofluorocarbons (HFCs), commonly used in air conditioning and refrigeration. However, HFCs are being regulated due to their greenhouse gas impact. As a result, the fastest-growing segment is technically not within the halocarbons but rather in the sustainable alternatives segment, driven by environmental concerns and government regulations.

Halocarbons Refrigerant Market Segmentation: By Application

-

Air Conditioning (AC)

-

Refrigeration

-

Transport Refrigeration

The dominant segment in the Halocarbon Refrigerant Market by application is likely Air Conditioning (AC), encompassing residential, commercial, and industrial uses. This widespread adoption makes it the largest consumer of halocarbons. On the other hand, Transport Refrigeration is expected to be the fastest-growing segment. Stricter regulations and the growing demand for perishable goods transportation are potential drivers for this segment's rise.

Halocarbons Refrigerant Market Segmentation: By End User

-

Residential Sector

-

Commercial Sector

-

Industrial Sector

The dominant segment by End User in the halocarbon refrigerant market is likely Air Conditioning (AC) due to its widespread use in residential and commercial buildings for cooling purposes. However, as the halocarbon market declines due to environmental regulations, there isn't a single fastest-growing segment within this category. The focus is instead shifting towards the development and adoption of more sustainable alternatives.

Halocarbons Refrigerant Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America boasts a mature halocarbon market, with a historical dominance of HFCs in air conditioning and refrigeration applications. However, stringent environmental regulations like those phasing out HCFCs and pushing for limitations on HFCs are driving a rapid shift towards sustainable alternatives. North America is expected to be at the forefront of adopting eco-friendly refrigerants due to strong environmental awareness and government initiatives.

Like North America, Europe has a well-established halocarbon market with a history of using HFCs for cooling needs. Strict regulations mirroring those in North America are pushing the market towards sustainable alternatives. Europe is another leader in adopting eco-friendly refrigerants, with a focus on research and development in this area.

Asia-Pacific currently holds the largest share of the global halocarbon market due to its booming economies, rising disposable income, and increasing demand for air conditioning and refrigeration. However, as environmental regulations become stricter in some Asian countries, a gradual shift towards sustainable options is underway. The pace of this transition might be slower compared to North America and Europe due to developing economies and lower levels of environmental regulations in some countries.

COVID-19 Impact Analysis on the Halocarbons Refrigerant Market:

The COVID-19 pandemic caused ripples of disruption in the halocarbon refrigerant market, though its long-term impact remains intertwined with the ongoing shift towards sustainable cooling solutions. Lockdowns and travel restrictions in 2020 caused temporary hiccups in the supply chain, leading to price fluctuations and even shortages of refrigerants in certain regions. Additionally, a decrease in demand arose due to business closures, particularly in sectors like hospitality and retail that rely heavily on air conditioning and refrigeration. Project delays due to lockdowns and labor shortages might have also impacted the installation of new cooling systems, further affecting halocarbon demand. However, these short-term disruptions are unlikely to significantly alter the long-term decline of the market driven by environmental regulations. The pandemic might have even indirectly accelerated the adoption of sustainable refrigerants in some cases. Businesses focusing on cost-saving measures might be more receptive to energy-efficient alternatives that offer lower operating costs over time. Furthermore, the pandemic's emphasis on public health has heightened awareness of air quality and hygiene. This could lead to a rise in demand for refrigerants with a lower environmental footprint, potentially benefiting the development and adoption of sustainable cooling technologies. Overall, while the COVID-19 pandemic caused temporary disruptions, the long-term trend of decline for halocarbons due to environmental regulations and the push for sustainable alternatives is expected to continue.

Latest Trends/ Developments:

The Halocarbon Refrigerant Market is undergoing a significant transformation, driven by a focus on natural refrigerants. Ammonia, carbon dioxide, and hydrocarbons are gaining traction due to their lower environmental impact compared to traditional halocarbons. Research and development efforts are pouring into improving the efficiency, safety, and flammability profiles of these natural options to make them more widely adopted. Additionally, system designs are evolving to accommodate these alternatives, with features like handling higher pressures for CO2 systems or incorporating safety protocols for flammable hydrocarbons.

Governments are also playing a role by implementing stricter regulations and policies. This includes phasing out halocarbons, offering financial incentives for adopting eco-friendly refrigerants or increasing the cost of using high-emission refrigerants. Recognizing the importance of a smooth transition, industry stakeholders are collaborating to develop best practices and standards for the safe and efficient use of natural refrigerants. This collaborative effort is crucial for building trust in these alternatives. Finally, a growing aftermarket service sector is emerging to address the needs of this changing landscape. Companies specializing in retrofitting existing equipment, training technicians on new refrigerants, and safely disposing of used halocarbons are well-positioned to capitalize on this trend. Overall, the focus on natural refrigerants, technological advancements, supportive policies, and industry collaboration are paving the way for a more sustainable future in the cooling sector.

Key Players:

-

Honeywell International Inc.

-

The Chemours Company

-

The Linde Group

-

Air Liquide

-

Daikin Industries Ltd.

-

Arkema

-

Mexichem

-

Dongyue Group

-

Navin Fluorine International Limited

-

Sinochem Group

-

SRF Limited

Chapter 1. Halocarbons Refrigerant Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Halocarbons Refrigerant Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Halocarbons Refrigerant Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Halocarbons Refrigerant Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Halocarbons Refrigerant Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Halocarbons Refrigerant Market – By Type of Halocarbon

6.1 Introduction/Key Findings

6.2 Chlorofluorocarbons (CFCs)

6.3 Hydrochlorofluorocarbons (HCFCs)

6.4 Hydrofluorocarbons (HFCs)

6.5 Y-O-Y Growth trend Analysis By Type of Halocarbon

6.6 Absolute $ Opportunity Analysis By Type of Halocarbon, 2024-2030

Chapter 7. Halocarbons Refrigerant Market – By End User

7.1 Introduction/Key Findings

7.2 Residential Sector

7.3 Commercial Sector

7.4 Industrial Sector

7.5 Y-O-Y Growth trend Analysis By End User

7.6 Absolute $ Opportunity Analysis By End User, 2024-2030

Chapter 8. Halocarbons Refrigerant Market – By Application

8.1 Introduction/Key Findings

8.2 Air Conditioning (AC)

8.3 Refrigeration

8.4 Transport Refrigeration

8.5 Y-O-Y Growth trend Analysis By Application

8.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Halocarbons Refrigerant Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type of Halocarbon

9.1.3 By End User

9.1.4 By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type of Halocarbon

9.2.3 By End User

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type of Halocarbon

9.3.3 By End User

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type of Halocarbon

9.4.3 By End User

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type of Halocarbon

9.5.3 By End User

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Halocarbons Refrigerant Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Honeywell International Inc.

10.2 The Chemours Company

10.3 The Linde Group

10.4 Air Liquide

10.5 Daikin Industries Ltd.

10.6 Arkema

10.7 Mexichem

10.8 Dongyue Group

10.9 Navin Fluorine International Limited

10.10 Sinochem Group

10.11 SRF Limited

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Halocarbons Refrigerant Market was valued at USD 25.34 billion in 2023 and is projected to reach a market size of USD 50.97 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 10.5%.

Stringent Environmental Regulations, Growing Demand for Sustainable Cooling Solutions, Escalating Costs of Compliance, Advancements in Sustainable Refrigerant Technology.

Residential Sector, Commercial Sector, and Industrial Sector.

Asia-Pacific region is likely the most dominant region for the Halocarbon Refrigerant Market due to its booming economies and high demand for cooling solutions.

Honeywell International Inc., The Chemours Company, The Linde Group, Air Liquide, Daikin Industries Ltd., Arkema, Mexichem, Dongyue Group, Navin Fluorine International Limited, Sinochem Group, SRF Limited.