Halal Ingredients Market Size (2025 – 2030)

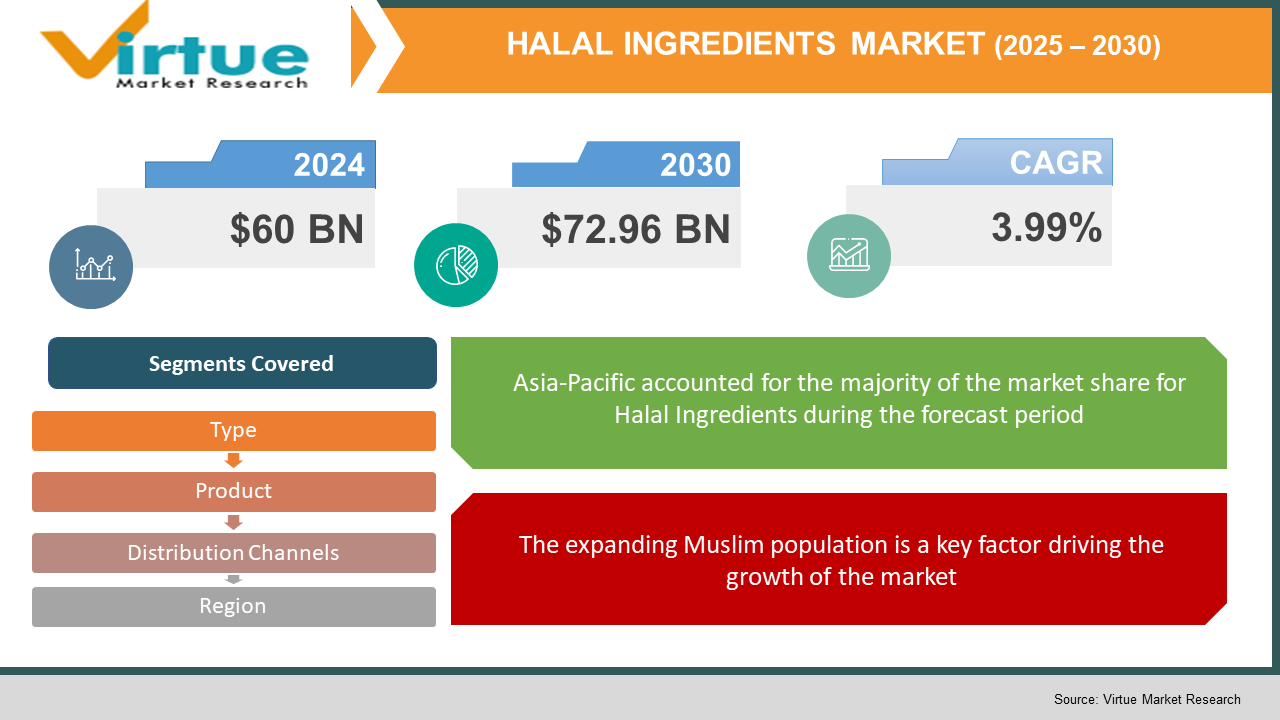

The Halal Ingredients Market was valued at USD 60 billion in 2024. Over the forecast period of 2025-2030, it is projected to reach USD 72.96 billion by 2030, growing at a CAGR of 3.99%.

Halal ingredients are substances utilized in the production of food, beverages, cosmetics, pharmaceuticals, and various other consumer goods that meet Islamic standards. The term "halal" in Arabic translates to "permissible," indicating that both the individual components and the final products comply with Islamic guidelines. A significant factor driving the growth of the halal ingredients market is the rising demand for halal food and ingredients, fueled by the expanding Muslim population.

Key Market Insights:

- Halal ingredients refer to substances that are deemed permissible under Islamic law for use in the production of a wide variety of products. Historically, the concept of halal was primarily associated with the Islamic community. However, over time, it has evolved into a more universally recognized concept. In contemporary times, halal products are often regarded as synonymous with being healthy, fresh, and clean, which has contributed to an increase in their market demand.

- The growing global consumption of products made with halal ingredients is expected to drive the market's expansion during the forecast period. Additionally, the rapidly increasing Muslim population worldwide is another key factor likely to further stimulate the growth of the halal ingredients market.

Halal Ingredients Market Drivers:

The expanding Muslim population is a key factor driving the growth of the market.

The global Muslim population is experiencing rapid growth, leading to an increased demand for halal products and ingredients. Research indicates that the Muslim population is expected to grow at a faster rate than the global population overall. This demographic shift significantly influences the halal sector, particularly the demand for halal ingredients. As more individuals follow Islamic dietary guidelines, the consumption of halal products—and consequently the demand for halal components—is anticipated to rise. Food, pharmaceutical, and personal care companies recognize the potential of this expanding market and are adjusting their product offerings to cater to the needs of the growing Muslim consumer base, which includes a preference for halal ingredients. This demographic change is driving the globalization of the halal industry, which in turn impacts trends in the halal ingredients market.

Halal Ingredients Market Restraints and Challenges:

Limited awareness in regions with non-Muslim majorities is a key factor restraining the growth of the market.

Limited awareness and understanding of halal principles in regions with non-Muslim majorities can hinder the widespread acceptance of halal products and ingredients. In countries such as Portugal, Iceland, Poland, Hungary, Slovakia, the Czech Republic, Romania, and Armenia, where Muslim populations are less than 1%, as well as in Angola and Zambia in Africa, and Laos and Vietnam in Asia, the demand for halal products may be lower due to a lack of familiarity with halal concepts.

This lack of awareness can restrict the market potential for halal ingredients and products in these areas. Additionally, companies operating in such regions may face challenges in developing and marketing halal products. To overcome these barriers, education and targeted marketing efforts may be necessary to increase awareness and stimulate demand for halal ingredients.

Halal Ingredients Market Opportunities:

Global Muslim tourism presents significant opportunities in the market.

The growth of global Muslim tourism offers significant opportunities for companies involved in halal ingredients. There is an increasing demand for halal-certified products, particularly in industries such as food and hospitality. Muslim travelers seek destinations and products that align with their religious and dietary needs. The halal tourism sector is expanding, fueled by a youthful, educated, and upwardly mobile population. This sector holds considerable promise, as the Islamic world encompasses a wide range of tourism markets and destinations, which positively influences the future prospects of halal tourism. Efforts to boost and promote tourism in countries like Uzbekistan and Saudi Arabia, alongside the restoration of historic heritage sites, are further driving the demand for halal tourism.

To cater to this growing market, hotels and resorts in key tourist destinations are adapting their offerings to meet the needs of Muslim visitors. This includes providing halal-certified meals in restaurants and ensuring that all food preparation processes adhere to halal standards. For instance, hotels may use halal-certified meat, employ halal-friendly cooking techniques, and offer designated prayer spaces. With the expansion of the Muslim travel industry, businesses are increasingly investing in halal certification to ensure their services, including ingredients, meet the specific requirements of Muslim tourists.

HALAL INGREDIENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

3.99% |

|

Segments Covered |

By Product, Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Koninklijke DSM N.V., Barentz B.V. and Cargill. |

Halal Ingredients Market Segmentation

Halal Ingredients Market Segmentation: By Type:

- Food Ingredients

- Sauces and marinades

- Thickening agents

- Sugar substitutes

- Flavors

-

- Other

- Beverage Industry

- Coffee

- Tea

- Concentrated beverages and juices

- Soft drinks

- Health and nutritional drinks

- Cosmetic Industry

- Body and skin care

- Oral care

- Fragrance

- Hair care

- Pharmaceutical

- Active Pharma Ingredients

- Excipients

The food industry holds the largest market share, encompassing companies involved in the manufacturing, processing, and distribution of halal food products. This segment includes a broad array of food items, ranging from raw ingredients to finished goods, with halal compliance maintained at every stage of the food supply chain. The food industry is expected to continue dominating the global market throughout the forecast period, driven by the increasing demand and consumption of halal cuisine worldwide, both among Muslim and non-Muslim populations. The production of halal-processed foods by manufacturers, along with their growing consumption, is anticipated to further fuel market growth during this period.

Companies in this sector also produce halal-compliant beverages, ensuring that the ingredients used meet halal standards. This includes non-alcoholic drinks, juices, and other beverages that are certified halal.

Halal Ingredients Market Segmentation By Product:

- Personal Care Products

- Color Cosmetics

The cosmetic sector within this market has experienced notable growth. However, in terms of market revenue, the food and beverages segment continues to dominate, primarily due to the high demand driven by the health benefits and cleanliness associated with these products. The introduction of new flavors and innovations in the industry has helped maintain the popularity of halal ingredient products, particularly among younger consumers who prefer quick snacks over traditional main courses. The growing importance of obtaining halal certification has become a key factor in ensuring the standardization of products, providing consumers with assurance regarding their authenticity and quality.

Halal Ingredients Market Segmentation By Distribution Channels:

- Offline

- Retailers

- Distributors

- Online

- Direct-to-Consumer

Supermarkets and hypermarkets have dominated the segment due to the cleanliness they offer and their adherence to flawless standardization processes. These outlets primarily stock certified halal ingredient products, ensuring customers that the items are authentic and of high quality. To mitigate health risks associated with cleanliness, these larger retailers are often preferred over local vendors. However, local retailers have also shown strong sales growth on a daily basis, largely due to the affordability of their products, which align well with consumers' disposable incomes.

Halal Ingredients Market Segmentation- by region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

The Asia-Pacific region holds the largest global market share and is projected to continue its growth over the forecast period. Several countries in the Asia-Pacific region demonstrate a strong cultural and religious commitment to halal principles, which significantly influence consumer choices and preferences. Some governments in this region may implement policies and initiatives to support the halal industry, promote exports, and improve the halal certification process. Home to over one billion Muslims, the Asia-Pacific region (stretching from Turkey to Indonesia) accounts for approximately 62% of the global Muslim population. Indonesia, with the largest Muslim population in the world, makes up 12.7% of the global Muslim population, followed by Pakistan (11.1%), India (10.9%), and Bangladesh (9.2%).

In addition, South Asia plays a dominant role in the global halal ingredients market and is expected to maintain this position during the forecast period. A growing focus on sustainability, as well as rising demand for halal flavors and cosmetics, has driven growth in Malaysia. Malaysian companies are capitalizing on the demand for halal ingredients by targeting neighboring countries such as India, appealing not only to the Muslim consumer base but also to non-Muslim consumers who are drawn to sustainable and cruelty-free products. Furthermore, the increasing adoption of halal ingredients and growing awareness of their benefits are boosting global sales, among both Muslim and non-Muslim populations.

The Middle East and Africa are expected to experience a compound annual growth rate (CAGR) of 6.0% over the forecast period. The Muslim population in the Middle East-North Africa region is projected to grow by more than a third (37%) over the next 20 years. Turkey leads the GCC countries in the halal ingredients industry, holding over 25% of the market share. Public support for a greater role of religion in governance has increased in Turkey over the past two decades. Muslim-majority countries like Indonesia (85%) and Nigeria also show significant support for religion, driving demand for halal ingredients. It is important to note that many Islamic values are widely appealing, meaning that many halal-certified products and services do not need to be marketed exclusively to Muslims. As a result, the substantial consumption of halal ingredients in key Muslim countries is creating opportunities for the establishment of new halal production facilities.

Latin America is expected to experience slower growth compared to other regions, primarily due to cultural and educational challenges in promoting awareness of halal products. However, the Muslim population has been growing in countries like Brazil, which increases the demand for halal products and ingredients in the region.

COVID-19 Pandemic: Impact Analysis

During the COVID-19 pandemic, halal ingredients companies initially faced a decline in revenue due to widespread store closures and stock shortages in various countries. However, the rapid growth of e-commerce played a pivotal role in reviving sales, as consumers increasingly turned to online platforms to purchase halal ingredients. In response to this shift, companies in the sector focused on enhancing their digital presence by collaborating with third-party online retailers such as Amazon. Furthermore, many brands began offering personalized virtual consultations through their official websites, enabling them to engage more directly with consumers and cater to their needs during the pandemic.

Latest Trends/ Developments:

In February 2024, CJ Foods, a South Korean company, launched its first halal-certified Bibigo Mandu products. This marks a significant milestone in the company's expansion plans, as it aims to introduce the popular Korean dumplings, which already dominate the market in Vietnam, Korea, and the U.S., to the Malaysian market.

In October 2023, Nestlé introduced a new range of flavorful and nutritious substitutes for white fish, catering to growing consumer demand for alternative protein sources.

Also in October 2023, ADM Protexin, a trusted brand of probiotic supplements under ADM, and Nutramax announced the expansion of their long-standing partnership. This collaboration will allow ADM Protexin to manage select Nutramax brands in Europe and several Asia-Pacific regions, facilitating their international expansion.

In October 2023, Ashland showcased its GPM™ fermented nutrients, which are available in organic, non-GMO, and soy-free varieties, highlighting their commitment to offering clean and sustainable ingredients.

Key Players:

These are top 10 players in the Halal Ingredients Market :-

- Koninklijke DSM N.V.

- Barentz B.V.

- Cargill

- Kerry

- Ashland

- Solvay S.A.

- DowDupont

- Symrise

- BASF

- Purecircle Limited

Chapter 1. Halal Ingredients Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Source

1.5. Secondary Source

Chapter 2. Halal Ingredients Market – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Halal Ingredients Market – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Product Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Halal Ingredients Market - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. Halal Ingredients Market - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Halal Ingredients Market – By Type

6.1 Introduction/Key Findings

6.2 Food Ingredients

6.2.1 Sauces and marinades

6.2.2 Thickening agents

6.2.3 Sugar substitutes

6.2.4 Flavors

6.2.5 Other

6.3 Beverage Industry

6.3.1 Coffee

6.3.2 Tea

6.3.3 Concentrated beverages and juices

6.3.4 Soft drinks

6.3.5 Health and nutritional drinks

6.4 Cosmetic Industry

6.4.1 Body and skin care

6.4.2 Oral care

6.4.3 Fragrance

6.4.4 Hair care

6.5 Pharmaceutical

6.5.1 Active Pharma Ingredients

6.5.2 Excipients

6.6 Y-O-Y Growth trend Analysis By Type :

6.7 Absolute $ Opportunity Analysis By Type :, 2025-2030

Chapter 7. Halal Ingredients Market – By Product

7.1 Introduction/Key Findings

7.2 Personal Care Products

7.3 Color Cosmetics

7.4 Y-O-Y Growth trend Analysis By Product

7.5 Absolute $ Opportunity Analysis By Product , 2025-2030

Chapter 8. Halal Ingredients Market – By Distribution channel

8.1 Introduction/Key Findings

8.2 Offline

8.3 Retailers

8.4 Distributors

8.5 Online

8.6 Direct-to-Consumer

8.7 Y-O-Y Growth trend Analysis Distribution channel

8.8 Absolute $ Opportunity Analysis Distribution channel , 2025-2030

Chapter 9. Halal Ingredients Market, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Product

9.1.3. By Distribution channel

9.1.4. By Type

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Product

9.2.3. By Distribution channel

9.2.4. By Type

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.1. By Country

9.3.1.1. China

9.3.1.2. Japan

9.3.1.3. South Korea

9.3.1.4. India

9.3.1.5. Australia & New Zealand

9.3.1.6. Rest of Asia-Pacific

9.3.2. By Product

9.3.3. By Distribution channel

9.3.4. By Type

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.1. By Country

9.4.1.1. Brazil

9.4.1.2. Argentina

9.4.1.3. Colombia

9.4.1.4. Chile

9.4.1.5. Rest of South America

9.4.2. By DISTRIBUTION CHANNEL

9.4.3. By Product

9.4.4. By Type

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.1. By Country

9.5.1.1. United Arab Emirates (UAE)

9.5.1.2. Saudi Arabia

9.5.1.3. Qatar

9.5.1.4. Israel

9.5.1.5. South Africa

9.5.1.6. Nigeria

9.5.1.7. Kenya

9.5.1.8. Egypt

9.5.1.9. Rest of MEA

9.5.2. By DISTRIBUTION CHANNEL

9.5.3. By Product

9.5.4. By Type

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Halal Ingredients Market – Company Profiles – (Overview, Packaging Automation Portfolio, Financials, Strategies & Developments)

10.1 Koninklijke DSM N.V.

10.2 Barentz B.V.

10.3 Cargill

10.4 Kerry

10.5 Ashland

10.6 Solvay S.A.

10.7 DowDupont

10.8 Symrise

10.9 BASF

10.10. Purecircle Limited

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Halal ingredients refer to substances that are deemed permissible under Islamic law for use in the production of a wide variety of products. Historically, the concept of halal was primarily associated with the Islamic community

The top players operating in the Halal Ingredients Market are - Koninklijke DSM N.V., Barentz B.V. and Cargill.

During the COVID-19 pandemic, halal ingredients companies initially faced a decline in revenue due to widespread store closures and stock shortages in various countries.

The growth of global Muslim tourism offers significant opportunities for companies involved in halal ingredients.

The Middle East and Africa is the fastest-growing region in the Halal Ingredients Market.