Global Hair Styling Tools Market (2024 - 2030)

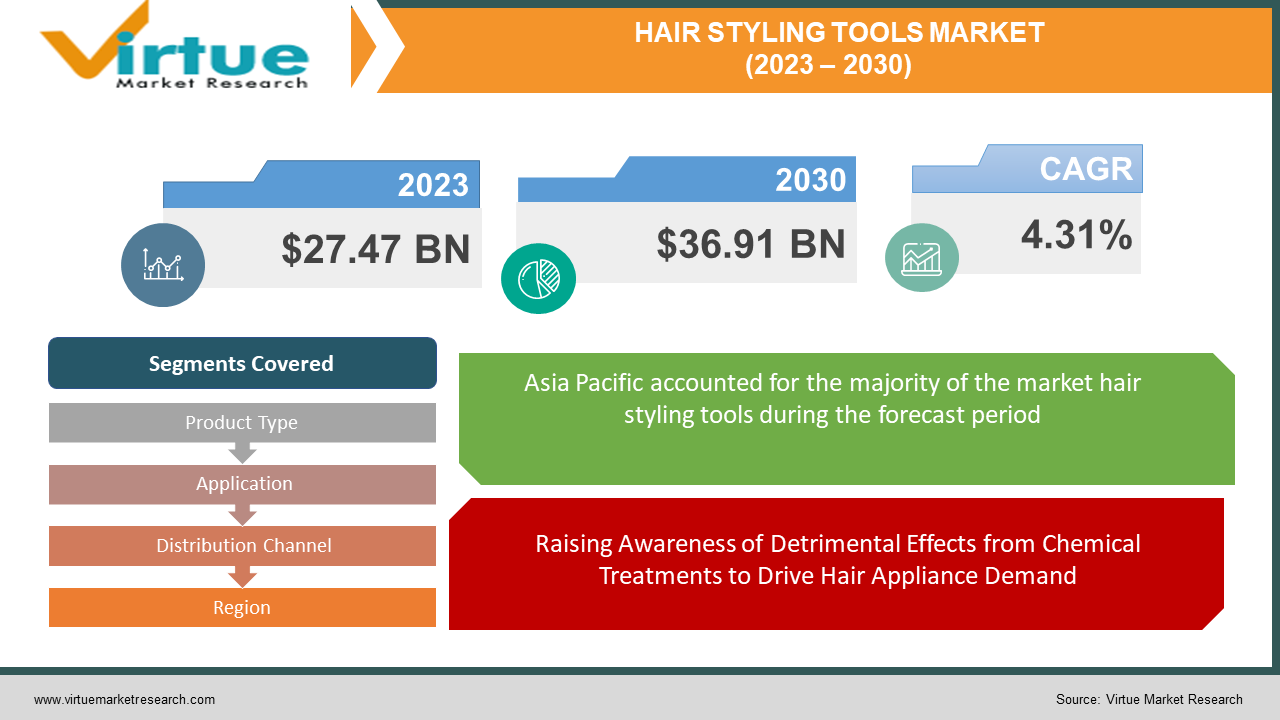

The Global Hair Styling Tools Market, initially valued at USD 27.47 billion in 2023, is anticipated to reach approximately USD 36.91 billion by 2030, projecting a Compound Annual Growth Rate (CAGR) of 4.31% during the forecast period from 2024 to 2030.

Hair styling tools serve the purpose of achieving desired hairstyles and are available in various types tailored to specific hair functions. These tools encompass a spectrum of technologically advanced options. The market has witnessed growing demand, attributed to the convenience, portability, and travel-friendly designs, thereby reducing dependence on salon visits. Market players continually introduce diverse ranges of hair styling tools to meet the demands of both individual users and salon professionals, enabling exploration of new looks and styles. These factors collectively contribute to the market's expansion.

Key Market Insights:

A research article published in The International Journal of Cancer highlighted that woman undergoing chemical hair straightening sessions every 5 to 8 weeks faced a 30% higher likelihood of developing breast cancer.

According to the Indian Beauty and Hygiene Association's report from June 2017, approximately 30% of women globally utilize beauty devices at home, with Asia exhibiting the highest usage rates.

The Cosmetic, Toiletry and Perfumery Association reported an increase in the market share of hair care products within the UK's cosmetics industry, attributing this rise to the spending habits of millennials focusing on grooming.

As per the report from Innovation, Science, and Economic Development Canada (ISED), Canada had 31,667 operating haircare and aesthetic service businesses in 2018.

Market Drivers:

Raising Awareness of Detrimental Effects from Chemical Treatments to Drive Hair Appliance Demand:

The surge in global demand for hair styling tools significantly contributes to market growth. Nonetheless, it's crucial to acknowledge the potential health implications associated with chemical treatments used for both permanent and temporary hair treatments, like straightening or relaxing. The compounds present in these processes often contain elements, such as formaldehyde, known for their carcinogenic properties, which can elevate the risk of severe cancer conditions. This heightened awareness of chemical health impacts is fostering a growing need for chemical-free hair styling tools.

Increased Adoption of Intelligent Styling Tools Driving Market Expansion:

Evolutionary advancements in hair care appliances are reshaping consumer preferences, supplanting the bulkier hair dryers from earlier times. For instance, Philips is in the developmental phase of a hairbrush prototype designed to assess various hair attributes like shine, elasticity, resilience, hydration, and damage. This innovative brush will offer users a comprehensive health evaluation through the Philips hair app. Manufacturers are diligently integrating cutting-edge features such as LED indicators, smartphone integration, and sophisticated designs to entice consumers.

Market Restraints and Challenges:

Concerns about the health risks associated with chemical-based hair straightening products, particularly their potential connection to uterine cancer, present a challenge to the hair styling tools market. Recent studies have shed light on the elevated likelihood of cancer among women using these products regularly.

Market Opportunities:

Innovations integrating technology and hairdressing, such as apps facilitating virtual hair transformations and AI-powered solutions aiding in hairstyle selection, present promising opportunities within the industry.

The emergence of hairdresser bots, mobile hairdresser stalls, and modern hair treatment labs incorporating cutting-edge technology is transforming the hairstyling landscape, offering convenience and creative solutions aligned with current demands.

HAIR STYLING TOOLS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.31% |

|

Segments Covered |

By Product Type, Application, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Philips N.V., Wahl Clipper Corporation, TESCOM, Andis Company Inc.,. Panasonic Corporation, Conair Corporation, Helen of Troy, Panasonic Corporation, Dyson Ltd., Revlon, Inc., BaBylissPRO, Remington Products, Philips N.V., T3 Micro, GHD (Good Hair Day) – Leeds |

Hair Styling Tools Market Segmentation - By Product Type

-

Manual

-

Electric

-

Dryers/Blowers

-

Straighteners

-

Curlers

-

Others (Hair Crimpers, Hot Brush, etc.)

The hair styling tools market is categorized into manual and electric products. While manual tools like combs and brushes cater to general usage, they have limitations compared to professional styling. Electric stylers, including dryers, straighteners, and curlers, meet diverse consumer demands, especially for various hair textures. Among these, hairdryers are projected to be the most popular due to their versatility and affordability. A report by Philips in 2022 revealed that 76% of surveyed women used hairdryers, 41% used straighteners, and approximately 30% relied on curlers.

Hair Styling Tools Market Segmentation - by Application

-

Household

-

Commercial

The market segments into household and commercial categories. Household products emphasize energy-saving features and convenience, exemplified by Dyson's Airwrap Styler, providing salon-like experiences without heat. On the other hand, the commercial segment caters to professional-grade appliances required by salons, spas, and beauty institutes for their styling services, resulting in higher demand compared to household usage.

Hair Styling Tools Market Segmentation - Distribution Channel

-

Hypermarkets & Supermarkets

-

Specialty Stores

-

Online Channels

-

Others (Salons, Departmental Stores, etc.)

The market is segmented across hypermarkets/supermarkets, specialty stores, online platforms, and other avenues. Online channels are anticipated to grow due to the convenience of shopping, particularly accelerated by the impact of COVID-19. Specialty stores and salons attract high-income consumers seeking professional-grade products. Hypermarkets/supermarkets maintain dominance through diverse product ranges and attractive offers.

Hair Styling Tools Market Segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Asia Pacific market is expected to grow significantly, fuelled by increased grooming expenditures in countries like Japan and Australia. Europe holds a substantial market share, especially in the UK, where the hair care product market share increased from 17.9% in 2018 to 18.4% in 2022. The Americas, particularly the US and Canada, exhibit market presence due to rising interest in hairstyling and disposable income. Canada had 31,667 businesses offering haircare and aesthetic services in 2018.

COVID-19 Impact Analysis:

Lockdown measures affected demand from salons but increased individual purchases, notably online. Remote work situations have shifted buying behaviours. Economic downturns, however, decreased interest in non-essential purchases.

Latest Trends and Developments:

The market's growth is propelled by tool advancements and the influence of salon experts, individuals, and social media influencers. Companies respond by innovating products and engaging in DIY hair styling tutorials. Versatile tools like the HSI Professionals Glider, appealing to consumers for its ease of use, have spurred market demand.

Key Players:

-

Philips N.V.

-

Wahl Clipper Corporation

-

TESCOM

-

Andis Company Inc.

-

Panasonic Corporation

-

Conair Corporation

-

Helen of Troy

-

Panasonic Corporation

-

Dyson Ltd.

-

Revlon, Inc.

-

BaBylissPRO

-

Remington Products

-

Philips N.V.

-

T3 Micro

-

GHD (Good Hair Day) – Leeds

In February 2022, Honasa Consumer Pvt Ltd, a specialist in hair care products, disclosed its acquisition of BBLUNT for USD 17.6 million. This acquisition encompasses BBLUNT's divisions in hair coloring, hairstyling, and their chain of salons. Renowned for its diverse range of hair care and styling products, BBLUNT stands as a prominent company in the industry.

Chapter 1. Global Hair Styling Tools Market – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Hair Styling Tools Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Global Hair Styling Tools Market – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Global Hair Styling Tools Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Global Hair Styling Tools Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Hair Styling Tools Market – By Product Type

6.1. Manual

6.2. Electric

6.3. Dryers/Blowers

6.4. Straighteners

6.5. Curlers

6.6. Others (Hair Crimpers, Hot Brush, etc

Chapter 7. Global Hair Styling Tools Market – By Application

7.1. Household

7.2. Commercial

Chapter 8. Global Hair Styling Tools Market – By Distribution Channel

8.1. Hypermarkets & Supermarkets

8.2. Specialty Stores

8.3. Online Channels

8.4. Others (Salons, Departmental Stores, etc.)

Chapter 9. Global Hair Styling Tools Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Product Type

9.1.3. By Application

9.1.4. By Distribution Channel

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Product Type

9.2.3. By Application

9.2.4. By Distribution Channel

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.1. By Country

9.3.1.1. China

9.3.1.2. Japan

9.3.1.3. South Korea

9.3.1.4. India

9.3.1.5. Australia & New Zealand

9.3.1.6. Rest of Asia-Pacific

9.3.2. By Product Type

9.3.3. By Application

9.3.4. By Distribution Channel

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.1. By Country

9.4.1.1. Brazil

9.4.1.2. Argentina

9.4.1.3. Colombia

9.4.1.4. Chile

9.4.1.5. Rest of South America

9.4.2. By Product Type

9.4.3. By Application

9.4.4. By Distribution Channel

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.1. By Country

9.5.1.1. United Arab Emirates (UAE)

9.5.1.2. Saudi Arabia

9.5.1.3. Qatar

9.5.1.4. Israel

9.5.1.5. South Africa

9.5.1.6. Nigeria

9.5.1.7. Kenya

9.5.1.8. Egypt

9.5.1.9. Rest of MEA

9.5.2. By Product Type

9.5.3. By Application

9.5.4. By Distribution Channel

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Global Hair Styling Tools Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1. Philips N.V.

10.2. Wahl Clipper Corporation

10.3. TESCOM

10.4. Andis Company Inc.

10.5. Panasonic Corporation

10.6. Conair Corporation

10.7. Helen of Troy

10.8. Panasonic Corporation

10.9. Dyson Ltd.

10.10. Revlon, Inc.

10.11. BaBylissPRO

10.12. Remington Products

10.13. Philips N.V.

10.14. T3 Micro

10.15. GHD (Good Hair Day) - Leeds

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Hair Styling Tools Market was appraised at USD 27.47 billion and is forecasted to attain a market magnitude of USD 36.91 billion by the conclusion of 2030. Anticipated growth spans a CAGR of 4.31% from 2024 to 2030.

Factors propelling the Global Hair Styling Tools Market encompass an amplified understanding of the detrimental reactions linked to chemical treatments and an escalated adoption of intelligent styling tools, fostering market expansion.

Segmentation of the Global Hair Styling Tools Market by application entails categorization into Household and Commercial sectors.

The Asia Pacific region emerges as the preeminent force within the Global Hair Styling Tools Market.

Key participants operating within the Global Hair Styling Tools Market include Philips N.V., Wahl Clipper Corporation, TESCOM, Andis Company Inc., Panasonic Corporation, and Conair Corporation.