GLOBAL GUMMY VITAMINS MARKET (2024 - 2030)

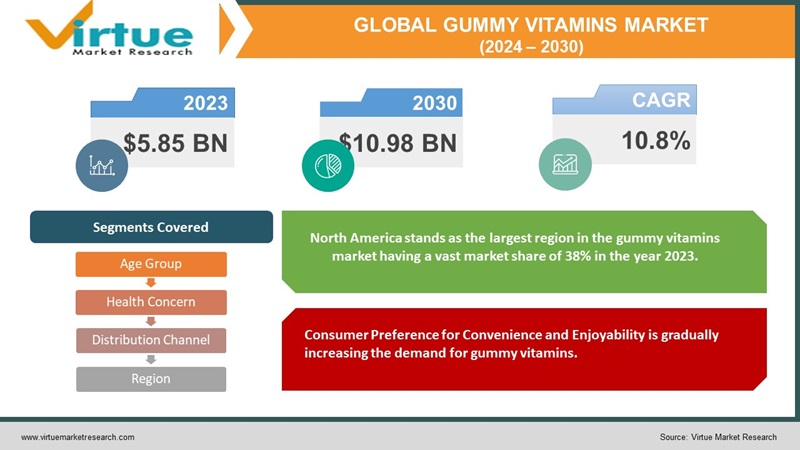

The Gummy Vitamins Market was valued at USD 5.35 Billion in 2023 and is projected to reach a market size of USD 10.98 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 10.8%.

The gummy vitamins market has experienced substantial growth over the past decade, primarily driven by increasing health consciousness, convenience, and the perception of gummies as an enjoyable way to consume supplements. This market expansion has been fueled by a shift in consumer preferences towards supplements that are easier to ingest, especially among children and adults who have difficulty swallowing pills. Key factors contributing to market growth include the availability of a wide range of gummy vitamin options targeting various age groups, genders, and health needs. The industry has seen innovation in formulations, incorporating diverse nutrients like vitamins, minerals, and herbal extracts into gummy formats. With a focus on natural ingredients, sugar-free or organic alternatives, and tailored formulations catering to specific health concerns, the gummy vitamins market continues to attract consumers seeking both health and indulgence in their supplement choices.

Key Market Insights:

In the United States, over three-quarters of consumers typically incorporate vitamin, mineral, or supplement products into their routines, with more than one-third having stocked up since the onset of the COVID-19 pandemic.

According to a survey, while qualities like the highest quality ingredients and affordability are crucial, the preferred format significantly influences consumers' choices when buying these products. The right format holds greater value than preferred brands, label claims, or taste preferences. Notably, the gummy format has swiftly emerged as the fastest-growing and top-selling option, especially appealing to 67% of American consumers aged 18 to 34 who currently use or intend to use vitamins, minerals, or supplements.

Gummy Vitamins Market Drivers:

Consumer Preference for Convenience and Enjoyability is gradually increasing the demand for gummy vitamins.

One major driver is the increasing demand for convenient and enjoyable supplement options. Gummy vitamins offer a more palatable and easier-to-consume alternative to traditional pills or capsules, especially for individuals who have difficulty swallowing pills, including children and older adults. This preference for convenience aligns with modern lifestyles, where time constraints and ease of use heavily influence consumer choices. Gummies provide a more enjoyable experience, often coming in various flavors, shapes, and colors, making them appealing to both children and adults. This trend towards enjoyable supplementation has significantly expanded the consumer base for gummy vitamins, contributing to their market growth.

Perception of Health and Wellness among consumers is significantly driving the growth of gummy vitamins.

The rising emphasis on health and wellness is another significant driver. With increased awareness about the importance of vitamins and minerals in maintaining overall health, consumers are actively seeking ways to incorporate supplements into their daily routines. Gummy vitamins are perceived as a healthier option due to their association with natural ingredients, and many formulations are designed to cater to specific health needs, such as immunity, bone health, or skincare. This alignment with wellness trends and the perception of gummies as a proactive step towards better health continues to drive their popularity and market expansion.

Gummy Vitamins Market Restraints and Challenges:

Regulatory Scrutiny and Formulation Constraints in the production of gummy vitamins are major challenges for businesses in this market.

One significant challenge is meeting regulatory standards while maintaining taste and texture in gummy formulations. Gummy vitamins often contain sugars, gelatin, or other ingredients that can pose formulation challenges, especially when aiming to create sugar-free or organic alternatives. Balancing taste and texture while adhering to strict regulatory guidelines on ingredients, dosages, and health claims presents a hurdle for manufacturers. For instance, restrictions on certain additives or fortification levels can limit the formulation options, potentially impacting the appeal or effectiveness of the product.

Perception and Efficacy Concerns among consumers might slow down the growth of gummy vitamins.

Another challenge is the perception of gummy vitamins as more of a treat than a supplement, leading to concerns about their efficacy and nutritional value. While gummy vitamins offer a convenient and enjoyable way to consume supplements, there's skepticism among some consumers about whether they provide the same health benefits as traditional pills or liquids. Questions arise regarding the stability of nutrients in gummy form, the actual absorption rates in the body, and the presence of added sugars or artificial flavors, which can affect how the product is perceived in terms of healthfulness. Educating consumers about the efficacy and proper usage of gummy vitamins becomes crucial to dispel doubts and establish credibility in the market.

Gummy Vitamins Market Opportunities:

The gummy vitamins market holds promising opportunities, especially in diversifying product offerings to cater to niche demographics and health concerns. Tailoring gummy formulations to specific dietary needs, such as vegan or gluten-free options, presents a significant opportunity for market expansion. Additionally, leveraging technological advancements in formulation and delivery methods to enhance nutrient absorption and bioavailability can further elevate the appeal and efficacy of gummy vitamins. The market also benefits from the growing focus on preventive healthcare, opening avenues for partnerships with healthcare providers or wellness programs, thus increasing consumer awareness and trust in gummy supplements as a convenient and effective way to support overall health and well-being.

GLOBAL GUMMY VITAMINS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10.8 % |

|

Segments Covered |

By Age Group, Health Concern, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Church & Dwight Co., Inc., Bayer AG, Nature's Bounty Co., SmartyPants Vitamins, Hero Nutritionals, Vitakem Nutraceutical Inc., Olly Nutrition, Rainbow Light, GummyVites (Nature Made), Zarbee's Naturals |

Gummy Vitamins Market Segmentation:

Gummy Vitamins Market Segmentation: By Age Group:

- Children

- Adults

- Seniors

The largest segment in the gummy vitamins market by age group is the adults age group segment having a significant market share of around 59% in 2023. Adults are more health-conscious and proactive about supplementing their diets to address specific health concerns or nutritional gaps. This demographic often faces diverse health needs associated with busy lifestyles, stress, and age-related factors, leading to a higher demand for targeted supplements. Adults are more likely to research and invest in wellness products, including gummy vitamins, seeking convenient and enjoyable ways to maintain their health. The fastest-growing segment is also the adult segment, particularly among young adults and middle-aged individuals. This growth can be attributed to evolving health consciousness and lifestyle trends within these demographics. The middle-aged population often experiences a heightened focus on preventive health measures, aiming to maintain overall wellness and address specific health concerns associated with aging. The diversification of formulations targeting various health needs, such as stress relief, energy boost, or specific nutrient deficiencies prevalent in these age groups, contributes significantly to the surging popularity of gummy vitamins among adults.

Gummy Vitamins Market Segmentation: By Health Concern:

- Immunity

- Bone health

- Digestion

- Hair/skin/nails

- Prenatal care

- Others

In 2023, the largest segment by health concern in the gummy vitamins market is likely the Immunity segment having a market share of 43%. This prominence is primarily driven by a widespread global focus on bolstering the immune system, particularly heightened due to the COVID-19 pandemic. Consumers have increasingly sought supplements that support immune health, turning to gummy vitamins containing key immune-boosting nutrients like vitamin C, vitamin D, zinc, and elderberry. The strong demand stems from a growing awareness of preventive health measures and a desire to strengthen the body's defenses against illnesses. The hair/skin/nails segment stands out as the fastest-growing within the gummy vitamins market expected to grow at a CAGR of 11.3% due to evolving beauty and wellness trends. Consumers are increasingly prioritizing holistic approaches to beauty from within, seeking supplements that nourish not just their internal health but also promote outward radiance. Gummy vitamins addressing hair, skin, and nail health appeal to a broad demographic, from younger consumers aiming for vibrant appearances to older individuals seeking anti-aging support. Additionally, social media influence and the rise of influencers increasingly advertising for comprehensive beauty routines, have significantly propelled the demand for gummy vitamins targeting hair, skin, and nails.

Gummy Vitamins Market Segmentation: By Distribution Channel:

- Retail Distribution

- Online Retail

- Pharmacies

- Others

Online retail stands as the largest segment in the distribution channels for gummy vitamins holding a market share of 61% in 2023. The convenience and accessibility of purchasing gummy vitamins online have significantly contributed to the segment's growth. Consumers increasingly prefer the ease of browsing through a wide range of products, comparing brands, reading reviews, and making purchases from the comfort of their homes. Online retailers often offer discounts, subscription options, and a broader assortment of gummy vitamins, attracting a larger consumer base beyond what's available in physical stores. Especially during the COVID-19 pandemic, the shift towards online shopping for health-related products further propelled the dominance of this segment. The fastest-growing segment in the gummy vitamins market by distribution channel is also Online Retail expected to grow at a fast pace of 18%. This surge can be attributed to evolving consumer behavior, characterized by a growing preference for the convenience, accessibility, and extensive product variety offered by online platforms. The shift towards e-commerce is driven by factors such as ease of comparison, availability of customer reviews, and the ability to purchase from anywhere at any time, which resonates strongly with consumers seeking health and wellness products like gummy vitamins.

Gummy Vitamins Market Segmentation: Regional Analysis:

- North America

- Asia- Pacific

- Europe

- South America

- Middle East and Africa

North America stands as the largest region in the gummy vitamins market having a vast market share of 38% in the year 2023. The region's dominance is fueled by heightened health consciousness, a strong inclination toward wellness trends, and a robust demand for convenient health supplements. North American consumers exhibit a growing preference for gummy vitamins due to their ease of consumption, especially among children and adults. The market in this region benefits from a diverse range of gummy vitamin offerings, catering to various age groups and health concerns. The presence of established key players, continuous product innovations, and aggressive marketing strategies contribute significantly to the market's substantial growth and dominance in North America. The Asia-Pacific region emerges as the fastest-growing market for gummy vitamins growing at a rate of 14.5%. Rising health consciousness, increasing disposable incomes, and a growing preference for convenient and appealing supplement formats drive the demand in this region. A burgeoning population, particularly in countries like China and India, presents a vast consumer base seeking innovative and enjoyable ways to address health needs. The influence of Western dietary trends and a shift towards preventive healthcare practices further propel the adoption of gummy vitamins in the Asia-Pacific region.

COVID-19 Impact Analysis on the Gummy Vitamins Market:

The COVID-19 pandemic has notably impacted the gummy vitamins market, witnessing both challenges and opportunities. Initially, supply chain disruptions and manufacturing constraints affected production and distribution, causing sporadic shortages and delays in availability. However, the increased focus on health and wellness during the pandemic has substantially boosted the demand for immune-boosting supplements like gummy vitamins, driving a surge in sales. Consumers sought ways to bolster their immune systems, leading to heightened interest in gummy supplements containing immune-supporting nutrients like vitamin C, D, and zinc. This increased demand accelerated the market's growth, prompting manufacturers to innovate and introduce new formulations addressing specific health concerns, thereby reinforcing the market's resilience amidst the global health crisis.

Latest Trends/ Developments:

A recent trend in the gummy vitamins market revolves around sustainability and eco-consciousness. Consumers are increasingly demanding environmentally friendly packaging and responsibly sourced ingredients. Brands are responding by adopting recyclable packaging materials, reducing plastic usage, and emphasizing sustainable practices in their production processes. This trend reflects a growing consumer awareness of the environmental impact of their purchases, influencing their choices in the supplement market.

Personalized gummy vitamins have gained traction. Companies are leveraging technology and consumer data to offer customized gummy supplements tailored to individual health needs, lifestyles, and dietary preferences. Through online platforms or subscription-based services, consumers can now access personalized recommendations, allowing them to select specific nutrients, dosages, and even flavors in their gummy vitamins. This development aligns with the increasing demand for personalized healthcare solutions, providing consumers with a more tailored and targeted approach to supplementation.

Key Players:

- Church & Dwight Co., Inc.

- Bayer AG

- Nature's Bounty Co.

- SmartyPants Vitamins

- Hero Nutritionals

- Vitakem Nutraceutical Inc.

- Olly Nutrition

- Rainbow Light

- GummyVites (Nature Made)

- Zarbee's Naturals

In May 2023, SmartyPants Vitamins introduced a fresh line of gummy multivitamins named SmartyPants Sugar Free Multi & Omegas, available in Kids, Women’s, and Prenatal formats. These new supplements do not rely on sugar alcohols in their formulation.

Chapter 1. GLOBAL GUMMY VITAMINS MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL GUMMY VITAMINS MARKET – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. GLOBAL GUMMY VITAMINS MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL GUMMY VITAMINS MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL GUMMY VITAMINS MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL GUMMY VITAMINS MARKET – By Age Group

6.1. Lidar, Radar and Camera

6.2. Sensor fusion and perception

Chapter 7. GLOBAL GUMMY VITAMINS MARKET – By Health Concern

7.1. Electric Vehicles

7.2. Hybrid Vehicles

7.3. Fuel Cell

Chapter 8. GLOBAL GUMMY VITAMINS MARKET – By Distribution Channel

8.1. Car Rental

8.2. Station Based

Chapter 9. GLOBAL GUMMY VITAMINS MARKET, By Geography – Market Size, Forecast, Trends & Insights

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Age Group

9.1.3. By Health Concern

9.1.4. By Distribution Channel

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Age Group

9.2.3. By Health Concern

9.2.4. By Distribution Channel

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.2. By Country

9.3.2.2. China

9.3.2.2. Japan

9.3.2.3. South Korea

9.3.2.4. India

9.3.2.5. Australia & New Zealand

9.3.2.6. Rest of Asia-Pacific

9.3.2. By Age Group

9.3.3. By Health Concern

9.3.4. By Distribution Channel

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.3. By Country

9.4.3.3. Brazil

9.4.3.2. Argentina

9.4.3.3. Colombia

9.4.3.4. Chile

9.4.3.5. Rest South America

9.4.2. By Age Group

9.4.3. By Health Concern

9.4.4. By Distribution Channel

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.4. By Country

9.5.4.4. United Arab Emirates (UAE)

9.5.4.2. Saudi Arabia

9.5.4.3. Qatar

9.5.4.4. Israel

9.5.4.5. South Africa

9.5.4.6. Nigeria

9.5.4.7. Kenya

9.5.4.8. Egypt

9.5.4.9. Rest of MEA

9.5.2. By Age Group

9.5.3. By Health Concern

9.5.4. By Distribution Channel

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. GLOBAL GUMMY VITAMINS MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1. Church & Dwight Co., Inc.

10.2. Bayer AG

10.3. Nature's Bounty Co.

10.4. SmartyPants Vitamins

10.5. Hero Nutritionals

10.6. Vitakem Nutraceutical Inc.

10.7. Olly Nutrition

10.8. Rainbow Light

10.9. GummyVites (Nature Made)

10.10. Zarbee's Naturals

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Gummy Vitamins Market was valued at USD 5.35 Billion in 2023 and is projected to reach a market size of USD 10.98 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 10.8%.

Consumer Preference for Convenience and Enjoyability along with Perception of Health and Wellness among consumers.are drivers of the Gummy Vitamins market.

Based on distribution channel, the Gummy Vitamins Market is segmented into Retail Distribution, Online Retail, Pharmacies, and Others.

North America is the most dominant region for the Gummy Vitamins Market.

Church & Dwight Co., Inc., Bayer AG, Nature's Bounty Co., SmartyPants Vitamins, and Hero Nutritionals are a few of the key players operating in the Gummy Vitamins Market.