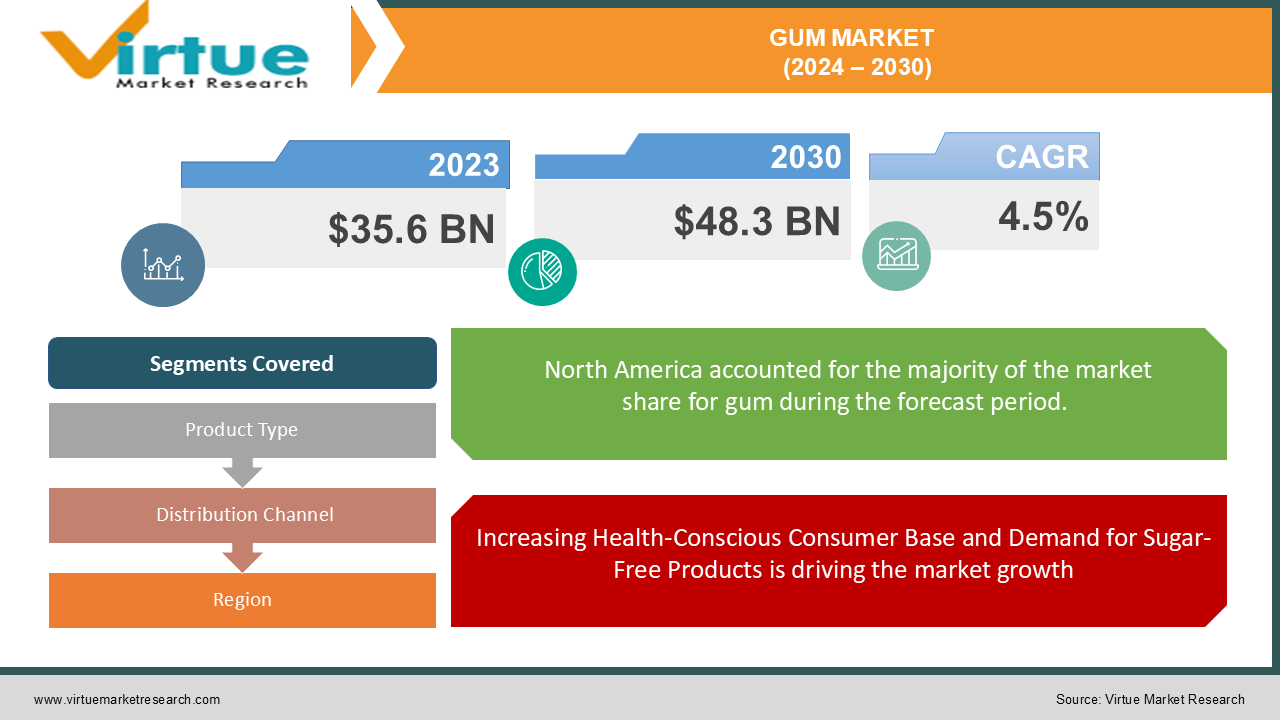

Gum Market Size (2024 – 2030)

As of 2023, the Global Gum Market is valued at approximately USD 35.6 billion, and it is projected to reach USD 48.3 billion by 2030, growing at a compound annual growth rate (CAGR) of 4.5% during the forecast period.

The growth of the market is driven by the increasing demand for sugar-free gum and functional gums, with heightened awareness regarding oral health and hygiene. Gum manufacturers are continually introducing new flavors, textures, and ingredients to cater to a diverse consumer base. In addition, the popularity of sugar-free gum is growing due to the rising health-consciousness of consumers, who seek low-calorie alternatives to traditional sugary snacks. The online retail channel is also playing a significant role in expanding the market’s reach, with more consumers purchasing gum online due to convenience and a wide range of options.

Key Market Insights:

-

Chewing Gum holds the largest market share, accounting for 60% of the total gum market, driven by its widespread popularity and frequent consumption.

-

Sugar-free gum is expected to grow at a CAGR of 6.8%, thanks to increasing health-consciousness and consumer demand for products that promote oral health.

-

Supermarkets and hypermarkets dominate the distribution channel, contributing 40% of total sales, followed closely by convenience stores.

-

North America leads the market with over 30% of market share, driven by high gum consumption, product innovation, and the popularity of functional and sugar-free gums.

Global Gum Market Drivers

Increasing Health-Conscious Consumer Base and Demand for Sugar-Free Products is driving the market growth

The growing focus on health and wellness is a major driver of the Global Gum Market, particularly with the increasing demand for sugar-free and functional gums. Sugar-free gum, which contains sugar substitutes like xylitol or sorbitol, is popular among health-conscious consumers because of its lower calorie content and benefits to oral health. Xylitol, for instance, is widely known for its cavity-prevention properties, making sugar-free gum an attractive choice for consumers seeking alternatives to traditional sugary confectioneries. The global rise in obesity, diabetes, and other lifestyle-related diseases has pushed consumers to reduce sugar intake, driving the growth of this segment. In addition to its oral health benefits, sugar-free gum is also being marketed for other functional purposes, such as improving concentration, reducing stress, and curbing hunger, further expanding its appeal. As a result, the sugar-free segment is expected to be the fastest-growing in the gum market over the forecast period.

Expanding Functional Gum Offerings is driving the market growth

The functional gum segment is seeing rapid growth due to its ability to meet the rising demand for convenience and health benefits. Functional gums provide additional advantages beyond oral health, including energy-boosting, sleep-aiding, stress-relief, and vitamin supplementation. As consumers seek out convenient ways to improve their overall well-being, functional gums have gained popularity as a quick and effective delivery system for supplements and active ingredients. Manufacturers are increasingly incorporating ingredients like caffeine, vitamins, and minerals into gum products to cater to consumers’ desire for multifunctional snacks. This shift toward functional gums is driven by the expanding interest in nutraceuticals, particularly in regions such as North America and Europe, where consumers are looking for new, innovative ways to enhance their diet and daily health routines. The growing demand for on-the-go health products has resulted in significant investment in research and development, leading to a wave of product innovations in this category.

Rising Online Retail Channels and E-Commerce is driving the market growth

The rapid expansion of online retail channels is playing a critical role in the growth of the Global Gum Market. Consumers are increasingly shifting toward online platforms for purchasing gum due to the convenience, variety of products, and easy comparison of prices. The rise of e-commerce platforms such as Amazon, Walmart, and specialty confectionery stores online has broadened the market's reach, allowing consumers to access a wider range of gum products, including rare or niche offerings that may not be available in traditional brick-and-mortar stores. The COVID-19 pandemic further accelerated the growth of online retailing as consumers preferred the safety and convenience of shopping from home. Even as pandemic-related restrictions ease, the online retail channel continues to maintain its momentum, with more consumers opting for digital platforms to meet their snacking needs. This shift is expected to have a lasting impact on the gum market, with online retail becoming an increasingly important distribution channel in the years to come.

Global Gum Market Challenges and Restraints

Declining Consumption of Sugary Confectioneries is restricting the market growth

One of the key challenges facing the Global Gum Market is the decline in the consumption of sugary confectioneries, driven by growing concerns over sugar-related health issues. Consumers are becoming increasingly wary of sugar-laden products due to the negative impact of sugar on overall health, including weight gain, diabetes, and dental problems. This has led to a shift in consumer preferences toward healthier snacks, which in turn has negatively affected the demand for traditional gum products containing sugar. In response to this trend, manufacturers have been introducing sugar-free alternatives, but the transition poses a challenge in maintaining consumer loyalty to well-established sugary gum brands. Additionally, governments and health organizations worldwide are implementing stricter regulations and higher taxes on sugar-based products, further pressuring the gum market to adapt to changing consumer behavior.

Competition from Alternative Snacks and Confectioneries is restricting the market growth

The gum market faces increasing competition from a wide array of alternative snacks and confectioneries, including mints, candies, and healthier snack options like nuts and fruit bars. Consumers now have more choices than ever before when it comes to snacks, with many opting for products that offer nutritional value or enhanced health benefits. This growing competition from alternative snacks is particularly strong in the convenience store segment, where customers may be more inclined to pick up healthier, more filling options over gum. Moreover, the convenience and portability that gum once offered are now being matched or exceeded by newer snack formats. As a result, gum manufacturers must continually innovate to stay competitive in the fast-paced snack industry, focusing on differentiating their products through flavor innovations, packaging, and health-related benefits.

Market Opportunities

The Global Gum Market offers significant growth opportunities, particularly in the development and marketing of functional and sugar-free gum products. As consumers increasingly prioritize health and wellness, the demand for gums that provide functional benefits such as energy boosting, vitamin supplementation, and stress relief is expected to rise. Additionally, the sugar-free gum segment presents a substantial opportunity, as more consumers move away from sugary snacks due to health concerns. Another opportunity lies in the regional expansion of gum products, especially in emerging markets like Asia-Pacific and Latin America, where disposable incomes are rising, and urbanization is driving the growth of convenience products. In these regions, the increasing adoption of Western eating habits, along with growing awareness of oral health, is likely to boost demand for both traditional and functional gums.

GUM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.5% |

|

Segments Covered |

By Product type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Mars, Incorporated, Mondelez International, Perfetti Van Melle, The Hershey Company, Lotte Corporation, Wrigley Company, Haribo GmbH & Co. KG, Meiji Holdings Co., Ltd., Cloetta AB, LOTTE Confectionery Co., Ltd. |

Gum Market Segmentation - By Product Type

-

Chewing Gum

-

Bubble Gum

-

Sugar-Free Gum

Chewing Gum remains the dominant segment, accounting for 60% of the total market share. Chewing gum is widely consumed for its flavor, stress-relieving properties, and benefits related to oral hygiene. Innovations in texture, flavor, and packaging have helped maintain its popularity. Sugar-Free Gum, however, is the fastest-growing segment, driven by its health benefits, including cavity prevention and low-calorie content.

Gum Market Segmentation - By Distribution Channel

-

Supermarkets/Hypermarkets

-

Convenience Stores

-

Online Retail

-

Others

Supermarkets and hypermarkets hold the largest share in the distribution channel, contributing around 40% of total sales. Convenience stores follow closely, as they remain a popular choice for on-the-go purchases. However, online retail is gaining significant traction, driven by the convenience and variety it offers to consumers.

Gum Market Segmentation - Regional Segmentation

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

North America dominates the global gum market, holding over 30% of the total market share. The region's leadership is driven by high gum consumption rates, innovative product offerings, and the increasing popularity of sugar-free and functional gum varieties. The U.S. is the largest market in North America, with manufacturers focusing on product differentiation, marketing campaigns, and brand loyalty.

COVID-19 Impact Analysis on Gum Market

The COVID-19 pandemic had a mixed impact on the Global Gum Market. On the one hand, lockdowns and social distancing measures reduced the frequency of gum consumption, as fewer consumers engaged in impulse purchases during trips to convenience stores. Additionally, concerns over hygiene and the spread of the virus led some consumers to avoid gum, which involves direct contact with the mouth. On the other hand, the rise of online retail channels during the pandemic mitigated some of the negative impacts, as consumers shifted to purchasing gum online. Moreover, the demand for functional and sugar-free gums remained resilient, as consumers continued to prioritize health and wellness. As restrictions ease and normalcy returns, the market is expected to recover, with a renewed focus on innovation and product differentiation.

Latest Trends/Developments

Recent trends in the Global Gum Market include the growing popularity of functional gums, with manufacturers introducing products that offer benefits beyond oral hygiene, such as boosting energy, reducing stress, and aiding sleep. The incorporation of ingredients like caffeine, melatonin, and vitamins has helped functional gums carve out a niche in the wellness market. Additionally, sustainability is becoming an important consideration for gum manufacturers. There is increasing demand for eco-friendly packaging and natural ingredients, as consumers become more environmentally conscious. Brands are exploring biodegradable packaging options and plant-based gum formulations to cater to this growing consumer preference.

Key Players

-

Mars, Incorporated

-

Mondelez International

-

Perfetti Van Melle

-

The Hershey Company

-

Lotte Corporation

-

Wrigley Company

-

Haribo GmbH & Co. KG

-

Meiji Holdings Co., Ltd.

-

Cloetta AB

-

LOTTE Confectionery Co., Ltd.

Chapter 1. Gum Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Gum Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Gum Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Gum Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Gum Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Gum Market – By Product Type

6.1 Introduction/Key Findings

6.2 Chewing Gum

6.3 Bubble Gum

6.4 Sugar-Free Gum

6.5 Y-O-Y Growth trend Analysis By Product Type

6.6 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Gum Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Supermarkets/Hypermarkets

7.3 Convenience Stores

7.4 Online Retail

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Distribution Channel

7.7 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Gum Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Gum Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Mars, Incorporated

9.2 Mondelez International

9.3 Perfetti Van Melle

9.4 The Hershey Company

9.5 Lotte Corporation

9.6 Wrigley Company

9.7 Haribo GmbH & Co. KG

9.8 Meiji Holdings Co., Ltd.

9.9 Cloetta AB

9.10 LOTTE Confectionery Co., Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

As of 2023, the Global Gum Market is valued at approximately USD 35.6 billion and is projected to reach USD 48.3 billion by 2030, growing at a CAGR of 4.5% during the forecast period.

The key drivers include increasing demand for sugar-free and functional gums, the rise of health-conscious consumers, and the expansion of online retail channels.

The major product segments include Chewing Gum, Bubble Gum, and Sugar-Free Gum, with Chewing Gum holding the largest market share.

North America leads the market, holding over 30% of the total share, followed by Europe and the Asia-Pacific region.

Some of the key players include Mars, Incorporated, Mondelez International, Perfetti Van Melle, and The Hershey Company.