Gum Arabic Market Size (2025 – 2030)

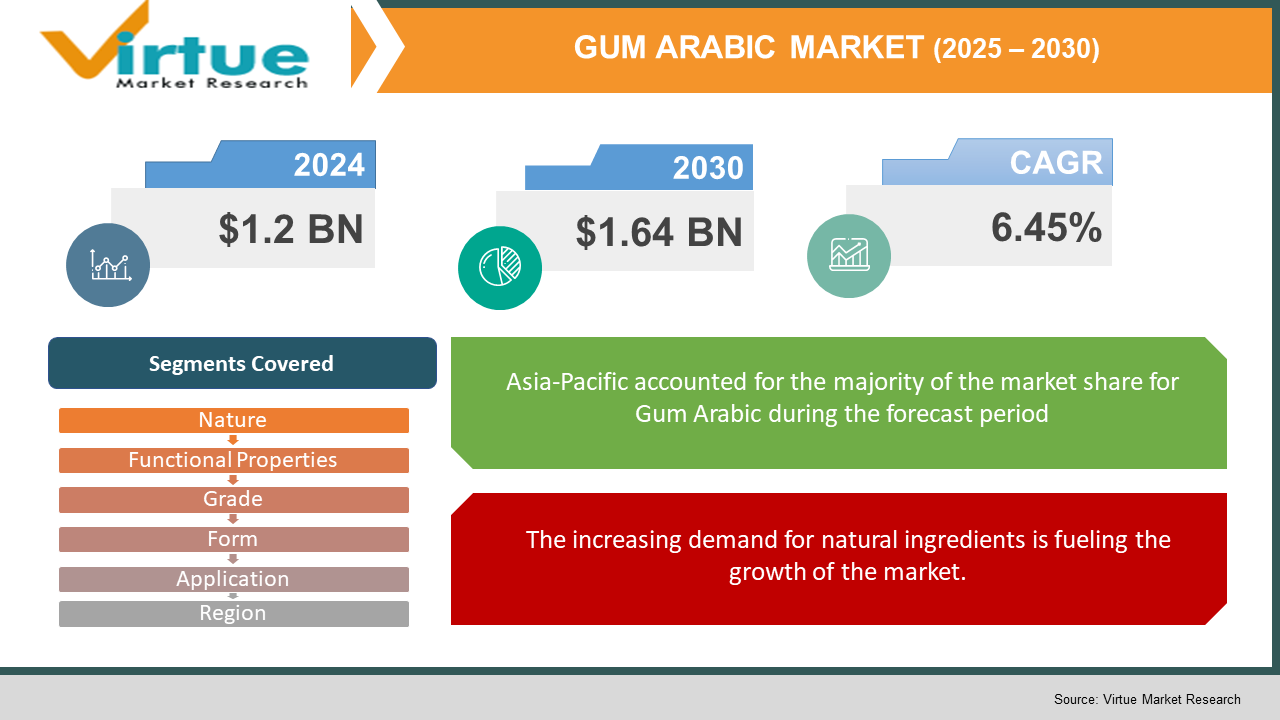

The Gum Arabic Market was valued at USD 1.2 billion in 2024. Over the forecast period of 2025-2030, it is projected to reach USD 1.64 billion by 2030, growing at a CAGR of 6.45%.

Gum arabic is a sophisticated blend of glycoproteins and polysaccharides, mainly consisting of arabinose and galactose polymers. It is water-soluble, safe for consumption, and widely utilized in the food and beverage industries, particularly as a stabilizer. In addition to its use in traditional lithography, gum arabic is also incorporated into printing, paints, cosmetics, adhesives, and numerous industrial sectors. It plays a significant role in viscosity control for inks and is also employed in the textile industry, although it faces competition from more cost-effective alternatives in many of these applications.

Key Market Insights:

- The market for Gum Arabic has seen significant growth in recent years, largely driven by the increasing demand for natural ingredients across various sectors.

- Sourced from the exudates of Acacia senegal and Acacia seyal trees, Gum Arabic has become a highly versatile and in-demand natural additive, with applications extending to the food and beverage, pharmaceutical, and cosmetic industries, among others.

- A major factor contributing to the rise of Gum Arabic is the growing consumer preference for natural, functional foods that offer additional health benefits.

- As consumers seek alternatives to synthetic ingredients, they are increasingly drawn to the natural properties and potential health benefits that Gum Arabic provides.

Gum Arabic Market Drivers:

The increasing demand for natural ingredients is fueling the growth of the market.

In recent years, the market for Gum Arabic has experienced significant growth, primarily driven by the rising demand for natural ingredients across a variety of industries. Sourced from the exudates of Acacia senegal and Acacia seyal trees, Gum Arabic has become a highly versatile and in-demand natural additive, with applications extending to the food and beverage industry, pharmaceuticals, cosmetics, and beyond. This surge in demand can be attributed to several interrelated factors, such as shifting consumer preferences, the increasing demand for clean-label products, heightened awareness of health and environmental issues, and the unique functional properties of Gum Arabic.

A key driver of this growing demand is the shift in consumer preferences.

As health consciousness continues to rise, consumers are increasingly opting for products that align with their desire for clean, natural, and minimally processed ingredients. Gum Arabic, being a plant-derived exudate, meets these preferences perfectly. Its natural origin resonates with consumers who seek transparency in the sourcing and composition of the products they use. Consequently, the food and beverage industry has seen a significant rise in the use of Gum Arabic as a natural alternative to synthetic additives and emulsifiers. Within this sector, Gum Arabic serves a variety of roles, further enhancing its appeal.

Gum Arabic Market Restraints and Challenges:

Fluctuations in the availability of Gum Arabic present a significant challenge to the growth of the market.

The global market faces challenges due to the unpredictable availability of Gum Arabic, a natural emulsifier and stabilizer primarily sourced from Acacia trees in the arid and semi-arid regions of Africa, such as Sudan and Chad. Climate change, deforestation, and desertification are significant threats to the growth and yield of these trees. Droughts, a frequent occurrence in these regions, adversely affect the development of acacia trees, leading to a reduced global supply of Gum Arabic. Additionally, human activities and climate change intensify these environmental challenges, heightening the risk of overharvesting acacia trees to meet rising demand. Such overuse can lead to environmental degradation and a loss of biodiversity.

Gum Arabic Market Opportunities:

The increasing use of Gum Arabic in the production of plant-based meat alternatives is emerging as a prominent trend in the market. The market is experiencing notable growth due to its expanding role in the food and beverage industry, particularly in the creation of plant-based meat substitutes. Gum Arabic serves as a crucial emulsifier and stabilizer in these products, helping manufacturers achieve the desired texture and mouthfeel. By stabilizing and emulsifying ingredients, it enhances the binding capacity of water, ensuring that plant-based meat substitutes maintain moisture and juiciness.

Additionally, in the pharmaceuticals and nutraceuticals sectors, Gum Arabic is widely utilized for its ability to enhance product stability and extend shelf life. Ashland Oil, a leading supplier of Gum Arabic, emphasizes the versatility of this natural ingredient, making it a preferred choice for manufacturers aiming to meet clean label claims—a growing priority for health-conscious consumers.

GUM ARABIC MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6.45% |

|

Segments Covered |

By nature, funcyional properties, application, grade, form, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Nexira, Kerry Group and Gum Arabic Company. |

Gum Arabic Market Segmentation:

Gum Arabic Market Segmentation By Nature:

- Organic

- Conventional

The conventional segment held the largest market share and is expected to register a high compound annual growth rate (CAGR) during the forecast period. This growth is primarily driven by increased demand across various industries. The continued and widespread use of conventional Gum Arabic in sectors such as food and beverage, pharmaceuticals, and textiles

remains a key factor in the market's expansion. Its reputation as a stable and traditional option for numerous applications further enhances its appeal to industries seeking reliability and proven performance standards.

Gum Arabic Market Segmentation By Functional Properties:

- Stabilizer

- Emulsifier

- Thickener

The emulsifier segment holds the largest market share and remains a dominant force in the Gum Arabic industry. As an essential emulsifying agent, it plays a crucial role in the food and beverage sector, where it helps stabilize emulsions and improves product quality and texture. This has led to a growing demand for Gum Arabic. Additionally, the expansion of the food processing industry is expected to significantly contribute to the growth of this segment, as the need for effective emulsifiers like Gum Arabic continues to increase alongside the industry's growth.

Gum Arabic Market Segmentation By Grade:

-

Acacia senegal

- Acacia seyal

The Acacia senegal segment commands the largest share of revenue in the Gum Arabic industry. This growth is driven by the increasing use of Acacia senegal across various industries such as food and beverage, pharmaceuticals, and cosmetics, thanks to its unique properties that meet the growing demand for natural and versatile ingredients. Acacia senegal gum, also known as gum hashab, is highly valued for its superior emulsifying properties, higher purity, and lower viscosity compared to Acacia Seyal (tall gum). These qualities make it especially desirable in industries where the quality of Gum Arabic plays a critical role in product stability and structure.

In the food industry, for instance, Acacia senegal gum is preferred for its ability to stabilize non-alcoholic emulsions, encapsulate aromas, and extend the shelf life of products. Furthermore, Acacia senegal is predominantly found in the Sahel region of Africa, where sustainable harvesting practices have led to more reliable and consistent production. These sustainable methods, along with efforts to improve the living standards of gum collectors, have contributed to a more stable supply chain, further solidifying Acacia senegal’s dominance in the global market. Its ability to thrive in semi-arid conditions and well-established trade networks in countries such as Sudan, Chad, and Nigeria ensure a steady supply of high-quality Gum Arabic, making Acacia senegal the leading player in the segment.

Gum Arabic Market Segmentation By Form:

- Kibbled Acacia Gum

- Raw Gum Arabic

- Powdered Acacia Gum

- Spray-Dried Acacia Gum

The kibbled acacia gum segment holds a larger market share and is projected to experience the highest compound annual growth rate (CAGR). The gum Arabic powder segment leads the market due to its versatile availability, ease of use, and the specific demands of the food and beverage, pharmaceutical, and cosmetic industries, which are the primary consumers of Gum Arabic. Ground Gum Arabic, available in raw, refined, and rough forms, strikes a balance between minimal usage and convenience, making it highly desirable.

This form of Gum Arabic preserves many of its natural properties, including excellent solubility and low viscosity, which are crucial for its roles as a stabilizer, emulsifier, and thickener in various products. The minimal processing involved in producing raw gum Arabic, compared to alternatives like spray-dried gum, helps it retain a higher quality of natural gum while maintaining its original molecular structure. This is particularly important in industries where the purity and natural composition of ingredients are prioritized, such as in organic and natural foods, advanced cosmetics, and pharmaceuticals, where reducing additives and processing is essential.

Gum Arabic Market Segmentation By Application:

- Food and Beverages

- Nutraceuticals

- Pharmaceuticals

- Cosmetics and Personal Care

- Paints and Coating

- Other Applications

The food and beverage segment holds the largest market share and is expected to experience the highest compound annual growth rate (CAGR). This dominance is attributed to the versatile and essential role of Gum Arabic in the sector. Known for its unique properties, including its function as a stabilizer, emulsifier, and thickener, Gum Arabic is highly valued in the food and beverage industry. It plays a critical role in a variety of applications, from stabilizing essential oils in citrus-flavored drinks and preventing separation in soft drinks, to providing the ideal texture and composition in confectionery products like sweets and chocolates. Additionally, it is used in bakery items to extend shelf life and as a stabilizer in dairy products.

With the growing demand for natural and clean-label ingredients, Gum Arabic's position in the food industry is further strengthened. Consumers are increasingly favoring products with natural additives over synthetic alternatives, boosting the demand for Gum Arabic as a preferred ingredient.

Gum Arabic Market Segmentation- By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

The Asia-Pacific Gum Arabic market holds the largest market share and is projected to grow at a compound annual growth rate (CAGR) of 8.80%, driven by its extensive agricultural base and the significant presence of Acacia trees, particularly in countries like India and China. The region's expanding food and beverage industry, along with the increasing demand for natural and clean-label ingredients, further fuels the demand for Gum Arabic. Additionally, the growing pharmaceutical and cosmetics sectors in the Asia-Pacific region are increasingly leveraging the properties of Gum Arabic, contributing to its market growth. Within the region, China holds the largest market share for Gum Arabic, while India is the fastest-growing market.

The North American Gum Arabic market is also expected to experience growth. The United States, in particular, dominates the North American market due to its robust food and beverage industry, well-established pharmaceutical sector, and strong demand for natural and organic products. The region’s emphasis on cleanly produced ingredients and a shift towards healthier, more natural additives has significantly boosted the demand for Gum Arabic, known for its versatility and natural origin. North America is home to some of the world’s largest food and beverage manufacturers, who continuously innovate and expand their Gum Arabic product lines to enhance the quality and stability of their offerings. In this region, the U.S. holds the largest market share, while Canada represents the fastest-growing market.

COVID-19 Pandemic: Impact Analysis

The global Gum Arabic market experienced significant disruptions due to the worldwide pandemic, with many regions implementing lockdowns, closures, and social distancing measures. These restrictions directly impacted the growth of the market, as the global supply chain faced challenges and investments in Gum Arabic products were delayed. As a result, key global players in the industry have adopted strategic approaches and solutions to address the decreased demand for Gum Arabic products. Despite these setbacks, the market is expected to recover and grow, with a forecasted increase in revenue over the projected period.

Latest Trends/ Developments:

In August 2024, Ampak Co. Inc. announced a strategic partnership with Agrigum International, a leading gum Arabic producer based in the UK. This collaboration is aimed at significantly improving the product distribution network within the U.S., strengthening both companies' market presence.

In April 2024, Farbest Brands launched Beyond Acacia, a new product developed using Alland & Robert's advanced technology to improve both usability and environmental sustainability compared to traditional gum acacia. Beyond Acacia features high-density granules, which are produced through an innovative manufacturing process. These granules offer enhanced solubilization, superior hydration, and high dispersibility, while also minimizing dust and foam during processing.

Key Players:

These are top 10 players in the Gum Arabic Market :-

- Nexira

- Kerry Group

- Gum Arabic Company

- Agrigum International Limited

- TIC Gums

- Hawkins Watts Limited

- Farbest Brands

- Archer-Daniels-Midland Company (ADM)

- Alland & Robert SE

Chapter 1 Gum Arabic Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2 Gum Arabic Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3 Gum Arabic Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4 Gum Arabic Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5 Gum Arabic Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6 Gum Arabic Market – By Nature

6.1 Introduction/Key Findings

6.2 Organic

6.3 Conventional

6.4 Y-O-Y Growth trend Analysis By Nature

6.5 Absolute $ Opportunity Analysis By Nature , 2025-2030

Chapter 7 Gum Arabic Market – By Functional Properties

7.1 Introduction/Key Findings

7.2 Stabilizer

7.3 Emulsifier

7.4 Thickener

7.5 Y-O-Y Growth trend Analysis By Functional Properties

7.6 Absolute $ Opportunity Analysis By Functional Properties , 2025-2030

Chapter 8 Gum Arabic Market – By Grade

8.1 Introduction/Key Findings

8.2 Acacia senegal

8.3 Acacia seyal

8.4 Y-O-Y Growth trend Analysis Grade

8.5 Absolute $ Opportunity Analysis Grade , 2025-2030

Chapter 9 Gum Arabic Market – By Form

9.1 Introduction/Key Findings

9.2 Kibbled Acacia Gum

9.3 Raw Gum Arabic

9.4 Powdered Acacia Gum

9.5 Spray-Dried Acacia Gum

9.6 Y-O-Y Growth trend Analysis Form

9.7 Absolute $ Opportunity Analysis Form , 2025-2030

Chapter 10 Gum Arabic Market – By Application

10.1 Introduction/Key Findings

10.2 Food and Beverages

10.3 Nutraceuticals

10.4 Pharmaceuticals

10.5 Cosmetics and Personal Care

10.6 Paints and Coating

10.7 Other Applications

10.8 Y-O-Y Growth trend Analysis Application

10.9 Absolute $ Opportunity Analysis Application , 2025-2030

Chapter 11 Gum Arabic Market, By Geography – Market Size, Forecast, Trends & Insights

11.1. North America

11.1.1. By Country

11.1.1.1. U.S.A.

11.1.1.2. Canada

11.1.1.3. Mexico

11.1.2. By Application

11.1.3. By Form

11.1.4. By Cargo Type

11.1.5. Functional Properties

11.1.6. Nature

11.1.7. Countries & Segments - Market Attractiveness Analysis

11.2. Europe

11.2.1. By Country

11.2.1.1. U.K.

11.2.1.2. Germany

11.2.1.3. France

11.2.1.4. Italy

11.2.1.5. Spain

11.2.1.6. Rest of Europe

11.2.2. By Application

11.2.3. By Form

11.2.4. By Grade

11.2.5. Functional Properties

11.2.6. Nature

11.2.7. Countries & Segments - Market Attractiveness Analysis

11.3. Asia Pacific

11.3.1. By Country

11.3.1.2. China

11.3.1.2. Japan

11.3.1.3. South Korea

11.3.1.4. India

11.3.1.5. Australia & New Zealand

11.3.1.6. Rest of Asia-Pacific

11.3.2. By Application

11.3.3. By Form

11.3.4. By Grade

11.3.5. Functional Properties

11.3.6. Nature

11.3.7. Countries & Segments - Market Attractiveness Analysis

11.4. South America

11.4.1. By Country

11.4.1.1. Brazil

11.4.1.2. Argentina

11.4.1.3. Colombia

11.4.1.4. Chile

11.4.1.5. Rest of South America

11.4.2. By Application

11.4.3. By Form

11.4.4. By Grade

11.4.5. Functional Properties

11.4.6. Nature

11.4.7. Countries & Segments - Market Attractiveness Analysis

11.5. Middle East & Africa

11.5.1. By Country

11.5.1.1. United Arab Emirates (UAE)

11.5.1.2. Saudi Arabia

11.5.1.3. Qatar

11.5.1.4. Israel

11.5.1.5. South Africa

11.5.1.6. Nigeria

11.5.1.7. Kenya

11.5.1.11. Egypt

11.5.1.11. Rest of MEA

11.5.2. By Application

11.5.3. By Form

11.5.4. By Grade

11.6.5. Functional Properties

11.5.6. Nature

11.5.7. Countries & Segments - Market Attractiveness Analysis

Chapter 12 Gum Arabic Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

12.1 Nexira

12.2 Kerry Group

12.3 Gum Arabic Company

12.4 Agrigum International Limited

12.5 TIC Gums

12.6 Hawkins Watts Limited

12.7 Farbest Brands

12.8 Archer-Daniels-Midland Company (ADM)

12.9 Alland & Robert SE

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The market for Gum Arabic has seen significant growth in recent years, largely driven by the increasing demand for natural ingredients across various sectors.

The top players operating in the Gum Arabic Market are - Nexira, Kerry Group and Gum Arabic Company.

The global Gum Arabic market experienced significant disruptions due to the worldwide pandemic, with many regions implementing lockdowns, closures, and social distancing measures

Gum Arabic serves as a crucial emulsifier and stabilizer in these products, helping manufacturers achieve the desired texture and mouthfeel. By stabilizing and emulsifying ingredients, it enhances the binding capacity of water, ensuring that plant-based meat substitutes maintain moisture and juiciness.

North America is the fastest-growing region in the Gum Arabic Market.