Grocery Subscription Market Size (2025– 2030)

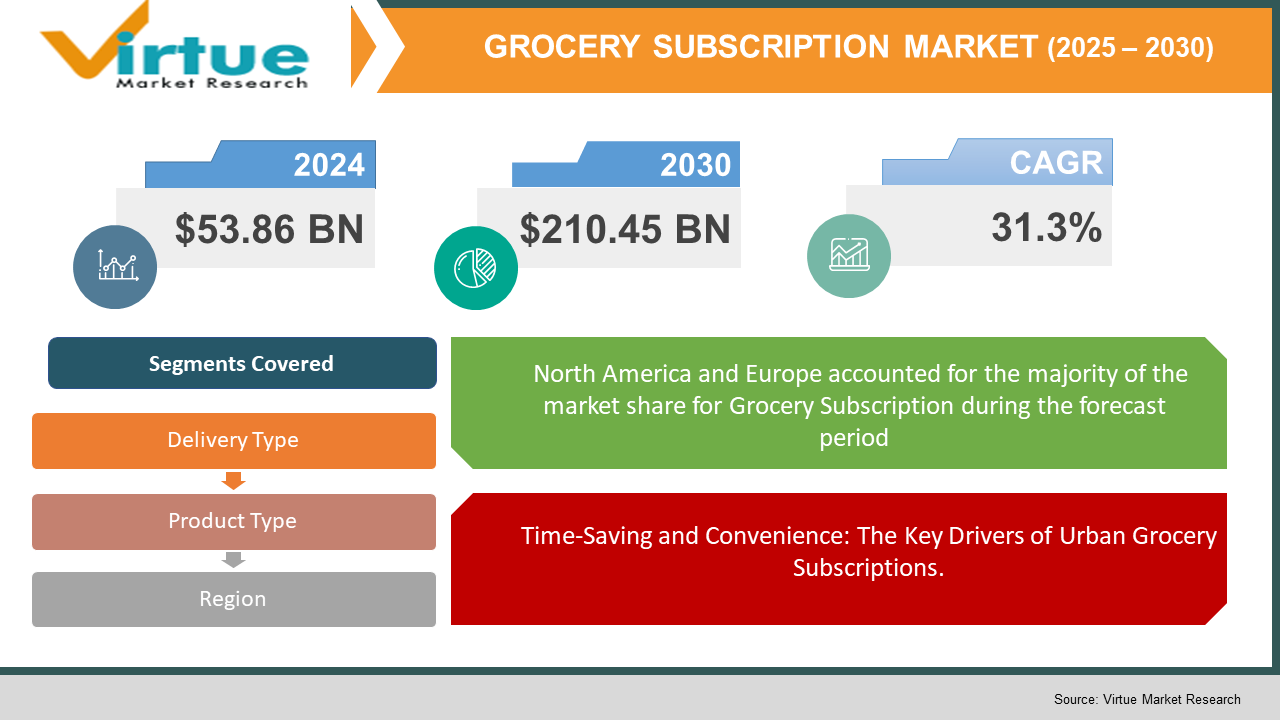

The Grocery Subscription Market was valued at USD 53.86 billion and is projected to reach a market size of USD 210.45 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 31.3%.

The grocery subscription market has taken off in the West as major players such as Kröger’s, Amazon Fresh, Walmart, etc. started investing heavily in this sector. A grocery subscription refers to the delivery of specifically selected groceries to consumers on a weekly, monthly, etc. basis. The market has gained major traction during the pandemic. It has increased its market share significantly because of the convenience it offers to consumers in terms of customisations and choices and saving time. The rise of AI-driven personalisation has further enhanced the appeal of these services, allowing companies to curate selections based on individual preferences and consumption patterns.

Key Market Insights:

- One of the key drivers of growth in this market is the increasing penetration of e-commerce and digital payment systems, making it easier for consumers to opt for recurring deliveries. Additionally, the growing focus on health-conscious consumption has led to a surge in specialised subscriptions catering to organic, vegan, keto, and gluten-free diets.

- The demand from urban consumers has increased significantly as busy lifestyles and work schedules have meant that more people are signing up for the subscription service, which reduces the time and effort involved in buying groceries.

- Sustainability is another major factor influencing consumer choices, with many providers emphasising eco-friendly packaging and local sourcing. However, challenges such as high customer churn rates, supply chain inefficiencies, and perishable inventory management remain significant hurdles for market players.

- Traditional grocery retailers are also integrating subscription-based models, intensifying competition. Looking ahead, the market is expected to see further innovations, including AI-powered grocery planning, hybrid models blending one-time purchases with subscription perks, and expansion into emerging markets where digital adoption is accelerating.

- As digital grocery adoption expands in emerging markets, companies have a significant opportunity to tap into new customer bases. As emerging markets are getting commercialized rapidly, there has been an increase in investment for the expansion of subscription-based models in these markets.

Grocery Subscription Market Drivers:

Time-Saving and Convenience: The Key Drivers of Urban Grocery Subscriptions.

City people are more likely to choose automated grocery delivery services over frequent journeys to physical stores due to their fast-paced lifestyles, long workdays, and growing use of digital technology. A growing desire for services that maximise time and effort while guaranteeing steady access to fresh produce, meal kits, and necessary household items is reflected in the trend towards subscription-based grocery shopping. The ability to schedule recurring deliveries eliminates the need for repetitive grocery shopping, reducing the mental load of meal planning and household inventory management. Consumers can subscribe to pre-selected grocery baskets or customizable options based on their preferences, ensuring they receive what they need without reordering manually. Many urban consumers expect smart recommendations, personalized grocery lists, and flexible delivery options. AI-driven grocery platforms optimize orders based on previous purchase history, dietary preferences, and consumption patterns, further simplifying the shopping process. Additionally, same-day and scheduled deliveries provide flexibility, allowing customers to receive groceries at their convenience.

Emerging Market are also emerging as important destinations for companies to expand their business as the urban population develops, Additionally, these places also have some of the necessary infrastructure required for deliveries such as affordable labour, proper training, etc.

As cities in developing economies expand and more consumers embrace e-commerce and digital payments, there is a significant opportunity for companies to tap into these regions. Moreover, the presence of affordable labour, scalable logistics networks, and workforce training initiatives further facilitates market entry and expansion. As more people migrate to cities for employment, their shopping habits evolve, creating a need for structured and efficient grocery procurement. The growing middle class, with higher purchasing power and a preference for digital services, is increasingly adopting subscription-based grocery shopping. Grocery subscriptions are becoming more practical in many emerging nations thanks to their developed logistics networks, reasonably priced last-mile delivery services, and advancing road and transportation infrastructure. With increasing rates of internet and mobile penetration, businesses can use digital transactions and app-based ordering to access a larger customer base. Companies entering emerging markets often tailor their offerings to local preferences, ensuring that grocery subscriptions include region-specific food staples, traditional ingredients, and culturally relevant meal kits.

Grocery Subscription Market Restraints and Challenges:

In Major cities there can be a problem with logistics and supply chains which can cause delays and ultimately cost customers. Delivery costs can also be off putting to consumers if they are too high.

In densely populated cities, traffic congestion, last-mile inefficiencies, and warehouse distribution complexities can result in delays, higher operational expenses, and reduced customer satisfaction. Many grocery subscriptions include fresh produce, dairy, and meat, which require temperature-controlled transportation. Any delays or inefficiencies in the cold chain can lead to spoilage and financial losses, affecting both companies and customers. The high cost of real estate in major cities makes it difficult for companies to establish large fulfilment centres near customer hubs. As a result, businesses may have to rely on multiple micro-fulfilment centres or third-party logistics (3PL) providers, adding to costs and operational complexity. Poor route planning can lead to longer delivery times and fewer deliveries per trip, making operations less cost-effective. This is particularly challenging when handling time-sensitive grocery items. Many urban areas have higher minimum wages, increasing the cost of hiring drivers, warehouse staff, and order pickers. These expenses often get passed on to consumers through delivery fees or subscription price hikes.

Grocery Subscription Market Opportunities:

A major opportunity is AI-driven personalization, where companies use predictive analytics and smart algorithms to curate grocery lists, automate restocking, and offer tailored meal planning based on individual preferences. Consumers are also increasingly interested in health-focused and speciality grocery subscriptions, including organic, plant-based, and dietary-specific meal kits (e.g., keto, vegan, gluten-free), creating a lucrative niche for businesses to cater to. Sustainability is becoming a key differentiator, with consumers willing to pay a premium for eco-friendly grocery subscriptions that focus on zero-waste packaging, carbon-neutral deliveries, and locally sourced ingredients. At the same time, businesses can explore hybrid models that blend subscriptions with on-demand ordering, giving customers greater flexibility while ensuring steady revenue streams.

GROCERY SUBSCRIPTION MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

31.3% |

|

Segments Covered |

By Product Type, delivery type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Kroger, Walmart, Costco, Amazon Fresh, Ocado, Sailsbury, Amazon Fresh, Zepto, Getir, JOKR |

Grocery Subscription Market Segmentation:

Grocery Subscription Market Segmentation: By Delivery Type

- Scheduled Delivery

- Instant Delivery

Scheduled Delivery services operate on a pre-planned basis, allowing customers to receive groceries at fixed intervals (daily, weekly, or monthly). This model is ideal for households and businesses that require regular grocery replenishments and prefer a structured approach to shopping. Scheduled deliveries offer benefits such as bulk discounts, reduced delivery fees, and better inventory management for both consumers and companies.

On the other hand, Instant Delivery caters to consumers who prioritize speed and convenience, often requiring groceries within minutes to a few hours. This segment has gained significant traction in urban areas where the on-demand shopping culture is strong, driven by busy lifestyles and the increasing reliance on quick-commerce platforms. Companies offering instant grocery deliveries leverage dark stores, micro-fulfilment centres, and AI-driven route optimization to ensure rapid order fulfilment. However, there are problems with high delivery costs with this mode.

Grocery Subscription Market Segmentation: By Product Type

- Fresh Produce

- Packaged Foods

- RTE Foods

- Household and Cleaning Products

Fruits, vegetables, dairy products, and meat make up the important category of fresh produce, which appeals to health-conscious customers looking for locally sourced, organic, and farm-fresh products. Fresh produce subscription services frequently prioritise sustainability, quality, and farm-to-table business practices, guaranteeing consistent restocking of perishable items. This market is highly demanding but operationally demanding, requiring effective cold chain logistics and well-planned supply schedules to preserve freshness and reduce waste.

Packaged Foods, Ready-to-Eat (RTE) Foods, and Household & Cleaning Products form other crucial segments. Packaged Foods, including snacks, beverages, and pantry staples, offer convenience and longer shelf life, making them a popular choice for bulk subscriptions. RTE Foods, such as meal kits and heat-and-eat options, cater to urban consumers seeking time-saving meal solutions, with growing demand for healthy, diet-specific, and gourmet meal kits. Meanwhile, Household and Cleaning Products, including detergents, personal care items, and hygiene essentials, ensure consistent demand due to their recurring usage and necessity-based consumption.

Grocery Subscription Market Segmentation: By Region

- North America

- Europe

- Asia-Pacific

- South America

- Middle East and Africa

Due to their high internet penetration rates, sophisticated e-commerce ecosystems, and consumer demand for convenience-driven grocery solutions, North America and Europe are two of the most developed marketplaces. Strong supply chains and AI-driven logistics are used by industry leaders in North America, such as Amazon Fresh, Instacart, and Walmart+, to improve the consumer experience. Similar to this, the demand for speciality, sustainable, and organic food items is fuelling the grocery subscription business in Europe. Meal kit services and zero-waste grocery models are also gaining traction. Quick-commerce firms and hyperlocal delivery services are becoming more competitive in both areas, which is encouraging innovation in the industry.

In contrast, Asia-Pacific, South America, and the Middle East & Africa represent high-growth markets with increasing urbanization, mobile commerce adoption, and evolving consumer habits. The Asia-Pacific region, led by India, China, and Southeast Asia, is experiencing a surge in grocery subscriptions due to rising disposable incomes, expanding middle-class populations, and investments in last-mile delivery solutions. Companies such as BigBasket, Dingdong Maicai, and GrabMart are rapidly scaling operations by integrating AI-driven inventory management and hyperlocal fulfilment models. South America’s market is growing steadily, driven by expanding e-commerce infrastructure and the rise of subscription-based bulk purchasing habits.

COVID-19 Impact Analysis on the Grocery Subscription Market:

The COVID-19 pandemic had a transformative impact on the grocery subscription market, accelerating its adoption as consumers shifted towards online grocery shopping and contactless delivery options. With lockdowns, movement restrictions, and safety concerns limiting physical store visits, demand for grocery subscriptions surged as households sought convenient, reliable, and safe alternatives to traditional grocery shopping. Many consumers, especially first-time users, subscribed to meal kits, fresh produce boxes, and essential goods deliveries, leading to an exponential increase in new sign-ups for subscription services. The pandemic also reshaped consumer behaviour, leading to a long-term shift towards digital-first grocery shopping habits. Even as restrictions eased, many consumers continued to use grocery subscriptions due to the convenience, time savings, and personalized shopping experience they offer.

Trends/Developments:

Companies are leveraging AI and machine learning to offer customized grocery experiences. Amazon Fresh and Instacart use predictive analytics to suggest grocery items based on past purchases, dietary preferences, and consumption patterns. Misfits Market and Imperfect Foods focus on personalized surplus food deliveries, helping consumers reduce food waste while saving money.

Supply chain disruptions have pushed companies to invest in AI-powered inventory management and logistics solutions. Ocado (UK), known for its advanced robotic warehouses, has partnered with major retailers like Kroger (US) to optimize automated grocery fulfilment centres. Walmart is also integrating AI-based inventory tracking to improve stock accuracy and reduce wastage, ensuring smoother operations in a highly competitive market.

To improve last-mile delivery efficiency, companies are forming partnerships with local grocery stores and investing in dark stores (small warehouses optimized for online orders). Instacart has partnered with major retailers like Costco, Publix, and Kroger to fulfil grocery subscriptions more effectively. Getir, Gorillas, and GoPuff continue expanding their dark store networks to speed up fulfilment and cut delivery times.

Key Players:

- Kroger

- Walmart

- Costco

- Amazon Fresh

- Ocado

- Sailsbury

- Amazon Fresh

- Zepto

- Getir

- JOKR

Chapter 1. GROCERY SUBSCRIPTION MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GROCERY SUBSCRIPTION MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GROCERY SUBSCRIPTION MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GROCERY SUBSCRIPTION MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. GROCERY SUBSCRIPTION MARKET- LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GROCERY SUBSCRIPTION MARKET – By Delivery Type

6.1 Introduction/Key Findings

6.2 Scheduled Delivery

6.3 Instant Delivery

6.4 Y-O-Y Growth trend Analysis By Delivery Type

6.5 Absolute $ Opportunity Analysis By Delivery Type , 2025-2030

Chapter 7. GROCERY SUBSCRIPTION MARKET – By Product Type

7.1 Introduction/Key Findings

7.2 Fresh Produce

7.3 Packaged Foods

7.4 RTE Foods

7.5 Household and Cleaning Products

7.6 Y-O-Y Growth trend Analysis By Product Type

7.7 Absolute $ Opportunity Analysis By Product Type , 2025-2030

Chapter 8. GROCERY SUBSCRIPTION MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Product Type

8.1.3. By Delivery Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Delivery Type

8.2.3. By Product Type

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Delivery Type

8.3.3. By Product Type

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Delivery Type

8.4.3. By Product Type

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Delivery Type

8.5.3. By Product Type

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GROCERY SUBSCRIPTION MARKET– Company Profiles – (Overview, Delivery Type Portfolio, Financials, Strategies & Developments)

9.1 Kroger

9.2 Walmart

9.3 Costco

9.4 Amazon Fresh

9.5 Ocado

9.6 Sailsbury

9.7 Amazon Fresh

9.8 Zepto

9.9 Getir

9.10 JOKR

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

A grocery subscription service allows consumers to receive groceries on a recurring basis—weekly, bi-weekly, or monthly—without having to place individual orders each time. These services offer fresh produce, packaged foods, meal kits, and household essentials, providing convenience, cost savings, and personalized shopping experiences.

The grocery subscription market was valued at USD 53.86 billion and is projected to reach USD 210.45 billion by 2030, growing at a CAGR of 31.3% (2025-2030). Growth is driven by urbanization, digital payments, AI-driven personalization, and increased consumer preference for convenience and time-saving solutions

Key growth drivers include rising e-commerce adoption, demand for convenience, and AI-powered grocery personalization. Urban consumers, who prefer automated grocery deliveries over frequent store visits, are major drivers of demand. Additionally, the rise in health-conscious and eco-friendly shopping trends is pushing companies to offer organic, zero-waste, and specialty grocery subscriptions

Major challenges include logistics inefficiencies, high customer churn rates, and perishable inventory management. In cities, traffic congestion and last-mile delivery issues can lead to delays, while high labour and delivery costs can reduce profitability. Additionally, consumer price sensitivity may lead to subscription cancellations if costs are perceived as too high.

Leading players in the market include Amazon Fresh, Walmart+, Instacart, Kroger, Costco, and Ocado. Quick-commerce startups such as Getir, Gorillas, JOKR, and Zepto are also expanding rapidly by offering instant grocery deliveries (within 10-30 minutes). Meanwhile, companies like HelloFresh, Blue Apron, and Freshly dominate the meal kit subscription segment