Grid Scale Stationary Battery Storage Market Size (2024 – 2030)

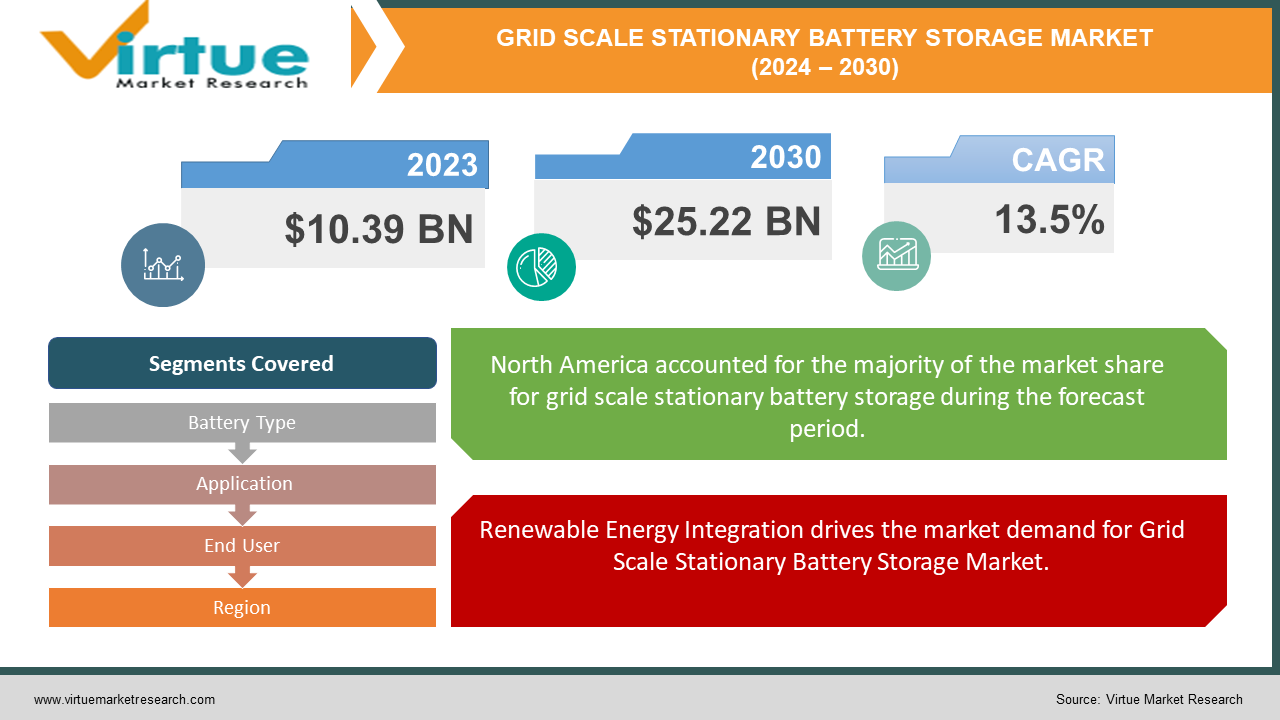

The Global Grid Scale Stationary Battery Storage Market is valued at USD 10.39 Billion and is projected to reach a market size of USD 25.22 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 13.5%.

The Grid Scale Stationary Battery Storage Market is witnessing significant growth, driven by various factors that shape its trajectory. One long-term market driver is the increasing demand for renewable energy integration. As countries strive to reduce their carbon footprint and transition to cleaner energy sources, the need for efficient energy storage solutions becomes paramount. Grid-scale stationary battery storage systems play a crucial role in storing excess renewable energy generated from sources like solar and wind power. This stored energy can then be released during periods of high demand or when renewable sources are not producing electricity, ensuring grid stability and reliability.

Additionally, a notable trend observed in the Grid Scale Stationary Battery Storage Market is the growing interest in utility-scale projects and mega-storage facilities. As battery technology advances and economies of scale are realized, the cost of battery storage continues to decline, making large-scale projects more economically viable. Utility-scale battery storage facilities, with capacities ranging from tens to hundreds of megawatt-hours, are being deployed to support grid stability, enhance renewable energy integration, and replace traditional peaker plants.

Key Market Insights:

The Grid Scale Stationary Battery Storage Market is projected to expand at a compound annual growth rate of over 13.5% in the coming seven years, propelled by increasing urbanization and population growth in major cities worldwide.

Advancements in solid-state battery technology, Expansion of renewable energy integration projects, and Growth of utility-scale battery storage projects are 3 major key players in Grid Scale Stationary Battery Storage Market.

North America & Asia-Pacific account for approximately 70-80 % of the Grid Scale Stationary Battery Storage Market, driven by Renewable Energy Integration, Grid Services and Ancillary Markets, Decarburization, and Climate Goals for Grid Stability and Reliability.

Grid Scale Stationary Battery Storage Market Drivers:

Renewable Energy Integration drives the market demand for Grid Scale Stationary Battery Storage Market.

As the world transitions towards renewable energy sources like solar and wind power, the need for efficient energy storage solutions becomes critical. Grid-scale stationary battery storage systems enable the integration of renewable energy by storing excess electricity generated during periods of high production. This stored energy can then be discharged during times of high demand or when renewable sources are not generating power, ensuring grid stability and reliability.

Grid Services and Ancillary Markets have boosted the market for Grid Scale Stationary Battery Storage Market

Grid operators are increasingly recognizing the value of battery storage for providing grid services and participating in ancillary markets. Grid-scale stationary battery storage systems can offer a wide range of services, including frequency regulation, voltage support, peak shaving, and demand response. By monetizing these services, battery storage operators can generate revenue and enhance the economic viability of their projects, driving further investment in the Grid Scale Stationary Battery Storage Market.

Decarburization and Climate Goals drive the market demand for Grid grid-scale stationary Battery Storage Market.

Governments and utilities worldwide are committed to reducing greenhouse gas emissions and combating climate change. Grid-scale stationary battery storage plays a crucial role in facilitating the transition to a low-carbon energy system by enabling the integration of renewable energy and reducing reliance on fossil fuels. By storing excess renewable energy and displacing traditional peaker plants powered by coal or natural gas, battery storage contributes to emissions reductions and helps achieve climate goals.

Grid Stability and Reliability have boosted the market for Grid Scale Stationary Battery Storage Market

The increasing variability and intermittency of renewable energy sources pose challenges to grid stability and reliability. Grid-scale stationary battery storage systems provide fast-response capabilities to stabilize grid frequency, regulate voltage, and mitigate the impacts of sudden fluctuations in supply and demand. By enhancing grid stability, battery storage supports the reliable operation of electricity networks and reduces the need for costly grid infrastructure upgrades.

Grid Scale Stationary Battery Storage Market Restraints and Challenges:

One of the primary challenges facing grid-scale stationary battery storage is the cost of deployment and operation. While battery prices have declined significantly in recent years, they still represent a significant portion of the overall project cost. Additionally, the economics of battery storage projects are highly dependent on factors such as energy prices, regulatory frameworks, and revenue streams from grid services. Uncertainty surrounding these factors can deter investment in battery storage projects and slow market growth.

Despite advancements in battery technology, grid-scale stationary battery storage systems still face limitations in terms of energy density, cycle life, and efficiency. Current battery chemistries may not be well-suited for long-duration storage applications or high-power applications required for grid-scale deployments. Additionally, battery degradation over time can affect performance and reliability, leading to concerns about the long-term viability of battery storage projects.

Grid Scale Stationary Battery Storage Market Opportunities:

There is a significant opportunity for the development and commercialization of advanced battery technologies to enhance the performance, efficiency, and cost-effectiveness of grid-scale stationary battery storage systems. Innovations in battery chemistries, such as solid-state batteries, lithium-sulfur batteries, and flow batteries, have the potential to offer higher energy densities, longer cycle lives, and improved safety compared to traditional lithium-ion batteries. These advanced technologies can address some of the current limitations of battery storage systems and make them more suitable for a wider range of applications, including long-duration storage and high-power grid support. Additionally, advancements in battery management systems, recycling, and second-life applications for used batteries can further enhance the sustainability and economic viability of grid-scale storage projects. By investing in research and development, fostering collaboration between industry and academia, and supporting pilot projects and demonstrations, stakeholders can unlock new opportunities for growth and innovation in the Grid Scale Stationary Battery Storage Market.

GRID SCALE STATIONARY BATTERY STORAGE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

13.5% |

|

Segments Covered |

By Battery Type, Application, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Tesla (USA), LG Chem (South Korea), BYD (China), Samsung SDI (South Korea), Panasonic (Japan), Contemporary Amperex Technology Co. Limited (CATL) (China), ABB (Switzerland), Siemens (Germany), AES Energy Storage (USA), Enel X (Italy), Fluence (USA), E.ON (Germany), Engie (France), Vestas (Denmark), Sunverge (USA), Sonnen (Germany), Johnson Controls (USA), Hitachi (Japan), NEC Energy Solutions (Japan), Varta (Germany) |

Grid Scale Stationary Battery Storage Market Segmentation: By Battery Type

-

Lithium-ion Batteries

-

Lead-acid Batteries

-

Flow Batteries

-

Sodium-sulfur Batteries

-

Others

Lithium-ion batteries dominate the grid-scale stationary battery storage market due to their high energy density, long cycle life, and declining costs. They are the preferred choice for many large-scale energy storage projects because of their efficiency and reliability. Lithium-ion technology has benefited from significant investment and innovation, making it the go-to solution for both renewable energy integration and grid stabilization.

Flow batteries are emerging as the fastest-growing segment in the market. They offer advantages in terms of scalability, long-duration energy storage, and lower degradation over time compared to lithium-ion batteries. Flow batteries, such as vanadium redox flow batteries, are particularly suited for applications requiring large-scale energy storage over extended periods, which is becoming increasingly important as renewable energy capacity grows.

Grid Scale Stationary Battery Storage Market Segmentation: By Application

-

Renewable Integration

-

Grid Stabilization

-

Peak Shaving

-

Load Shifting

-

Backup Power

-

Others

Renewable integration is the largest application segment for grid-scale stationary battery storage. As the world shifts towards renewable energy sources like wind and solar, the need for effective energy storage solutions to manage intermittent generation and ensure a stable power supply has surged. Battery storage systems are essential for storing excess renewable energy and providing power when generation is low, making this the dominant application.

Grid stabilization is the fastest-growing application segment. With the increasing complexity of power grids and the rising share of variable renewable energy, maintaining grid stability is crucial. Battery storage systems provide fast-response capabilities to balance supply and demand, regulate frequency and voltage, and support overall grid reliability. This need for enhanced grid stability is driving rapid growth in this application area.

Grid Scale Stationary Battery Storage Market Segmentation: By End User

-

Utilities

-

Industrial

-

Commercial

-

Residential

Utilities represent the largest end-user segment in the grid-scale stationary battery storage market. Utility companies deploy large-scale battery storage systems to support renewable energy integration, enhance grid stability, and defer infrastructure investments. The sheer scale of utility projects and their critical role in the power sector make them the dominant end-users of battery storage solutions.

The industrial sector is the fastest-growing end-user segment. Industries are increasingly adopting battery storage to manage energy costs, ensure reliable power supply, and meet sustainability goals. Industrial battery storage systems can provide backup power, peak shaving, and load shifting, helping businesses optimize energy usage and reduce dependence on the grid. The growing focus on energy efficiency and resilience is driving rapid adoption in this sector.

Grid Scale Stationary Battery Storage Market Segmentation: By Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America is the largest regional market for grid scale stationary battery storage. The region has seen substantial investment in renewable energy projects and energy storage solutions, driven by supportive policies and incentives. The United States, in particular, leads in battery storage capacity, with numerous large-scale projects enhancing grid reliability and renewable integration.

The Asia Pacific region is the fastest-growing market for grid scale stationary battery storage. Countries like China, Japan, South Korea, and India are making significant investments in renewable energy and energy storage to meet rising energy demand, reduce emissions, and enhance grid stability. Government initiatives and favorable regulations are propelling rapid growth in battery storage deployments across the region.

COVID-19 Impact Analysis on Grid Scale Stationary Battery Storage Market:

One of the immediate impacts of the COVID-19 pandemic was the disruption of global supply chains. The production and distribution of battery storage components were significantly affected due to lockdowns, travel restrictions, and factory shutdowns. Key materials like lithium, cobalt, and other critical minerals faced supply bottlenecks, leading to delays in manufacturing and increased costs. This disruption caused delays in ongoing and planned grid-scale battery storage projects, affecting the overall market growth temporarily.

The pandemic-induced economic uncertainty led to cautious spending and delayed investment decisions in many sectors, including energy storage. Utilities, governments, and private investors became more conservative with their capital expenditures. This slowdown in investment impacted the rollout of new battery storage projects. Projects that were in the planning stages faced postponements, and some initiatives were put on hold as stakeholders reassessed their financial positions and market conditions.

Latest Trends/ Developments:

There is a marked increase in the number and scale of utility-scale battery storage projects. These large-scale installations, often with capacities ranging from tens to hundreds of megawatt-hours, are designed to provide grid stability, peak shaving, and renewable energy integration. High-profile projects, such as Tesla's Hornsdale Power Reserve in Australia and the Moss Landing Energy Storage Facility in California, are setting benchmarks for the industry.

The integration of battery storage with other energy systems, such as solar-plus-storage or wind-plus-storage projects, is becoming more common. Hybrid systems combine renewable energy generation with battery storage to provide a more consistent and reliable power supply. These systems are particularly useful in remote or off-grid locations, where they can reduce reliance on diesel generators and other fossil fuels.

Key Players:

-

Tesla (USA)

-

LG Chem (South Korea)

-

BYD (China)

-

Samsung SDI (South Korea)

-

Panasonic (Japan)

-

Contemporary Amperex Technology Co. Limited (CATL) (China)

-

ABB (Switzerland)

-

Siemens (Germany)

-

AES Energy Storage (USA)

-

Enel X (Italy)

-

Fluence (USA)

-

E.ON (Germany)

-

Engie (France)

-

Vestas (Denmark)

-

Sunverge (USA)

-

Sonnen (Germany)

-

Johnson Controls (USA)

-

Hitachi (Japan)

-

NEC Energy Solutions (Japan)

-

Varta (Germany)

Chapter 1. Grid Scale Stationary Battery Storage Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Grid Scale Stationary Battery Storage Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Grid Scale Stationary Battery Storage Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Grid Scale Stationary Battery Storage Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Grid Scale Stationary Battery Storage Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Grid Scale Stationary Battery Storage Market – By Battery Type

6.1 Introduction/Key Findings

6.2 Lithium-ion Batteries

6.3 Lead-acid Batteries

6.4 Flow Batteries

6.5 Sodium-sulfur Batteries

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Battery Type

6.8 Absolute $ Opportunity Analysis By Battery Type, 2024-2030

Chapter 7. Grid Scale Stationary Battery Storage Market – By Application

7.1 Introduction/Key Findings

7.2 Renewable Integration

7.3 Grid Stabilization

7.4 Peak Shaving

7.5 Load Shifting

7.6 Backup Power

7.7 Others

7.8 Y-O-Y Growth trend Analysis By Application

7.9 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Grid Scale Stationary Battery Storage Market – By End-User

8.1 Introduction/Key Findings

8.2 Utilities

8.3 Industrial

8.4 Commercial

8.5 Residential

8.6 Y-O-Y Growth trend Analysis By End-User

8.7 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 9. Grid Scale Stationary Battery Storage Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Battery Type

9.1.3 By Application

9.1.4 By By End-User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Battery Type

9.2.3 By Application

9.2.4 By End-User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Battery Type

9.3.3 By Application

9.3.4 By End-User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Battery Type

9.4.3 By Application

9.4.4 By End-User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Battery Type

9.5.3 By Application

9.5.4 By End-User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Grid Scale Stationary Battery Storage Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Tesla (USA)

10.2 LG Chem (South Korea)

10.3 BYD (China)

10.4 Samsung SDI (South Korea)

10.5 Panasonic (Japan)

10.6 Contemporary Amperex Technology Co. Limited (CATL) (China)

10.7 ABB (Switzerland)

10.8 Siemens (Germany)

10.9 AES Energy Storage (USA)

10.10 Enel X (Italy)

10.11 Fluence (USA)

10.12 E.ON (Germany)

10.13 Engie (France)

10.14 Vestas (Denmark)

10.15 Sunverge (USA)

10.16 Sonnen (Germany)

10.17 Johnson Controls (USA)

10.18 Hitachi (Japan)

10.19 NEC Energy Solutions (Japan)

10.20 Varta (Germany)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Grid Scale Stationary Battery Storage Market is valued at USD 10.39 Billion and is projected to reach a market size of USD 25.22 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 13.5%.

Renewable Energy Integration, Grid Services and Ancillary Markets, Decarburization and Climate Goals & Grid Stability and Reliability.

Utilities, Industrial, Commercial, and Residential are the segments under the Grid Scale Stationary Battery Storage Market by end user.

North America is the most dominant region for the Grid Scale Stationary Battery Storage Market.

Asia-Pacific is the fastest-growing region in the Grid Scale Stationary Battery Storage Market.