Green Methanol Market Size (2025 – 2030)

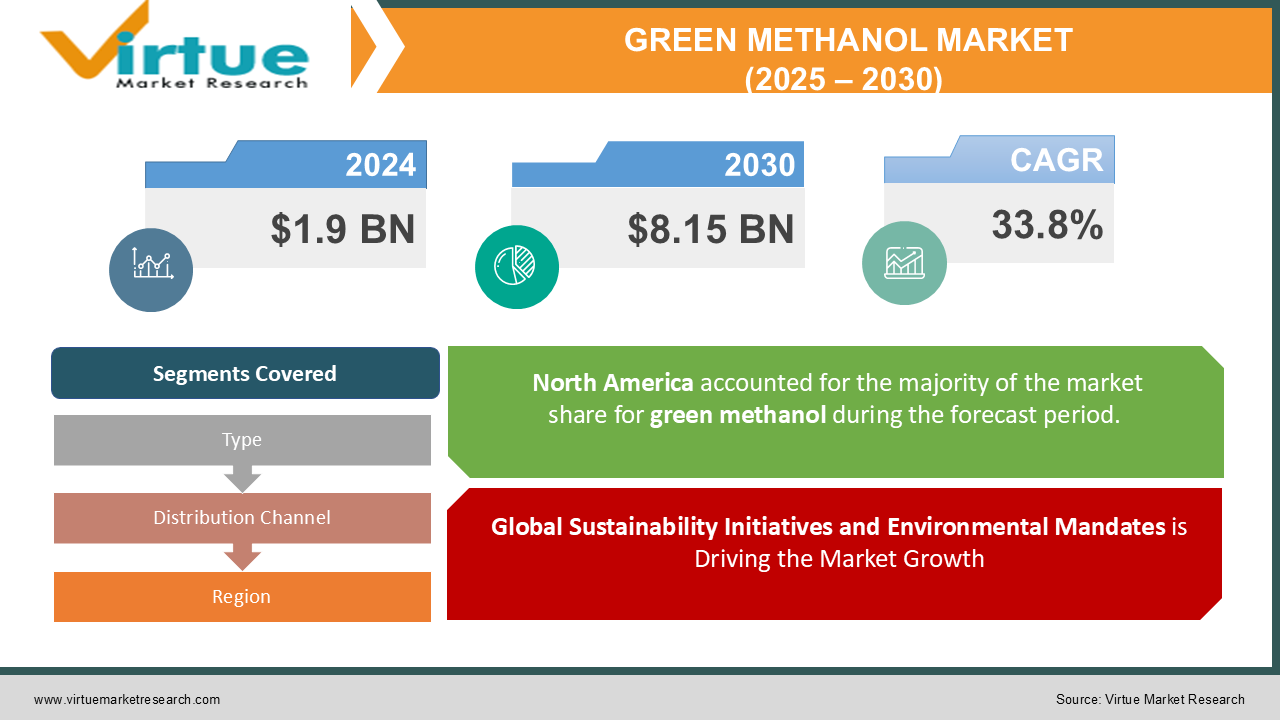

The Green Methanol Market was valued at USD 1.9 Billion in 2024 and is projected to reach a market size of USD 8.15 Billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 33.8%.

The Green Methanol Market has emerged as a pivotal segment in the global renewable energy landscape, symbolizing a transformative shift towards environmentally conscious industrial processes and cleaner fuel alternatives. Driven by an increasing emphasis on sustainability and carbon footprint reduction, the market has witnessed robust interest from both the private and public sectors. This innovative fuel, derived from renewable sources such as biomass, waste streams, and captured carbon dioxide, stands as a testament to technological progress and environmental stewardship. Manufacturers are investing heavily in research and development to enhance production efficiency, reduce costs, and meet the growing demand for a cleaner, sustainable energy option that can replace conventional fossil fuels.

Key Market Insights:

-

In 2024, global green methanol production reached approximately 3.8 million metric tons.

-

The market generated revenue estimated at USD 8.5 billion during 2024.

-

Investment in green methanol technologies surpassed USD 1.2 billion in 2024.

-

Over 150 new production facilities were commissioned worldwide in 2024.

-

2024 saw a 25% increase in research collaborations focused on green methanol production.

-

The average investment per project in green methanol technology in 2024 was USD 15 million.

-

Nearly 80% of green methanol producers in 2024 reported meeting or exceeding emission reduction targets.

Market Drivers:

Global Sustainability Initiatives and Environmental Mandates is Driving the Market Growth

A foremost driver of the green methanol market is the growing emphasis on global sustainability initiatives and stringent environmental mandates. Worldwide, policymakers are increasingly prioritizing the reduction of carbon emissions and the transition toward renewable energy sources. This trend is underscored by ambitious national and international commitments to environmental protection, compelling industries to adopt cleaner technologies. As governments enforce stricter emission standards and implement policies that reward green investments, industries across sectors are actively seeking alternative fuels that can help reduce their ecological footprint. The appeal of green methanol lies in its ability to serve as a viable substitute for fossil fuels while simultaneously offering the benefits of reduced carbon emissions and enhanced energy security. Manufacturers and energy companies are thus accelerating their shift toward renewable production processes, which not only meet regulatory requirements but also align with corporate sustainability strategies.

Government Support and Technological Innovation is Driving the Market Growth

Another pivotal driver for the green methanol market is the extensive government support coupled with rapid technological innovation. Governments across the globe have recognized the potential of green methanol in meeting both energy security and environmental sustainability objectives. Through an array of financial incentives such as tax breaks, grants, and subsidies, state authorities are actively promoting the development and adoption of green methanol technologies. These measures not only alleviate the initial capital burden associated with establishing production facilities but also foster an ecosystem of innovation and competitive pricing. In many instances, government-backed research initiatives are collaborating with private enterprises to explore new feedstock sources and optimize catalytic conversion processes. Such collaborations have resulted in significant breakthroughs that lower production costs and enhance overall energy efficiency, thereby making green methanol an increasingly attractive option for industrial applications. In this climate of robust support and rapid innovation, the green methanol market is witnessing a surge in new entrants and technological disruptors, all of whom are eager to leverage the financial and regulatory advantages offered by progressive policy frameworks. This dynamic interplay between government backing and technological advancement is not only accelerating market growth but also reshaping the global energy paradigm, marking a significant leap forward in the race to achieve a sustainable energy future.

Market Restraints and Challenges:

Despite the promising outlook, the green methanol market faces several restraints and challenges that could potentially hinder its full-scale adoption and growth. One of the primary challenges is the high initial capital expenditure required for setting up green methanol production facilities. The integration of advanced technologies such as carbon capture, catalytic conversion, and renewable energy inputs demands significant investment, which may deter smaller enterprises and emerging players from entering the market. Additionally, the availability and consistent supply of sustainable feedstocks remain a critical concern. The market’s reliance on biomass, waste streams, and carbon capture technologies requires an efficient and reliable supply chain that is often affected by regional limitations and seasonal variability. These factors contribute to fluctuations in production output and, in some cases, increased production costs, thereby impacting market stability. Market participants also face regulatory uncertainties and policy shifts that may alter the competitive landscape. Changes in environmental regulations or inconsistent policy support across different jurisdictions can create operational ambiguities for producers. Additionally, the market is susceptible to fluctuations in energy prices and economic cycles, which can impact investment decisions and consumer confidence. In summary, while the environmental imperatives drive the adoption of green methanol, the market must navigate a complex interplay of high capital requirements, feedstock supply challenges, stiff competition from established fuels, and technological as well as regulatory uncertainties. Addressing these issues will require coordinated efforts among industry stakeholders, technology innovators, and government bodies to ensure that the growth of green methanol is both sustainable and resilient in the face of evolving market dynamics.

Market Opportunities:

Amid the array of challenges, the green methanol market is also rich with opportunities that promise to revolutionize energy production and consumption patterns. One of the most compelling prospects is the potential for technological breakthroughs that can lower production costs and enhance efficiency. Continued investment in R&D is opening avenues for the development of next-generation catalysts and novel process technologies, which not only streamline production but also improve the yield and purity of green methanol. These advancements can significantly reduce operational expenses, making green methanol a more attractive alternative to conventional fuels. The burgeoning interest in circular economy principles also presents a unique opportunity: industries can harness waste streams and by-products from other sectors as feedstock for green methanol production, thereby creating synergistic partnerships and enhancing overall resource efficiency. Furthermore, the increasing global focus on decarbonization and sustainable industrial practices creates an expansive market for green methanol in sectors such as maritime shipping, chemical manufacturing, and transportation. The maritime industry, in particular, stands to benefit enormously from the transition to green methanol, as regulatory bodies are imposing stricter emission limits and seeking cleaner fuel alternatives. Similarly, urban transportation networks and heavy-duty vehicles can leverage green methanol to achieve lower emissions while maintaining performance standards. The market is also witnessing a surge in cross-border collaborations and joint ventures that are aimed at consolidating technological expertise and market reach. Such alliances not only drive innovation but also facilitate the rapid deployment of green methanol infrastructure on a global scale.

GREEN METHANOL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

33.8% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

GreenChem Solutions, Eco Methanol Inc., Renew Fuel Technologies, BioGreen Energy, Metha Renew, NextGen Methanol, PureEnergy Methanol, Sustainable Fuel Corp, GreenWave Technologies, Eco Synergy Energy |

Green Methanol Market Segmentation: by Type

-

Bio-based Methanol

-

Electrolytic Methanol

-

Biomethanol from Gasification

-

Green Methanol from Carbon Capture

-

Waste-Derived Methanol

Within this segmentation, the fastest-growing type is electrolytic methanol, spurred by rapid advancements in renewable electricity integration and efficient electrolyzer technologies. Conversely, bio-based methanol remains the most dominant type due to its established production methods, widespread feedstock availability, and proven track record in delivering consistent quality and performance.

Green Methanol Market Segmentation: by Distribution Channel

-

Direct Sales

-

Distributors

-

OEM Partnerships

-

Online Platforms

-

Contract Manufacturing

Among these channels, online platforms have experienced rapid growth as digitalization and e-commerce integration streamline customer access and order fulfilment processes, making them the fastest-growing channel. However, the direct sales channel continues to be the most dominant due to its strong customer relationships and customized service offerings that ensure reliability and high levels of support for bulk industrial clients.

Green Methanol Market Segmentation: by Regional Analysis

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East and Africa

In 2024, market share estimates indicate that North America contributed around 30% of the total market volume, while Europe accounted for approximately 35% owing to its stringent environmental regulations and robust infrastructure for renewable energy. Asia-Pacific emerged with an estimated 25% share, driven by rapid industrialization and high demand for clean energy solutions in emerging economies.

Among these segments, Europe is recognized as the most dominant region, primarily due to the extensive network of supportive policies, well-established green energy infrastructure, and strong industrial partnerships that drive both production and consumption of green methanol. On the other hand, Asia-Pacific is identified as the fastest-growing region.

COVID-19 Impact Analysis on the Market:

The global COVID-19 pandemic had a multifaceted impact on the green methanol market, reshaping both supply and demand dynamics while accelerating long-term structural changes. In 2024, the market continued to recover from the disruptions of previous years, with a renewed focus on building resilient supply chains and diversifying production sources. During the height of the pandemic, lockdowns and travel restrictions temporarily hampered logistics and supply chain operations, causing intermittent delays in raw material procurement and equipment maintenance. However, as industries adapted to the new normal, digitalization and remote monitoring technologies were rapidly adopted, enabling manufacturers to maintain operational continuity despite reduced workforce availability and logistical challenges. The crisis also underscored the need for sustainable energy solutions, prompting governments and corporations to invest in renewable projects that promise a more resilient future. In summary, the COVID-19 pandemic, while introducing significant short-term challenges, ultimately paved the way for accelerated innovation and strategic realignments in the green methanol market.

Latest Trends and Developments:

Recent developments in the green methanol market reflect a vibrant landscape of innovation and strategic adaptation. One of the most notable trends is the increasing integration of digital technologies into production processes. Companies are employing advanced process control systems, real-time monitoring, and data analytics to optimize yields, minimize waste, and ensure consistent product quality. This digital transformation is not only streamlining production but is also enabling proactive maintenance, reducing downtime, and ultimately driving operational efficiencies. In parallel, there is a strong trend towards collaborative innovation, as leading market players form alliances with technology providers, research institutions, and even competitors to collectively address shared challenges. These strategic partnerships are accelerating the development of next-generation catalysts, more efficient conversion processes, and novel feedstock utilization methods that promise to significantly lower production costs. Furthermore, the green methanol market is experiencing a surge in geographical diversification, with new production facilities emerging in previously underexplored territories. This expansion is not only addressing regional demand surges but is also mitigating risks associated with concentrated production hubs. Overall, the confluence of digital transformation, feedstock innovation, strategic collaborations, and expanding geographic footprints is reshaping the competitive dynamics of the market, setting the stage for sustained long-term growth.

Key Players in the Market:

-

GreenChem Solutions

-

Eco Methanol Inc.

-

Renew Fuel Technologies

-

BioGreen Energy

-

Metha Renew

-

NextGen Methanol

-

PureEnergy Methanol

-

Sustainable Fuel Corp

-

GreenWave Technologies

-

Eco Synergy Energy

Chapter 1. Green Methanol Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Green Methanol Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Green Methanol Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Green Methanol Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Green Methanol Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Green Methanol Market – By Type

6.1 Introduction/Key Findings

6.2 Bio-based Methanol

6.3 Electrolytic Methanol

6.4 Biomethanol from Gasification

6.5 Green Methanol from Carbon Capture

6.6 Waste-Derived Methanol

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Green Methanol Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Direct Sales

7.3 Distributors

7.4 OEM Partnerships

7.5 Online Platforms

7.6 Contract Manufacturing

7.7 Y-O-Y Growth trend Analysis By Distribution Channel

7.8 Absolute $ Opportunity Analysis By Distribution Channel, 2025-2030

Chapter 8. Green Methanol Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Green Methanol Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 GreenChem Solutions

9.2 Eco Methanol Inc.

9.3 Renew Fuel Technologies

9.4 BioGreen Energy

9.5 Metha Renew

9.6 NextGen Methanol

9.7 PureEnergy Methanol

9.8 Sustainable Fuel Corp

9.9 GreenWave Technologies

9.10 Eco Synergy Energy

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The growth of the Green Methanol Market is driven by several interrelated factors that are reshaping the global energy landscape and accelerating the transition toward sustainable fuels. One of the foremost drivers is the heightened global emphasis on reducing carbon emissions and combating climate change.

Major concerns in the Green Methanol Market include high production costs, unreliable feedstock supply, technological scaling challenges, limited infrastructure, regulatory uncertainties, and stiff competition from fossil fuels, all of which hinder consistent growth and long-term economic viability despite environmental benefits.

GreenChem Solutions, Eco Methanol Inc., Renew Fuel Technologies, BioGreen Energy, Metha Renew, NextGen Methanol, PureEnergy Methanol

North America currently holds the largest market share, estimated at around 35%.

Asia Pacific has shown significant room for growth in specific segments.