Green Chelates Market Size (2025 – 2030)

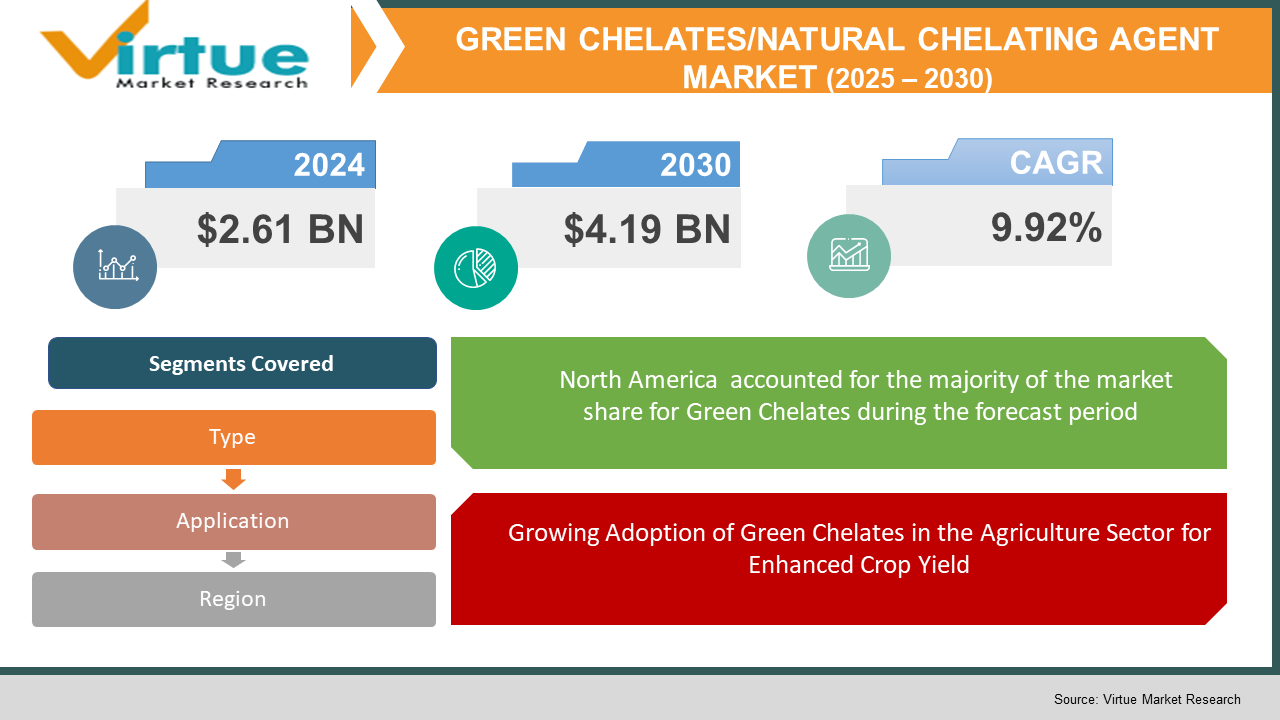

The Global Green Chelates Market was valued at USD 2.61 billion in 2024 and is projected to reach a market size of USD 4.19 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 9.92%.

The Green Chelates market is gaining momentum because of the rising demand for environmentally friendly and biodegradable solutions in industries such as cleaning, agriculture, food & beverages, and personal care. These chelating agents, derived from natural sources, help in binding metal ions without causing environmental harm, making them a sustainable alternative to conventional synthetic chelators. With increasing regulatory restrictions on phosphates and other harmful chemicals, industries are shifting towards bio-based chelating agents to meet stringent environmental standards. The market is also witnessing innovations in plant-based and biodegradable chelators, further driving adoption across various sectors.

Key Market Insights:

- The demand for green chelates and natural chelating agents is rising significantly because of the increasing preference for sustainable and non-toxic alternatives in industrial and consumer applications. Over 70% of industries in the cleaning and detergent sector are shifting towards biodegradable chelating agents to comply with stringent environmental regulations. This shift is largely driven by government policies banning phosphate-based chelators, particularly in Europe and North America, accelerating the adoption of eco-friendly alternatives.

- The agricultural sector is experiencing a rapid uptake of natural chelating agents, with an estimated 60% of organic fertilizers now incorporating bio-based chelators to enhance nutrient absorption. The growing awareness of soil health and the reduction of heavy metal contamination in crops have fueled the use of green chelates, ensuring better yield and environmental safety. Additionally, their role in stabilizing micronutrients without causing toxicity has made them a preferred choice among farmers and agrochemical manufacturers.

- The food and beverage industry are another major contributor, with natural chelating agents witnessing a 40% increase in adoption for food preservation and processing. Chelates derived from citric acid, polyaspartic acid, and other organic sources are being used to enhance product shelf life, prevent oxidation, and maintain food quality without synthetic additives. This aligns with the clean-label movement, where consumers demand transparency and natural ingredients in food products.

- In the personal care and cosmetics industry, the integration of plant-based chelators has grown by contributing over 50% in the past five years. These chelating agents are widely used in skincare, haircare, and oral care formulations to improve product stability and efficacy. As consumers become more conscious of ingredient safety and environmental impact, major brands are reformulating their products to exclude synthetic chelators, further driving the demand for natural alternatives.

Green Chelates Market Drivers:

Rising Demand for Eco-Friendly and Biodegradable Chelating Agents in Various Industries is Driving the Market Growth

With rising environmental regulations and consumer awareness, industries such as agriculture, cleaning, food & beverages, and personal care are shifting towards sustainable and biodegradable alternatives. Green chelating agents provide effective metal ion control while reducing environmental impact, making them a preferred choice over synthetic options. This shift is further driven by government policies restricting the use of harmful chelators like phosphates and EDTA, which pose ecological threats. Additionally, businesses are increasingly integrating sustainable sourcing practices to align with global sustainability goals.

Growing Adoption of Green Chelates in the Agriculture Sector for Enhanced Crop Yield

Green chelating agents play a crucial role in improvising soil nutrient availability and promoting plant growth without causing soil toxicity. Farmers and agribusinesses are increasingly adopting natural chelators like amino acid-based and plant-derived chelating agents to enhance micronutrient absorption in crops. This trend is supported by the rising demand for organic farming and sustainable agricultural practices, which are gaining traction worldwide. The increasing focus on food security and sustainable agricultural productivity further fuels the demand for these eco-friendly solutions.

Stringent Environmental Regulations Against Synthetic Chelating Agents

Regulatory bodies across North America, Europe, and Asia-Pacific are adopting strict guidelines to limit the use of synthetic chelators due to their persistence in the environment and potential health risks. Industries are proactively transitioning to safer, biodegradable alternatives to comply with these regulations and avoid penalties. Companies investing in research and development for innovative green chelates are also gaining a competitive edge in the market. Additionally, regulatory incentives and certifications for eco-friendly ingredients further encourage manufacturers to adopt sustainable alternatives.

Increasing Consumer Preference for Natural Ingredients in Personal Care and Household Products

Consumers are becoming highly conscious of the ingredients used in everyday products, leading to a shift towards natural, non-toxic formulations. Green chelating agents are widely used in personal care products like shampoos, skincare, and cosmetics, as well as in household cleaning products to replace synthetic alternatives. The clean-label movement and rising demand for organic personal care products are key factors driving this trend. Moreover, leading brands are reformulating their products with biodegradable chelators to cater to environmentally conscious consumers.

Green Chelates Market Restraints and Challenges:

Challenges in the Green Chelates Market: High Production Costs and Limited Raw Material Availability

Despite the growing demand for eco-friendly alternatives, the green chelates market faces significant challenges, primarily due to the high production costs associated with natural chelating agents. These chelators often require specialized raw materials that are not as widely available as synthetic counterparts, leading to supply chain limitations. Additionally, the production process for natural chelates can be more complex and expensive, making it difficult for smaller manufacturers to compete with established players. Moreover, the market’s reliance on agricultural sources for raw materials can be susceptible to fluctuations in crop yields, leading to price volatility and potential supply disruptions.

Green Chelates Market Opportunities:

The green chelates market offers numerous opportunities, particularly driven by the growing emphasis on sustainable agricultural practices. With environmental concerns at the forefront, farmers are increasingly adopting natural chelates as an eco-friendly alternative to traditional synthetic chemical solutions. Green chelates serve as efficient micronutrient carriers, enhancing soil health and improving crop yields without the harmful side effects of chemical fertilizers. In parallel, consumer demand for eco-friendly products is pushing industries such as food, cosmetics, and pharmaceuticals to adopt natural ingredients, creating new avenues for growth in the chelates sector.

Furthermore, governments worldwide are executing stricter regulations on the use of chemicals in agriculture, incentivizing the transition toward organic and natural solutions. These regulations, combined with rising awareness about the negative environmental impact of conventional farming methods, present a significant opportunity for green chelates to penetrate the market further. Additionally, advancements in biotechnological innovations are enabling more efficient and cost-effective production of natural chelates, driving their accessibility and affordability across various sectors. The integration of green chelates in precision agriculture techniques also opens the door to new applications, further boosting their market potential.

GREEN CHELATES/NATURAL CHELATING AGENT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

9.92% |

|

Segments Covered |

By Type, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF SE, AkzoNobel N.V., Dow Chemical Company, and Huntsman Corporation |

Green Chelates Market Segmentation:

Green Chelates Market Segmentation: By Type:

- Sodium Gluconate

- Ethylenediamine-N, N’-succinic acid (EDDS)

- L-glutamic Acid N, N-diacetic acid (GLDA)

- Methyl Glycindiacetic Acid (MGDA)

- Others (Sodium Iminodisuccinate, etc.)

In the Green Chelates market, Sodium Gluconate stands as the dominant segment because of its widespread usage and well-established applications across various industries such as agriculture, food, and pharmaceuticals. Sodium gluconate is highly favored because of its excellent chelating properties and safety, making it a preferred choice in the formulation of products that require metal ion sequestration, such as detergents, cleaners, and fertilizers. It’s also recognized for its biodegradability, which aligns with the increasing demand for environmentally friendly alternatives.

The fastest-growing sub-segment is Ethylenediamine-N, N’-succinic acid (EDDS), which has gained remarkable traction due to its strong performance as a biodegradable chelate in agricultural applications, especially for enhancing micronutrient absorption in crops. EDDS is favored for its superior stability in neutral and alkaline conditions, making it an ideal choice for diverse agricultural environments. As the global agricultural sector moves towards more sustainable and efficient farming practices, EDDS is poised to see rapid adoption, driven by its ability to provide enhanced crop productivity while minimizing environmental impact.

Green Chelates Market Segmentation: By Application:

- Disinfectant Formulations

- Cosmetics/Personal Care Products Formulations

- Pharmaceutical Product Formulation

- Cleaning Solutions Formulations

- Laundry Detergent Formulations

- Pulp and Paper Production

- Agrochemicals Production

- Food Processing

- Water Treatment

In the Green Chelates market, Disinfectant Formulations is one of the dominant application segments. This is due to the rising demand for eco-friendly disinfectants that effectively eliminate bacteria and viruses while being safe for the environment. Green chelates, such as those used in disinfectant formulations, improve the stability and efficacy of active ingredients by stabilizing metal ions, which helps enhance the product's cleaning power. The rise in consumer preference for non-toxic, sustainable cleaning products is fueling this segment's growth.

The fastest-growing application segment is Water Treatment. With raising concerns over water pollution and the need for sustainable water management, chelating agents play a critical role in preventing scaling, removing heavy metals, and enhancing the efficiency of water filtration processes. As industries focus on reducing their environmental impact, the demand for green chelates in water treatment is growing rapidly. These chelates help in mitigating harmful chemicals in water while being biodegradable, thus making them an attractive solution for water treatment facilities globally.

Green Chelates Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

North America dominates the largest share in the Green Chelates market, contributing approximately 35%. The region leads due to its high demand for eco-friendly and sustainable products across industries like agriculture, water treatment, and personal care. Stringent environmental regulations and consumer preference for green solutions are significant factors boosting the market here. Moreover, the presence of major players in the market, coupled with increasing awareness of sustainability, strengthens its dominance.

Asia-Pacific is expected to be the fastest-growing region, with an estimated contribution of 25%. The region is witnessing rapid industrial growth, particularly in emerging markets like China and India. The demand for sustainable alternatives in agriculture, water treatment, and cleaning solutions is driving the expansion of the Green Chelates market. Increased awareness of environmental issues and government support for eco-friendly technologies contribute to the growth in this region. As industries continue to evolve, the demand for green chelates in Asia-Pacific is expected to rise steadily.

COVID-19 Impact Analysis on the Global Green Chelates Market:

The COVID-19 pandemic had a significant impact on the global Green Chelates market, disturbing supply chains and manufacturing operations across various industries. With many countries experiencing lockdowns and restrictions, demand for green chelates temporarily decreased in sectors such as agrochemicals, cosmetics, and food processing. However, the pandemic also heightened the focus on sustainable and environmentally-friendly products, which led to a renewed interest in green chelates. As industries recover, there is an increasing emphasis on green chemicals and sustainable practices, which is expected to drive the market’s growth post-pandemic. The pandemic has highlighted the importance of resilience in supply chains, which will likely result in stronger demand for eco-friendly and biodegradable alternatives moving forward.

Latest Trends/ Developments:

The Green Chelates market has experienced several key trends and developments in recent years, driven by the increasing demand for sustainable, eco-friendly products. One notable trend is the rising adoption of biodegradable chelates in agricultural applications to reduce the environmental impact of synthetic chemicals. This has led to the development of new, plant-based chelates that offer improved performance while being environmentally friendly. Additionally, advancements in technology and manufacturing processes have enabled more cost-effective production of green chelates, making them accessible to a broader range of industries. Furthermore, there is a growing emphasis on regulatory compliance, with governments worldwide tightening environmental standards, prompting industries to adopt greener alternatives. The expansion of applications across sectors such as water treatment, personal care, and cleaning solutions is also driving innovation and market growth.

Key Players:

- BASF SE

- AkzoNobel N.V.

- Dow Chemical Company

- Huntsman Corporation

- DuPont de Nemours, Inc.

- Clariant AG

- Nouryon

- Innospec Inc.

- ADM

- Evonik Industries AG

Chapter 1. GREEN CHELATES MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GREEN CHELATES MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GREEN CHELATES MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GREEN CHELATES MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. GREEN CHELATES MARKET- LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GREEN CHELATES MARKET – By Type

6.1 Introduction/Key Findings

6.2 Sodium Gluconate

6.3 Ethylenediamine-N, N’-succinic acid (EDDS)

6.4 L-glutamic Acid N, N-diacetic acid (GLDA)

6.5 Methyl Glycindiacetic Acid (MGDA)

6.6 Others (Sodium Iminodisuccinate, etc.)

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type , 2025-2030

Chapter 7. GREEN CHELATES MARKET – By Application

7.1 Introduction/Key Findings

7.2 Disinfectant Formulations

7.3 Cosmetics/Personal Care Products Formulations

7.4 Pharmaceutical Product Formulation

7.5 Cleaning Solutions Formulations

7.6 Laundry Detergent Formulations

7.7 Pulp and Paper Production

7.8 Agrochemicals Production

7.9 Food Processing

7.10 Water Treatment

7.11 Y-O-Y Growth trend Analysis By Application

7.12 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. GREEN CHELATES MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Application

8.2.3. By Type

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Application

8.3.3. By Type

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Application

8.4.3. By Type

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Application

8.5.3. By Type

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GREEN CHELATES MARKET– Company Profiles – (Overview, Type Portfolio, Financials, Strategies & Developments)

9.1 BASF SE

9.2 AkzoNobel N.V.

9.3 Dow Chemical Company

9.4 Huntsman Corporation

9.5 DuPont de Nemours, Inc.

9.6 Clariant AG

9.7 Nouryon

9.8 Innospec Inc.

9.9 ADM

9.10 Evonik Industries AG

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Green Chelates Market was valued at USD 2.61 billion in 2024 and is projected to reach a market size of USD 4.19 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 9.92%.

The global Green Chelates market is driven by the growing demand for eco-friendly, sustainable, and safe chelating agents in various industries.

Based on Application, the Global Green Chelates Market is segmented into Disinfectant, Cosmetics, Pharmaceutical, Cleaning formulations, etc.

. North America is the most dominant region for the Global Green Chelates Market.

BASF SE, AkzoNobel N.V., Dow Chemical Company, and Huntsman Corporation are the leading players in the Global Green Chelates Market.