Green Ammonia Market Size (2025 – 2030)

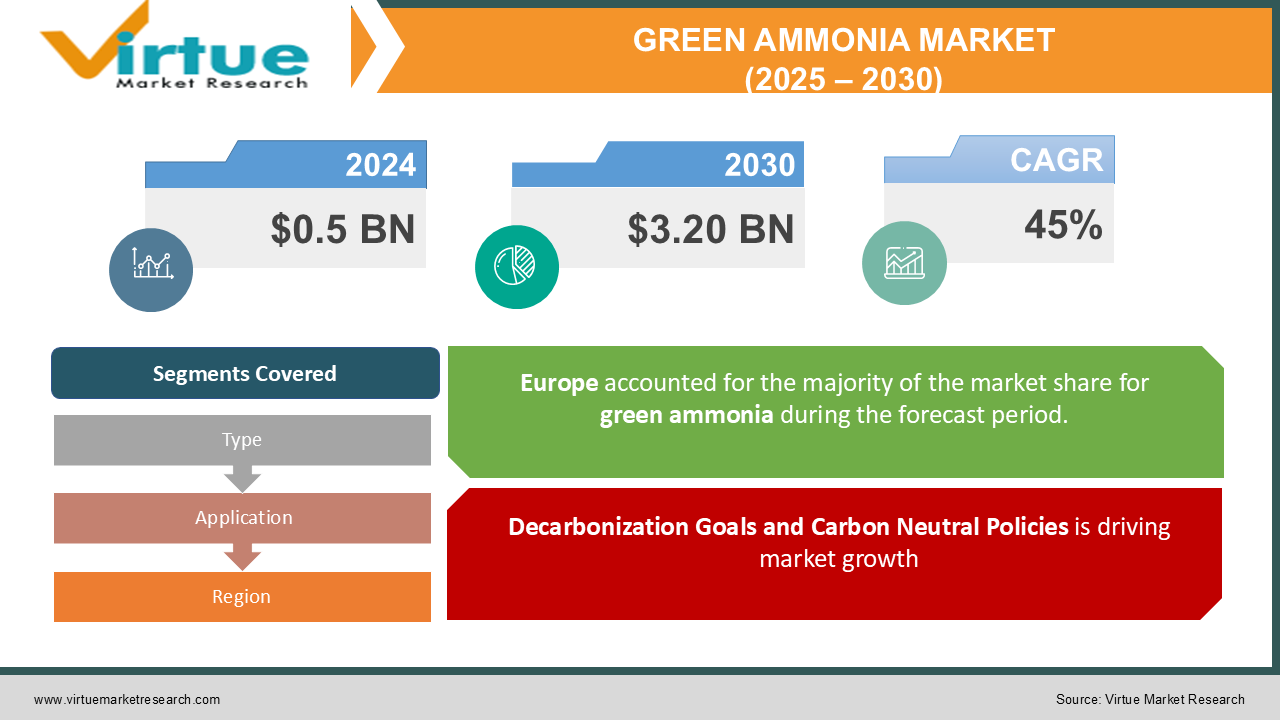

The Global Green Ammonia Market was valued at USD 0.5 billion in 2024 and will grow at a CAGR of 45% from 2025 to 2030. The market is expected to reach USD 3.20 billion by 2030.

The Green Ammonia Market focuses on ammonia production through renewable energy sources such as wind, solar, and hydropower instead of conventional fossil fuel-based methods. This market is rapidly gaining traction due to the increasing focus on decarbonization, sustainable agriculture, and the transition to green hydrogen. Green ammonia is primarily used as a sustainable fuel, an energy carrier, and a key ingredient in fertilizers. The demand is expected to surge with the rise in global renewable energy capacity and government initiatives supporting carbon-neutral industrial processes.

Key Market Insights

-

The global green ammonia production capacity is expected to exceed 10 million metric tons by 2030, driven by investments in large-scale renewable ammonia projects.

-

The transportation sector is emerging as a major consumer of green ammonia, with maritime shipping projected to account for over 30% of total market demand by 2030.

-

Europe currently leads in green ammonia development, with over 40% of planned projects located in the region due to strong regulatory support and decarbonization policies.

-

The cost of green ammonia production is anticipated to decrease by over 50% by 2030, primarily due to declining renewable energy prices and advancements in electrolyzer technology.

-

The agricultural sector remains the dominant end-user, accounting for approximately 60% of current demand, as farmers shift toward low-carbon fertilizers.

Global Green Ammonia Market Drivers

Decarbonization Goals and Carbon Neutral Policies is driving market growth:

Governments and industries worldwide are aggressively pursuing decarbonization strategies to combat climate change. Green ammonia, produced through electrolysis powered by renewable energy, eliminates carbon emissions, making it a crucial component of global net-zero initiatives. The European Union's "Fit for 55" package and the U.S. Inflation Reduction Act incentivize green hydrogen and ammonia adoption through subsidies and tax credits. Additionally, carbon pricing mechanisms, such as the EU Emissions Trading System (ETS), further promote the shift toward sustainable energy solutions. With industries such as shipping, power generation, and fertilizer manufacturing seeking low-carbon alternatives, green ammonia has emerged as a key solution. As more nations implement stringent carbon reduction policies, the demand for green ammonia is expected to surge, fostering significant investment in production infrastructure.

Growing Demand for Green Fuels and Energy Storage is driving market growth:

Green ammonia is increasingly being recognized as a viable alternative fuel, particularly for maritime and power generation applications. The International Maritime Organization (IMO) has set ambitious carbon reduction targets, prompting the shipping industry to explore green ammonia as a zero-emission fuel. Similarly, power plants are investigating ammonia as a means of storing and transporting hydrogen, allowing for the efficient use of renewable energy across regions. As advancements in ammonia combustion and fuel cell technology progress, green ammonia is poised to play a crucial role in the future of clean energy. Countries such as Japan and South Korea are investing in ammonia co-firing technologies, further driving market demand. These factors contribute to the rapid growth of the green ammonia market as industries transition to sustainable energy solutions.

Technological Advancements and Cost Reductions is driving market growth:

One of the biggest challenges in green ammonia production has been the high cost associated with electrolysis and renewable energy. However, continuous advancements in electrolyzer technology, coupled with the decreasing cost of solar and wind power, are making green ammonia production more competitive. The price of electrolyzers has dropped significantly over the past decade, and further improvements in efficiency and scaling are expected to drive costs down even more. Additionally, companies are investing in novel ammonia synthesis processes, such as solid oxide electrolysis and plasma catalysis, to enhance production efficiency. As a result, green ammonia is becoming an economically viable alternative to traditional ammonia, attracting increased investment and industry adoption.

Global Green Ammonia Market Challenges and Restraints

High Initial Capital Investment and Infrastructure Challenges is restricting market growth:

The transition to green ammonia production requires significant capital investment in renewable energy infrastructure, electrolyzers, and ammonia synthesis plants. Unlike conventional ammonia plants that rely on natural gas, green ammonia facilities must be integrated with large-scale renewable energy sources, which can be costly and time-consuming to develop. Additionally, existing ammonia transportation and storage infrastructure is designed for fossil fuel-derived ammonia, requiring modifications to accommodate the growing supply of green ammonia. While government incentives and private investments are helping to bridge the funding gap, the high upfront costs and logistical complexities remain key barriers to market expansion.

Limited Commercialization and Market Adoption is restricting market growth:

Despite growing interest in green ammonia, large-scale commercial adoption remains limited due to concerns about supply chain readiness, regulatory uncertainties, and production scalability. Many industries, particularly in developing regions, still rely on cheaper, conventional ammonia, making the transition to green alternatives economically challenging. Moreover, while green ammonia is being explored as a fuel, combustion technologies and safety standards are still under development, slowing widespread adoption. The market's growth depends on overcoming these challenges through continued technological innovation, policy support, and industry collaboration.

Market Opportunities

The growing emphasis on decarbonization, energy security, and sustainability presents significant opportunities for the green ammonia market. The transportation sector, particularly maritime shipping, is emerging as a key growth area, with companies such as Maersk and Yara International investing in ammonia-powered vessels. Power generation applications also offer substantial potential, as ammonia can be co-fired with coal and natural gas to reduce carbon emissions in existing power plants. Additionally, emerging economies in Asia-Pacific and the Middle East are exploring green ammonia as a way to enhance energy independence and meet climate commitments. The increasing adoption of green hydrogen further complements the expansion of the green ammonia market, as ammonia serves as an efficient medium for hydrogen storage and transportation. With continued advancements in production technology and decreasing costs, green ammonia is poised to become a mainstream solution for industries seeking carbon-free alternatives.

GREEN AMMONIA MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

45% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Yara International, CF Industries, Siemens Energy, Thyssenkrupp, Air Products, Linde, Haldor Topsoe, ITM Power, Ørsted, ACME Group |

Green Ammonia Market Segmentation - By Type

-

Solid Green Ammonia

-

Liquid Green Ammonia

-

Gaseous Green Ammonia

The most dominant segment in this category is liquid green ammonia, as it is the most widely used form in transportation, power generation, and fertilizer production. Liquid ammonia is easier to store and transport compared to gaseous ammonia, making it the preferred choice for large-scale applications. The growing demand for ammonia-based fuels in maritime shipping further reinforces the dominance of this segment.

Green Ammonia Market Segmentation - By Application

- Fertilizers

- Power Generation

- Transportation Fuel

- Industrial Feedstock

The most dominant segment in this category is fertilizers, accounting for the largest share of global green ammonia consumption. Agriculture remains heavily dependent on ammonia-based fertilizers, and the transition toward low-carbon alternatives is driving demand for green ammonia. Government policies promoting sustainable farming and the reduction of carbon-intensive fertilizers are further propelling this segment’s growth.

Green Ammonia Market Segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Europe is the dominant region in the global green ammonia market, accounting for the largest share due to strong policy support, technological advancements, and significant investments in green hydrogen infrastructure. The European Union's Green Deal and Fit for 55 initiatives have accelerated the adoption of low-carbon ammonia, with countries like Germany, the Netherlands, and Denmark leading in project development. Several large-scale green ammonia plants are under construction in Europe, supported by subsidies and partnerships between governments and private enterprises. Additionally, Europe has stringent carbon reduction targets, driving industries to shift toward sustainable energy solutions, including ammonia as an energy carrier and fuel. The presence of key market players, research institutions, and regulatory frameworks further solidifies Europe's leadership in green ammonia development.

COVID-19 Impact Analysis on the Green Ammonia Market

The COVID-19 pandemic had a mixed impact on the green ammonia market. On one hand, supply chain disruptions and economic uncertainties initially slowed the development of green ammonia projects. However, the crisis also highlighted the critical need for energy security and sustainability, prompting a shift in focus toward cleaner energy solutions. In response to the pandemic, governments around the world introduced stimulus packages that emphasized investments in green energy. This move reignited momentum in ammonia and hydrogen projects, positioning them as key players in the transition to a low-carbon economy. Furthermore, the pandemic accelerated the global push for decarbonization, with industries reevaluating their energy strategies to ensure resilience in the face of future disruptions. Many sectors began to prioritize sustainability as a safeguard against environmental and economic vulnerabilities. As a result, post-pandemic recovery efforts have significantly benefited the green ammonia market. Increased funding, new partnerships, and robust policy support have emerged, all contributing to the sector’s growth. The long-term effects of COVID-19 on the green ammonia market are shaping a more sustainable future. The pandemic’s lessons have reinforced the need for a cleaner, more resilient energy infrastructure, which will drive continued innovation in green ammonia production. As governments and industries align around decarbonization goals, the market is expected to see further advancements, especially as green ammonia plays a pivotal role in both energy storage and as a zero-carbon fuel alternative. This period of recovery has not only reinforced the importance of sustainability but also positioned green ammonia at the forefront of the global energy transformation.

Latest Trends/Developments

The green ammonia market is experiencing several key trends that are shaping its future. One of the most notable trends is the surge in investment in ammonia-powered shipping. As the shipping industry seeks cleaner fuel alternatives, ammonia is emerging as a promising solution due to its ability to power large vessels with zero-carbon emissions. To support this transition, advancements in electrolyzer technology are making green ammonia production more efficient, reducing costs and expanding its potential for global adoption. Another significant trend is the growing interest in ammonia cracking technologies, which enable the conversion of ammonia back into hydrogen. This innovation allows for the long-distance transport of hydrogen, overcoming the logistical challenges of transporting this volatile gas. By using ammonia as a hydrogen carrier, companies can expand the reach of hydrogen energy across regions, making it a more viable option for global energy systems. Countries like Japan and South Korea are also playing a crucial role in the development of the green ammonia market. Both nations are accelerating ammonia co-firing projects, where green ammonia is blended with traditional fuels for power generation. This process not only helps reduce carbon emissions but also enables a smoother transition to renewable energy sources in the power sector. Furthermore, strategic collaborations between energy firms and shipping companies are driving innovation in ammonia-fueled engines and storage solutions. These partnerships are key to developing the infrastructure necessary for the widespread use of green ammonia in energy and transportation sectors. With these advancements, the green ammonia market is poised for long-term growth, contributing significantly to global decarbonization efforts.

Key Players

-

Yara International

-

CF Industries

-

Siemens Energy

-

Thyssenkrupp

-

Air Products

-

Linde

-

Haldor Topsoe

-

ITM Power

-

Ørsted

-

ACME Group

Chapter 1. Green Ammonia Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Green Ammonia Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Green Ammonia Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Green Ammonia Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Green Ammonia Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Green Ammonia Market – By Type

6.1 Introduction/Key Findings

6.2 Solid Green Ammonia

6.3 Liquid Green Ammonia

6.4 Gaseous Green Ammonia

6.5 Y-O-Y Growth trend Analysis By Type

6.6 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Green Ammonia Market – By Application

7.1 Introduction/Key Findings

7.2 Fertilizers

7.3 Power Generation

7.4 Transportation Fuel

7.5 Industrial Feedstock

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Green Ammonia Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Green Ammonia Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Yara International

9.2 CF Industries

9.3 Siemens Energy

9.4 Thyssenkrupp

9.5 Air Products

9.6 Linde

9.7 Haldor Topsoe

9.8 ITM Power

9.9 Ørsted

9.10 ACME Group

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Global Green Ammonia Market was valued at USD 0.5 billion in 2024 and is expected to reach USD 3.20 billion by 2030, growing at a CAGR of 45%.

Key drivers include decarbonization policies, demand for green fuels, and cost reductions in electrolyzer technology.

The market is segmented by product (solid, liquid, gaseous) and application (fertilizers, power generation, transportation fuel, industrial feedstock).

Europe is the dominant region, driven by strong regulatory support, investment, and technological advancements.

Key players include Yara International, CF Industries, Siemens Energy, Thyssenkrupp, and Air Products.