Green Ammonia Energy Market Size (2024 – 2030)

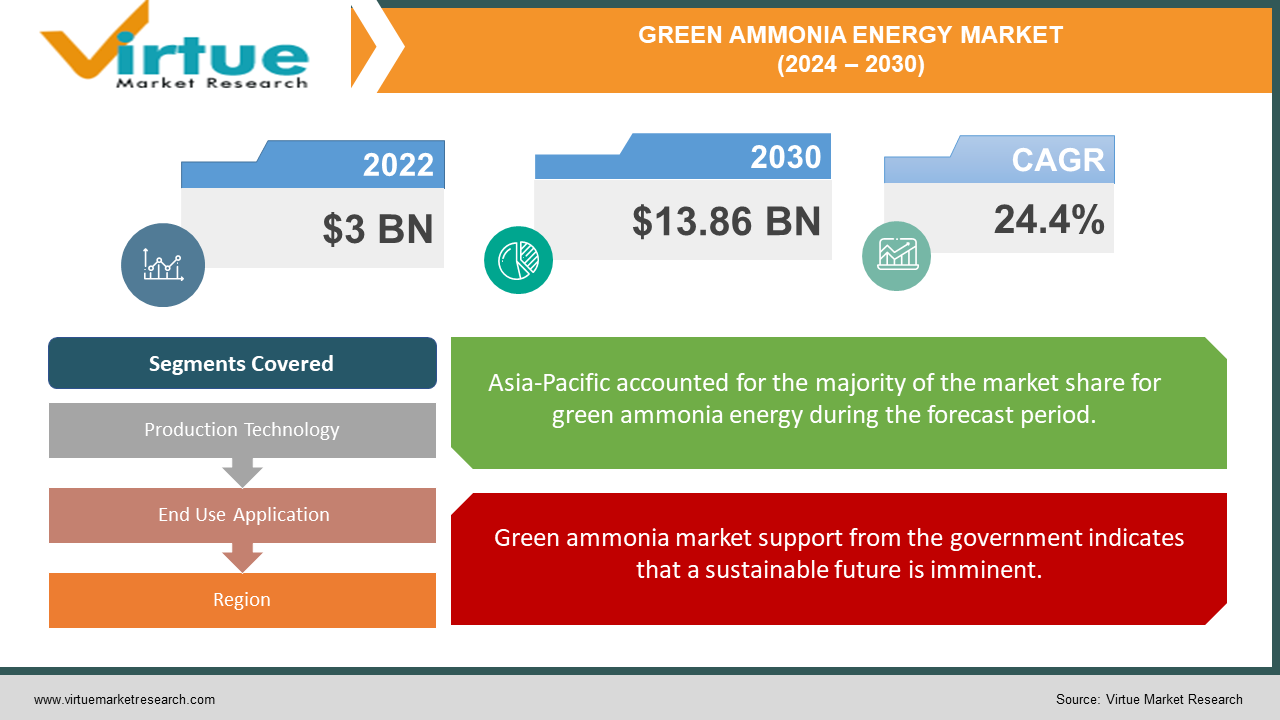

The Global Green Ammonia Energy Market was valued at USD 3 billion in 2023 and is projected to reach a market size of USD 13.86 billion by 2030. Over the forecast period of 2024-2030, market is projected to grow at a CAGR of 24.4%.

Green ammonia is an alternative fuel that is carbon neutral and is made with renewable energy sources like wind and solar electricity. By doing away with the greenhouse gas emissions linked to conventional ammonia manufacturing, this might revolutionise the fight against climate change. Because of its adaptability, green ammonia may be stored as extra renewable energy, burned in engines to generate power, or utilised as fertiliser. Although there are still issues with infrastructure development, scalability, and production costs, green ammonia is a promising technology that is being investigated for a clean energy future.

Key Market Insights:

Announcements of large-scale green ammonia projects have increased dramatically. Partnerships with a combined capacity of over 10 million tonnes, such as NEOM in Saudi Arabia and Avina in the US, were announced in the last year alone. This increase is a result of businesses and governments aggressively investing in large-scale manufacturing facilities, which shows a rising belief in the technology's promise.

The falling costs of solar and wind power, which are the main sources of green ammonia production, are a major motivator. The International Renewable Energy Agency (IRENA) reports that over 2010–2015, the price of solar PV modules has dropped by more than 80%, while the cost of onshore wind energy has dropped by more than 50% during the same period. When compared to conventional techniques, green ammonia is now more affordable due to the decreased cost of power.

Globally, governments are establishing aggressive climate goals, and the market for green ammonia is poised to profit from this. The European Union, for example, wants to cut greenhouse gas emissions by 55% by 2030 compared to 1990 levels. The government is investing heavily in clean technology as a result of this policy drive, with green ammonia emerging as a leading contender because of its potential to be carbon neutral.

Large companies in the chemical and energy industries are making significant investments in the area. Bloomberg New Energy Finance reports that investments in green hydrogen and ammonia projects exceeded $5 billion globally in 2023 alone. This additional funding is essential for increasing production and lowering the total cost of green ammonia, which will make it a more affordable and appealing choice for a wider range of sectors.

Global Green Ammonia Energy Market Drivers:

Green ammonia market support from the government indicates that a sustainable future is imminent.

Global governments are becoming a more significant influence behind the green ammonia industry. This is a result of the global movement towards sustainability, which has led to the setting of aggressive climate targets to reduce greenhouse gas emissions and fight climate change. With its potential to achieve carbon neutrality, green ammonia stands to benefit greatly from the substantial government expenditures made in clean technology to achieve these goals. In many respects, this fosters a climate that is conducive to market expansion. Research and development activities in green ammonia production technologies are directly fueled by government financing, which speeds up innovation and lowers prices. Green ammonia can benefit from supporting policies that provide a favourable market environment. This might include implementing carbon pricing plans that penalise conventional ammonia production or providing tax exemptions and other financial incentives to businesses who use green ammonia technology.

As the cost of renewable energy declines, green ammonia is becoming more and more of an economic opportunity.

The growing cost of renewable energy sources like solar and wind power is a major driver driving the green ammonia industry. These sources serve as the foundation for the manufacture of green ammonia because they supply the clean electricity required to run the electrolysis process. The good news is that solar and wind power have become more and more affordable in recent years. Because of this, green ammonia is now a more alluring option than conventional ammonia manufacturing techniques, which depend on fossil fuels. Green ammonia faced significant obstacles in the past due to the high cost of renewable energy. Ongoing developments in wind and solar technologies, however, have resulted in a notable drop in their production costs. Lower power costs result from this, making green ammonia a more appealing alternative.

Global Green Ammonia Energy Market Restraints and Challenges:

Despite its potential as a clean fuel, the worldwide industry for green ammonia energy is confronted with obstacles. Due to high production costs brought on by the high cost of green hydrogen electrolyzers and renewable energy, it is less competitive than conventional techniques. Furthermore, the amount of green ammonia produced currently is restricted, necessitating a major investment in technology and infrastructure for widespread implementation. In addition, the transportation and storage of green ammonia need the construction of completely new infrastructure, such as storage tanks, pipelines, and specialised vessels.

Global Green Ammonia Energy Market Opportunities:

The worldwide market for green ammonia offers a wide range of prospects. Investment in clean technologies, such as green ammonia, is being stimulated by government climate programmes, which is fostering market development. In addition, the decreasing cost of renewable energy makes green ammonia manufacturing more competitive when compared to conventional techniques. Customers' and companies' increasing need for environmentally friendly solutions is creating a promising market for green ammonia as a clean fuel source. In addition to being a viable energy storage option, green ammonia has the potential to decarbonise the fertiliser sector, which would remove a significant barrier to the transition to clean energy. Technological developments, especially in the area of electrolyzers, might result in further lower production costs and further establish green ammonia's disruptive role in the energy sector.

GREEN AMMONIA ENERGY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

24.4% |

|

Segments Covered |

By Production Technology, End Use Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Air Products and Chemicals, Inc. (US), Aker Clean Hydrogen (Norway), BASF SE (Germany), CF Industries Holdings, Inc. (US), Fertiglobe (Switzerland), Haldor Topsoe A/S (Denmark), ITM Power (UK), NEL ASA (Norway), Siemens Energy (Germany),thyssenkrupp AG (Germany) |

Global Green Ammonia Energy Market Segmentation: By Production Technology

-

Alkaline Water Electrolysis

-

Proton Exchange Membrane (PEM) Electrolysis

-

Solid Oxide Electrolysis (SOE)

Alkaline water electrolysis (AWE) is the most established choice. Although the simplicity and reduced initial expenses of this technology make it appealing, its efficiency is not as high as that of more recent alternatives. With its superior efficiency, proton exchange membrane (PEM) electrolysis stands out as a potential rival that is ideal for upcoming uses. PEM is now limited, nevertheless, by the more expensive nature of its specialised materials. Lastly, because solid oxide electrolysis (SOE) may attain even higher efficiency than PEM, it offers tremendous future promise. Even though this market sector is expected to expand the quickest, SOE technology does not now have the biggest market share because it is still in the development stage and not yet commercially accessible.

Global Green Ammonia Energy Market Segmentation: By End Use Application

-

Power Generation

-

Transportation

-

Fertilizer

Fertiliser is the industry leader. This is since green ammonia may directly replace ammonia generated traditionally in fertilisers, thus reducing the agriculture sector's carbon footprint. Green ammonia is also making waves in the power generating industry, where it provides a clean alternative to produce electricity and contributes to the energy sector's decarbonisation. Green ammonia offers a viable path forward as a clean fuel source for transportation, especially marine shipping, where it may significantly cut emissions from a significant source of pollution. Green ammonia is a disruptive clean energy solution that shows promise for additional uses, such as industrial processes and chemical feedstocks, even if it is still in its early phases of research.

Global Green Ammonia Energy Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Europe is presently in the lead, with Germany and France in the forefront. However, due to government initiatives, the presence of heavyweights like China, Japan, and India, and a boom in demand for sustainable energy, Asia-Pacific is set to experience the quickest increase. With several project announcements and technology developments led by the US, North America is another interesting competitor. Even though South America is young, there is room for growth, especially in Brazil given the abundance of renewable resources there. while being the least prominent region now, the Middle East and Africa are expected to develop significantly in the future because of their enormous potential for renewable energy and their governments' backing of clean energy initiatives.

COVID-19 Impact Analysis on the Global Green Ammonia Energy Market:

The COVID-19 pandemic had a variety of repercussions on the market for green ammonia. Lockdowns caused supply chain disruptions for equipment essential to the manufacturing of green ammonia, and economic uncertainty caused delays in green energy projects, which included the manufacture of green ammonia. Furthermore, governments could have given short-term public health requirements precedence over long-term renewable energy projects. Still, the epidemic could have contributed to certain industry advancements. COVID-19's increased emphasis on sustainability may result in long-term backing for environmentally friendly innovations like ammonia. The market may gain from government stimulus plans focused on green infrastructure initiatives. Additionally, fewer trips during lockdowns may have resulted in a brief decline in the market for conventional ammonia in some industries, thereby opening future opportunities for green ammonia.

Recent Trends and Developments in the Global Green Ammonia Energy Market:

Exciting new advancements in the global green ammonia market point to a bright future. First off, there has been an increase in the announcement of large-scale projects; in the last year alone, partnerships such as NEOM in Saudi Arabia and Avina in the US have announced over 10 million tonnes of capacity. This atmosphere of cooperation reflects increased optimism about the possibilities of green ammonia. Second, it is anticipated that the first green ammonia plants would begin operations in 2024, most likely in conjunction with facilities for green fertiliser. More widespread acceptance will be made possible by these early efforts. Additionally, improvements in the technology of electrolyzers a vital component of production—are essential for cutting costs. Research and development are actively reducing the cost of electrolyzers and increasing efficiency. Giants in the chemical and energy industries are making large investments in the industry, which is fuelling its momentum. This financial support is essential for increasing production and lowering the total cost of green ammonia. Governments are now releasing legislation and policies that are helpful. Initiatives include setting financial goals, reducing emissions, and fostering an environment that will support the sale of clean energy products like green ammonia. These recent developments point to a fast-expanding market for green ammonia, one that will likely see considerable growth in the years to come because of ongoing improvements, higher investment, and favourable legislative frameworks.

Key Players:

-

Air Products and Chemicals, Inc. (US)

-

Aker Clean Hydrogen (Norway)

-

BASF SE (Germany)

-

CF Industries Holdings, Inc. (US)

-

Fertiglobe (Switzerland)

-

Haldor Topsoe A/S (Denmark)

-

ITM Power (UK)

-

NEL ASA (Norway)

-

Siemens Energy (Germany)

-

thyssenkrupp AG (Germany)

Chapter 1. Green Ammonia Energy Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Green Ammonia Energy Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Green Ammonia Energy Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Green Ammonia Energy Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Green Ammonia Energy Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Green Ammonia Energy Market – By Production Technology

6.1 Introduction/Key Findings

6.2 Alkaline Water Electrolysis

6.3 Proton Exchange Membrane (PEM) Electrolysis

6.4 Solid Oxide Electrolysis (SOE)

6.5 Y-O-Y Growth trend Analysis By Production Technology

6.6 Absolute $ Opportunity Analysis By Production Technology, 2024-2030

Chapter 7. Green Ammonia Energy Market – By End Use Application

7.1 Introduction/Key Findings

7.2 Power Generation

7.3 Transportation

7.4 Fertilizer

7.5 Y-O-Y Growth trend Analysis By End Use Application

7.6 Absolute $ Opportunity Analysis By End Use Application, 2024-2030

Chapter 8. Green Ammonia Energy Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Production Technology

8.1.3 By End Use Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Production Technology

8.2.3 By End Use Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Production Technology

8.3.3 By End Use Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Production Technology

8.4.3 By End Use Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Production Technology

8.5.3 By End Use Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Green Ammonia Energy Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Air Products and Chemicals, Inc. (US)

9.2 Aker Clean Hydrogen (Norway)

9.3 BASF SE (Germany)

9.4 CF Industries Holdings, Inc. (US)

9.5 Fertiglobe (Switzerland)

9.6 Haldor Topsoe A/S (Denmark)

9.7 ITM Power (UK)

9.8 NEL ASA (Norway)

9.9 Siemens Energy (Germany)

9.10 thyssenkrupp AG (Germany)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Green Ammonia Energy Market size is valued at USD .3 billion in 2023.

The worldwide Global Green Ammonia Energy Market growth is estimated to be 24.4% from 2024 to 2030.

The Global Green Ammonia Energy Market is segmented By Production Technology (Alkaline Water Electrolysis, Proton Exchange Membrane (PEM) Electrolysis, Solid Oxide Electrolysis (SOE)); By End Use Application (Power Generation, Transportation, Fertilizer) and by region.

The global green ammonia market is anticipated to continue growing due to a number of factors, including expanding applications in fertiliser, transportation, and energy storage; government policies that support clean energy solutions; and further cost reductions through technological advancements and economies of scale.

The market for green ammonia was not entirely affected by the COVID-19 outbreak. It may have accelerated long-term growth by exposing the significance of sustainability, possibly leading to green stimulus packages and a greater focus on clean energy solutions, even though it temporarily disrupted supply chains and delayed projects.