Graphene-Based Lubricants Market Size (2023 – 2030)

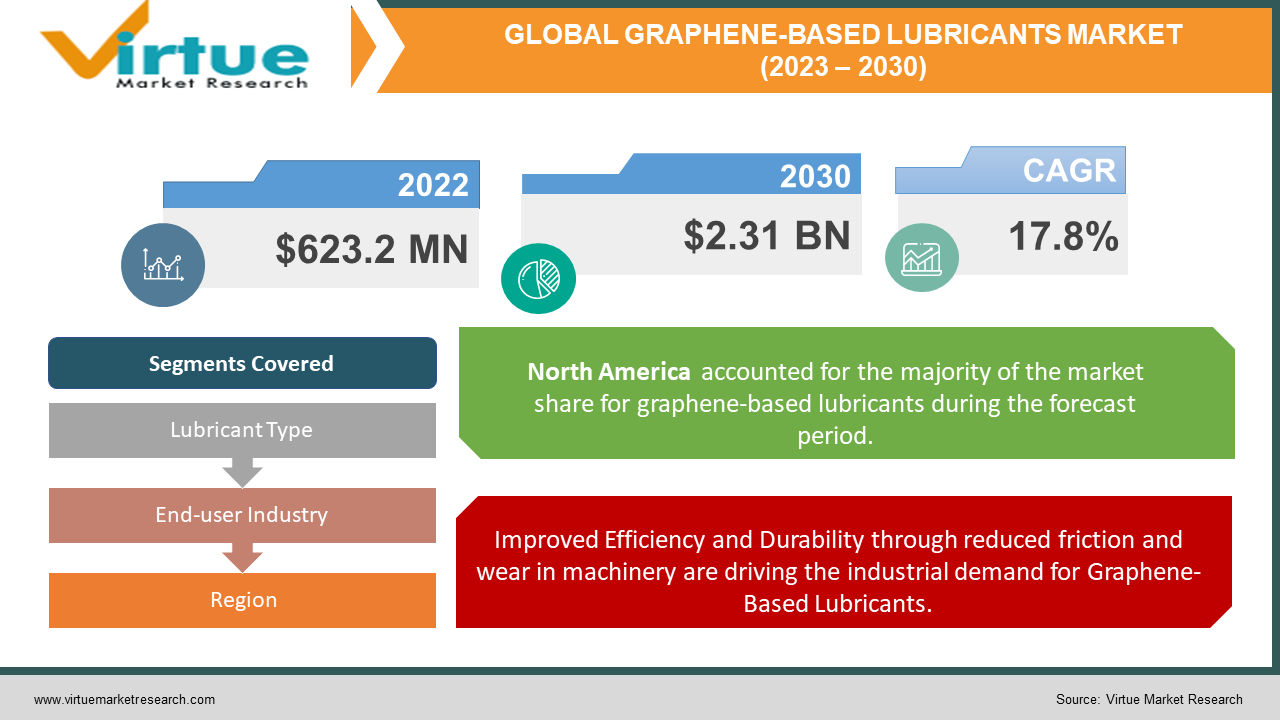

The Global Graphene-Based Lubricants Market was valued at USD 623.2 million and is projected to reach a market size of USD 2.31 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 17.8%.

Graphene-based lubricants have evolved into a promising solution for various industries. In the past, traditional lubricants were the norm, but the present landscape is witnessing a significant shift. The exceptional properties of graphene, such as its ability to reduce friction, and wear, and enhance overall performance, have captured the attention of industries seeking more efficient and sustainable lubrication options. This shift towards graphene-based lubricants signifies a transition from conventional solutions to advanced, high-performance alternatives. Looking to the future, this market is poised for continued growth as industries increasingly recognize the value of graphene in optimizing their operations and reducing environmental impacts.

Key Market Insights:

Graphene-based lubricants find applications in various sectors, including automotive, industrial, aerospace & defense, marine, and energy. The automotive sector accounts for the largest share of the graphene-based lubricants market. Graphene's superior lubrication properties improve fuel efficiency, reduce emissions, and extend the lifespan of automotive components, making it an ideal choice for lubricants.

The industrial sector is another key application area, where graphene-based lubricants are used in heavy machinery and equipment. These lubricants enhance machinery performance, reduce maintenance costs, and increase operational efficiency.

Aerospace and defense applications require high-performance lubricants to withstand extreme conditions. Graphene-based lubricants offer exceptional stability and lubrication under high temperatures and pressure, making them suitable for aerospace and defense applications.

Marine and energy sectors also benefit from graphene-based lubricants due to their ability to provide long-lasting lubrication in harsh environments.

Graphene-based solid lubricants, liquid lubricants, and greases are available in the market, catering to various lubrication needs across industries. Solid lubricants are particularly popular in applications where continuous lubrication is required, such as in the aerospace industry.

North America and Europe are currently the leading regions in the graphene-based lubricants market, with a strong presence in the automotive, aerospace, and industrial sectors. However, the Asia-Pacific region is expected to witness the fastest growth during the forecast period, driven by increasing industrialization and the adoption of advanced lubrication technologies in countries like China and India.

Graphene-Based Lubricants Market Drivers:

Improved Efficiency and Durability through reduced friction and wear in machinery are driving the industrial demand for Graphene-Based Lubricants.

Graphene-based lubricants have garnered significant attention in the industrial sector due to their exceptional ability to reduce friction and wear within machinery components. By introducing graphene-based lubricants into their operations, industries can achieve improved operational efficiency and extended equipment lifespan. These lubricants effectively minimize the frictional forces that typically lead to wear and tear, resulting in reduced maintenance costs and downtime. As a result, industries are increasingly adopting graphene-based lubricants to optimize their machinery's performance and ensure long-term durability, making them a crucial driver in the industrial demand for these innovative lubricants.

The automotive industry's growing focus on reducing emissions has led to the adoption of graphene-based lubricants, propelling the growth of the Industry.

The automotive industry's relentless pursuit of reduced emissions and enhanced fuel efficiency has led to the widespread adoption of graphene-based lubricants. These lubricants offer a unique advantage by lowering friction within engine components, leading to increased fuel efficiency and reduced emissions. As stringent emissions standards become the norm worldwide, automotive manufacturers are turning to graphene-based lubricants to meet these requirements while also improving engine performance. This strategic shift towards more eco-friendly lubrication solutions is a significant driver propelling the growth of graphene-based lubricants within the automotive industry.

Diverse Applications in various industries are driving graphene-based lubricant demand across multiple sectors.

The versatility of graphene-based lubricants is a key driver for their growing demand across various industries. These lubricants find applications not only in the automotive sector but also in aerospace, manufacturing, energy production, and more. Their ability to enhance efficiency, reduce wear and tear, and withstand high temperatures makes them suitable for a wide range of industrial processes. As industries seek innovative solutions to improve machinery performance and reduce operational costs, graphene-based lubricants stand out as a versatile and effective option, driving their adoption in multiple sectors and contributing to their increasing demand in the market.

Graphene-Based Lubricants Market Restraints and Challenges:

The production of graphene-based lubricants can be expensive, which may limit their adoption in price-sensitive industries.

The production of graphene-based lubricants can be cost-prohibitive, presenting a significant challenge for their widespread adoption, especially in price-sensitive industries. The complex and specialized manufacturing processes required to produce high-quality graphene-based lubricants can result in elevated production costs. As a result, industries operating on tight budgets or in highly competitive markets may hesitate to invest in these lubricants due to concerns about cost-effectiveness. This cost barrier may limit the accessibility of graphene-based lubricants to certain industries, hindering their broader adoption and market penetration.

Some industries may not be fully aware of the benefits of graphene-based lubricants, leading to slower adoption rates.

A notable challenge in the adoption of graphene-based lubricants is the limited awareness of their benefits in some industries. While these lubricants offer significant advantages, such as reduced friction, improved efficiency, and prolonged machinery lifespan, not all sectors may be fully informed about these advantages. Consequently, there may be slower adoption rates in industries where decision-makers are unaware of the potential gains in operational efficiency and cost savings offered by graphene-based lubricants. Addressing this knowledge gap and educating industry professionals about the benefits is essential to accelerate adoption.

Compliance with industry-specific regulations and standards can pose challenges to market players.

Another challenge for market players in the graphene-based lubricants industry is ensuring compliance with industry-specific regulations and standards. Different sectors and regions may have stringent requirements related to lubricants and additives. Meeting these standards while maintaining the desirable properties of graphene-based lubricants can be complex. Navigating the regulatory landscape and ensuring that products meet the necessary criteria for safety and performance can be a time-consuming and resource-intensive process. Failure to meet these regulatory requirements can result in barriers to market entry and acceptance by industry stakeholders.

Graphene-Based Lubricants Market Opportunities:

Continued R&D efforts can lead to the creation of more cost-effective production methods, opening up new opportunities in the graphene-based Lubricants market.

The Graphene Lubricants market presents significant opportunities for innovation through ongoing research and development (R&D) efforts. By focusing on developing more cost-effective production methods for graphene-based lubricants, market players can unlock new opportunities. Cost-efficient production techniques can potentially lower overall manufacturing costs, making these lubricants more accessible to a broader range of industries, including those with budget constraints. As R&D efforts progress and yield more efficient and affordable production methods, the market is poised for growth, with the potential to capture a larger market share.

Partnerships and Collaborations between lubricant manufacturers and industry players can help promote awareness and drive adoption in various sectors.

Collaborations and partnerships between lubricant manufacturers and industry players are instrumental in promoting awareness and driving the adoption of graphene-based lubricants. These strategic alliances can help create educational initiatives, conduct joint marketing campaigns, and provide training programs to highlight the benefits of these lubricants. By working together, companies can collectively raise awareness about the advantages of graphene-based lubricants, thereby increasing their acceptance across various sectors. Such partnerships can play a crucial role in accelerating the market's growth by expanding its reach and customer base.

Exploring opportunities in emerging economies where industrial growth is on the rise can be a lucrative strategy for market expansion.

Emerging economies with rapidly growing industrial sectors offer a promising avenue for market expansion in the Graphene-Based Lubricants industry. These regions often experience increasing industrialization, creating a growing demand for lubricants and additives. By proactively exploring and investing in these emerging markets, companies can tap into new customer bases and capitalize on the rising demand for high-performance lubricants. Tailoring products and marketing strategies to suit the specific needs and budgets of these markets can lead to lucrative opportunities for growth and market penetration, making it a strategic move for industry players.

GRAPHENE-BASED LUBRICANTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

17.8% |

|

Segments Covered |

By Lubricant Type, End-user Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Graphene Corporation, LubraGraphene Inc., NanoMech Inc., XG Sciences Inc., Applied Graphene Materials plc, Garmor Inc., Directa Plus plc, Haydale Graphene Industries plc, First Graphene Limited, Graphmatech AB |

Graphene-Based Lubricants Market Segmentation: By Lubricant Type

-

Graphene-based Engine Oil

-

Graphene-based Greases

-

Graphene-based Transmission Fluids

-

Other

In 2022, Graphene-based Engine Oil held the largest market share. Engine oil is a critical lubricant in various industries, including automotive and manufacturing, making it a primary application for graphene-based lubricants. As the automotive industry increasingly adopts graphene-based engine oils to enhance fuel efficiency and reduce emissions, this segment witnesses substantial growth.

Moreover, The Graphene-based Transmission Fluids segment is the fastest growing. The transmission fluids market benefits from the unique properties of graphene, such as reduced friction and improved thermal stability, which are especially advantageous in high-performance transmission systems. This segment tends to exhibit a higher CAGR as industries seek advanced lubrication solutions for efficient power transmission and enhanced durability.

Graphene-Based Lubricants Market Segmentation: By End-user Industry

-

Automotive

-

Aerospace

-

Manufacturing

-

Energy

-

Others

In 2022, the automotive sector commanded the largest market share in the Graphene-based Lubricants market. This dominance is driven by the extensive use of lubricants in vehicles, including passenger cars, commercial trucks, and other automotive applications. Graphene-based lubricants are increasingly adopted in the automotive industry to enhance fuel efficiency, reduce emissions, and improve overall engine performance. With the global automotive industry's vast scale, it consistently contributes to a substantial portion of the market share.

However, The Aerospace segment is the fastest-growing sector in the Graphene-Based Lubricants market. While it represents a smaller share compared to automotive, the aerospace industry demands high-performance lubricants for critical aircraft components. Graphene-based lubricants offer superior properties such as reduced friction and improved thermal stability, making them ideal for aerospace applications. As the aerospace sector seeks to enhance the efficiency and durability of aircraft systems, the adoption of graphene-based lubricants is expected to experience rapid growth, often with a notable Compound Annual Growth Rate (CAGR).

Graphene-Based Lubricants Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2022, North America held the largest market share of 29.7% in the Graphene-Based Lubricants market. This region, including the United States and Canada, is characterized by a strong presence of industries, including automotive, aerospace, and manufacturing, which are significant consumers of lubricants. Moreover, the region's emphasis on technological advancements and sustainability often drives the adoption of graphene-based lubricants, contributing to its substantial market share.

Moreover, The Asia-Pacific region, encompassing countries like China, India, and Japan, experienced rapid industrialization and economic growth. This growth fuels the demand for lubricants across various industries. Graphene-based lubricants are increasingly adopted in this region due to their potential for enhancing efficiency and sustainability. As a result, the Asia-Pacific segment often demonstrates the highest Compound Annual Growth Rate (CAGR) as industries in the region seek advanced lubrication solutions.

COVID-19 Impact Analysis on the Global Graphene-Based Lubricants Market:

The COVID-19 pandemic had a notable impact on the Global Graphene-Based Lubricants Market. During the initial phases, disruptions in supply chains and reduced industrial activities led to a temporary slowdown in demand. However, as industries adapted to the new normal, the market witnessed a resurgence. Graphene-based lubricants, known for their ability to enhance operational efficiency, gained traction as industries sought ways to optimize machinery performance. The ongoing emphasis on sustainability and eco-friendly solutions further accelerated the adoption of graphene-based lubricants post-pandemic, positioning the market for long-term growth as industries prioritize efficiency and environmental responsibility.

Latest Trends/ Developments:

Recent trends in the Graphene-Based Lubricants Market have been marked by significant technological advancements. Reports indicate that researchers have made substantial progress in developing graphene-based lubricants with tailored properties to address specific industrial needs. These innovations are leading to lubricants that offer improved thermal stability, reduced friction, and enhanced wear resistance. This aligns with the growing demand for high-performance lubrication solutions across various industries.

Industry players have increasingly been forming strategic agreements and collaborations to strengthen their positions in the market. For instance, leading lubricant manufacturers have partnered with research institutions and graphene producers to develop and commercialize advanced graphene-based lubricants. These collaborations aim to leverage the expertise of each party to accelerate product development and market penetration.

The global emphasis on sustainability has spurred a notable trend towards eco-friendly lubrication solutions. Graphene-based lubricants are garnering attention due to their potential to reduce friction and enhance energy efficiency, aligning with sustainability goals. Reports suggest that industries are actively seeking lubrication options that not only improve performance but also contribute to reduced environmental impact, making graphene-based lubricants a preferred choice in this regard.

Key Players:

-

Graphene Corporation

-

LubraGraphene Inc.

-

NanoMech Inc.

-

XG Sciences Inc.

-

Applied Graphene Materials plc

-

Garmor Inc.

-

Directa Plus plc

-

Haydale Graphene Industries plc

-

First Graphene Limited

-

Graphmatech AB

In 2022, Graphene-XT and Roma TRE University's DIIEM partnered to research next-generation graphene-based hydraulic fluids. Initial experiments at DIIEM's laboratory, led by Prof. Fulvio Palmieri, revealed significant improvements in energy efficiency for hydraulic gear pumps using hydraulic fluids infused with exfoliated graphene. These findings offered promising possibilities for enhancing the power management of hydraulic systems, particularly under challenging operational conditions.

In March 2022, Poland's Advanced Graphene Products (AGP) signed a cooperation agreement with U.S.-based Garmor, a division of Asbury Carbons, to expand its graphene operations. The collaboration aimed to accelerate the use of graphene in paints, anti-corrosion lubricants, and oils. Garmor, with its patented environmentally friendly graphene production process, was a key partner.

Chapter 1. Graphene-Based Lubricants Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Graphene-Based Lubricants Market – Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Graphene-Based Lubricants Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Graphene-Based Lubricants Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Graphene-Based Lubricants Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Graphene-Based Lubricants Market – By Lubricant Type

6.1 Introduction/Key Findings

6.2 Graphene-based Engine Oil

6.3 Graphene-based Greases

6.4 Graphene-based Transmission Fluids

6.5 Other

6.6 Y-O-Y Growth trend Analysis By Lubricant Type

6.7 Absolute $ Opportunity Analysis By Lubricant Type, 2023-2030

Chapter 7. Graphene-Based Lubricants Market – By End-user Industry

7.1 Introduction/Key Findings

7.2 Automotive

7.3 Aerospace

7.4 Manufacturing

7.5 Energy

7.6 Others

7.7 Y-O-Y Growth trend Analysis By End-user Industry

7.8 Absolute $ Opportunity Analysis By End-user Industry, 2023-2030

Chapter 8. Graphene-Based Lubricants Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.1.4 By Lubricant Type

8.1.2 By End-user Industry

8.1.3 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Lubricant Type

8.2.3 By End-user Industry

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Lubricant Type

8.3.3 By End-user Industry

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Lubricant Type

8.4.3 By End-user Industry

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Lubricant Type

8.5.3 By End-user Industry

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Graphene-Based Lubricants Market – Company Profiles – (Overview, Graphene-Based Lubricants Market Portfolio, Financials, Strategies & Developments)

9.1 Graphene Corporation

9.2 LubraGraphene Inc.

9.3 NanoMech Inc.

9.4 XG Sciences Inc.

9.5 Applied Graphene Materials plc

9.6 Garmor Inc.

9.7 Directa Plus plc

9.8 Haydale Graphene Industries plc

9.9 First Graphene Limited

9.10 Graphmatech AB

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Graphene-Based Lubricants Market was valued at USD 623.2 million and is projected to reach a market size of USD 2.31 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 17.8%.

Graphene-based lubricants find applications in automotive, industrial, aerospace & defense, marine, energy, and other sectors.

North America held the largest market share in 2022, with a strong presence in industries such as automotive and aerospace.

The Asia-Pacific region is expected to experience the fastest growth, driven by rapid industrialization and economic growth.

Leading players include Graphene Corporation, LubraGraphene Inc., NanoMech Inc., XG Sciences Inc., and others.