Gourmet Salt Market Size (2024 – 2030)

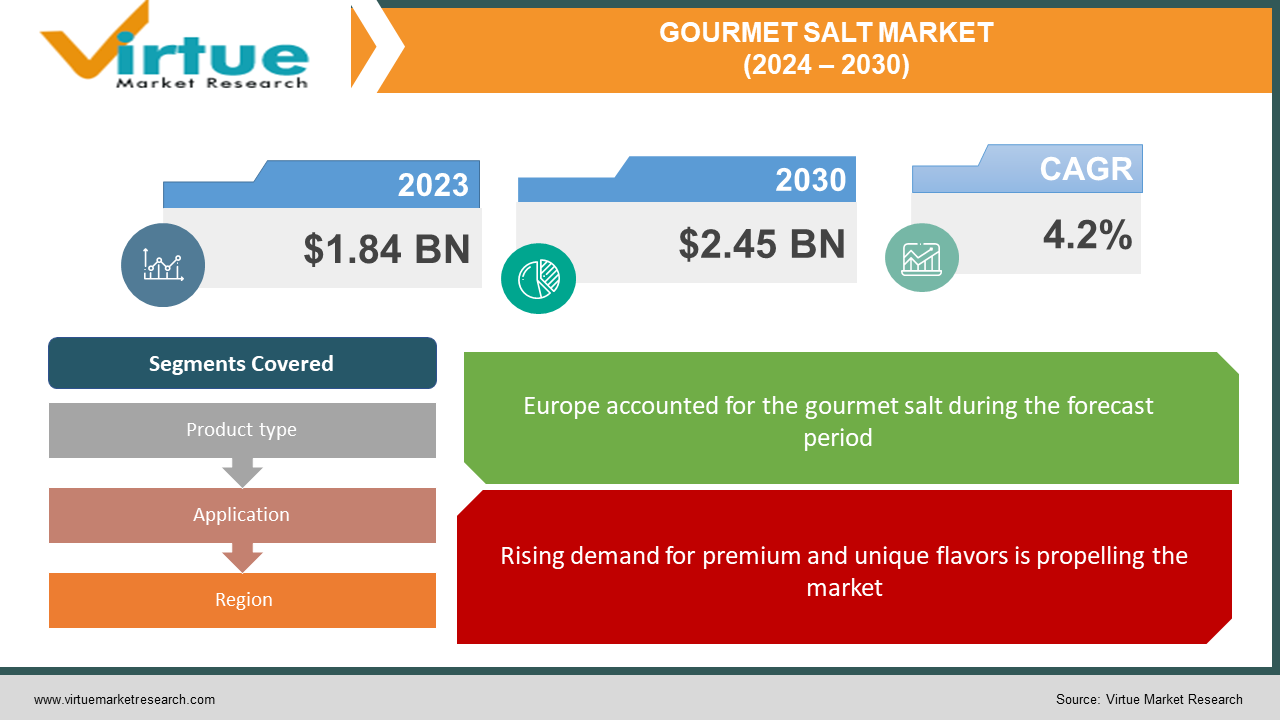

The global gourmet salt market was valued at USD 1.84 billion in 2023 and will grow at a CAGR of 4.2% from 2024 to 2030. The market is expected to reach USD 2.45 billion by 2030.

The gourmet salt market caters to consumers seeking high-quality, unique salts beyond basic table salt. These specialty salts often boast specific flavors, textures, and mineral compositions, reflecting diverse origins like the Himalayan Mountains or the volcanic Hawaiian coast. This growing market is driven by increasing health awareness and a desire for culinary experiences beyond the ordinary. This market is anticipated to expand significantly owing to diverse product offerings, innovations, and sustainable initiatives.

Key Market Insights:

The gourmet salt market simmers with exciting growth potential. Fueled by a growing appreciation for unique flavors and health-conscious consumers seeking alternatives to table salt, the market is experiencing a surge in demand for exotic varieties like Himalayan pink salt, smoked sea salt, and black lava salt. This trend is particularly strong in North America and Europe, where consumers are willing to pay a premium for high-quality, artisanal salts. Moreover, the rise of home cooking and celebrity chef influence is driving interest in culinary experimentation, further boosting the gourmet salt market. To capitalize on this trend, manufacturers are innovating with new flavors, textures, and packaging, catering to diverse palates and creating visually appealing products for a premium shelf presence. This focus on innovation, coupled with the growing awareness of the health benefits of certain gourmet salts, positions the market for continued expansion shortly.

Global Gourmet Salt Market Drivers:

Rising demand for premium and unique flavors is propelling the market.

Discerning palates in developed regions like North America and Europe are driving the gourmet salt market. Consumers, no longer content with the ubiquitous table salt, are actively seeking out unique flavor profiles to elevate their culinary experiences. This translates to a willingness to pay a premium for gourmet salts, from the delicate flakes of French fleur de sel to the smoky intensity of Hungarian smoked sea salt. This trend is fueled by a growing appreciation for diverse cuisines and a desire for experimentation in the kitchen. As consumers become more adventurous with their taste buds, the demand for these exotic flavor enhancers is expected to continue to rise, shaping the landscape of the global gourmet salt market.

The growth of the food service industry is accelerating the growth rate.

Fine dining establishments are setting the table for a surge in gourmet salt demand. As these restaurants strive to create unique and memorable culinary experiences, the allure of gourmet salts with their diverse flavor profiles and textures becomes irresistible. Chefs are increasingly incorporating these salts to elevate dishes, from finishing touches on grilled meats with smoked sea salt to enhancing seafood with the delicate touch of French fleur de sel. This trend extends beyond fine dining, as the general food service industry witnesses a growing demand for gourmet flavors. Restaurants catering to diverse palates are recognizing the power of these specialty salts to elevate everyday dishes and attract customers seeking a more sophisticated dining experience. This increasing demand from the food service industry, coupled with the innovative spirit of chefs, presents a significant growth opportunity for the gourmet salt market.

Growing awareness of health benefits is contributing to the success.

The health halo effect plays a role in the gourmet salt market, even if the actual benefits are often overstated. While most gourmet salts offer minimal nutritional advantages compared to table salt, the perception of them being healthier due to their lower sodium content or the presence of trace minerals like magnesium in some sea salt varieties fuels consumer interest. This perception, often driven by marketing and anecdotal claims, isn't always supported by scientific evidence. However, it undeniably contributes to the market's growth. Additionally, some consumers believe specific gourmet salts offer unique health benefits, such as improved digestion or detoxification, further propelling their popularity. It's crucial to note that these claims often lack substantial scientific backing. Nevertheless, the perception of health advantages, regardless of their validity, remains a significant driver in the booming gourmet salt market.

Global Gourmet Salt Market Restraints and Challenges:

High costs, limited accessibility, and intense competition are the main issues that the market is currently facing.

Gourmet salt is frequently made using specific techniques, such as sun evaporation or hand harvesting, which can be more expensive and labor-intensive than traditional salt production techniques. Gourmet salt products' pricing may be impacted by these increased production costs, which may restrict consumer access to them. Secondly, they are frequently obtained from particular areas or places that are renowned for their distinctive mineral compositions or techniques of collection. Meeting the increasing demand for gourmet salt products may be difficult due to the limited availability of these sources, especially as consumer preferences are shifting towards natural and artisanal culinary components. Moreover, conventional table salt is more affordable and readily accessible than gourmet salt. Gourmet salt has distinct tastes, textures, and mineral profiles, yet in price-sensitive regions, customers could value affordability more than these features.

Global Gourmet Salt Market Opportunities:

The gourmet salt market brims with exciting opportunities for savvy businesses. The rising demand for unique flavor profiles presents an opening for manufacturers to develop innovative offerings beyond traditional sea salt. Experimentation with exotic ingredients like Himalayan pink salt, infused salts with herbs and spices, and smoked varieties can cater to adventurous palates and create a premium product experience. Additionally, the growing health-conscious consumer base presents an opportunity to leverage the perceived health benefits of certain gourmet salts, like lower sodium content or specific mineral content. However, clear and responsible communication about these benefits, avoiding unsubstantiated claims, is crucial to maintaining consumer trust. Furthermore, the increasing influence of social media and celebrity chefs creates a platform for creative marketing and brand collaborations, allowing manufacturers to tap into new consumer segments and leverage the power of influencer endorsements. By staying ahead of these trends, focusing on innovation, ethical marketing practices, and building brand loyalty, businesses operating in the gourmet salt market can unlock significant growth potential.

GOURMET SALT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.2% |

|

Segments Covered |

By Product type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Cargill, Inc., Morton Salt, Inc., Saltworks, Inc., Cheetham Salt, Sel Gris, Murray River Salt, Herbamare, Maldon Crystal Salt Co. |

Gourmet Salt Market Segmentation: By Product Type

-

Sea Salt

-

Refined Salt

-

Flavored Salt

-

Smoked Salt

The gourmet salt market caters to diverse palates and preferences through a variety of product types. Sea salt reigns supreme, encompassing the delicate flakes of French fleur de sel, the bold crystals of Maldon salt, and the mineral-rich Himalayan pink salt. Refined salt, like table salt, offers a familiar, finely-textured option. Meanwhile, the fastest-growing flavored salt segment tantalizes taste buds with herbs, spices, and other exciting infusions. Smoked salt adds a touch of campfire magic, while functional salts cater to the health-conscious with perceived benefits like the high mineral content of Himalayan pink salt. This diverse range ensures there's a perfect gourmet salt to enhance any culinary creation.

Gourmet Salt Market Segmentation: By Application

-

Food Service

-

Retail

The gourmet salt market caters to two distinct buying sectors: food service and retail. Foodservice is the largest growing application. It encompasses restaurants, cafes, and other establishments and prioritizes high-quality and unique salts to elevate their culinary offerings. Chefs utilize these specialty salts to add depth of flavor, create visually appealing presentations, and cater to discerning palates. The retail segment is the fastest-growing channel. Gourmet salt products are sold directly to customers in the retail sector for use in seasoning and cooking at home. Customers looking to improve their cooking and eating experiences are driving up demand for gourmet salt products as gourmet cuisine and culinary experimentation become more popular at home.

Gourmet Salt Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Europe, with its established culinary traditions and appreciation for fine ingredients, holds the largest market share at nearly 38% in 2023. This might be attributed to changing consumer preferences and a rise in the demand for specialty salts for the region's diverse culinary traditions. As more people in the area become aware of the health advantages of gourmet salts—like Himalayan salt, which has less sodium than ordinary table salt—they are moving away from table salt and towards gourmet salt. In contrast, Asia-Pacific is the fastest-growing region, driven by rising disposable income, expanding cafe culture, and a growing appreciation for specialty coffee, often paired with gourmet salts. North America sits between the two, with a strong, mature market fueled by premiumization and innovation demands, showcasing steady growth. Latin America, the Middle East & Africa hold smaller market shares but boast significant growth potential due to developing economies and emerging coffee cultures seeking to emulate Western trends. Despite these variations, the global gourmet salt market is expected to continue its upward trajectory, fueled by diverse consumer preferences and a growing appreciation for unique flavors and culinary experiences.

COVID-19 Impact Analysis on the Global Gourmet Salt Market

The COVID-19 pandemic's impact on the gourmet salt market was mixed. While initial lockdowns and restaurant closures caused a steep decline in demand from the food service industry, a surprising surge occurred in the retail sector. Consumers stuck at home embraced home cooking, leading them to experiment with new recipes and seek out premium ingredients like gourmet salts to elevate their culinary creations. This home-cooking boom effectively offset some of the losses from shuttered restaurants. Additionally, the heightened focus on health and wellness during the pandemic might have contributed to a rise in interest in certain gourmet salts perceived as offering health benefits, like those rich in specific minerals. As the world adjusts to a post-pandemic landscape, the gourmet salt market is on track for a gradual recovery. The balance between food service and retail channels is expected to re-establish itself, presenting exciting opportunities for businesses that can effectively cater to both segments.

Latest trends/Developments

Businesses in this sector are driven to grow their market share through a variety of tactics, such as investments, joint ventures, and acquisitions. Companies are investing a significant amount of money in developing strategies to maintain competitive pricing. This has led to more growth.

The global gourmet salt market is experiencing a wave of exciting trends and developments. Flavor innovation reigns supreme, with manufacturers venturing beyond traditional sea salt to offer exotic varieties like Himalayan pink salt, infused salts with botanicals like lavender and chilies, and even smoked options. This caters to the growing consumer desire for unique flavor profiles and elevated culinary experiences. Additionally, sustainability is becoming a key consideration, with manufacturers developing eco-friendly packaging and ethically sourced salts. Furthermore, the market sees a growing trend towards functional salts, with specific varieties perceived to offer health benefits like improved mineral intake. However, ethical marketing practices are crucial, as the actual health advantages of most gourmet salts compared to table salt are often minimal. Finally, the rise of e-commerce platforms and social media influence is creating new avenues for direct-to-consumer sales and brand storytelling, allowing manufacturers to connect directly with consumers and build brand loyalty.

Key Players:

-

Cargill, Inc.

-

Morton Salt, Inc.

-

Saltworks, Inc.

-

Cheetham Salt

-

Sel Gris

-

Murray River Salt

-

Herbamare

-

Maldon Crystal Salt Co.

Chapter 1. Gourmet Salt Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Gourmet Salt Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Gourmet Salt Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Gourmet Salt Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Gourmet Salt Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Gourmet Salt Market – By Application

6.1 Introduction/Key Findings

6.2 Food Service

6.3 Retail

6.4 Y-O-Y Growth trend Analysis By Application

6.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 7. Gourmet Salt Market – By Product Type

7.1 Introduction/Key Findings

7.2 Sea Salt

7.3 Refined Salt

7.4 Flavored Salt

7.5 Smoked Salt

7.6 Y-O-Y Growth trend Analysis By Product Type

7.7 Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 8. Gourmet Salt Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Application

8.1.3 By Product Type

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Application

8.2.3 By Product Type

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Application

8.3.3 By Product Type

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Application

8.4.3 By Product Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Application

8.5.3 By Product Type

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Gourmet Salt Market – Company Profiles – (Overview, Product Type Portfolio, Financials, Strategies & Developments)

9.1 Cargill, Inc.

9.2 Morton Salt, Inc.

9.3 Saltworks, Inc.

9.4 Cheetham Salt

9.5 Sel Gris

9.6 Murray River Salt

9.7 Herbamare

9.8 Maldon Crystal Salt Co.

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The global gourmet salt market was valued at USD 1.84 billion in 2023 and will grow at a CAGR of 4.2% from 2024 to 2030. The market is expected to reach USD 2.45 billion by 2030.

Rising demand for premium and unique flavors, the growth of the food service industry, and growing awareness of health benefits are the reasons that are driving the market.

Based on type, the market is divided into four segments: sea salt, refined salt, flavored salt, and smoked salt.

Europe is the most dominant region for the gourmet salt market.

Morton Salt, Inc., Saltworks, Inc., and Cheetham Salt are the major players.