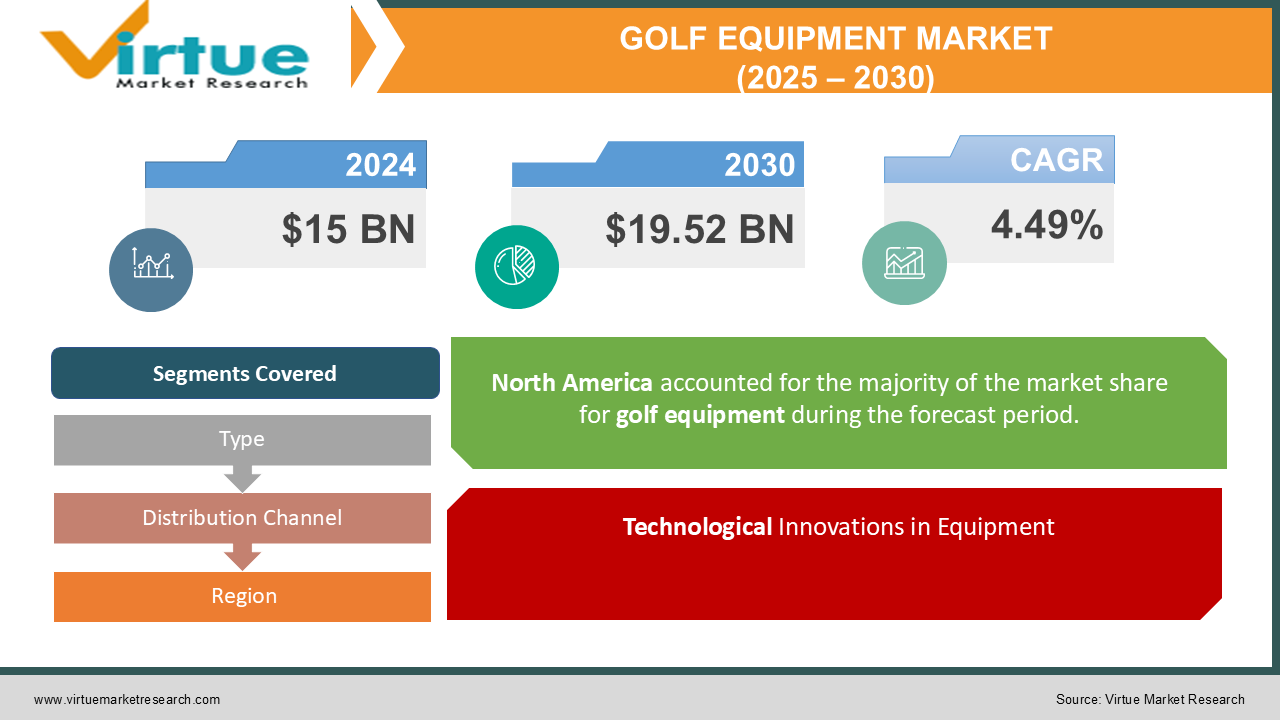

Golf Equipment Market Size (2025 – 2030)

The Golf Equipment Market was valued at USD 15 Billion in 2024 and is projected to reach a market size of USD 19.52 Billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 4.49%.

The golf equipment market has emerged as a dynamic and ever-evolving industry, blending tradition with innovation to cater to a growing global audience. This market encompasses a wide range of products, including golf clubs, balls, bags, apparel, and accessories, each designed to enhance the player’s experience and improve performance on the course. Over the years, golf has transitioned from being a niche sport to a widely popular recreational activity, with its appeal cutting across age groups, genders, and geographic regions. The proliferation of professional tournaments, increased media coverage, and the integration of advanced technologies have all contributed to the robust expansion of the market. As golfers seek improved performance and personalized experiences, manufacturers are investing heavily in research and development, introducing products with cutting-edge features that appeal to both amateurs and professionals alike. Furthermore, sustainability has become a focal point for the industry, with companies increasingly using eco-friendly materials in their products and adopting sustainable manufacturing practices to align with consumer demand for environmentally conscious solutions. As the market continues to expand, it also faces challenges such as the high cost of equipment, which can be a barrier for entry-level players. The premium pricing of advanced gear and accessories often limits accessibility, particularly in emerging markets where disposable incomes may be lower. Moreover, golf's reputation as a sport for the elite still persists in some regions, necessitating targeted efforts to make the game more inclusive and affordable. Despite these challenges, the industry is rife with opportunities, including the growing popularity of indoor golf simulators and driving ranges, which provide an accessible and convenient way for players to hone their skills. These innovations cater to urban populations with limited access to traditional golf courses, ensuring the sport remains relevant in a rapidly urbanizing world. In terms of segmentation, the market can be classified by type, distribution channel, and regional presence. Among the product types, golf clubs remain the most dominant, accounting for a significant share of the market. The fastest-growing segment, however, is golf apparel and footwear, driven by increasing consumer focus on performance-enhancing and stylish gear. Distribution channels are divided between offline outlets, such as pro shops and specialty stores, and online platforms. While offline stores dominate the market due to the tactile nature of golf equipment purchases, online channels are the fastest-growing segment, propelled by the convenience and wide product selection they offer.

Key Market Insights:

-

Global golf equipment sales surpassed $15.4 billion in 2023. Over 70 million golf clubs were sold globally in 2023.

-

Golf balls accounted for 25% of total equipment sales in 2023. The average price of a premium driver was $550 in 2023. Golf apparel sales saw an 18% increase compared to 2022. Women’s golf equipment sales rose by 22% in 2023.

-

Beginner-friendly golf clubs comprised 30% of total club sales. Smart golf equipment generated $1.2 billion in revenue in 2023.

-

E-commerce platforms represented 40% of total sales in 2023. The demand for golf gloves increased by 16% over the year.

-

Used golf equipment sales contributed 10% to the market’s revenue. Over 5 million new golfers entered the market in 2023.

-

Electric golf carts experienced a 20% sales spike in 2023.

-

Over 15,000 golf courses worldwide reported increased rounds played. Golf simulator sales grew by 35% due to urban demand.

-

25% of golfers under the age of 30 used wearable tech for training. Customized golf club orders increased by 28% in 2023.

-

Golf bags featuring eco-friendly materials saw a 30% growth in sales.

-

Over 40% of golf players purchased equipment influenced by professional endorsements.

-

Junior golf club sales rose by 19% due to rising youth interest.

-

The average spending per golfer on equipment reached $2,000 in 2023.

-

Hybrid golf clubs saw a sales increase of 12% compared to 2022.

Market Drivers:

Golf’s Popularity Surge: A Market Driven by Inclusivity and Innovation

The surging popularity of golf has become a pivotal market driver, fueled by increasing inclusivity across genders, age groups, and demographics. Traditionally perceived as an elite sport, golf has transformed into an accessible and mainstream recreational activity, with marketing campaigns targeting a broader audience. Initiatives to involve youth through school programs and beginner-friendly tournaments have expanded the market base. Women’s participation has also seen remarkable growth, spurred by tailored product offerings and women-only events. The media’s focus on professional tournaments and celebrity endorsements has also inspired aspirational purchases, creating a ripple effect on equipment sales.

Technological Innovations in Equipment

Advancements in technology are redefining the standards of golf equipment, making the sport more attractive to both professionals and amateurs. Smart devices such as GPS-enabled golf balls and clubs with embedded sensors provide players with real-time data on swing mechanics and ball trajectory. These innovations offer a personalized approach to improvement, enhancing player satisfaction. Additionally, lightweight and aerodynamically designed golf clubs reduce strain and increase efficiency, catering to golfers of all skill levels. Such advancements ensure consistent consumer interest and encourage frequent upgrades, driving overall market growth.

Market Restraints and Challenges:

Despite its growth, the golf equipment market faces significant challenges, including high product costs and limited accessibility. Premium pricing for high-quality equipment remains a barrier for entry-level players and those in emerging markets. Furthermore, the sport’s reputation as an elite activity deters some demographics from participating. Environmental concerns also pose challenges, as traditional golf equipment often utilizes non-recyclable materials. Lastly, economic fluctuations and unpredictable consumer spending patterns can impact sales, particularly for discretionary purchases like golf accessories and apparel.

Market Opportunities:

The golf equipment market is rife with opportunities, particularly in urban areas where innovations like indoor simulators and compact driving ranges are gaining traction. These solutions cater to populations with limited access to traditional courses, ensuring steady market demand. Sustainability-focused products, such as biodegradable golf balls and eco-friendly apparel, offer untapped potential, appealing to environmentally conscious consumers. Moreover, expanding online platforms provide manufacturers with direct-to-consumer channels, enabling wider product reach and customization options. Capitalizing on these trends can unlock significant revenue streams for market players.

GOLF EQUIPMENT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

4.49% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Callaway Golf Company, TaylorMade Golf, Acushnet Holdings Corp., Ping, Wilson Sporting Goods, Mizuno Corporation, Cobra Golf, Cleveland Golf, Bridgestone Golf, PXG (Parsons Xtreme Golf), Tour Edge Golf, Honma Golf, Adidas Golf, Nike Golf, Srixon |

Golf Equipment Market Segmentation: by Type

-

Golf Clubs

-

Golf Balls

-

Golf Apparel and Footwear

-

Golf Bags

-

Golf Accessories

The dominance of golf clubs is driven by their essential role in gameplay, with professionals and amateurs continually seeking upgrades. Meanwhile, golf apparel and footwear are the fastest-growing segment due to the increasing focus on performance-enhancing and stylish gear.

Golf Equipment Market Segmentation: by Distribution Channel

-

Pro Shops

-

Specialty Sports Stores

-

Online Platforms

-

Hypermarkets and Supermarkets

Pro shops dominate due to their expertise and tailored services, while online platforms are rapidly growing due to their convenience and wider product selection.

Golf Equipment Market Segmentation - by Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

Middle East and Africa

-

Latin America

The market’s regional distribution highlights North America as the most dominant region, with a market share of 35%, driven by a strong golfing tradition and robust infrastructure. However, Asia-Pacific emerges as the fastest-growing region, with a growth rate of 25%, attributed to rising urbanization, economic development, and growing interest in the sport. Europe holds 30% of the market share, followed by Latin America and the Middle East with 15% and 10%, respectively.

COVID-19 Impact Analysis:

The COVID-19 pandemic significantly altered consumer behaviours, with golf witnessing a surge in participation due to its socially distanced nature. Lockdowns spurred the adoption of home-based golf solutions, such as simulators and training aids. Although supply chain disruptions initially hampered the market, demand rebounded strongly, highlighting the sport’s resilience.

Latest Trends and Developments:

The golf equipment market is undergoing a transformative phase, driven by innovations, sustainability efforts, and changing consumer preferences. A significant trend is the integration of advanced technology into golf equipment. Smart golf clubs, GPS-enabled golf balls, and wearable devices are becoming standard for players looking to enhance performance. These tools provide data-driven insights, such as swing analysis and shot tracking, enabling golfers to refine their game with precision. Furthermore, AI-powered simulators are gaining popularity among urban enthusiasts, offering a realistic golfing experience in compact settings. Sustainability is another critical development, with manufacturers introducing eco-friendly products. Biodegradable golf balls, recyclable club components, and environmentally conscious apparel are becoming mainstream as consumers prioritize sustainability. Brands are also reducing their carbon footprint by adopting greener manufacturing processes and materials. The rise of lightweight, durable golf bags made from sustainable fabrics is a prime example of this shift. Personalization is reshaping the market as well. Consumers are increasingly seeking customized golf clubs, balls, and accessories tailored to their preferences and playing style. This trend has spurred demand for custom fitting services and limited-edition equipment. Collaborations with renowned athletes and designers have further propelled interest in personalized products. The shift to online retail is a notable trend, with e-commerce platforms witnessing significant growth. Consumers value the convenience of online shopping, which offers a broader range of products and easy customization options. Virtual fitting tools and augmented reality apps have enhanced the online buying experience, making it easier for golfers to choose the right equipment without visiting a physical store.

Key Players in the Market:

-

Callaway Golf Company

-

TaylorMade Golf

-

Acushnet Holdings Corp.

-

Ping

-

Wilson Sporting Goods

-

Mizuno Corporation

-

Cobra Golf

-

Cleveland Golf

-

Bridgestone Golf

-

PXG (Parsons Xtreme Golf)

-

Tour Edge Golf

-

Honma Golf

-

Adidas Golf

-

Nike Golf

-

Srixon

Chapter 1. Golf Equipment Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Golf Equipment Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Golf Equipment Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Golf Equipment Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Golf Equipment Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Golf Equipment Market – By Type

6.1 Introduction/Key Findings

6.2 Golf Clubs

6.3 Golf Balls

6.4 Golf Apparel and Footwear

6.5 Golf Bags

6.6 Golf Accessories

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Golf Equipment Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Pro Shops

7.3 Specialty Sports Stores

7.4 Online Platforms

7.5 Hypermarkets and Supermarkets

7.6 Y-O-Y Growth trend Analysis By Distribution Channel

7.7 Absolute $ Opportunity Analysis By Distribution Channel, 2025-2030

Chapter 8. Golf Equipment Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Golf Equipment Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Callaway Golf Company

9.2 TaylorMade Golf

9.3 Acushnet Holdings Corp.

9.4 Ping

9.5 Wilson Sporting Goods

9.6 Mizuno Corporation

9.7 Cobra Golf

9.8 Cleveland Golf

9.9 Bridgestone Golf

9.10 PXG (Parsons Xtreme Golf)

9.11 Tour Edge Golf

9.12 Honma Golf

9.13 Adidas Golf

9.14 Nike Golf

9.15 Srixon

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The golf equipment market grows due to technological advancements, eco-friendly innovations, rising disposable incomes, increasing youth participation, the popularity of golf tourism, personalized product demand, urbanization driving indoor golf facilities, and the surge in e-commerce platforms globally.

The golf equipment market faces several challenges, including high costs of premium products, which deter new or casual players. Environmental concerns regarding golf course maintenance and equipment materials impact sustainability perceptions. Additionally, the sport's time-intensive nature and limited accessibility in urban areas hinder wider adoption.

Callaway Golf Company, TaylorMade Golf, Acushnet Holdings Corp., Ping, Wilson Sporting Goods, Mizuno Corporation, Cobra Golf, Cleveland Golf.

North America currently holds the largest market share, estimated around 35%.

Asia Pacific has shown significant room for growth in specific segments.