Gold Market Size (2025-2030)

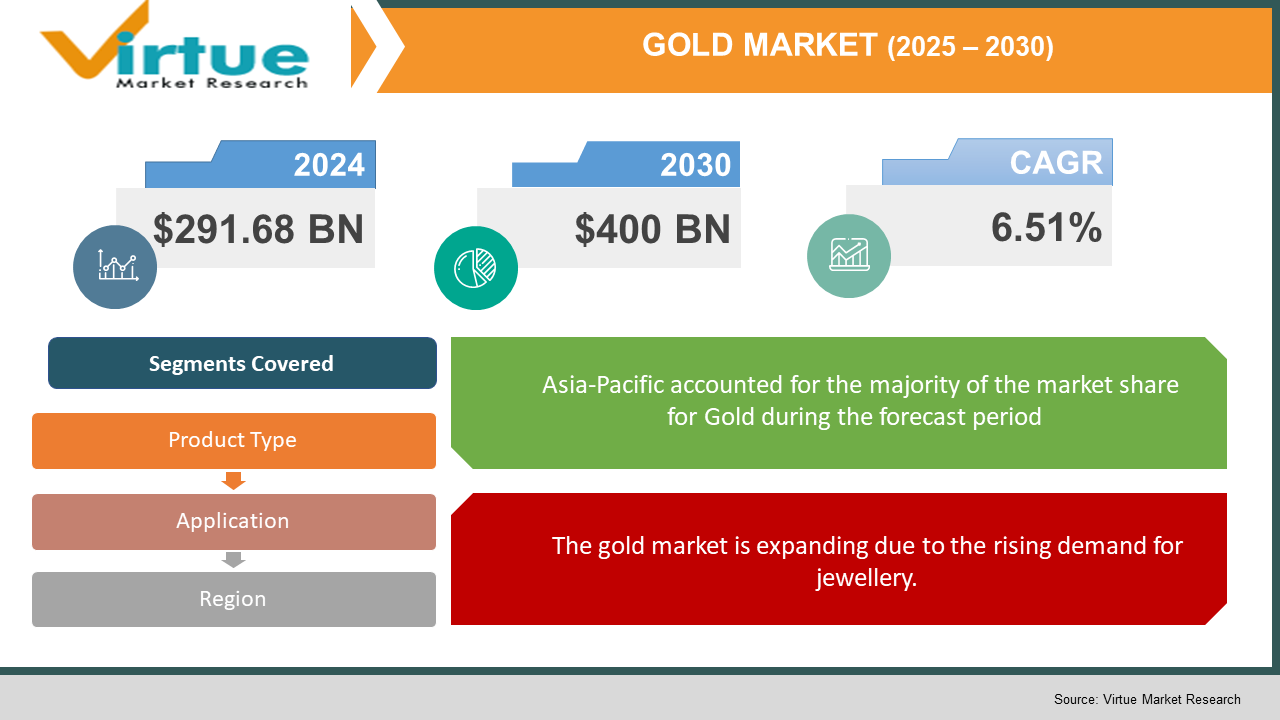

The Global Gold Market was valued at USD 291.68 billion in 2024 and is projected to reach a market size of USD 400 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 6.51%.

Gold, the most sought-after precious metal, is known for its luster and conductivity. It is the backbone of jewellery making, portraying wealth and beauty. Its exceptional conductive capabilities make it the go-to element in electronics, particularly in connectors, switches, and relay contacts. Their inability to tarnish or corrode gives them extra longevity. Moreover, it plays a crucial part in dentistry for crowns and fillings due to its non-reactive nature. Also, its investment significance as a cushion against inflation and currency depreciation underscores its diversity and enduring demand. Incorporating gold in electrical and electronic products has brought in new profitable avenues in the market. With excellent conductivity and corrosion resistance, it is increasingly becoming a material that is indispensable in the design and production of efficient and trustworthy components. This maximizes the performance of devices and provides a longer lifespan and more sustainability. As businesses keep pushing for better standards for electronic devices and systems, the application of this metal is poised to transform product design, resulting in market innovations and competitiveness for the players. This strategic incorporation marks a major move toward high quality and performance in electronics.

Key Market Insights:

- The growth in the market will be driven by environmental control, oil & gas exploration, and technological progress in seal materials.

- Conventional seals still enjoy consistent demand as they are cost-effective and well-established, but they are threatened by newer and more sophisticated seal technologies.

- Balanced seals are being used in higher-temperature and higher-pressure applications, whereas unbalanced seals are limited to specialized applications because of their simplicity and lower price.

- Technological and material innovation enhances efficiency and longevity dramatically, catering to the varied needs of varied industries.

- New material developments are a leading trend in the mechanical seals industry. Manufacturers are concentrating more on custom-made solutions developed for industries.

Global Gold Market Drivers:

The gold market is expanding due to the rising demand for jewellery.

Gold share in the gold market is likely to see significant growth, spurred primarily by the increasing demand for jewellery. Over time, along with changing consumption patterns, lifestyle aspirations have begun to shift, precious metals have gained greater popularity, and gold has become a preferred metal. This has been a rising trend across geography, but nevertheless a worldwide development, as aspirational lifestyles along with increasing discretionary incomes have emerged. Also, its inherent attributes, including its enduring popularity and perceived value as an investment, further spur consumers to purchase gold. Traditional and cultural considerations are also very important, particularly in regions where the metal is deeply rooted in social and ceremonial traditions. Therefore, these forces are likely to drive the market's growth constantly, and thus, it is a sector of interest to investors and players in the industry.

One of the strongest drivers of the global gold market is the increasing accumulation of gold reserves by central banks worldwide.

Among the most powerful impetuses driving the international gold market is central banks' mounting gold reserve accumulation globally. Nations such as China, India, and Russia are considerably increasing their gold reserves to diversify foreign reserves and decrease their dependency on the U.S. dollar. It is fueled by economic uncertainty, inflation fears, and geopolitical instability, which cause gold to become a favored instrument for financial stability. Also, as international trade patterns change and digital money is introduced, central banks view gold as insurance against possible market instability. The International Monetary Fund (IMF) and the World Gold Council have regularly announced increased central bank purchases of gold, affirming gold's long-term worth as a safe financial asset. This ongoing demand underpins the world gold market, supporting prices and offering stability against economic volatility. The rise in gold reserves is not confined to emerging nations; developed countries are also rethinking their gold reserves in the face of changing global economic landscapes. The de-dollarization process, in which nations decrease reliance on the U.S. dollar for international transactions, is also driving gold accumulation. China and Russia have been especially busy in lowering their U.S. Treasury holdings in favor of gold to ensure financial stability during times of geopolitical tensions. In addition, gold's liquidity and widespread acceptability as a reserve asset are also best suited to stabilizing the economies of countries during periods of inflation or financial crisis. Such stable purchasing patterns by central banks set a firm base price for gold that discourages extreme drops and reaffirms gold's position as a long-term value store.

Global Gold Market Restraints and Challenges:

A major challenge facing the global gold market is its sensitivity to interest rate movements.

One of the biggest challenges for the world gold market is its susceptibility to interest rate fluctuations, especially those of the U.S. Federal Reserve and other central banks. As gold is a non-yielding asset, an increase in interest rates makes it less attractive than interest-paying assets such as bonds and savings accounts. As rates increase, investors divert their attention towards fixed-income investments, which creates lower demand for gold and downward price movements. In a situation where interest rates are low or unpredictable, gold demand is high as investors desire stability. The cyclical nature of rate-driven fluctuations causes the gold market to be very volatile, affecting short-term traders as well as long-term investors. In addition, abrupt monetary policy shifts have the potential to precipitate speculative pressures, which bring about rapid price fluctuations and complicate the forecasting of market direction by business enterprises and governments alike. Beyond rate increases, the expectation of monetary policy changes has the capacity to set market movements in motion. Market players watch closely what central banks are saying, and even subtle indications of imminent future rate hikes cause gold prices to correct promptly. Also, gold prices are affected by inflation expectations—when inflation increases more rapidly than interest rates, gold is still desirable, but if central banks raise rates sharply to contain inflation, demand for gold falters. This volatility complicates it for industries that use gold, like jewelry makers and technology firms, to effectively plan production costs. In addition, speculative gold futures trading increases price fluctuations, which introduces additional risk for investors and companies alike.

Global Gold Market Opportunities:

The international gold market offers many opportunities fueled by changing investment patterns, technological innovation, and sustainability efforts. The growth of digital gold investments, such as blockchain-supported gold trading and tokenized gold assets, is drawing a new generation of investors looking for secure and transparent transactions. Moreover, increasing demand for responsibly sourced and recycled gold is opening up opportunities for ethical mining and green refining technologies. The growing demand for gold from new industries such as electronics, nanotechnology, and renewable energy is also driving its industrial demand further. Further, with continued additions to central bank gold reserves, the market is stable with long-term investment potential. Owing to varying economic conditions and increasing geopolitical uncertainty, the role of gold as a safe-haven asset is ensuring its lasting relevance, offering a profitable opportunity for investors, financial institutions, and technology innovations.

GOLD MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6.51% |

|

Segments Covered |

By Product Type, APPLICATION, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Agnico, Harmony Gold Mining Company Limited, Newmont, Polyus, Furukawa, and Agnico Eagle |

Global Gold Market Segmentation:

Gold Market Segmentation: By Product Type

- Pusher Seals and Non-Pusher Seals

- Cartridge Seals

- Conventional Seals

- Balanced Seals and Unbalanced Seals

The world gold market is categorized into different product types, each having different uses across industries. Gold bullion, such as coins and bars, is highly used for investment and central bank reserves because of its high liquidity and store of value. Gold jewelry continues to be one of the biggest demand drivers, particularly in markets such as Asia-Pacific and the Middle East, where cultural and traditional reasons drive consumption. As technology-based investments become more prominent, digital gold and gold ETFs are gaining traction, enabling investors to invest in gold effortlessly without actually holding gold. Industrial gold is also an important sector, used heavily in electronics, medical equipment, and aerospace technologies for its high conductivity and corrosion resistance. Moreover, reused gold is also gaining significance as sustainability issues escalate, promoting ethical sourcing and environmentally friendly refining techniques. All these segments drive the world's demand for gold, influencing its market dynamics.

Gold Market Segmentation: By Application

- Oil and Gas Industry

- Chemical Industry

- Water Industry

- Power Industry

- Others

Gold has uses in various industries, solidifying its value and versatility. Investment is still the biggest use, as gold is universally accepted as a hedge against economic uncertainty and inflation. The demand for manufacturing jewelry continues, with luxury names and traditional markets depending on gold's cultural and aesthetic appeal. In the technology and electronics industry, gold is used in high-performance devices such as semiconductors and connectors, supporting industries like computing and telecommunications. The medical and healthcare sector also uses gold for medicine, diagnostic equipment, and biomedical applications because of its biocompatibility. Additionally, within aerospace and defense, gold's resistance to corrosion and extreme temperatures provides it with a vital role to play in spacecraft, satellite technologies, and military hardware. This wide variety of uses guarantees the perpetuation of gold's relevance in both established and new industries.

Gold Market Segmentation: Regional Analysis:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

The Asia-Pacific region dominates the global gold market of 2024 by a substantial margin, capturing 66.25% of the total market share. The reason behind this dominance is fueled by strong consumer demand in India and China, where gold has strong cultural and investment roots. North America stands at 15%, fueled by robust investment demand and sophisticated mining activities, led by the U.S. and Canada. Europe takes a 10% share, with stable demand from central banks and institutional buyers. South America takes up 5%, owing to its lucrative gold reserves and rising exports. The Middle East & Africa provide 3.75%, with a burgeoning market driven by jewelry demand and expanding mining activities. This division highlights Asia-Pacific's unrivaled dominance in the gold market, but other places still have critical roles to play in mining, investment, and consumption.

COVID-19 Impact Analysis on the Global Gold Market:

COVID-19 significantly influenced the international gold market, pushing prices to historical highs as investors turned to safe-haven assets during economic turmoil. Disruptions in supply chains, mine shutdowns, and decreased availability of workers temporarily curbed gold output, especially in major mining areas such as South Africa and Latin America. Demand for gold rose, however, driven by increased market volatility, low interest rates, and interventions by central banks. Jewelry purchases fell first in response to lockdowns and decreasing consumer outlays, while investment demand, led by purchases in gold ETFs and bullion, rocketed. Once the economies gradually opened up again, gold stabilized, but the lasting influence of the pandemic further established gold as the fundamental asset class to preserve wealth and ensure security amid uncertainty.

Latest Trends/ Developments:

The world gold market is experiencing dynamic transformations induced by changing investment patterns, technology growth, and sustainability efforts. Central banks continue to add gold reserves, with a notable increase in emerging markets such as China and India, bolstering gold as a safe-haven metal. Digital gold investments such as blockchain-supported gold trade and tokenized assets are on the rise, offering investors secure and convenient options. Sustainability issues are driving the sector, with increasingly greater emphasis placed on recycled and responsibly sourced gold to achieve environmental and ethical considerations. Moreover, changing interest rates and geopolitical risks are spurring investment demand, and increased Asian consumer spending is supporting the jewelry market. All these trends reinforce gold's timeless position as both an industrial and financial asset in a shifting global economy.

Key Players:

- Agnico

- Harmony Gold Mining Company Limited

- Newmont

- Polyus

- Pan American Silver

- Furukawa Co

- Gold Fields Limited

- Kinross Gold Corporation

Chapter 1. GOLD MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GOLD MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GOLD MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GOLD MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. GOLD MARKET- LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GOLD MARKET – By Product Type

6.1 Introduction/Key Findings

6.2 Pusher Seals and Non-Pusher Seals

6.3 Cartridge Seals

6.4 Conventional Seals

6.5 Balanced Seals and Unbalanced Seals

6.6 Y-O-Y Growth trend Analysis By Product Type

6.7 Absolute $ Opportunity Analysis By Product Type , 2025-2030

Chapter 7. GOLD MARKET – By Application

7.1 Introduction/Key Findings

7.2 Oil and Gas Industry

7.3 Chemical Industry

7.4 Water Industry

7.5 Power Industry

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. GOLD MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Product Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Product Type

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Product Type

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Product Type

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Product Type

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GOLD MARKET– Company Profiles – (Overview, Product Type Portfolio, Financials, Strategies & Developments)

9.1 Agnico

9.2 Harmony Gold Mining Company Limited

9.3 Newmont

9.4 Polyus

9.5 Pan American Silver

9.6 Furukawa Co

9.7 Gold Fields Limited

9.8 Kinross Gold Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Gold Market was valued at USD 291.68 billion in 2024 and is projected to reach a market size of USD 400 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 6.51%.

The rising demand for jewellery is set to drive market growth, and one of the strongest drivers of the global gold market is the increasing accumulation of gold reserves by central banks worldwide.

. Based on the Service Provider, the Global Gold Market is segmented into Mining companies, Refining companies, Investment firms, jewelry manufacturers, distributors, and suppliers.

. Asia-Pacific is the most dominant region for the Global Gold Market

Agnico, Harmony Gold Mining Company Limited, Newmont, Polyus, Furukawa, and Agnico Eagle are the key players in the Global Gold Market.