GNSS-aided inertial navigation system Market Size (2024 – 2030)

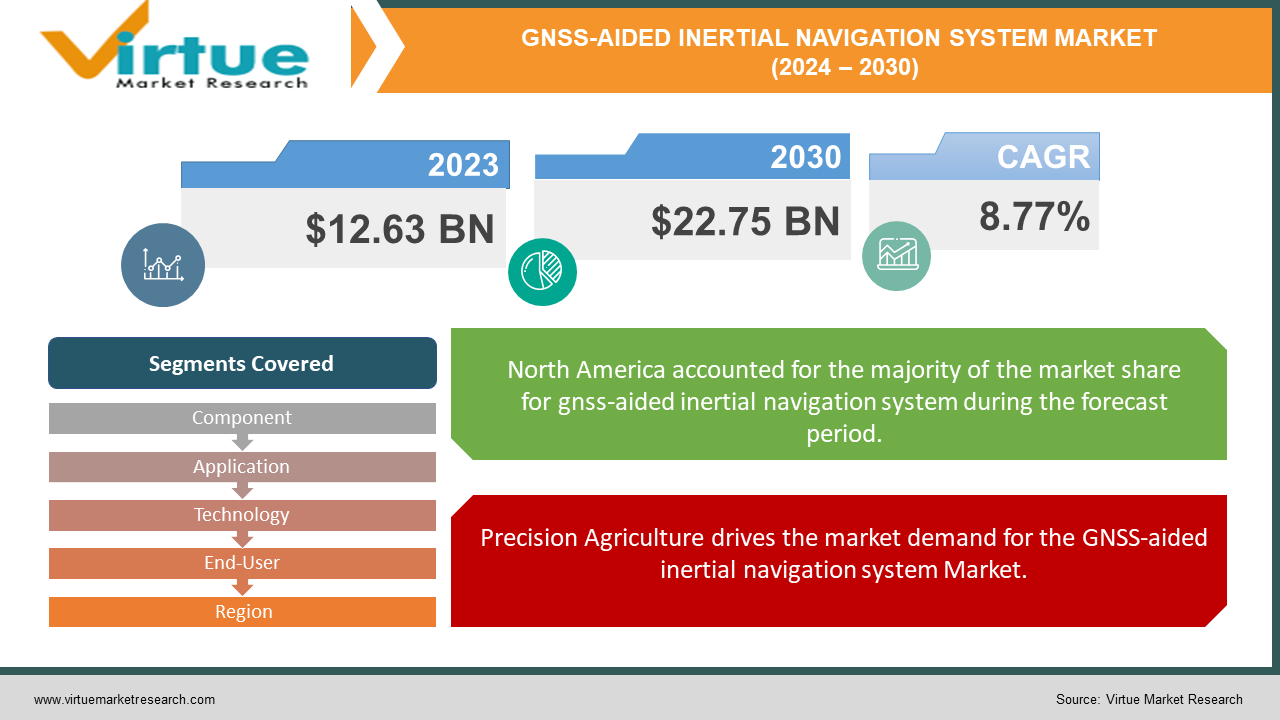

The GNSS-aided inertial navigation system Market is valued at USD 12.63 Billion and is projected to reach a market size of USD 22.75 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 8.77%.

Global Navigation Satellite System (GNSS)-aided inertial navigation systems are essential for precise positioning and navigation. A significant long-term driver for this market is the continuous advancement in autonomous vehicle technology. Autonomous vehicles, such as self-driving cars, drones, and unmanned aerial vehicles (UAVs), rely heavily on accurate navigation systems. GNSS-aided inertial navigation systems combine satellite signals with inertial sensors to provide highly accurate positioning, even in challenging environments where satellite signals may be weak or unavailable. This technological synergy is crucial for the safe and efficient operation of autonomous vehicles, driving long-term demand in the market. One notable opportunity in the GNSS-aided inertial navigation system market is the expanding use of these systems in the construction industry. With the need for accurate positioning and navigation on construction sites, GNSS-aided inertial navigation systems are becoming indispensable.

A prominent trend observed in the GNSS-aided inertial navigation system industry is the integration of artificial intelligence (AI) and machine learning (ML) algorithms. These advanced technologies are being incorporated into navigation systems to improve their accuracy and reliability.

Key Market Insights:

The GNSS-aided inertial navigation system Market is projected to expand at a compound annual growth rate of over 8.77% in the coming seven years, propelled by increasing urbanization and population growth in major cities worldwide.

Honeywell International Inc. - United States, Northrop Grumman Corporation - United States, Collins Aerospace (a unit of Raytheon Technologies) - United States are some examples of GNSS-aided inertial navigation system Market.

North America, Europe, Asia-Pacific, and Latin America account for approximately 65-70 % of the GNSS-aided inertial navigation system Market, driven by the Rise of Autonomous Vehicles, Precision Agriculture, Construction and Infrastructure Development & Integration of Artificial Intelligence and Machine Learning.

GNSS-aided inertial navigation system Market Drivers:

The rise of Autonomous Vehicles drives the market demand for the GNSS-aided inertial navigation system Market.

The rapid advancement of autonomous vehicle technology is a major driver of the GNSS-aided inertial navigation system market. Self-driving cars, drones, and unmanned aerial vehicles (UAVs) rely on precise navigation to operate safely and efficiently. GNSS-aided inertial navigation systems combine data from satellite signals with inertial sensors to provide highly accurate positioning. This is especially crucial in environments where satellite signals may be weak or obstructed, such as urban canyons or dense forests. As the demand for autonomous vehicles continues to grow, so does the need for reliable and precise navigation systems.

Precision Agriculture drives the market demand for the GNSS-aided inertial navigation system Market.

Modern agriculture is increasingly adopting precision farming techniques to optimize crop yields and reduce resource consumption. GNSS-aided inertial navigation systems play a vital role in this transformation by enabling farmers to monitor and manage their fields with high accuracy. These systems assist in tasks such as planting, fertilizing, and harvesting, ensuring that every action is performed at the right time and place. This precision helps minimize waste, lower costs, and increase productivity, making GNSS-aided inertial navigation systems indispensable tools in the agricultural sector.

Construction and Infrastructure Development drive the market demand for the GNSS-aided inertial navigation system Market.

The construction industry is another significant market driver for GNSS-aided inertial navigation systems. Accurate positioning and navigation are essential for various construction activities, from surveying land to controlling machinery. GNSS-aided inertial navigation systems provide the precision needed for these tasks, improving efficiency and safety on construction sites. For example, they help in automating construction equipment, ensuring that excavation and building processes are carried out precisely according to plan. As infrastructure projects continue to expand globally, the demand for these advanced navigation systems is set to increase.

Integration of Artificial Intelligence and Machine Learning drives the market demand for GNSS-aided inertial navigation system Market.

The integration of artificial intelligence (AI) and machine learning (ML) algorithms is revolutionizing the capabilities of GNSS-aided inertial navigation systems. These advanced technologies enable systems to process large amounts of data from GNSS and inertial sensors, learning from patterns and making real-time adjustments to enhance positioning accuracy. This AI-driven improvement makes navigation systems more adaptable and reliable in various applications, from urban navigation to complex industrial operations. As AI and ML continue to evolve, their incorporation into GNSS-aided inertial navigation systems will drive further market growth by enhancing the functionality and reliability of these systems.

GNSS-aided inertial navigation system Market Restraints and Challenges:

Despite the promising growth of the GNSS-aided inertial navigation system market, several significant restraints and challenges must be addressed. One of the primary challenges is the high cost associated with these advanced navigation systems. The integration of sophisticated GNSS and inertial sensors, along with the development of robust algorithms and software, contributes to the overall expense. This high cost can be a barrier for smaller businesses or industries with limited budgets, hindering widespread adoption. Additionally, the maintenance and calibration of these systems require specialized skills and equipment, adding to the long-term operational costs.

Another major challenge is the susceptibility of GNSS signals to interference and jamming. GNSS signals, which are crucial for accurate positioning, can be disrupted by various factors such as atmospheric conditions, physical obstructions, or intentional jamming. In environments like urban canyons or dense forests, signal blockage or multipath interference can significantly degrade the accuracy of navigation systems. Furthermore, the increasing threat of cyber-attacks and signal spoofing poses a significant risk to the reliability and security of GNSS-aided inertial navigation systems. To overcome these challenges, continuous advancements in anti-jamming technologies, robust encryption methods, and alternative positioning solutions are essential, ensuring the systems' resilience and reliability in diverse operational environments.

GNSS-aided inertial navigation system Market Opportunities:

One significant opportunity in the GNSS-aided inertial navigation system market lies within the construction industry. As construction projects become more complex and demand higher precision, the adoption of advanced navigation systems is critical. GNSS-aided inertial navigation systems offer precise positioning, which is essential for tasks such as land surveying, machine control, and real-time monitoring of construction equipment. By automating these processes, construction companies can enhance efficiency, reduce human error, and maintain strict adherence to project timelines. This not only improves productivity but also ensures the safety of workers by minimizing the need for manual interventions in hazardous environments. As urbanization and infrastructure development continue to surge globally, the construction industry's reliance on these advanced navigation systems is expected to grow, presenting a substantial market opportunity.

Another promising opportunity is the expanding use of GNSS-aided inertial navigation systems in the field of precision agriculture. As the global population increases, so does the demand for food, necessitating more efficient agricultural practices. Precision agriculture relies on accurate navigation to optimize field management, ensuring precise planting, fertilizing, and harvesting. GNSS-aided inertial navigation systems enable farmers to perform these tasks with high accuracy, leading to better crop yields and resource management. Additionally, these systems support the integration of autonomous farming machinery, further enhancing operational efficiency. As the agriculture sector seeks to maximize productivity and sustainability, the adoption of GNSS-aided inertial navigation systems offers a valuable solution, driving market growth in this area

GNSS-AIDED INERTIAL NAVIGATION SYSTEM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.77% |

|

Segments Covered |

By Component, Application, Technology, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Honeywell International Inc. - United States, Northrop Grumman Corporation - United States, Collins Aerospace (a unit of Raytheon Technologies) - United States, Thales Group - France, Leonardo S.p.A. - Italy, General Atomics - United States, Safran Electronics & Defense - France, Rockwell Collins- United States, InvenSense (a TDK Group Company) - United States, STMicroelectronics - Switzerland, VectorNav Technologies - United States, Orolia - France, Textron Systems - United States, Esterline Technologies Corporation - United States, IRIS Technology - Spain, Tersus GNSS Inc. - China, Trimble Inc.-United States, Aerojet Rocketdyne - United States, Sensonor AS - Norway, Xsens Technologies - Netherlands |

GNSS-aided inertial navigation system Market Segmentation: By Component

-

GNSS Receiver

-

Inertial Measurement Unit

-

Data Processing Unit

-

Software

-

Others

The Inertial Measurement Unit (IMU) stands as the largest component within the GNSS-aided inertial navigation system market. IMUs are critical to the functionality of these systems, providing the necessary inertial data that complements GNSS signals to ensure accurate and reliable navigation. These units consist of accelerometers and gyroscopes that measure linear acceleration and angular velocity, respectively. The demand for IMUs is high across various sectors, including aerospace, defense, automotive, and industrial applications, due to their essential role in enhancing navigation precision, especially in environments where GNSS signals are weak or obstructed. Their ubiquitous use in critical applications, such as aircraft navigation, missile guidance, and autonomous vehicle operations, underlines their significance in the market. The robust growth of industries relying heavily on precise navigation further cements the IMU’s position as the largest component segment.

Software is emerging as the fastest-growing component in the GNSS-aided inertial navigation system market. The integration of advanced algorithms and artificial intelligence (AI) into navigation software is revolutionizing the accuracy and functionality of these systems. As industries increasingly adopt autonomous technologies, the need for sophisticated software that can process complex data from both GNSS and inertial sensors in real time is soaring. This software not only enhances the performance of navigation systems but also introduces features such as predictive maintenance, improved user interfaces, and adaptive learning capabilities. The rapid advancement in AI and machine learning technologies is driving continuous innovation in navigation software, making it a critical growth area. Moreover, the shift towards cloud-based solutions and the increasing reliance on real-time data analytics are further propelling the demand for advanced navigation software, establishing it as the fastest-growing component in the market.

GNSS-aided inertial navigation system Market Segmentation: By Application

-

Aerospace and Defense

-

Automotive

-

Marine

-

Agriculture

-

Construction

-

Industrial

The aerospace and defense sector is the largest application area for GNSS-aided inertial navigation systems. These systems are integral to a wide range of military and aviation operations, providing critical navigation and positioning data. In aerospace, GNSS-aided inertial navigation systems ensure precise navigation for aircraft, enhancing flight safety and efficiency. In the defense sector, these systems are indispensable for missile guidance, targeting accuracy, and the navigation of unmanned aerial vehicles (UAVs). The high stakes associated with military and aerospace operations necessitate the use of reliable and precise navigation systems, driving substantial demand in this application area. The ongoing advancements in military technology and the increasing adoption of UAVs for surveillance, reconnaissance, and combat further bolster the prominence of the aerospace and defense sector as the largest market segment.

The automotive sector is the fastest-growing application for GNSS-aided inertial navigation systems, driven by the rapid development and adoption of autonomous vehicles and advanced driver assistance systems (ADAS). These navigation systems are crucial for the safe and efficient operation of self-driving cars, providing accurate positioning data that enables autonomous vehicles to navigate complex environments, avoid obstacles, and adhere to traffic regulations. As car manufacturers and technology companies race to bring autonomous vehicles to market, the demand for reliable and precise navigation systems is surging. Additionally, the integration of GNSS-aided inertial navigation systems in ADAS features, such as lane-keeping assistance, adaptive cruise control, and parking automation, is becoming increasingly common in modern vehicles. The push towards smarter, safer, and more autonomous driving experiences is propelling the automotive sector to be the fastest-growing application area in the GNSS-aided inertial navigation system market.

GNSS-aided inertial navigation system Market Segmentation: By Technology

-

MEMS

-

Fiber Optic Gyros

-

Ring Laser Gyros

-

Mechanical Gyros

MEMS (Micro-Electro-Mechanical Systems) technology is the largest segment in the GNSS-aided inertial navigation system market. MEMS devices are small, lightweight, and cost-effective sensors used in a wide range of applications. In the context of GNSS-aided inertial navigation systems, MEMS-based IMUs (Inertial Measurement Units) provide crucial measurements of acceleration and angular velocity. These sensors are used extensively in consumer electronics, automotive systems, and industrial applications due to their affordability and compact size. For example, MEMS sensors are commonly found in smartphones for features like screen orientation and in cars for navigation and stability control. Their scalability and ability to integrate with GNSS technology make them the dominant technology in the market. As these sensors continue to advance, offering improved performance and reduced costs, MEMS remains the largest and most established technology in the GNSS-aided inertial navigation system market.

Fiber optic gyros are the fastest-growing technology segment in the GNSS-aided inertial navigation system market. This technology uses the interference of light waves in a fiber optic coil to measure rotational movements, offering high precision and stability. Fiber optic gyros are particularly valued in applications that require extremely accurate and reliable navigation data, such as in aerospace and defense systems. Their growth is driven by the increasing demand for high-performance navigation solutions in advanced military equipment, aircraft, and high-end commercial applications. Recent advancements in fiber optic technology have led to the development of more compact, cost-effective, and higher-performing gyros. This technological evolution is fueling the expansion of fiber optic gyros in the market, as industries seek to enhance their navigation systems with cutting-edge technology that provides superior performance in challenging environments.

GNSS-aided inertial navigation system Market Segmentation: By End-User

-

Commercial

-

Military

-

Industrial

-

Consumer

In the GNSS-aided inertial navigation system market, the aerospace and defense sector is the largest end-user. This sector's expansive use of navigation systems stems from the critical nature of their operations, which demand the highest levels of precision and reliability. Aerospace applications include the navigation of commercial and military aircraft, where GNSS-aided inertial navigation systems ensure accurate flight paths, precise landing procedures, and effective air traffic management. In defense, these systems are essential for missile guidance, target tracking, and the operation of advanced military UAVs (Unmanned Aerial Vehicles). The large-scale and high-stakes nature of aerospace and defense operations requires sophisticated navigation systems that can function in diverse and challenging environments. As these sectors continue to invest in technology to maintain operational superiority and efficiency, they remain the largest consumers of GNSS-aided inertial navigation systems.

The automotive sector is the fastest-growing end-user of GNSS-aided inertial navigation systems. This growth is driven by the rapid development and deployment of autonomous vehicles and advanced driver assistance systems (ADAS). Self-driving cars and new vehicle technologies require precise navigation and sensor fusion to operate safely and effectively on roads. GNSS-aided inertial navigation systems provide the data needed for autonomous vehicles to make real-time decisions, manage routes, and avoid obstacles. The increasing emphasis on smart mobility solutions, enhanced safety features, and innovative driving experiences is fueling the demand for these advanced systems. Additionally, the growing trend of integrating GNSS-aided inertial navigation into ADAS features like lane-keeping assistance, adaptive cruise control, and automatic parking contributes to the automotive sector’s rapid growth. As manufacturers strive to meet consumer expectations for safer and more advanced vehicles, the automotive sector is expanding its use of GNSS-aided inertial navigation systems at a fast pace.

GNSS-aided inertial navigation system Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East and Africa

North America is the largest region in the GNSS-aided inertial navigation system market. This dominance stems from the region's strong presence in both the aerospace and defense sectors, as well as its advanced automotive industry. In North America, countries like the United States and Canada lead in developing and deploying high-precision navigation systems for military applications, including missile guidance, aircraft navigation, and UAVs. The U.S. Department of Defense and major defense contractors invest heavily in advanced GNSS-aided inertial navigation technologies to maintain national security and enhance military capabilities. Additionally, North American automotive companies are at the forefront of developing autonomous driving technologies, integrating GNSS-aided inertial navigation systems into advanced driver assistance systems (ADAS). The combination of high defense spending, cutting-edge aerospace technology, and innovations in automotive technology makes North America the largest market for GNSS-aided inertial navigation systems.

The Asia-Pacific region is the fastest-growing market for GNSS-aided inertial navigation systems. This rapid growth is fueled by significant advancements in technology and increasing investments in both infrastructure and defense. Countries like China, Japan, and India are leading the way in adopting advanced navigation systems for various applications. In China, there is a strong focus on enhancing military capabilities and expanding the use of autonomous vehicles and drones for both commercial and defense purposes. Japan is advancing its technology in the aerospace sector, while India is increasing its defense investments and infrastructure development. Additionally, the booming automotive industry in the Asia-Pacific region is driving the demand for sophisticated navigation systems as manufacturers develop new models with advanced driver assistance features and autonomous driving technologies. The region’s rapid urbanization, expanding defense budgets, and growth in technology sectors contribute to its status as the fastest-growing market for GNSS-aided inertial navigation systems.

COVID-19 Impact Analysis on GNSS-aided inertial navigation system Market:

The COVID-19 pandemic initially caused significant disruptions in the GNSS-aided inertial navigation system market. Lockdowns, travel restrictions, and supply chain interruptions led to delays in the production and delivery of key components such as GNSS receivers and inertial measurement units (IMUs). Many aerospace and defense projects were put on hold as governments and companies adjusted to the new reality of remote work and operational restrictions. Manufacturing facilities faced closures, and the movement of goods across borders was slowed, impacting the availability of essential parts for navigation systems. However, these challenges also accelerated the adoption of remote technologies and digital solutions. Companies quickly adapted by shifting to virtual meetings, enhancing their online collaboration tools, and exploring innovative ways to maintain project momentum despite physical barriers. This period of adjustment highlighted the importance of resilient supply chains and digital infrastructure, which are expected to influence market strategies moving forward.

Latest Trends/ Developments:

One of the most exciting recent trends in the GNSS-aided inertial navigation system market is the integration of artificial intelligence (AI) and machine learning (ML) technologies. These advanced algorithms are transforming how GNSS-aided inertial navigation systems operate by enhancing their ability to process complex data and make real-time adjustments. AI and ML can analyze vast amounts of sensor data from both GNSS satellites and inertial measurement units (IMUs) to improve accuracy and reliability. For instance, AI-driven algorithms can predict and compensate for errors caused by satellite signal interruptions or environmental factors, leading to more precise navigation solutions. This trend is particularly evident in autonomous vehicles, where AI helps refine navigation algorithms for better route planning, obstacle detection, and adaptive control systems. The ongoing development of AI and ML is making GNSS-aided inertial navigation systems smarter and more efficient, driving innovation across industries from aerospace to automotive.

Key Players:

-

Honeywell International Inc. - United States

-

Northrop Grumman Corporation - United States

-

Collins Aerospace (a unit of Raytheon Technologies) - United States

-

Thales Group - France

-

Leonardo S.p.A. - Italy

-

General Atomics - United States

-

Safran Electronics & Defense - France

-

Rockwell Collins- United States

-

InvenSense (a TDK Group Company) - United States

-

STMicroelectronics - Switzerland

-

VectorNav Technologies - United States

-

Orolia - France

-

Textron Systems - United States

-

Esterline Technologies Corporation - United States

-

IRIS Technology - Spain

-

Tersus GNSS Inc. - China

-

Trimble Inc.-United States

-

Aerojet Rocketdyne - United States

-

Sensonor AS - Norway

-

Xsens Technologies - Netherlands

Chapter 1. GNSS-aided inertial navigation system Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. GNSS-aided inertial navigation system Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. GNSS-aided inertial navigation system Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. GNSS-aided inertial navigation system Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. GNSS-aided inertial navigation system Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. GNSS-aided inertial navigation system Market – By Component

6.1 Introduction/Key Findings

6.2 GNSS Receiver

6.3 Inertial Measurement Unit

6.4 Data Processing Unit

6.5 Software

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Component

6.8 Absolute $ Opportunity Analysis By Component, 2024-2030

Chapter 7. GNSS-aided inertial navigation system Market – By Technology

7.1 Introduction/Key Findings

7.2 MEMS

7.3 Fiber Optic Gyros

7.4 Ring Laser Gyros

7.5 Mechanical Gyros

7.6 Y-O-Y Growth trend Analysis By Technology

7.7 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 8. GNSS-aided inertial navigation system Market – By Application

8.1 Introduction/Key Findings

8.2 Aerospace and Defense

8.3 Automotive

8.4 Marine

8.5 Agriculture

8.6 Construction

8.7 Industrial

8.8 Y-O-Y Growth trend Analysis End-Use Industry

8.9 Absolute $ Opportunity Analysis End-Use Industry, 2024-2030

Chapter 9. GNSS-aided inertial navigation system Market – By End-User

9.1 Introduction/Key Findings

9.2 Commercial

9.3 Military

9.4 Industrial

9.5 Consumer

9.6 Y-O-Y Growth trend Analysis End-User

9.7 Absolute $ Opportunity Analysis End-User, 2024-2030

Chapter 10. GNSS-aided inertial navigation system Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Component

10.1.2.1 By Technology

10.1.3 By Application

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Component

10.2.3 By Technology

10.2.4 By Application

10.2.5 By End-User

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Component

10.3.3 By Technology

10.3.4 By Application

10.3.5 By End-User

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Component

10.4.3 By Technology

10.4.4 By Application

10.4.5 By End-User

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Component

10.5.3 By Technology

10.5.4 By Application

10.5.5 By End-User

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. GNSS-aided inertial navigation system Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Honeywell International Inc. - United States

11.2 Northrop Grumman Corporation - United States

11.3 Collins Aerospace (a unit of Raytheon Technologies) - United States

11.4 Thales Group - France

11.5 Leonardo S.p.A. - Italy

11.6 General Atomics - United States

11.7 Safran Electronics & Defense - France

11.8 Rockwell Collins- United States

11.9 InvenSense (a TDK Group Company) - United States

11.10 STMicroelectronics - Switzerland

11.11 VectorNav Technologies - United States

11.12 Orolia - France

11.13 Textron Systems - United States

11.14 Esterline Technologies Corporation - United States

11.15 IRIS Technology - Spain

11.16 Tersus GNSS Inc. - China

11.17 Trimble Inc.-United States

11.18 Aerojet Rocketdyne - United States

11.19 Sensonor AS - Norway

11.20 Xsens Technologies - Netherlands

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The GNSS-aided inertial navigation system Market is valued at USD 12.63 Billion and is projected to reach a market size of USD 22.75 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 8.77%.

The rise of Autonomous Vehicles, Precision Agriculture, Construction and Infrastructure Development & Integration of Artificial Intelligence and Machine Learning are the major drivers of the GNSS-aided inertial navigation system Market.

MEMS, Fiber Optic Gyros, Ring Laser Gyros, and Mechanical Gyros are the segments under the GNSS-aided inertial navigation system Market by technology.

North America is the most dominant region for the GNSS-aided inertial navigation system Market.

Asia-Pacific is the fastest-growing region in the GNSS-aided inertial navigation system Market.