Gluten-Free Desserts and Ice Creams Market Size (2025 – 2030)

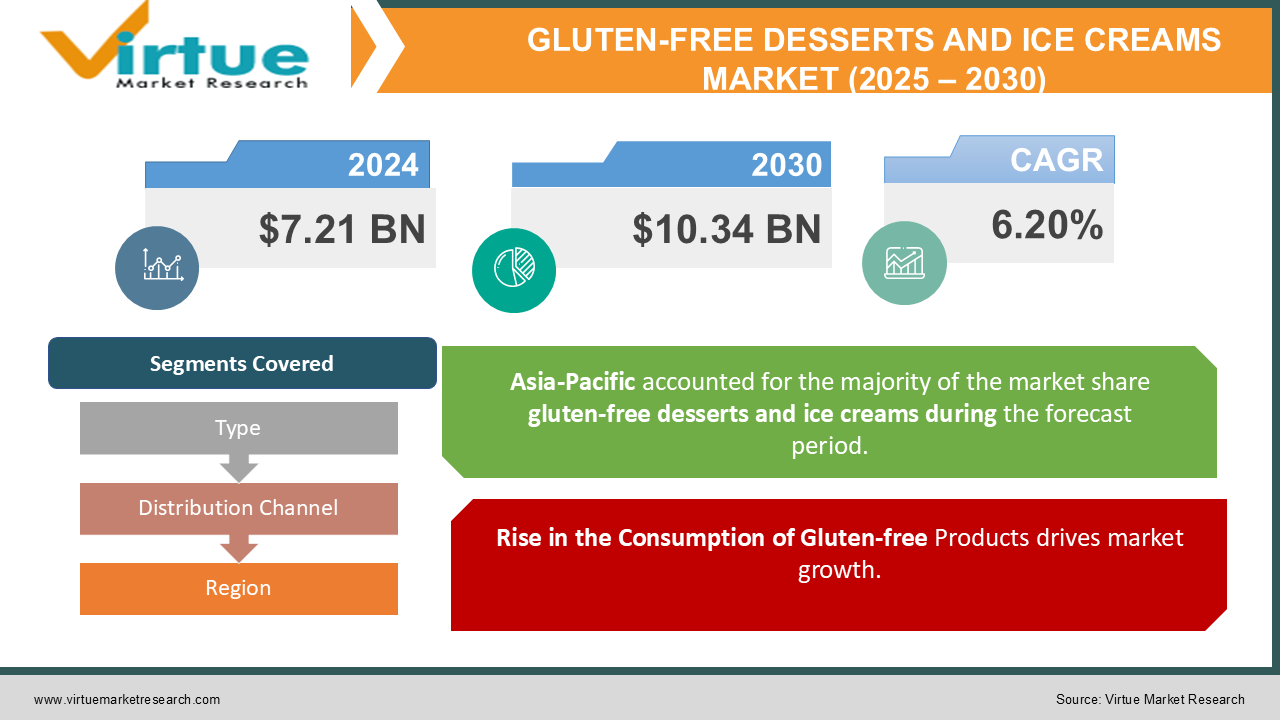

The Gluten-Free Desserts and Ice Creams Market was valued at USD 7.21 billion in 2024. Over the forecast period of 2025-2030, it is projected to reach USD 10.34 billion by 2030, growing at a CAGR of 6.20%.

Gluten-free foods are those that do not contain gluten, a protein found in wheat, barley, rye, and other similar grains. These products are specially developed and processed to remove gluten, ensuring their safety for individuals with gluten-related conditions, such as celiac disease, wheat allergy, or non-celiac gluten sensitivity. A wide range of gluten-free options is available in the market, including bread, cereals, pasta, snacks, and baked goods, offering suitable choices for those adhering to a gluten-free lifestyle.

Key Market Insights:

-

The increasing prevalence and diagnosis of celiac disease and gluten sensitivities are notably expanding the consumer demand for gluten-free products. As awareness and knowledge of these conditions continue to rise, a growing number of individuals are being diagnosed and recommended to follow a gluten-free diet. This has led to an increased demand for gluten-free options across various demographic groups, including both children and adults.

-

Additionally, advancements in diagnostic methods have simplified the identification of individuals who could benefit from a gluten-free diet, further contributing to the growth of the market.

Gluten-Free Desserts and Ice Creams Market Drivers:

Rise in the Consumption of Gluten-free Products drives market growth.

Celiac disease, an autoimmune disorder that affects the small intestine and is triggered by gluten, has seen an increase in prevalence in recent years. A survey conducted by the Mayo Clinic identified three key groups of individuals following a gluten-free diet. The first group includes those diagnosed with celiac disease, the second consists of individuals with undiagnosed celiac disease, and the third group is made up of people without celiac disease who are choosing to avoid gluten. According to Beyond Clinics, approximately 1 in 133 Americans, or around 1% of the population, is expected to have celiac disease by 2021. In 2021, the Ministry of Agriculture, Food, and Environment in Spain reported that the consumption of gluten-free dairy products accounted for approximately 19.1%. The growing number of individuals with gluten sensitivities, allergies, and celiac disease is significantly driving the market demand for gluten-free products.

Gluten-Free Desserts and Ice Creams Market Restraints and Challenges:

High Cost of Gluten-Free Products hinder market growth.

The production of gluten-free products typically requires specialized ingredients and manufacturing processes, which can lead to higher production costs. Furthermore, the relatively niche nature of the gluten-free market may prevent economies of scale from being fully achieved, further driving up prices. This can make gluten-free products less affordable for certain consumers, particularly those with limited disposable income or heightened price sensitivity. Consequently, the cost remains a significant barrier for many individuals attempting to adopt a gluten-free diet.

Gluten-Free Desserts and Ice Creams Market Opportunities:

In recent years, there has been a notable increase in consumer demand for natural, organic, and health-focused food products. This surge in interest for nutritious options, along with the rising number of clean-label product claims, is contributing to the global market's expansion. The growing prevalence of gluten intolerance and celiac disease is a key driver behind the increased demand for gluten-free food products, including desserts and ice cream.

Consumers are increasingly adopting a "clean living" approach, favoring healthier dietary choices. Furthermore, gluten-free foods are now seen as mainstream lifestyle products. Several organizations, including the Association of European Coeliac Societies and the German Coeliac Society, are playing a key role in shaping the gluten-free market by regulating the use of gluten-free claims on packaged foods. However, one of the major challenges to the growth of the global gluten-free dessert and ice cream market is the higher cost of these products compared to their regular counterparts. This price difference is primarily due to the increased production costs and the use of high-quality raw materials.

GLUTEN-FREE DESSERTS AND ICE CREAMS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6.20% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Amy's Kitchen, Inc, Bob's Red Mill Natural Foods Kelkin Ltd. Seitz glutenfrei Enjoy Life Foods, Dun & Bradstreet, Inc., Silly Yaks- For Real, FREEDOM FOODS GROUP LIMITED, The Kraft Heinz Company, Quinoa Corporation |

Gluten-Free Desserts and Ice Creams Market Segmentation: By type

-

Dessert

-

Ice cream

Guilt-free desserts have become an important source of fiber, minerals, and vitamins, significantly driving market growth. The rising prevalence of gluten intolerance has prompted manufacturers to focus on creating gluten- and guilt-free products. These desserts, made from plant-based ingredients, offer a versatile option for both vegan and gluten-sensitive consumers. They contribute to improved digestion, increased energy levels, and better cholesterol management. Additionally, the growing demand for gluten-free ready meals and convenience foods, alongside the increasing incidence of celiac disease, presents lucrative opportunities for market players.

However, the high cost of raw materials and price sensitivity continue to be major challenges that could hinder the growth of the global guilt-free desserts market. These desserts have become a healthy alternative to animal-based products, making them essential for individuals with dietary restrictions. Furthermore, increasing health consciousness, rising disposable incomes, and greater awareness of guilt-free options are all contributing to the expansion of the guilt-free dessert market worldwide.

Gluten-Free Desserts and Ice Creams Market Segmentation:By distribution channel

-

Supermarket/hypermarket

-

Convenience store

-

Specialty stores

-

Online retailers

-

Others

Guilt-free desserts are increasingly available at a variety of food establishments, including restaurants, cafes, and hotels. Desserts such as cakes, pastries, and baked pies have gained significant popularity due to their appeal at social events like birthdays and festive parties. However, with consumers increasingly engaging in bulk shopping, retail channels such as supermarkets have become the most convenient and reliable option for customers worldwide. In addition to the dominance of hypermarkets and supermarkets, the specialty food and drink grocery market is also experiencing steady, modest growth. To further expand the availability of guilt-free products, they are now being offered in convenience stores, contributing to the overall growth of the guilt-free desserts and ice cream market.

Gluten-Free Desserts and Ice Creams Market Segmentation- by region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

The Asia-Pacific region is the fastest-growing market for gluten-free products, including desserts and ice cream. This segment has become a key alternative for individuals with gluten intolerance and those conscious of their health. Increased disposable income in emerging markets, combined with significant spending by the upper-class population on healthier foods, has further fueled market growth. In January 2021, Prerna's Handcrafted Ice Cream launched India's first gluten-free dairy ice creams, made with low-fat cream (without milk) and free from stabilizers, emulsifiers, preservatives, artificial colors, flavors, and thickeners. With a growing interest in fitness across all age groups in the region, consumers are increasingly choosing gluten-free products over gluten-containing options, which are often perceived as less healthy. According to Agriculture and Agri-Food Canada, retail sales of free-from-dairy products in South Korea are expected to reach approximately USD 410.7 million by 2022. Fitness enthusiasts and health-conscious consumers are opting for gluten-free products, particularly in the on-the-go snack category.

North America is projected to dominate the market due to the rising incidence of celiac disease and strong demand for gluten-free products in the region. The growing prevalence of gluten intolerance, coupled with heightened awareness of celiac disease, is driving the demand for gluten-free foods.

Europe is also expected to experience significant growth, driven by a marked increase in awareness of celiac disease and gluten intolerance. The region is witnessing a shift in consumer preferences toward healthier food options, including gluten-free products. This evolving consumer behavior, alongside a better understanding of gluten-related disorders, is anticipated to drive the demand for gluten-free products across Europe.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic has significantly affected the global food and beverage industry, impacting both manufacturing and revenue worldwide. The initial shutdowns led to a global food crisis, disrupting production on a global scale. These disruptions were primarily caused by supply chain challenges, including shortages of raw materials, limited workforce availability, and transportation restrictions. As a result, the availability of guilt-free desserts was negatively affected, posing a potential risk to consumers' health. However, with the easing of lockdown measures, various strategies have been proposed to improve economic conditions and stabilize the industry in the coming years.

Latest Trends/ Developments:

In February 2024, GOODLES, renowned for its innovative take on mac and cheese, introduced its first gluten-free products: GLUTEN-FREE VEGAN BE HEROES and GLUTEN-FREE CHEDDY MAC. These new offerings are both nutritious and flavorful, providing all the deliciousness without the gluten.

In January 2023, Ben & Jerry's introduce a new vegan, gluten-free flavor: Oatmeal Dream Pie. This flavor features a vanilla ice cream base filled with chunks of oatmeal cookies and swirls of marshmallow.

In October 2022, a gluten-free gourmet dessert brand debuted in Tesco with the launch of the Dough Chi. This vegan and gluten-free dessert combines vanilla frozen dessert wrapped in soft chocolate chip cookie dough and sprinkled with cookie crumbs.

In April 2021, General Mills, Inc. launched a new gluten-free yogurt with an enhanced protein ratio. Made with ultrafiltered nonfat milk and whey protein, this dairy-based snack provides 25 grams of protein and 3 grams of sugar per serving. Ratio Protein yogurt, available in single-serve cups, comes in five flavors: strawberry, vanilla, blueberry, coconut, and key lime, with each cup containing 170 calories, 7 grams of net carbs, and 4 grams of fat.

Key Players:

These are top 10 players in the Gluten-Free Desserts and Ice Creams Market :-

-

Amy's Kitchen, Inc

-

Bob's Red Mill Natural Foods Kelkin Ltd.

-

Seitz glutenfrei Enjoy Life Foods

-

Dun & Bradstreet, Inc.

-

Silly Yaks- For Real

-

FREEDOM FOODS GROUP LIMITED

-

The Kraft Heinz Company

-

Quinoa Corporation

Chapter 1. Gluten-Free Desserts and Ice Creams Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Gluten-Free Desserts and Ice Creams Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Gluten-Free Desserts and Ice Creams Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Gluten-Free Desserts and Ice Creams Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Gluten-Free Desserts and Ice Creams Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Gluten-Free Desserts and Ice Creams Market – By Type

6.1 Introduction/Key Findings

6.2 Dessert

6.3 Ice cream

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Gluten-Free Desserts and Ice Creams Market – By distribution channel

7.1 Introduction/Key Findings

7.2 Supermarket/hypermarket

7.3 Convenience store

7.4 Specialty stores

7.5 Online retailers

7.6 Others

7.7 Y-O-Y Growth trend Analysis By distribution channel

7.8 Absolute $ Opportunity Analysis By distribution channel, 2025-2030

Chapter 8. Gluten-Free Desserts and Ice Creams Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By distribution channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By distribution channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By distribution channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By distribution channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By distribution channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Gluten-Free Desserts and Ice Creams Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Amy's Kitchen, Inc

9.2 Bob's Red Mill Natural Foods

9.3 Kelkin Ltd.

9.4 Seitz glutenfrei Enjoy Life Foods

9.5 Dun & Bradstreet, Inc.

9.6 Silly Yaks- For Real

9.7 FREEDOM FOODS GROUP LIMITED

9.8 The Kraft Heinz Company

9.9 Quinoa Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The increasing prevalence and diagnosis of celiac disease and gluten sensitivities are notably expanding the consumer demand for gluten-free products.

The top players operating in the Gluten-Free Desserts and Ice Creams Market are - Amy's Kitchen, Inc, Bob's Red Mill Natural Foods, Kelkin Ltd., Seitz glutenfrei and Enjoy Life Foods.

The COVID-19 pandemic has significantly affected the global food and beverage industry, impacting both manufacturing and revenue worldwide.

In February 2024, GOODLES, renowned for its innovative take on mac and cheese, introduced its first gluten-free products: GLUTEN-FREE VEGAN BE HEROES and GLUTEN-FREE CHEDDY MAC.

The Asia-Pacific region is the fastest-growing region in the Gluten-Free Desserts and Ice Creams Market.