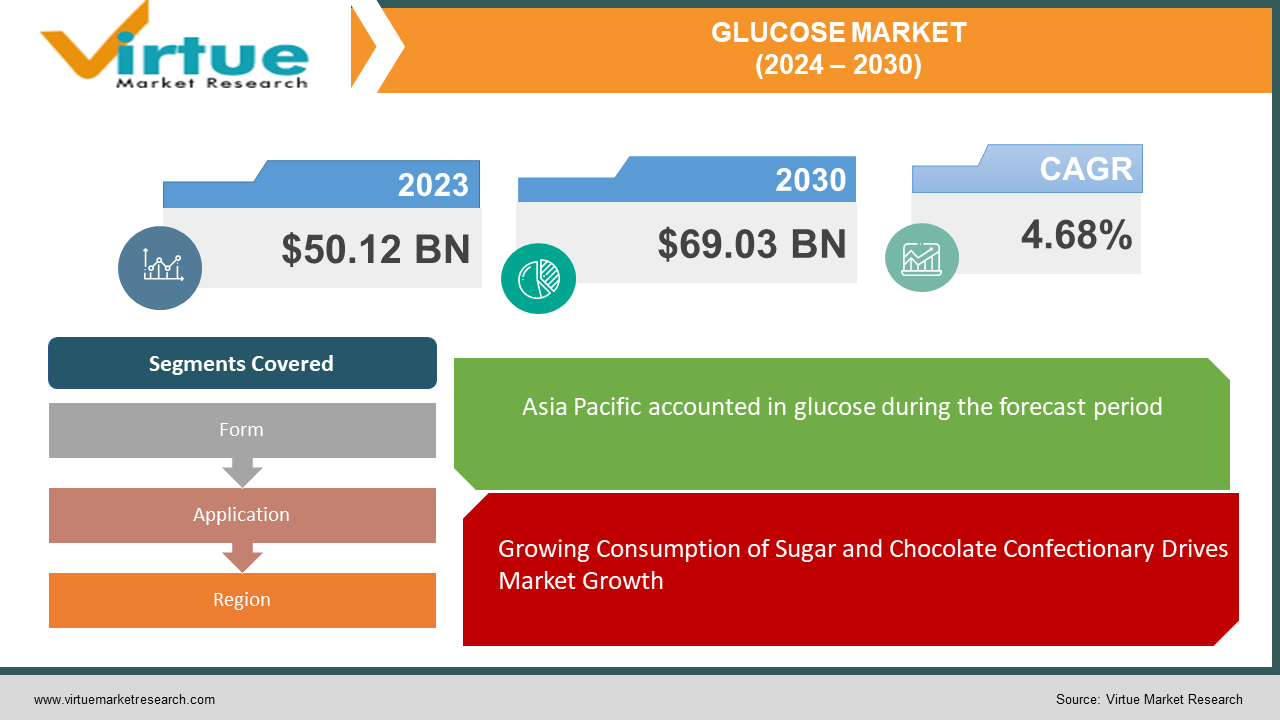

Glucose Market Size (2024 – 2030)

The Glucose Market was valued at USD 50.12 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 69.03 billion by 2030, growing at a CAGR of 4.68%.

Glucose, classified as a monosaccharide, an aldose, and a reducing sugar, stands as the predominant carbohydrate. Its chemical composition is denoted by the formula C6H12O6. The process of photosynthesis utilized by most plants and algae harnesses solar energy to synthesize glucose from water and carbon dioxide, a pivotal step in cellulose formation, the most ubiquitous carbohydrate in nature, particularly found in cell walls.

In the realm of energy metabolism, glucose reigns supreme as the primary energy source for all organisms. Its storage occurs in the form of polymers, predominantly as starch and amylopectin in plants, and glycogen in mammals. Recognized for its dextrorotatory properties, which cause it to rotate plane-polarized light to the right, thus serving as the foundation for the designation "D," it is also referred to as dextrose. Within the bloodstream, glucose maintains a concentration ranging from 65 to 110 mg/dL, earning it the moniker of blood sugar.

Key Market Insights:

In terms of composition, syrup emerges as the dominant segment within the market, commanding over 72% of the revenue share in the next 5 years. In 2023, the food and beverage sector emerged as the dominant force within the industry, commanding a significant share of approximately 55%.

Glucose Market Drivers:

Growing Consumption of Sugar and Chocolate Confectionary Drives Market Growth.

The confectionery industry is experiencing significant global expansion, particularly among adult demographics, driven by the increasing number of product innovations from major industry players. Manufacturers are actively engaging in experimentation with novel varieties of sweets and chocolates, aiming to enhance their profitability both within the region and on a global scale. Key ingredients for sugar-based confectionery include glucose syrups, sucrose, and inverted sugars.

Consumers' emotional and historical connections with these products also contribute substantially to their success in the marketplace. According to research from the London School of Economics and Political Science (LSE), chocolate consumption is associated with immediate pleasure, comfort, and the alleviation of negative moods or emotions. Additionally, traditional customs surrounding the consumption of chocolate and other sugary treats lead to heightened demand during festive occasions such as the New Year, Christmas, and Valentine's Week, driven by the tradition of exchanging sweet items with loved ones. Consequently, the anticipated increase in sugar and chocolate confectionery consumption is expected to further fuel market growth.

Increasing Demand for Natural Cosmetics raises market growth.

Glucose serves as a valuable ingredient in cosmetics and personal care products, leveraging its natural properties. It finds application as a flavoring agent, humectant, and skin-conditioning agent, among other roles. Sugar-based ingredients offer numerous benefits to skincare formulations due to their natural and non-toxic characteristics. The high solubility of glucose in water, along with its prebiotic and humectant properties, further enhances its appeal in cosmetics.

Various sugar-based cosmetic products are available in the market, including day creams, night creams, eye creams, and body lotions, as well as hair care products such as masks and styling products.

According to the National Library of Medicine of the National Center for Biotechnology Information, sugar is recognized as a well-established cosmetic ingredient known for its skin-whitening and moisturizing effects, with minimal side effects. Moreover, there is a growing trend among companies to invest in environmentally friendly surfactants and materials within the cosmetics market. For instance, Clariant AG, a Swiss multinational specialty chemicals company, offers green surfactants derived from plant sugars within its GlucoTain product line. These initiatives contribute to the expansion of the cosmetics market.

Glucose Market Restraints and Challenges:

High Health Risks due to Excess Consumption of Sugar Products hinder market growth.

Overindulgence in sugar and related products poses significant health risks, potentially leading to conditions such as diabetes, obesity, elevated blood pressure, inflammation, and fatty liver disease. These conditions, in turn, heighten the likelihood of experiencing heart attacks and strokes. Moreover, excessive sugar intake is associated with additional health concerns including tooth decay, acne, premature aging, and skin issues.

Furthermore, symptoms linked to excessive sugar consumption encompass low energy levels, mood fluctuations, and bloating. According to the Centers for Disease Control and Prevention (CDC), Americans tend to consume excessive amounts of added sugar, with an average daily intake of 17 teaspoons, equating to approximately 270 calories. The prevalence of such health risks stemming from overconsumption of sugar is anticipated to impede market growth.

Glucose Market Opportunities:

Increased investment in research and development across multiple sectors, including pharmaceuticals, food, and beverage, among others, coupled with a strategic approach to exploring untapped market segments, presents an advantageous opportunity for manufacturers in the market. One notable trend gaining momentum within the glucose market is the emergence of low-sugar glucose syrup variants. Leading companies in the glucose market are directing their efforts toward introducing low-sugar glucose syrups to meet consumer demand and bolster their market presence.

These low-sugar glucose syrups, typically derived from maize, are designed to provide stability, sweetness, and reduced sugar content across a range of products, including chewy candies, lollipops, hard-boiled candy, jellies, and gummies. Such innovations not only enhance the color and shelf-life stability of the final products but also mitigate issues such as stickiness and sugar recrystallization. These initiatives by key industry players are poised to unlock significant opportunities for market participants.

GLUCOSE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.68% |

|

Segments Covered |

By Form, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Roquette Freres, Sigma Aldrich Corporation, Gulshan Polyols, Tate & Lyle PLC, Atn Investments Pty Ltd., Archer Daniels Midland Company, Cargill, Inc., Ingredion, Inc., Pfizer, Inc., Grain Processing Corporation |

Glucose Market Segmentation: By Form

-

Syrup

-

Solid

The syrup segment commands a leading position in the global market and is anticipated to demonstrate a Compound Annual Growth Rate (CAGR) of 5.01% throughout the forecast period. Glucose syrup, typically characterized by its colorless, viscous consistency and sweet taste, is primarily derived from corn, tapioca, wheat, or rice through starch hydrolysis.

In pharmaceutical applications, liquid glucose finds usage in various formulations such as cough syrups, tonics, and injections. Furthermore, it serves as a valuable ingredient in cosmetics and personal care products, functioning as both a humectant and moisturizing agent.

A significant application of glucose syrups lies within the food and beverage industry, where it enhances the taste and texture of a wide array of products. Its unique properties, including its ability to prevent crystallization and lower the freezing point, contribute to maintaining product softness. Consequently, its utilization in sauces, ice creams, jams, and jellies has witnessed an uptick owing to its advantageous characteristics.

Glucose Market Segmentation: By Application

-

Food and Beverage

-

Pharmaceuticals

-

Cosmetics and Personal Care

-

Pulp and Paper

-

Others

The food and beverage segment commands the largest market share and is forecasted to demonstrate a Compound Annual Growth Rate (CAGR) of 4.8% over the forecast period. Glucose plays a pivotal role in enhancing the volume, smoothness, and taste of food and beverage products. Moreover, it contributes to improving stability and extending the shelf-life of these items. Sugar syrup, with its ability to modify viscosity and texture, influences the sensory attributes of food, thereby enhancing mouthfeel.

Glucose, also known as dextrose, is utilized across a diverse range of food formulations, including soft drinks, toppings, sauces, salad dressings, and soups. Furthermore, it imparts coating effects in confectionery applications and enhances the browning effect in baked goods. The rising popularity of sweetened food and beverages globally is attributed to their superior mouthfeel, driving demand.

According to the Organization for Economic Cooperation and Development, global sugar consumption is anticipated to reach 173.5 million metric tons, with a projected increase to 195.9 million metric tons by 2030. This growing demand for sweetened products is expected to bolster the growth of the glucose market.

Glucose Market Segmentation- by region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

In the glucose market, the Asia-Pacific region holds the highest global market share and is poised to exhibit a Compound Annual Growth Rate (CAGR) of 5.4% throughout the forecast period. The escalating demand for glucose in Asia-Pacific can be attributed to its vast consumer base and the presence of various end-use industries. Market development in this region is fueled by the availability of raw materials and substantial production capacities for glucose. The rapid growth of the food and beverage sector in Asia-Pacific further contributes to the expansion of the glucose market. Manufacturers are increasingly prioritizing sustainable ingredient sourcing in response to rising consumer demand for clean-label foods and beverages.

On the other hand, Europe is projected to demonstrate a CAGR of 3.9% over the forecast period. The European glucose market is characterized by fragmentation, with numerous small and medium-sized manufacturers operating in the sector. Corn serves as the primary raw material for dextrose production in Europe, leveraging the region's status as one of the leading corn producers. Regulatory and societal trends, including policy recommendations and industry commitments to reduce sugar content in various food and beverage products, suggest a potential stabilization or even decline in total sugar consumption in the EU despite the cessation of sugar production quotas.

Glucose holds appeal in many food applications in Europe due to its ability to be incorporated without altering the taste of the final product. Additionally, its versatility as a liquid syrup facilitates its use in certain food applications, while its capacity to enhance texture, color, and flavor surpasses that of artificial sweeteners. Consequently, European food manufacturers are expected to increase their demand for glucose over the forecast period, driven by these factors.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic has emerged as a profound health crisis, exerting significant impacts on nearly every industry worldwide, with enduring repercussions expected to affect manufacturing expansion throughout the projected period. Global lockdown measures and restrictions disrupted the supply chain, presenting formidable challenges for producers operating in the glucose, dextrose, and maltodextrin markets. Additionally, retailers faced continued pressure on profit margins amidst intense competition, pricing dynamics, and evolving consumer preferences, contributing to a deceleration in market growth.

Despite these challenges, the demand for glucose experienced an upsurge following the COVID-19 pandemic, driven by a heightened consumer awareness regarding health and fitness concerns. This shift in consumer behavior underscores the evolving market dynamics and the imperative for industry players to adapt and innovate in response to changing market conditions.

Latest Trends/ Developments:

-

In March 2023, CUBIQ FOODS embarked on a collaboration aimed at accelerating the development of plant-based products leveraging new fat technology.

-

In January 2023, Cargill and BASF joined forces to deliver cutting-edge enzyme solutions designed to enhance performance.

-

In July 2023, the CSIR-Central Food Technological Research Institute (CFTRI) unveiled two innovative technologies as part of the 'One Week One Lab' (OWOL) campaign: a beverage infused with glucose and a nutrition-rich quinoa germ superfood.

-

In May 2023, Ciranda introduced a new line of reduced-sugar syrups, featuring flavors such as agave and tapioca, offering consumers alternatives to traditional syrups.

Key Players:

These are the top 10 players in the Glucose Market: -

-

Roquette Freres

-

Sigma Aldrich Corporation

-

Gulshan Polyols

-

Tate & Lyle PLC

-

Atn Investments Pty Ltd.

-

Archer Daniels Midland Company

-

Cargill, Inc.

-

Ingredion, Inc.

-

Pfizer, Inc.

-

Grain Processing Corporation

Chapter 1. Glucose Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Glucose Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Glucose Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Glucose Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Glucose Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Glucose Market – By Form

6.1 Introduction/Key Findings

6.2 Syrup

6.3 Solid

6.4 Y-O-Y Growth trend Analysis By Form

6.5 Absolute $ Opportunity Analysis By Form, 2024-2030

Chapter 7. Glucose Market – By Application

7.1 Introduction/Key Findings

7.2 Food and Beverage

7.3 Pharmaceuticals

7.4 Cosmetics and Personal Care

7.5 Pulp and Paper

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Glucose Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Form

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Form

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Form

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Form

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Form

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Glucose Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Roquette Freres

9.2 Sigma Aldrich Corporation

9.3 Gulshan Polyols

9.4 Tate & Lyle PLC

9.5 Atn Investments Pty Ltd.

9.6 Archer Daniels Midland Company

9.7 Cargill, Inc.

9.8 Ingredion, Inc.

9.9 Pfizer, Inc.

9.10 Grain Processing Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Glucose serves as a valuable ingredient in cosmetics and personal care products, leveraging its natural properties. It finds application as a flavoring agent, humectant, and skin-conditioning agent, among other roles.

The top players operating in the Glucose Market are - Roquette Freres, Sigma Aldrich Corporation, Gulshan Polyols, Tate & Lyle PLC, Atn Investments Pty Ltd., Archer Daniels Midland Company, Cargill, Inc., Ingredion, Inc., Pfizer, Inc. and Grain Processing Corporation.

The COVID-19 pandemic has emerged as a profound health crisis, exerting significant impacts on nearly every industry worldwide, with enduring repercussions expected to affect manufacturing expansion throughout the projected period.

Innovations not only enhance the color and shelf-life stability of the final products but also mitigate issues such as stickiness and sugar recrystallization. These initiatives by key industry players are poised to unlock significant opportunities for market participants.

Europe is projected to demonstrate a CAGR of 3.9% over the forecast period. The European glucose market is characterized by fragmentation, with numerous small and medium-sized manufacturers operating in the sector.