Video Bar Market Size (2023 – 2030)

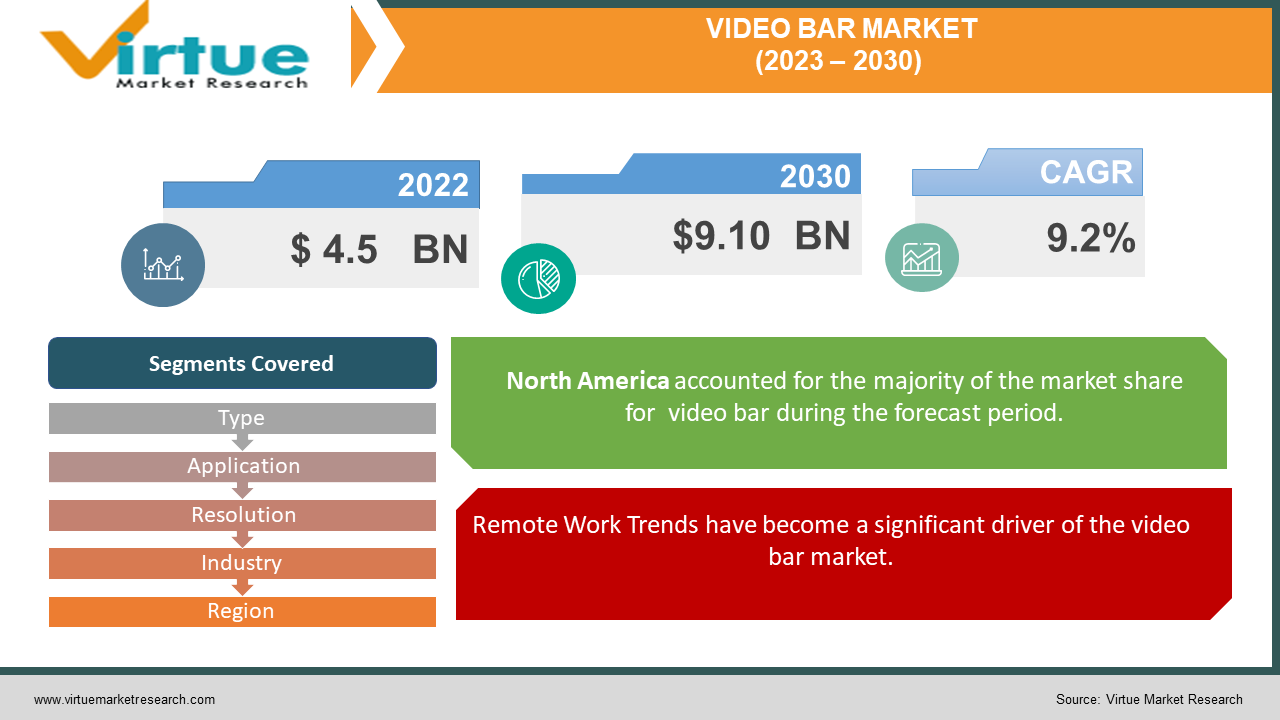

The Global Video Bar Market was valued at USD 4.5 billion and is projected to reach a market size of USD 9.10 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 9.2%.

Download FREE Sample Copy Of This Report

The video bar market has undergone a profound transformation in recent years. Initially, these conferencing tools were a luxury primarily used by larger corporations for select high-profile meetings. Adoption was limited due to factors like cost and infrastructure constraints. However, the landscape has dramatically changed. Video bars are now an integral part of modern business operations, from startups to large enterprises. The surge is attributed to the widespread acceptance of remote work, accelerated by the COVID-19 pandemic.

Video bars have become indispensable tools for seamless virtual collaboration, connecting teams across the globe. Looking forward, the market is set for continuous expansion. Businesses recognize the long-term benefits, including enhanced productivity and reduced travel costs. Advancements in technology, such as AI-driven features and 4K video quality, are improving the user experience. As organizations embrace hybrid work models, the demand for video bars is expected to rise, further integrating them into unified communication and collaboration ecosystems, making them vital for the future of work.

Key Market Insights:

- The global Video Bar market has witnessed remarkable growth, driven by the surging demand for remote collaboration and communication tools. Video bars have become integral to modern businesses, transforming the way meetings and conferences are conducted. Initially a niche technology, they have gained widespread adoption due to their vital role in enhancing remote work and communication efficiency.

- North America has been a major contributor to this market's expansion, with companies recognizing the benefits of video bars, including improved productivity and cost-effectiveness.

- Europe is also playing a pivotal role in the market's growth, driven by stringent regulations and an increasing emphasis on sustainable conferencing solutions.

- Beyond the corporate sector, video bars are gaining traction in the education and healthcare industries, facilitating remote learning and telemedicine. Despite facing competition and technology-driven changes, the global Video Bar market is poised for sustained growth, offering opportunities for businesses and stakeholders that can adapt to the evolving landscape of remote collaboration and communication.

However, it's essential to remain adaptable and resilient in this dynamic market. While the outlook is positive, the industry must continue to innovate and cater to evolving user demands and technological advancements to maintain stability and drive future growth.

Video Bar Market Drivers:

Remote Work Trends have become a significant driver of the video bar market.

The surge in remote work arrangements, accelerated by global events, has propelled the Video Bar market. As more professionals work from home or in flexible environments, the need for efficient remote communication tools like video bars has surged. They offer a seamless way for teams to collaborate, bridging geographical gaps and fostering productivity.

Hybrid Work Models are driving the demand for video bars for enhanced communication for both on-site and remote employees.

The rise of hybrid work models, combining in-person and remote work, has further boosted demand for video bars. These systems enable effective communication between on-site and remote employees, ensuring seamless collaboration regardless of location. They have become essential tools for businesses aiming to maintain efficient operations in hybrid work environments.

Continuous advancements in video bar technology are attracting businesses looking for high-quality collaboration tools.

Continuous advancements in video bar technology are luring businesses in search of high-quality collaboration tools. These innovations include improved video and audio quality, AI-driven features, and integration capabilities with popular communication platforms. As companies prioritize effective communication, video bars have become a crucial part of their strategy to stay competitive in the evolving business landscape.

Unlock Market Insights: Get Your FREE Sample Report Now!

Video Bar Market Restraints and Challenges:

Growing concerns about the security and privacy of virtual meetings hamper the penetration aspect of the Video Bar Market.

Heightened concerns regarding the security and privacy of virtual meetings pose a significant challenge to the Video Bar Market. As businesses increasingly rely on video conferencing, ensuring the confidentiality and integrity of sensitive discussions becomes paramount. Addressing these concerns through robust encryption and privacy measures is crucial for market players to gain and maintain user trust.

The intense competition poses a challenge for manufacturers to differentiate their products and capture market share.

The video bar market faces intense competition, making it challenging for manufacturers to distinguish their products and secure market share. With numerous players offering similar solutions, differentiation becomes essential. Companies must focus on innovation, unique features, and exceptional user experiences to stand out in this crowded marketplace.

Video Bar Market Opportunities:

Developing industry-specific video bars presents opportunities for market growth.

One promising opportunity in the Video Bar Market lies in the development of industry-specific video bars. Tailoring these solutions to the unique needs of sectors such as healthcare, education, or finance can unlock new avenues for market growth. Industry-specific video bars can offer specialized features and functionalities that cater to the distinct communication requirements of various sectors, thereby expanding their adoption and market reach.

Integrating artificial intelligence (AI) capabilities into video bars can provide competitive advantages.

The integration of artificial intelligence (AI) capabilities into video bars represents a significant opportunity. AI can enhance video bar functionality by enabling features like automatic background noise reduction, smart camera framing, and real-time language translation. Businesses that invest in AI-driven video bars can gain a competitive edge by offering advanced, user-friendly, and efficient communication solutions. This innovation can drive increased demand and growth in the market.

GLOBAL VIDEO BAR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

9.2% |

|

Segments Covered |

By Type, Application, Resolution, Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Logitech, Poly (formerly Polycom), Cisco Systems, Microsoft Corporation, Avaya Inc., Crestron Electronics., Shure Incorporated, Yamaha Corporation, Sony Corporation, Koninklijke Philips N.V. |

CUSTOMIZE THIS FULL STUDY AS PER YOUR NEEDS

Segmentation Analysis

Video Bar Market - By Type:

-

Integrated Video Bars

-

Standalone Video Bars

In 2022, Standalone Video Bars have the largest market share and are anticipated to grow at the fastest rate owing to their self-contained design solely for video conferencing. It's not integrated into a larger system and can be used on its own or with other peripherals. They are usually easier to install and can be mounted on a wall or placed on a tabletop with minimal effort, making them suitable for smaller rooms or ad-hoc setups. Standalone video bars are designed primarily for video conferencing.

Standalone Video Bars have built-in cameras, microphones, and speakers, but their functionality is more focused on providing a good video and audio experience for small to medium-sized meeting spaces. Standalone video bars are more versatile and can be easily relocated or used in various settings, making them suitable for businesses with changing needs.

However, the Integrated Video Bar segment holds the second largest share as they are typically built into a larger conferencing or collaboration system, such as a video conferencing room or huddle room setup which is a part of a more comprehensive audio and video solution. Moreover, the installation of integrated video bars is more complex and often requires a professional setup as they are part of a broader conferencing infrastructure.

Video Bar Market - By Application:

-

Small Rooms

-

Huddle Rooms

-

Middle Rooms

-

Large Rooms

In 2022, small meeting rooms accounted for a significant 39.2% share of the market, surpassing other categories in popularity. This can be attributed to several key factors, including affordability and user-friendliness. Small rooms offer a cost-effective and straightforward solution that allows end-users to initiate online conferences without the need for additional peripheral devices.

Furthermore, the huddle rooms segment is anticipated to experience the fastest growth. This expansion is primarily driven by the increasing adoption of hardware & and software-based solutions, the rise in open office environments, and the growing demand for impromptu team collaborations. Additionally, the market has witnessed a proliferation of budget-friendly, high-definition video collaboration solutions, which is expected to further fuel the growth of this segment.

Video Bar Market - By Resolution:

-

HD

-

Full HD

-

4K

In 2022, 2022, Full HD (1080p) resolution created the largest market demand in the video bar market due to its optimal balance between image quality and bandwidth efficiency. It provides clear and detailed video, making it suitable for standard business video conferencing needs. The majority of organizations and individuals found Full HD resolution to meet their requirements without straining network resources.

However, the demand for higher-resolution video bars, such as 4K, is also growing. This was particularly noticeable in settings where ultra-high-definition clarity was essential, such as telemedicine, design collaboration, and high-end professional presentations. As technology continues to advance and network infrastructure improves, the demand for higher resolutions will continue to grow in the following years.

Video Bar Market - By Industry:

-

IT & Telecom

-

Government

-

Healthcare

-

Manufacturing

-

BFSI

-

Education

-

Entertainment

-

Others

In 2022, the Information Technology (IT) and Telecommunications sector emerged as the dominant force in the market. This was primarily driven by substantial investments made by enterprises in cutting-edge technologies. The IT industry has been an early adopter of video bar solutions, especially during the pandemic, where it played a crucial role in facilitating remote work.

The Banking, Financial Services, and Insurance (BFSI) segment, on the other hand, is projected to achieve the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This growth can be attributed to the increasing adoption of customer-specific solutions in response to the growing digitization trends.

Similarly, the healthcare sector is poised for significant growth due to its increasing emphasis on providing patient support through various communication channels.

In the education sector, investments in video bar solutions are steadily increasing to enhance e-learning capabilities and expand the reach to a larger student audience. Additionally, governments worldwide are implementing video bar technology to minimize communication delays and improve overall efficiency.

What's Next for Your Market? Get a Snapshot with FREE Sample Report

Video Bar Market Segmentation:– By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

In 2022, North America emerged as the leader in the Global Video Bar market in terms of revenue which holds 40.1% of the market share. This can be attributed to the region's early adoption of emerging technologies and the presence of major industry players like Microsoft Corporation and Zoom Video Communications, Inc. These factors have driven the demand for conferencing solutions, particularly in the United States and Canada, and are expected to continue fueling market growth in North America.

Meanwhile, the Asia-Pacific region has exhibited remarkable growth, positioning itself as the fastest-growing segment with a CAGR of 15.1%. The increased demand for video communication solutions, especially in the education and research sectors, is a key driver of this growth. Additionally, the presence of a significant number of small and medium-sized enterprises (SMEs) and a growing interest in digitalization solutions bode well for the region's market potential.

In Europe, a substantial Compound Annual Growth Rate (CAGR) is anticipated. This growth is supported by the availability of numerous video collaboration solutions and services, contributing to market expansion. Furthermore, increased corporate investments in research and development are expected to boost Europe's market share shortly.

COVID-19 Impact Analysis on the Global Video Bar Market:

The COVID-19 pandemic had a profound impact on the video bar market, driving increased adoption as businesses and organizations turned to remote work and virtual collaboration to maintain operations. The worldwide onset of the COVID-19 pandemic prompted businesses to overhaul their operational approaches and tactics. Significant investments are being directed towards cloud-based solutions and diversifying portfolios to meet the growing demand for establishing digital workplaces, especially for remote employees. A notable illustration of this trend is seen with Google LLC, renowned for its video conferencing software solutions, as it expanded its offerings by introducing Series One, a suite of meeting room hardware. While the initial surge in demand was pandemic-driven, the market is expected to continue growing as remote and hybrid work models become more prevalent.

Latest Trends/ Developments:

In the video bar market, AI-driven advancements are increasingly prevalent, including features like background noise elimination, automatic framing, and gesture recognition, all aimed at improving user interaction. For example, Logitech's Rally Bar integrates its dual camera system with optical zoom and an AI ViewFinder that delivers a fluid, cinematic video in medium and large rooms. Additionally, sustainability is gaining traction, with manufacturers emphasizing energy-efficient construction and the use of eco-friendly materials, reflecting a broader commitment to environmental responsibility in the industry. These developments signify a dual focus on enhancing user experiences and reducing the ecological footprint of video conferencing technology.

Key Players:

-

Logitech

-

Poly (formerly Polycom)

-

Cisco Systems

-

Microsoft Corporation

-

Avaya Inc.

-

Crestron Electronics

-

Shure Incorporated

-

Yamaha Corporation

-

Sony Corporation

-

Koninklijke Philips N.V.

- In June 2023, Sennheiser made its entry into the unified communications A/V bar market with the introduction of an all-in-one device series. The products, known as TeamConnect Bar Solutions, are designed for small and mid-sized meeting rooms and collaboration spaces. The TC Bar Solutions offer flexible options for both small-scale (TeamConnect Bar S) and mid-sized (TeamConnect Bar M) meeting and collaboration spaces.

- In March 2023, Owl Labs Launched Owl Bar, the First Front-of-Room Video Conferencing Device on the market to seamlessly connect with a 360-degree camera and audio device. The Owl Bar works as a standalone device or integrates with other award-winning Owl Labs products using proprietary multi-camera software to create a custom ecosystem that accurately frames the faces of in-room participants on-screen as they turn their heads, improving eye contact and preventing side views.

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Chapter 1. Video Bar Market – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Video Bar Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. Video Bar Market – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Video Bar Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Video Bar Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Video Bar Market – By Type

6.1. Introduction/Key Findings

6.2 Integrated Video Bars

6.3 Standalone Video Bars

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2023-2030

Chapter 7. Video Bar Market – By Application

7.1. Introduction/Key Findings

7.2 Small Rooms

7.3 Huddle Rooms

7.4 Middle Rooms

7.5 Large Room

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2023-2030

Chapter 8. Assistive Robotic Rehabilitative Therapy Market - By Resolution

8.1. Introduction/Key Findings

8.2 HD

8.3 Full HD

8.4 4k

8.5 Y-O-Y Growth trend Analysis By Resolution

8.6 Absolute $ Opportunity Analysis By Resolution, 2023-2030

Chapter 9. Video Bar Market – By Industry

9.1. Introduction/Key Findings

9.2 IT & Telecom

9.3 Government

9.4 Healthcare

9.5 Manufacturing

9.6 BFSI

9.7 Education

9.8 Entertainment

9.9 Others

9.10 Y-O-Y Growth trend Analysis By Industry

9.11 Absolute $ Opportunity Analysis By Industry, 2023-2030

Chapter 10. Video Bar Market , By Geography – Market Size, Forecast, Trends & Insights

10.1. North America

10.1.1. By Country

10.1.1.1. U.S.A.

10.1.1.2. Canada

10.1.1.3. Mexico

10.1.2 By Type

10.1.3 By Application

10.1.4. By Resolution

10.1.5. By Industry

10.1.6. Countries & Segments - Market Attractiveness Analysis

10.2. Europe

10.2.1. By Country

9.2.1. U.K.

9.2.2. Germany

9.2.3. France

9.2.4. Italy

9.2.5. Spain

9.2.6. Rest of Europe

10.2.2 By Type

10.2.3 By Resolution

10.2.4. By Portability

10.2.5. By Industry

10.2.6. Countries & Segments - Market Attractiveness Analysis

10.3. Asia Pacific

10.3.1. By Country

10.3.1. China

10.3.2. Japan

10.3.3. South Korea

10.3.4. India

10.3.5. Australia & New Zealand

10.3.6. Rest of Asia-Pacific

10.3.2 By Type

10.3.3. By Application

10.3.4. By Resolution

10.3.5By Industry

10.3.6. Countries & Segments - Market Attractiveness Analysis

10.4. South America

10.4.1. By Country

10.4.1. Brazil

10.4.2. Argentina

10.4.3. Colombia

10.4.4. Chile

10.4.5. Rest of South America

10.4.2 By Type

10.4.3. By Application

10.4.4. By Resolution

10.4.5. By Industry

10.4.6. Countries & Segments - Market Attractiveness Analysis

10.5. Middle East & Africa

10.5.1. By Country

10.5.1. United Arab Emirates (UAE)

10.5.2. Saudi Arabia

10.5.3. Qatar

10.5.4. Israel

10.5.5. South Africa

10.5.6. Nigeria

10.5.7. Kenya

10.5.8. Egypt

10.5.9. Rest of MEA

10.5.2. By Type

10.5.3. By Application

10.5.4. By Resolution

10.5.5.By Industry

10.5.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. Video Bar Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Logitech

11.2 Poly (formerly Polycom)

11.3 Cisco Systems

11.4 Microsoft Corporation

11.5 Avaya Inc.

11.6 Crestron Electronics

11.7 Shure Incorporated

11.8 Yamaha Corporation

11.9 Sony Corporation

11.10 Koninklijke Philips N.V.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The current market size of the Global Video Bar Market is USD 4.5 billion, and it is projected to reach USD 9.10 billion by the end of 2030, with a forecasted CAGR of 9.2%.

Key drivers include remote work trends, the rise of hybrid work models, continuous technological advancements, and increased reliance on video conferencing for efficient communication.

The widespread adoption of video bars can be attributed to the acceptance of remote work, accelerated by the COVID-19 pandemic. They are now essential tools for seamless virtual collaboration, connecting teams worldwide.

North America has been a major contributor to market growth due to early technology adoption and the presence of key industry players. Europe is also growing, driven by regulations and sustainable solutions, while the Asia-Pacific region is experiencing exceptional growth.

Logitech, Poly, Cisco, Microsoft, Avaya, Crestron, Shure, Yamaha, Sony, and Philips are some of the key players in the video bar market.