Thermal Interface Material Market Size (2023-2030)

Mastering the Thermal Interface Material Market: Your Essential Guide to Gaining a Competitive Edge in Cooling Solutions.

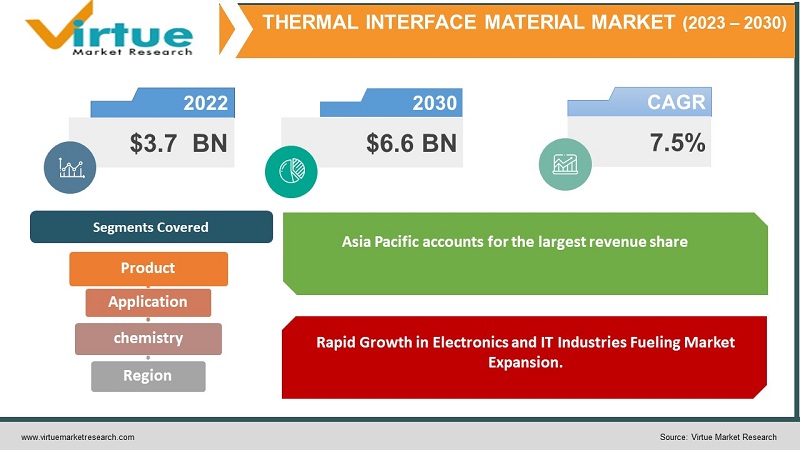

The Global Thermal Interface Material (TIMs) Market was estimated to be worth USD 3.7 Billion in 2022 and is projected to reach a value of USD 6.6 Billion by 2030, growing at a steady CAGR of 7.5% during the forecast period 2023-2030.

Thermal Interface Materials (TIMs) serve as vital components in the efficient dissipation of heat generated within electronic and mechanical systems. They play an indispensable role in ensuring these systems perform optimally and enjoy a longer lifespan. TIMs are ingeniously designed to bridge the gaps and irregularities that often exist between heat-producing components and cooling solutions, such as heat sinks. In recent years, the TIMs market has experienced remarkable growth, primarily driven by the surging demand for high-performance electronic devices. The ever-advancing miniaturization of electronics has intensified the heat management challenges, making TIMs all the more essential. These materials are the unsung heroes that prevent overheating and uphold the reliability of electronic systems. Furthermore, as electronic devices continue to become smaller yet more powerful, the demand for effective thermal management solutions has soared. TIMs have risen to this challenge, proving their worth in various industries, ranging from consumer electronics to the automotive and aerospace sectors. What's particularly intriguing is the continuous evolution of TIM formulations and the emergence of novel Material. These innovations have significantly broadened the scope of TIM applications. As technology and industry demands continue to evolve, TIMs are poised to remain pivotal in addressing the complex thermal challenges of modern electronic systems.

Global Thermal Interface Material Market Drivers:

Rapid Growth in Electronics and IT Industries Fueling Market Expansion.

The electronics and information technology (IT) sectors have witnessed exponential growth, characterized by the proliferation of smartphones, laptops, data centers, and high-performance computing systems. These electronic devices generate substantial heat during operation, necessitating effective thermal management solutions. TIMs, such as thermal greases, adhesives, and phase change Materials, are integral in dissipating heat and ensuring the reliability and longevity of electronic components. The continual evolution and innovation in electronics are driving the demand for advanced TIMs to enhance heat dissipation capabilities.

Increasing Adoption of Electric Vehicles (EVs) Driving TIMs Demand.

The global shift toward electric vehicles (EVs) has created a significant demand for thermal management solutions in the automotive industry. EVs rely on efficient battery cooling systems to maintain optimal operating temperatures and ensure battery longevity. TIMs are instrumental in improving heat transfer efficiency within battery packs and electric drivetrains. As the adoption of EVs continues to surge, the TIMs market is poised for substantial growth, with manufacturers focusing on developing specialized Materials to cater to the unique thermal challenges of electric mobility.

Global Thermal Interface Material Market Drivers:

Rapid Growth in Electronics and IT Industries Fueling Market Expansion.

The electronics and information technology (IT) sectors have witnessed exponential growth, characterized by the proliferation of smartphones, laptops, data centers, and high-performance computing systems. These electronic devices generate substantial heat during operation, necessitating effective thermal management solutions. TIMs, such as thermal greases, adhesives, and phase change Materials, are integral in dissipating heat and ensuring the reliability and longevity of electronic components. The continual evolution and innovation in electronics are driving the demand for advanced TIMs to enhance heat dissipation capabilities.

Increasing Adoption of Electric Vehicles (EVs) Driving TIMs Demand.

The global shift toward electric vehicles (EVs) has created a significant demand for thermal management solutions in the automotive industry. EVs rely on efficient battery cooling systems to maintain optimal operating temperatures and ensure battery longevity. TIMs are instrumental in improving heat transfer efficiency within battery packs and electric drivetrains. As the adoption of EVs continues to surge, the TIMs market is poised for substantial growth, with manufacturers focusing on developing specialized Materials to cater to the unique thermal challenges of electric mobility.

Growing Emphasis on Energy Efficiency and Sustainability in Electronics is Driving the Adoption in Market.

Energy efficiency has become a paramount concern in the electronics industry due to environmental considerations and regulatory mandates. Efficient thermal management using TIMs can reduce energy consumption by ensuring that electronic components operate at lower temperatures, which, in turn, extends their lifespan. Additionally, TIMs contribute to sustainability efforts by enabling the design of more compact and energy-efficient electronic devices. The increasing focus on eco-friendly solutions is driving the adoption of TIMs across various applications.

Advancements in TIM Formulations and Material Expanding Possibilities for Emerging Markets and Industries.

Ongoing research and development efforts have led to significant advancements in TIM formulations and Materials. Novel Materials such as graphene-based TIMs and advanced phase change Material offer enhanced thermal conductivity and stability. These innovations are opening up new possibilities for TIM applications in cutting-edge technologies, including 5G infrastructure, high-performance computing, and advanced industrial machinery. As TIM technology continues to evolve, manufacturers are exploring opportunities to cater to emerging markets and industries.

Global Thermal Interface Material Market Challenges:

Complexity in Material Selection and Application Process hampers specific Industry Requirements.

Choosing the right TIM material and application method can be challenging, as it depends on specific industry requirements, heat dissipation goals, and compatibility with existing systems. Incorrect material selection or application can lead to inadequate thermal management, affecting the performance and reliability of electronic devices. Manufacturers and end-users face the challenge of navigating a wide range of TIM options and determining the most suitable solutions for their applications.

Cost Constraints and Pricing Pressure Impacts the profit of sales for the manufacturers.

The TIMs market faces cost-related challenges, especially in price-sensitive industries such as consumer electronics. Manufacturers must balance the development of high-performance TIMs with cost-effective production methods to remain competitive. Additionally, intense competition and price pressures in the market can impact profit margins, necessitating continuous innovation and cost optimization.

Regulatory Compliance and Environmental Concerns hampering the product performance in the market.

Environmental regulations and compliance requirements are becoming more stringent in the thermal interface Material industry. Manufacturers must ensure that their TIM products adhere to environmental standards and restrictions, such as RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals). Meeting these regulations while maintaining product performance can be a challenge for industry players.

Global Thermal Interface Material Market Opportunities:

Emerging Opportunities in 5G Infrastructure Development is providing growth prospects for the market.

The rollout of 5G technology is driving significant infrastructure development worldwide. 5G networks require advanced electronic systems and data centers to support their high-speed and low-latency capabilities. TIMs play a vital role in managing the heat generated by these systems, ensuring their reliability and performance. The expansion of 5G infrastructure presents substantial growth opportunities for TIM manufacturers, who can provide solutions tailored to the unique thermal challenges of 5G equipment.

Rising Demand for Sustainable and Eco-Friendly TIMs is attracting the environmentally conscious demand base.

The growing emphasis on sustainability and environmental responsibility is leading to an increased demand for eco-friendly TIMs. Manufacturers can capitalize on this trend by developing and marketing TIM products that are free from harmful chemicals and meet stringent environmental standards. Offering sustainable TIM solutions can attract environmentally conscious customers and align with corporate sustainability goals.

Customization and Application-Specific TIM Solutions can strengthen customer relationships.

As industries become more specialized and technology-driven, there is a growing need for customized TIM solutions tailored to specific applications. Manufacturers can seize this opportunity by offering consulting and customization services to clients, helping them select or develop TIM Materials and applications optimized for their unique requirements. Customized TIM solutions can provide a competitive edge and strengthen customer relationships.

THERMAL INTERFACE MATERIAL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

7.5% |

|

Segments Covered |

By Product, Application, chemistry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

The 3M Company, DuPont, Zalman, Honeywell International Inc., SIBELCO |

Global Thermal Interface Material Market Segmentation:

Thermal Interface Material Market Segmentation – By Chemistry

- Silicone

- Epoxy

- Polyimide

- Others

Based on market segmentation by Chemistry, Silicone holds the largest market due to its excellent thermal conductivity and versatile adhesion capabilities. Silicone is a preferred choice across various TIM categories, including adhesives, encapsulants, thermal pads, and gap fillers. Its capacity to efficiently transfer heat and adhere to diverse substrates makes it instrumental in ensuring the optimal performance and durability of electronic and mechanical systems.

However, Silicone is also the fastest growing due to its exceptional thermal conductivity, versatility in adhering to various substrates, and ease of application. As electronic devices become more compact and powerful, the demand for efficient thermal management solutions, particularly silicone-based TIMs, has surged across industries like consumer electronics, automotive, and aerospace.

Thermal Interface Material Market Segmentation – By Product

- Tapes and Films

- Elastomeric Pads

- Greases and Adhesives

- Phase Change Material

- Metal Based

- Others

Based on market segmentation by Product, Greases & Adhesives holds the largest market share, primarily attributed to their extensive utilization in consumer products and their remarkable capacity to withstand high levels of thermal resistance. Thus, their effectiveness in facilitating efficient heat transfer ensures the reliable performance and longevity of various electronic and mechanical systems. Their versatility, durability, and compatibility with consumer applications make them a preferred choice in the market.

However, Phase Change Materials (PCMs) are emerging as the fastest-growing segment within the Thermal Interface Material (TIMs) market. This growth is propelled by their extensive use in personal computers, including microprocessors, graphics processors, memory modules, chipsets, power modules, and semiconductors. PCMs provide efficient heat management solutions, ensuring the optimal performance and longevity of electronic components, making them a preferred choice, and driving their rapid adoption in the market.

Thermal Interface Material Market Segmentation – By Application

- Telecom

- Computer

- Medical Devices

- Industrial Machinery

- Consumer Durables

- Automotive Electronics

- Others

Based on market segmentation by Application, the Computer segment holds the largest revenue share Technological development has led to the development of high-power computers with minimalistic weight and design. Factors such as low thermal impedance, high thermal conductivity, improved conformability, and high adhesion strength make thermal grease a crucial thermal interface material in computers. All these factors are driving the demand for thermal interface Materials in computer applications. Moreover, thermal grease and paste remove heat from computer semiconductor junctions to ambient environment or heat sinks. Thus, the demand and use of thermal interface Material across advanced PCs for proper thermal management are anticipated to offer new growth opportunities.

However, the telecom segment is the fastest growing due to increasing preference for digital and cashless economies. The banks, e-commerce, utilities, and media rely on the telecom industry for their businesses and it is seen as their lifeline. Thus, is likely to support the industry’s growth over the projected time.

Thermal Interface Material Market Segmentation: By Region

- North America

- Europe

- Asia-Pacific

- Middle East and Africa

- South America

Based on market segmentation by region, Asia Pacific holds the largest market due to high demand owing to the presence of a large base of manufacturing zone. In addition to the manufacturing base, reduction in corporate tax, GST, rising household incomes, consumer health awareness, changing lifestyle, and government policies have the potential to propel the industry growth in this region.

However, the Europe region is the fastest growing due to the adoption of Electric vehicles that will boost the thermal interface market. Moreover, Europe being one of the leading consumers of smartphones, laptops, and other digital devices provides a significant base for the market growth.

Recent Industry Developments:

- In May 2022, Arieca, a leader in liquid-metal-based Thermal Interface Materials (TIM), entered into a joint research agreement with ROHM Co., Ltd., a leading provider of power semiconductor devices for the xEV market, to develop next-generation TIM using Arieca’s Liquid Metal Embedded Elastomer (LMEE) Technology. This joint research leverages the LMEE platform to provide high heat transfer without the reliability issues facing conventional TIM technologies.

Global Thermal Interface Material Market Key Players:

- The 3M Company

- DuPont

- Zalman

- Honeywell International Inc.

- SIBELCO

Chapter 1. Global Thermal Interface Material (TIMs) Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Thermal Interface Material (TIMs) Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Global Thermal Interface Material (TIMs) Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Global Thermal Interface Material (TIMs) Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Global Thermal Interface Material (TIMs) Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Thermal Interface Material (TIMs) Market– By Chemistry

6.1. Introduction/Key Findings

6.2 Silicone

6.3. Epoxy

6.4. Polyimide

6.5. Others

6.6. Y-O-Y Growth trend Analysis By Chemistry

6.7. Absolute $ Opportunity Analysis By Chemistry, 2023-2030

Chapter 7. Global Thermal Interface Material (TIMs) Market– By Product

7.1. Introduction/Key Findings

7.2. Tapes and Films

7.3. Elastomeric Pads

7.4. Greases and Adhesives

7.5. Phase Change Material

7.6. Metal Based

7.7. Others

7.8. Y-O-Y Growth trend Analysis By Product

7.9. Absolute $ Opportunity Analysis By Product, 2023-2030

Chapter 8. Global Thermal Interface Material (TIMs) Market– By Application

8.1. Introduction/Key Findings

8.2. Telecom

8.3. Computer

8.4. Medical Devices

8.5. Industrial Machinery

8.6. Consumer Durables

8.7. Automotive Electronics

8.8. Others

8.9. Y-O-Y Growth trend Analysis Application

8.10. Absolute $ Opportunity Analysis Application, 2023-2030

Chapter 9. Global Thermal Interface Material (TIMs) Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Chemistry

9.1.3. By Product

9.1.4. By Application

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Chemistry

9.2.3. By Product

9.2.4. By Application

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.1. By Country

9.3.1.1. China

9.3.1.2. Japan

9.3.1.3. South Korea

9.3.1.4. India

9.3.1.5. Australia & New Zealand

9.3.1.6. Rest of Asia-Pacific

9.3.2. By Chemistry

9.3.3. By Product

9.3.4. By Application

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.1. By Country

9.4.1.1. Brazil

9.4.1.2. Argentina

9.4.1.3. Colombia

9.4.1.4. Chile

9.4.1.5. Rest of South America

9.4.2. By Chemistry

9.4.3. By Product

9.4.4. By Application

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.1. By Country

9.5.1.1. United Arab Emirates (UAE)

9.5.1.2. Saudi Arabia

9.5.1.3. Qatar

9.5.1.4. Israel

9.5.1.5. South Africa

9.5.1.6. Nigeria

9.5.1.7. Kenya

9.5.1.8. Egypt

9.5.1.9. Rest of MEA

9.5.2. By Application

9.5.3. By Product

9.5.4. By Chemistry

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Global Thermal Interface Material (TIMs) Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1. ABB Ltd.

10.2. Emerson Electric Co.

10.3. Siemens AG

10.4. Omron Corp

10.5. Mitsubishi Corp

10.6. Honeywell International Inc.

10.7. General Electric Co

10.8. Rockwell Automation

10.9. Yokogawa Electric Corp

10.10. Schnieder Electric SE

10.11. Fanuc Corp

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Thermal Interface Material (TIMs) Market was estimated to be worth USD 3.7 Billion in 2022 and is projected to reach a value of USD 6.6 Billion by 2030, growing at a steady CAGR of 7.5% during the forecast period 2023-2030.

The drivers for the Global Thermal Interface Material Market include rapid growth in electronics and IT industries, increasing adoption of electric vehicles (EVs), growing emphasis on energy efficiency and sustainability in electronics, and advancements in TIM formulations and Materials.

Tapes and Films, Elastomeric Pads, Greases and Adhesives, Phase Change Material, Metal Based, and Others are the segments under the Global Thermal Interface Material Market by Product.

Asia-Pacific dominates the market in the Global Thermal Interface Material Market.

The Telecom segment is the fastest-growing segment by Application in the Global Thermal Interface Material Market.