Tail and Tactical Spend Solution Market Size (2025 – 2030)

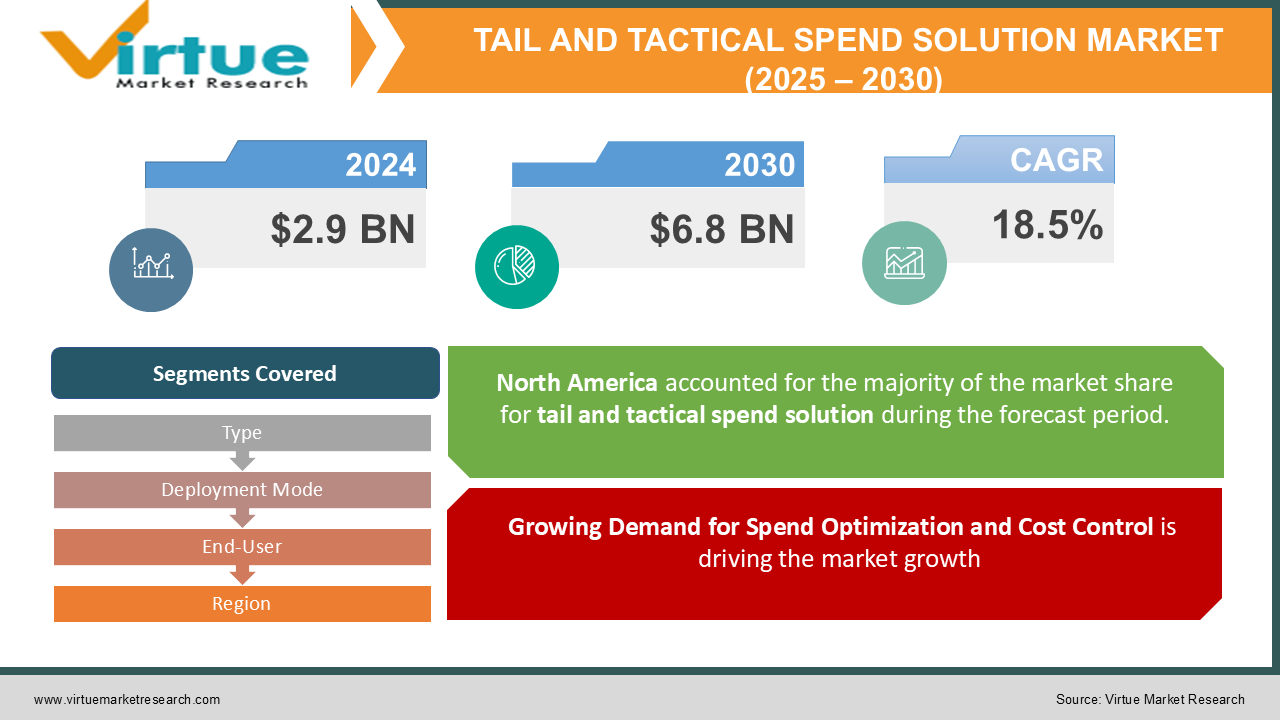

The Global Tail and Tactical Spend Solution Market was valued at USD 2.9 billion in 2024 and is projected to reach USD 6.8 billion by 2030, growing at a CAGR of 18.5% during the forecast period.

Tail and tactical spend solutions help organizations manage low-value, high-volume purchases efficiently, reducing maverick spending, enhancing cost visibility, and improving supplier relationships. These solutions integrate AI-powered analytics, automation, and procurement intelligence to optimize spending across multiple business units.

Key Market Insights

-

Cloud-based deployment holds the largest share, accounting for 55% of market revenue, due to its scalability and real-time procurement tracking.

-

Manufacturing and IT & telecom sectors dominate the end-user segment, holding a 40% market share, as they deal with high-volume, decentralized purchasing.

-

North America leads the market with a 38% share, driven by the widespread adoption of digital procurement solutions and regulatory compliance needs.

-

Artificial intelligence (AI) and machine learning (ML) integration is revolutionizing spend analytics, supplier categorization, and fraud detection.

-

The rise of B2B e-procurement platforms is fueling market growth by providing automated vendor selection and pricing optimization.

-

On-premise solutions are witnessing slower growth, with a CAGR of 10%, due to the higher initial setup costs and maintenance requirements.

-

Cybersecurity and data privacy concerns remain major challenges in cloud-based procurement solutions.

Global Tail and Tactical Spend Solution Market Drivers

1. Growing Demand for Spend Optimization and Cost Control is driving the market growth

Organizations are increasingly prioritizing spend visibility, supplier consolidation, and procurement efficiency. Tail and tactical spend solutions help businesses reduce costs by centralizing procurement data, automating approvals, and eliminating unnecessary purchases.

2. Rising Adoption of AI and Data Analytics in Procurement is driving the market growth

AI-driven spend analytics platforms enable companies to analyze purchasing patterns, detect anomalies, and optimize supplier negotiations. Machine learning models can predict cost-saving opportunities and enhance procurement decision-making.

3. Increasing Shift Toward Digital Procurement and Cloud-Based Solutions is driving the market growth

The demand for cloud-based procurement software is growing as businesses move toward digital transformation and automation. These solutions offer real-time data access, supplier collaboration, and contract lifecycle management, making procurement more efficient.

Global Tail and Tactical Spend Solution Market Challenges and Restraints

1. Lack of Awareness and Resistance to Change is restricting the market growth

Many organizations still rely on manual procurement methods or legacy ERP systems, delaying the adoption of tail and tactical spend solutions. Resistance to digital procurement transformation is a challenge, especially among small and medium enterprises (SMEs).

2. Data Security and Compliance Risks is restricting the market growth

Handling sensitive procurement data poses cybersecurity challenges. Businesses must ensure compliance with financial regulations and data protection laws (e.g., GDPR, CCPA) while using cloud-based spend management platforms.

Market Opportunities

The Global Tail and Tactical Spend Solution Market is brimming with opportunities for growth and innovation. One key area lies in the expansion of AI-Driven Procurement Automation. AI-powered procurement bots can automate repetitive tasks such as purchase order creation, invoice processing, and supplier communication, freeing up procurement professionals to focus on more strategic activities. Automated invoice matching, powered by AI, significantly reduces manual effort and minimizes errors, leading to improved efficiency and cost savings. Blockchain technology presents another significant opportunity for transforming tail spend management. Blockchain-based procurement platforms can ensure transparency, security, and efficiency in contract management. Smart contracts, executed automatically on the blockchain, streamline contract creation, execution, and enforcement, reducing the risk of disputes and fraud. The increasing demand for Supplier Diversity Programs also creates a unique opportunity. Organizations are increasingly prioritizing supplier diversity and inclusion, seeking to engage with businesses owned by minorities, women, and other underrepresented groups. Tail spend analytics can play a crucial role in identifying and engaging these diverse suppliers, helping organizations meet their diversity goals while also gaining access to a wider pool of potential vendors. Finally, significant growth opportunities exist in Emerging Markets. The adoption of digital procurement solutions is rapidly increasing in regions like Asia-Pacific and Latin America, driven by economic growth, increasing internet penetration, and government initiatives promoting enterprise digitalization. These regions present a fertile ground for vendors of tail and tactical spend solutions to expand their market reach and cater to the growing demand for efficient and cost-effective procurement processes. By capitalizing on these opportunities, vendors can strengthen their position in the market and contribute to the evolution of tail spend management.

TAIL AND TACTICAL SPEND SOLUTION MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

18.5% |

|

Segments Covered |

By Type, Deployment Mode, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

SAP Ariba, Coupa Software, GEP, Jaggaer, Ivalua, Basware, Proactis Zycus, Fairmarkit, SynerTrade |

Tail and Tactical Spend Solution Market Segmentation - By Type

-

Software

-

Services

The software segment currently dominates. This encompasses the various software applications and platforms that facilitate digital procurement processes, including spend analytics tools, e-sourcing platforms, contract management software, and supplier relationship management systems. While services, such as implementation, training, and consulting, are essential for successful deployment and utilization of digital procurement solutions, the core functionality and value proposition reside in the software itself. Therefore, the software segment constitutes the larger portion of the market, driven by the demand for innovative tools that automate processes, improve visibility, and enhance decision-making in procurement. Services play a crucial supporting role, enabling businesses to maximize the benefits of their software investments, but the software itself remains the primary driver of market revenue and growth.

Tail and Tactical Spend Solution Market Segmentation - By Deployment Mode

-

Cloud-Based

-

On-Premise

The digital procurement market is currently dominated by cloud-based solutions, holding a significant 55% market share. The advantages of cloud deployment, such as scalability, accessibility, and cost-effectiveness, have made it the preferred choice for businesses of all sizes. Cloud-based platforms eliminate the need for significant upfront investments in hardware and IT infrastructure, allowing companies to quickly deploy and access procurement solutions from anywhere with an internet connection. This flexibility is particularly crucial in today's dynamic business environment, where remote work and distributed teams are increasingly common. While on-premise solutions still exist, they are gradually losing ground to cloud-based alternatives due to the higher costs associated with maintenance, upgrades, and IT support. The ease of integration with other cloud-based applications and the ability to scale resources on demand further contribute to the dominance of cloud-based digital procurement solutions. As organizations prioritize agility, cost efficiency, and accessibility, the trend towards cloud adoption in procurement is expected to continue.

Tail and Tactical Spend Solution Market Segmentation - By End-User

-

BFSI

-

Healthcare

-

Manufacturing (Largest Market Share, 25%)

-

Retail

-

IT & Telecom (Fastest-Growing, CAGR 16.5%)

-

Others

The manufacturing sector currently holds the largest market share (25%). This sector's complex supply chains, stringent quality control requirements, and focus on operational efficiency drive a high demand for digital procurement solutions to optimize sourcing, manage inventory, and ensure compliance. While other sectors like BFSI, healthcare, retail, and IT & Telecom also contribute to the market, manufacturing's intricate processes and large-scale operations make it the dominant force. However, the IT & Telecom sector is experiencing the fastest growth, with a CAGR of 16.5%, driven by rapid technological advancements and the increasing need for agile procurement in this dynamic industry. As businesses across all sectors embrace digital transformation, the demand for digital procurement solutions is expected to rise, with each sector leveraging these tools to address specific challenges and improve overall efficiency.

Tail and Tactical Spend Solution Market Segmentation - By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

The global digital procurement market is experiencing significant regional variations. North America currently leads, holding the largest market share (38%), driven by high adoption rates of digital procurement solutions among enterprises, stringent regulatory compliance and financial reporting requirements, and the presence of key industry players like SAP Ariba, Coupa, and GEP. Europe is also witnessing substantial growth, fueled by a strong focus on sustainable procurement and ESG compliance, as well as increasing investments in AI-driven spend management tools. The Asia-Pacific region is projected to be the fastest-growing, with a remarkable CAGR of 17%, thanks to the rising adoption of cloud-based procurement solutions in enterprises and government initiatives promoting digital transformation. Finally, Latin America, the Middle East, and Africa are gradually embracing e-procurement solutions, with growing enterprise investments in digital procurement tools and AI analytics, indicating a promising future for market expansion in these regions.

COVID-19 Impact Analysis

The COVID-19 pandemic dramatically accelerated the adoption of digital procurement solutions, forcing organizations to adapt to unprecedented challenges and disruptions. The pandemic exposed vulnerabilities in global supply chains, highlighting the critical need for effective tail spend management. As traditional supply networks faltered, businesses needed to quickly identify and onboard alternative suppliers, optimize spending on non-core items, and manage a fragmented procurement landscape. This surge in demand for agile and responsive procurement processes fueled the adoption of digital tools for tail spend management. The rapid shift to remote work models further amplified the need for digital procurement solutions. With employees dispersed and working from various locations, organizations required cloud-based procurement software that could be accessed remotely, ensuring business continuity and maintaining control over spending. Cloud-based platforms enabled seamless collaboration, automated workflows, and provided real-time visibility into procurement activities, regardless of location. The pandemic also intensified the focus on cost savings and supplier risk assessment. As economic uncertainty loomed, businesses prioritized cost optimization strategies, scrutinizing every aspect of their spending. Digital procurement solutions provided the data analytics capabilities needed to identify cost-saving opportunities, negotiate better deals with suppliers, and streamline procurement processes. Furthermore, the pandemic underscored the importance of robust supplier risk assessment. Organizations needed to evaluate the financial stability and operational resilience of their suppliers to mitigate potential disruptions and ensure business continuity. Digital procurement platforms offered tools for supplier risk scoring, monitoring, and management, enabling businesses to proactively identify and address potential risks. Even post-pandemic, enterprises continue to invest heavily in AI-driven procurement intelligence and automation. Recognizing the long-term benefits of digitalization, businesses are leveraging AI to gain deeper insights into spending patterns, automate repetitive tasks, optimize supplier relationships, and improve overall procurement efficiency. AI-powered solutions are transforming procurement into a more strategic and data-driven function, enabling organizations to achieve greater cost savings, reduce risks, and enhance agility in a dynamic business environment.

Latest Trends/Developments

The procurement landscape is undergoing a significant transformation, driven by technological advancements and evolving business priorities. AI-powered spend analytics is revolutionizing how companies manage their expenditures. By leveraging AI algorithms, businesses can gain deep insights into their spending patterns, identify anomalies, detect potential fraud, reduce waste, and optimize supplier selection. These intelligent analytics tools provide a granular view of procurement data, enabling companies to make data-driven decisions and achieve significant cost savings. Blockchain technology is also making inroads into procurement, particularly in areas like vendor verification and contract management. The use of smart contracts and blockchain-based systems enhances transparency, security, and efficiency in procurement processes, reducing the risk of fraud and streamlining interactions with suppliers. Furthermore, the rise of sustainable procurement reflects a growing emphasis on environmental, social, and governance (ESG) factors. Businesses are increasingly implementing ESG-compliant procurement strategies, carefully considering the social and environmental impact of their sourcing decisions. This includes prioritizing suppliers who adhere to ethical labor practices, promote environmental sustainability, and demonstrate strong corporate governance. Finally, the integration of tail spend solutions with existing enterprise resource planning (ERP) and finance platforms, such as SAP, Oracle, and Workday, is becoming increasingly crucial. Seamless integration improves procurement workflows, automates data exchange, and enhances visibility across the entire procurement lifecycle. This integration allows companies to consolidate procurement data, streamline processes, and gain a holistic view of their spending, leading to better decision-making and improved overall efficiency. These combined trends are shaping the future of procurement, making it more data-driven, transparent, sustainable, and integrated

Key Players

-

SAP Ariba

-

Coupa Software

-

GEP

-

Jaggaer

-

Ivalua

-

Basware

-

Proactis

-

Zycus

-

Fairmarkit

-

SynerTrade

Chapter 1. Tail and Tactical Spend Solution Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Tail and Tactical Spend Solution Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Tail and Tactical Spend Solution Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Tail and Tactical Spend Solution Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Tail and Tactical Spend Solution Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Tail and Tactical Spend Solution Market – By Type

6.1 Introduction/Key Findings

6.2 Software

6.3 Services

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Tail and Tactical Spend Solution Market – By Deployment Mode

7.1 Introduction/Key Findings

7.2 Cloud-Based

7.3 On-Premise

7.4 Y-O-Y Growth trend Analysis By Deployment Mode

7.5 Absolute $ Opportunity Analysis By Deployment Mode, 2025-2030

Chapter 8. Tail and Tactical Spend Solution Market – By End-User

8.1 Introduction/Key Findings

8.2 BFSI

8.3 Healthcare

8.4 Manufacturing (Largest Market Share, 25%)

8.5 Retail

8.6 IT & Telecom (Fastest-Growing, CAGR 16.5%)

8.7 Others

8.8 Y-O-Y Growth trend Analysis By End-User

8.9 Absolute $ Opportunity Analysis By End-User, 2025-2030

Chapter 9. Tail and Tactical Spend Solution Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By Deployment Mode

9.1.4 By End-User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By Deployment Mode

9.2.4 By End-User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By Deployment Mode

9.3.4 By End-User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By Deployment Mode

9.4.4 By End-User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By Deployment Mode

9.5.4 By End-User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Tail and Tactical Spend Solution Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 SAP Ariba

10.2 Coupa Software

10.3 GEP

10.4 Jaggaer

10.5 Ivalua

10.6 Basware

10.7 Proactis

10.8 Zycus

10.9 Fairmarkit

10.10 SynerTrade

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market was valued at USD 2.9 billion in 2024 and is projected to reach USD 6.8 billion by 2030, growing at a CAGR of 18.5%.

Key drivers include spend optimization, AI-powered procurement analytics, and increased adoption of cloud-based procurement solutions.

North America, with a 38% market share, due to high adoption of e-procurement platforms and regulatory compliance.

Spend analytics, e-procurement, vendor management, and contract lifecycle management.

Leading players include SAP Ariba, Coupa Software, GEP, Jaggaer, and Ivalua.