Sorghum Seed Market size (2023 - 2030)

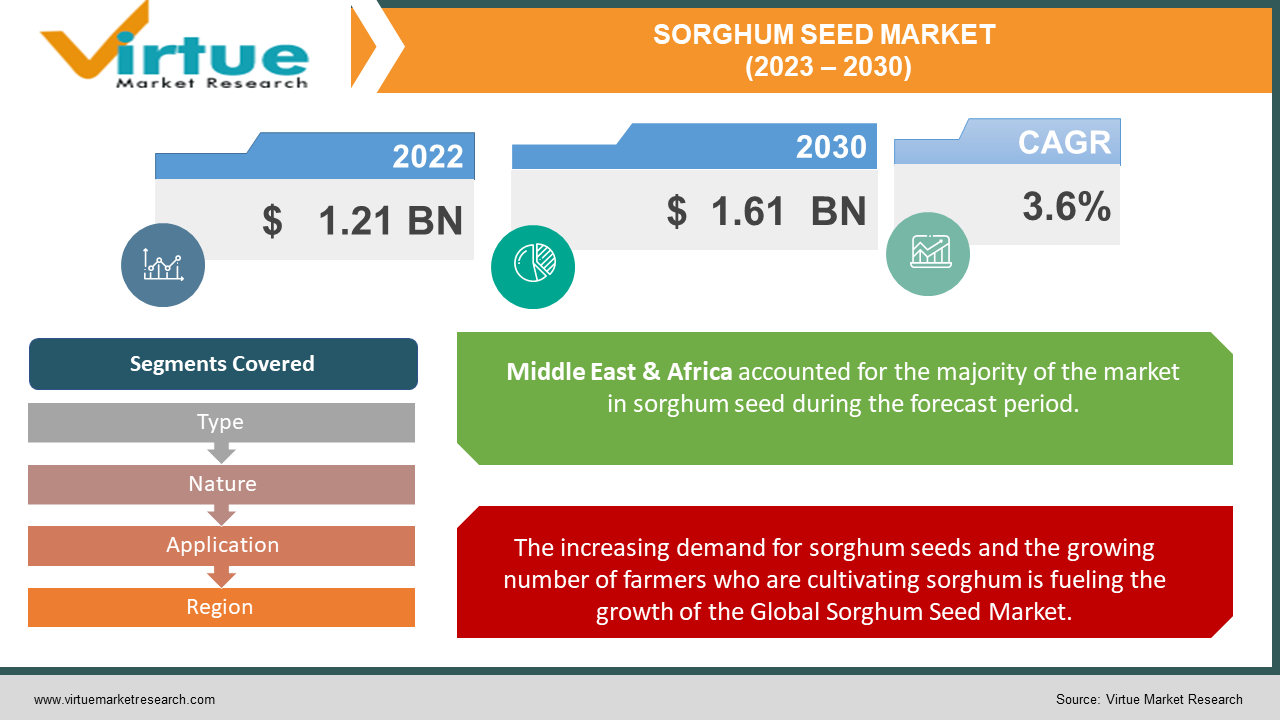

Global Sorghum Seed Market is estimated to be worth USD 1.21 Billion in 2022 and is projected to reach a value of USD 1.61 Billion by 2030, growing at a CAGR of 3.6% during the forecast period 2023-2030.

Sorghum, scientifically identified as Sorghum bicolor L, is a cereal grain plant belonging to the grass family (Poaceae). It is acknowledged by multiple names like great millet, Indian millet, milo, durra, or shallu. This adaptable plant originated in Africa, where it plays a vital role as a staple food crop. There are various varieties of sorghum, encompassing grain sorghums, which are consumed by humans, grass sorghums, cultivated for hay and fodder, and broomcorn, utilized in crafting brooms and brushes. In India, sorghum is commonly known as jowar, cholam, or jonna; in West Africa, it goes by the name Guinea corn, and in China, it is referred to as kaoliang. Sorghum has lower feed quality when contrasted with maize. It is hefty in carbohydrates and comprises approximately 10% protein and 3.4% fat. It also consists of calcium and trace amounts of iron, vitamin B1, and niacin. When intended for human consumption, this gluten-free grain is generally ground into a meal and utilized to make porridge, flatbreads, and cakes. Its distinct pungent flavor can be lessened via processing. Furthermore, sorghum finds application in various other ways like producing edible oil, starch, dextrose (a type of sugar), paste, and alcoholic beverages. Apart from its culinary usage, sorghum stalks are utilized as fodder for livestock and as building materials. In the United States and southern Africa, sweet sorghums, also known as sorgos, are chiefly cultivated for forage and syrup production. They are occasionally employed in the production of ethyl alcohol for biofuel.

Global Sorghum Seed Market Drivers:

The increasing demand for sorghum seeds and the growing number of farmers who are cultivating sorghum is fueling the growth of the Global Sorghum Seed Market.

As per the AgMRC Organization, global acreage devoted entirely to sorghum cultivation has escalated by 66% during the previous 50 years. This trend can be ascribed to the favorable characteristics of sorghum seeds like their capacity to defy drought, soil toxicity, and extreme temperatures better than other forage seeds. Sorghum seeds are well-suited for regions with inadequate water availability and less fertile soil, which permits them to thrive in arduous planting conditions. Furthermore, sorghum seeds offer higher yields to farmers when contrasted with other forage crops. Therefore, this factor propels the demand for sorghum seeds.

The rising consumption of sorghum seeds in everyday diets is another factor contributing to the growth of the Global Sorghum Seed Market.

The Global Sorghum Seed Market is expanding owing to the rising utilization of sorghum seeds in everyday diets and their versatility in varied applications. Sorghum is utilized in fields like floral arrangements, fencing, building material, and pet food, propelling its expansion. Sorghum's copious dietary fiber content benefits heart health by clearing out LDL cholesterol, thereby lowering the risk of cardiovascular afflictions. Furthermore, sorghum seeds are utilized in animal feed owing to their supply of dietary phospholipids. Rising meat consumption worldwide contributes to the demand for sorghum syrup. Therefore, this factor also propels the demand for sorghum seeds.

Global Sorghum Seed Market Challenges:

The Global Sorghum Seed Market is encountering challenges, primarily in terms of sorghum seeds' limited shelf life. Treating sorghum seeds with protective substances helps avert insect damage during plant growth, which stalls crop loss and pest establishment. Yet, treated seeds have a brief shelf duration and rapidly lose their vigor and ability to germinate, specifically in sorghum seeds. The viability of microorganisms in the seed coating is affected by the elements of the treatment, which spurs complications in preserving their survival and diminishing the shelf longevity of the seeds. Farmers have been hesitant in adopting beneficial practices such as reducing pesticide utilization and implementing crop rotation. Thus, these obstacles inhibit the growth of the Global Sorghum Seed Market.

Global Sorghum Seed Market Opportunities:

Market expansion strategies present a lucrative opportunity in the Global Sorghum Seed Market. The demand for sorghum seeds is augmenting owing to their advantages, including short growth cycles, lower input requirements, disease and pest resistance, bioenergy potential, and climate resilience. Businesses specializing in the cultivation of sorghum seeds can attain considerable benefits from this opportunity by broadening their product offerings to emerging markets, encompassing South Korea, Brazil, and Turkey. By pursuing this expansion, companies can broaden their customer base and drive a notable increase in their overall revenue.

COVID-19 Impact on the Global Sorghum Seed Market:

The Global Sorghum Seed Market has been considerably influenced by the COVID-19 outbreak. As a result of rigorous lockdowns, travel restrictions, and social distancing measures, the demand for sorghum seeds waned. Disruptions in the supply chains highly affected the expedited cultivation and distribution of sorghum seeds. Furthermore, the export of sorghum seeds dwindled in several countries, and both public and private organizations dealt with a paucity of workers for production, transportation, and documentation tasks associated with sorghum seeds. These factors negatively impacted the market's growth. Despite these challenges, the market is projected to rebound alongside the global recovery from the pandemic.

Global Sorghum Seed Market Recent Developments:

-

In February 2023, ICRISAT and the Seed Co Group collaborated to create a new sorghum variety with the potential to yield up to 8 tonnes/hectare. This innovative variety offers farmers a remarkable 25% increase in yield when contrasted with existing varieties.

-

In May 2022, LongPing High-Tech, a Chinese seed company, unveiled the introduction of a new sorghum seed specifically targeted at Brazilian farmers.

-

In June 2020, Alta Seeds, a Texas-based seed company, launched the world’s first non-GMO, herbicide-tolerant sorghum.

SORGHUM SEED MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

3.6% |

|

Segments Covered |

By Type, Nature, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

KWS SAAT SE & Co. KGaA (Germany), Corteva Agriscience LLC (United States), Groupe Limagrain Holding S.A. (France), Dyna-Gro, Inc. (United States), DeKalb Genetics Corporation (United States), Advanta Seeds Pty. Ltd. (Australia), Nufarm Ltd. (Australia), Archer-Daniels-Midland Company (United States), Richardson Seeds Ltd. (United States), Allied Seed, LLC (United States) |

Global Sorghum Seed Market Segmentation: By Type

-

Biomass Sorghum

-

Forage Sorghum

-

Grain Sorghum

-

Sweet Sorghum

Based on the Type, the Grain Sorghum segment occupied the highest market share in the year 2022. The growth can be ascribed to the gluten-free nature, protein-abounding content, and fiber-loaded attributes of grain sorghum. Grain sorghum is highly acknowledged owing to its high levels of antioxidant-rich phenolic compounds. The phenolic compounds in sorghum exhibit vital anti-inflammatory traits and have the potential to alleviate contrasting forms of inflammation. Furthermore, specific phenolic compounds occurring in sorghum have been linked to profound anti-cancer attributes.

Global Sorghum Seed Market Segmentation: By Nature

-

Conventional

-

Organic

Based on Nature, the Conventional segment occupied the highest market share in the year 2022. The growth can be ascribed to the advantages that conventional sorghum seeds offer in contrast to organic counterparts, encompassing easy and quick accessibility, heightened availability, and cost-effectiveness. Conventional sorghum seeds' lower price contrasted with their organic counterpart makes them highly attractive to price-conscious consumers.

Global Sorghum Seed Market Segmentation: By Application

-

Human Feed

-

Livestock Feed

-

Biofuel & Ethanol

Based on the Application, the Biofuel & Ethanol segment occupied the highest market share in the year 2022. The growth can be ascribed to the augmenting demand for modestly priced and sustainable fuel alternatives, especially in emerging economies, encompassing China, India, Brazil, and others. Furthermore, the rising emphasis on energy security and the notable increase in crude oil prices are key factors propelling the demand for sorghum in the Global Sorghum Seed Market.

Global Sorghum Seed Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

Based on the Region, the Middle East & Africa occupied the highest share of the Global Sorghum Seed Market in the year 2022. The growth can be ascribed to the rising awareness of the health benefits linked with the utilization of sorghum seeds. Sorghum, scientifically identified as Sorghum bicolor (L.) Moench, is a vital grain crop farmed chiefly in temperate and tropical regions. It holds profound agricultural importance in Africa, especially in nations like Sudan, Ethiopia, and Somalia, as well as other countries positioned southward from the Sahara in West Africa. The region of Europe is anticipated to expand at the quickest rate over the forecast period 2023-2030 owing to the extensive cultivation of sorghum seeds for biofuels and animal feed, the rising awareness of sorghum's nutritional benefits, and the strong presence of significant market players, including KWS SAAT SE & Co. KGaA, Groupe Limagrain Holding S.A., and GSSE Group.

Global Sorghum Seed Market Key Players:

-

KWS SAAT SE & Co. KGaA (Germany)

-

Corteva Agriscience LLC (United States)

-

Groupe Limagrain Holding S.A. (France)

-

Dyna-Gro, Inc. (United States)

-

DeKalb Genetics Corporation (United States)

-

Advanta Seeds Pty. Ltd. (Australia)

-

Nufarm Ltd. (Australia)

-

Archer-Daniels-Midland Company (United States)

-

Richardson Seeds Ltd. (United States)

-

Allied Seed, LLC (United States)

Chapter 1. Sorghum Seed Market - Scope & Methodology

1.1 Market Segmentation

1.2 Assumptions

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Sorghum Seed Market - Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.3 COVID-19 Impact Analysis

2.3.1 Impact during 2023 – 2030

2.3.2 Impact on Supply – Demand

Chapter 3. Sorghum Seed Market - Competition Scenario

3.1 Market Share Analysis

3.2 Product Benchmarking

3.3 Competitive Strategy & Development Scenario

3.4 Competitive Pricing Analysis

3.5 Supplier - Distributor Analysis

Chapter 4. Sorghum Seed Market - Entry Scenario

4.1 Case Studies – Start-up/Thriving Companies

4.2 Regulatory Scenario - By Region

4.3 Customer Analysis

4.4 Porter's Five Force Model

4.4.1 Bargaining Power of Suppliers

4.4.2 Bargaining Powers of Customers

4.4.3 Threat of New Entrants

4.4.4 Rivalry among Existing Players

4.4.5 Threat of Substitutes

Chapter 5. Sorghum Seed Market - Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Sorghum Seed Market - By Type

6.1 Biomass Sorghum

6.2 Forage Sorghum

6.3 Grain Sorghum

6.4 Sweet Sorghum

Chapter 7. Sorghum Seed Market - By Nature

7.1 Conventional

7.2 Organic

Chapter 8. Sorghum Seed Market - By Application

8.1 Human Feed

8.2 Livestock Feed

8.3 Biofuel & Ethanol

Chapter 9. Sorghum Seed Market – By Region

9.1 North America

9.2 Europe

9.3 Asia-Pacific

9.4 Latin America

9.5 The Middle East

9.6 Africa

Chapter 10. Sorghum Seed Market – Key players

10.1 KWS SAAT SE & Co. KGaA (Germany)

10.2 Corteva Agriscience LLC (United States)

10.3 Groupe Limagrain Holding S.A. (France)

10.4 Dyna-Gro, Inc. (United States)

10.5 DeKalb Genetics Corporation (United States)

10.6 Advanta Seeds Pty. Ltd. (Australia)

10.7 Nufarm Ltd. (Australia)

10.8 Archer-Daniels-Midland Company (United States)

10.9 Richardson Seeds Ltd. (United States)

10.10 Allied Seed, LLC (United States)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Global Sorghum Seed Market is estimated to be worth USD 1.21 Billion in 2022 and is projected to reach a value of USD 1.61 Billion by 2030, growing at a CAGR of 3.6% during the forecast period 2023-2030.

The Global Sorghum Seed Market Drivers are the Increasing Demand for Sorghum Seeds and the Growing Number of Farmers Who Are Cultivating Sorghum and the Rising Consumption of Sorghum Seeds in Everyday Diets.

Based on the Type, the Global Sorghum Seed Market is segmented into Biomass Sorghum, Forage Sorghum, Grain Sorghum, and Sweet Sorghum.

Nigeria, Sudan, and South Africa are the most dominating countries in the region of Middle East & Africa for the Global Sorghum Seed Market.

KWS SAAT SE & Co. KGaA, Corteva Agriscience LLC, and Groupe Limagrain Holding S.A. are the leading players in the Global Sorghum Seed Market.