Soil Stabilization Market Size (2024 – 2030)

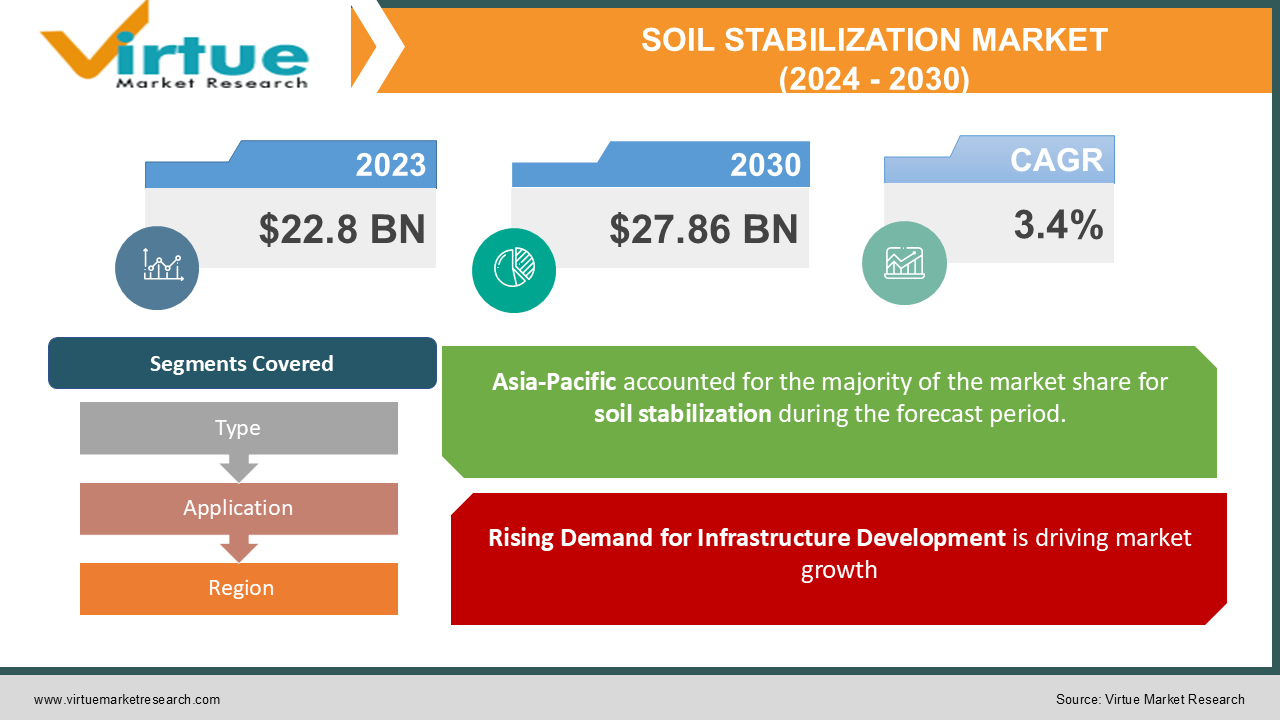

The Global Soil Stabilization Market was valued at USD 22.8 billion in 2024 and is projected to grow at a CAGR of 3.4% from 2024 to 2030. By the end of 2030, the market is expected to reach USD 27.86 billion.

The Soil Stabilization Market focuses on techniques and materials used to improve the physical properties of soil, enhancing its strength and durability for construction and agricultural applications. With the rapid growth of infrastructure projects, increased urbanization, and a growing need for efficient land use, the demand for soil stabilization has been rising globally. This market's expansion is also driven by increased awareness of sustainable agricultural practices and the use of environment-friendly stabilizing agents.

Key Market Insights:

-

The construction sector holds the largest share in the Soil Stabilization Market, driven by the rising number of infrastructure projects globally, including road construction, railways, and airport runways.

-

The lime and cement stabilization method remains the most widely used due to its effectiveness in improving soil properties and its cost-efficiency, particularly in large-scale infrastructure projects.

-

The Asia-Pacific region is expected to witness the fastest growth in the Soil Stabilization Market, driven by rapid urbanization, infrastructure development, and government initiatives to improve agricultural productivity.

Global Soil Stabilization Market Drivers:

Rising Demand for Infrastructure Development is driving market growth:

The need for infrastructure development is a primary driver of the Soil Stabilization Market. Governments and private entities around the world are investing heavily in new roads, highways, railways, airports, and residential and commercial buildings. The increasing focus on durable and long-lasting infrastructure necessitates the use of soil stabilization to ensure a stable foundation and reduce the risk of structural failures. Soil stabilization techniques help enhance load-bearing capacity, reduce settlement, and control soil erosion, making it a critical component of modern construction projects. Moreover, the rapid urbanization in developing countries is contributing to a surge in construction activities, further propelling market growth. In many emerging economies, such as China, India, and Brazil, the demand for efficient land use is increasing, and soil stabilization provides an effective solution for utilizing challenging terrains.

Growing Awareness of Sustainable Agricultural Practices is driving market growth:

In the agricultural sector, soil stabilization is increasingly used to prevent soil erosion, improve soil fertility, and enhance water retention capabilities. With the growing emphasis on sustainable farming practices, there is a heightened focus on using environmentally safe stabilizers that do not harm the soil's natural composition. Farmers and agricultural organizations are adopting soil stabilization methods to mitigate the adverse effects of climate change, such as increased soil erosion due to heavy rainfall and wind. The use of bio-based stabilizers, like enzymes and plant-based polymers, is on the rise, providing an eco-friendly alternative to chemical additives. These practices not only help in improving crop yields but also contribute to soil health and sustainability, aligning with global efforts to promote regenerative agriculture.

Technological Advancements in Soil Stabilization Techniques is driving market growth:

The evolution of soil stabilization technologies has significantly enhanced the efficiency and effectiveness of stabilization processes. New materials, such as geosynthetics, including geogrids and geotextiles, have been developed to provide superior soil reinforcement and erosion control. The use of nano-materials and advanced polymers has also shown promising results in improving soil strength and reducing permeability. Moreover, the advent of digital solutions, like remote sensing and Geographic Information System (GIS) technologies, has revolutionized soil testing and analysis, enabling more accurate determination of soil properties and the optimal choice of stabilization methods. These innovations are reducing project costs and time while ensuring high-quality results, thus driving the adoption of advanced soil stabilization solutions.

Global Soil Stabilization Market Challenges and Restraints:

High Costs of Advanced Stabilization Materials and Techniques is restricting market growth:

One of the major challenges faced by the Soil Stabilization Market is the high cost associated with advanced stabilization techniques and materials. While traditional methods like lime and cement stabilization are relatively cost-effective, the use of innovative materials, such as geosynthetics, nano-polymers, and bio-based stabilizers, can be expensive. These materials often require specialized equipment and skilled labor for proper application, further increasing the overall project costs. In regions with budget constraints or where cost sensitivity is high, the adoption of such advanced techniques can be limited. Additionally, the lack of awareness and technical expertise in using new stabilization materials in developing countries can hinder market growth. Although costs are expected to decline as production scales up, the current high expenses act as a barrier to widespread adoption.

Environmental Concerns and Regulatory Challenges is restricting market growth:

The use of chemical stabilizers like lime, cement, and fly ash in soil stabilization processes raises environmental concerns. These materials can alter the natural composition of the soil and potentially harm the local ecosystem, especially when used excessively. The production of cement and lime also contributes to greenhouse gas emissions, making it less favorable in regions with strict environmental regulations. Governments and regulatory bodies are increasingly implementing policies to minimize the environmental impact of construction activities, pushing for the adoption of more sustainable and eco-friendly alternatives. However, transitioning to these greener options can be challenging due to higher costs and limited availability, presenting a restraint for the market.

Market Opportunities:

The Soil Stabilization Market presents significant growth opportunities due to the increasing focus on sustainable construction and environmental protection. The growing trend towards green infrastructure and the adoption of sustainable building practices are driving the demand for eco-friendly soil stabilization materials. As the global construction industry shifts towards reducing its carbon footprint, the use of bio-based stabilizers and recycled materials is expected to increase. Moreover, advancements in soil analysis technologies, such as real-time soil monitoring and predictive modeling using AI and machine learning, are enabling more precise application of stabilization techniques, reducing waste and enhancing efficiency. The surge in infrastructure development projects across emerging economies also presents a vast untapped market for soil stabilization solutions. Governments in countries like India, Indonesia, and Vietnam are investing heavily in transportation infrastructure, creating a robust demand for effective soil stabilization methods. Additionally, the increasing emphasis on climate resilience and disaster mitigation has heightened the importance of soil stabilization in protecting critical infrastructure from natural disasters, such as landslides and flooding.

SOIL STABILIZATION MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.4% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Caterpillar Inc., Global Road Technology, Soilworks LLC, SNF Holding Company, Wirtgen Group, AB Volvo, AggreBind Inc., Carmeuse, Graymont, Tensar International Corporation |

Soil Stabilization Market Segmentation: By Type

-

Mechanical Stabilization

-

Chemical Stabilization

-

Biological Stabilization

Among the types, Chemical Stabilization is the most dominant segment in 2024. It is widely used due to its effectiveness in altering the physical properties of soil, improving load-bearing capacity, and providing long-term stability. Lime and cement remain the preferred choices due to their cost-effectiveness and wide availability.

Soil Stabilization Market Segmentation: By Application

-

Roads & Highways

-

Airports

-

Railways

-

Residential & Commercial Construction

-

Agriculture

In terms of application, Roads & Highways hold the largest market share. The extensive need for durable and stable road infrastructure, especially in developing countries, has made soil stabilization a critical part of road construction projects. The use of stabilizers helps in creating a solid foundation, reducing maintenance costs, and extending the lifespan of road networks.

Soil Stabilization Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Asia-Pacific region is the dominant market for soil stabilization, driven by rapid infrastructure development and urbanization. Countries like China, India, and Japan are investing heavily in road construction, railways, and airport expansion projects, creating a substantial demand for soil stabilization solutions. The agricultural sector in the region also contributes to market growth, as soil stabilization techniques are increasingly used to enhance soil health and combat erosion in farming areas. The presence of numerous construction companies and raw material suppliers further supports the market’s growth in Asia-Pacific.

COVID-19 Impact Analysis on the Soil Stabilization Market:

The COVID-19 pandemic had a mixed impact on the Soil Stabilization Market. In the early stages of the pandemic, lockdowns and travel restrictions led to the suspension of many construction projects, causing a decline in demand for soil stabilization products and services. The disruption of supply chains also affected the availability of stabilizing materials, leading to project delays. However, as economies started to recover, governments around the world launched stimulus packages focused on infrastructure development as a key strategy for economic revival. This resulted in a resurgence of demand for soil stabilization, especially in the transportation infrastructure sector. Additionally, the agricultural sector showed resilience, as soil stabilization continued to be necessary for maintaining soil health and productivity. The pandemic has also accelerated the adoption of digital solutions and remote monitoring technologies in the soil stabilization industry, paving the way for more efficient project management in the post-pandemic period.

Latest Trends/Developments:

The Soil Stabilization Market is experiencing several emerging trends, including the increasing use of geosynthetics for improved soil reinforcement and erosion control. Geosynthetics, such as geogrids and geotextiles, are being used more frequently due to their durability and effectiveness in enhancing soil properties. Another key trend is the rising adoption of bio-based stabilizers, which offer an eco-friendly alternative to traditional chemical stabilizers. These organic compounds, derived from natural sources, help in improving soil structure without causing environmental harm. The integration of digital technologies, such as GIS mapping and real-time soil monitoring, is also transforming the market, enabling more accurate soil analysis and efficient application of stabilization methods. The growing emphasis on climate-resilient infrastructure is further driving innovation in the industry, with a focus on developing materials and techniques that can withstand extreme weather conditions and natural disasters.

Key Players:

-

Caterpillar Inc.

-

Global Road Technology

-

Soilworks LLC

-

SNF Holding Company

-

Wirtgen Group

-

AB Volvo

-

AggreBind Inc.

-

Carmeuse

-

Graymont

-

Tensar International Corporation

Chapter 1. Soil Stabilization Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Soil Stabilization Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Soil Stabilization Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Soil Stabilization Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Soil Stabilization Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Soil Stabilization Market – By Type

6.1 Introduction/Key Findings

6.2 Mechanical Stabilization

6.3 Chemical Stabilization

6.4 Biological Stabilization

6.5 Y-O-Y Growth trend Analysis By Type

6.6 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Soil Stabilization Market – By Application

7.1 Introduction/Key Findings

7.2 Roads & Highways

7.3 Airports

7.4 Railways

7.5 Residential & Commercial Construction

7.6 Agriculture

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Soil Stabilization Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Soil Stabilization Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Caterpillar Inc.

9.2 Global Road Technology

9.3 Soilworks LLC

9.4 SNF Holding Company

9.5 Wirtgen Group

9.6 AB Volvo

9.7 AggreBind Inc.

9.8 Carmeuse

9.9 Graymont

9.10 Tensar International Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Soil Stabilization Market was valued at USD 22.8 billion in 2024 and is projected to grow at a CAGR of 3.4% from 2024 to 2030. By the end of 2030, the market is expected to reach USD 27.86 billion.

The primary drivers include increasing infrastructure development, rising awareness of sustainable agricultural practices, and advancements in soil stabilization technologies.

The market is segmented by type (mechanical, chemical, biological stabilization) and by application (roads & highways, airports, railways, residential & commercial construction, agriculture).

The Asia-Pacific region is the most dominant, driven by extensive infrastructure projects and significant agricultural activities.

Leading players include Caterpillar Inc., Wirtgen Group, SNF Holding Company, and Graymont, among others