Short-term Alert System for Power System Operations Market Size (2024 – 2030)

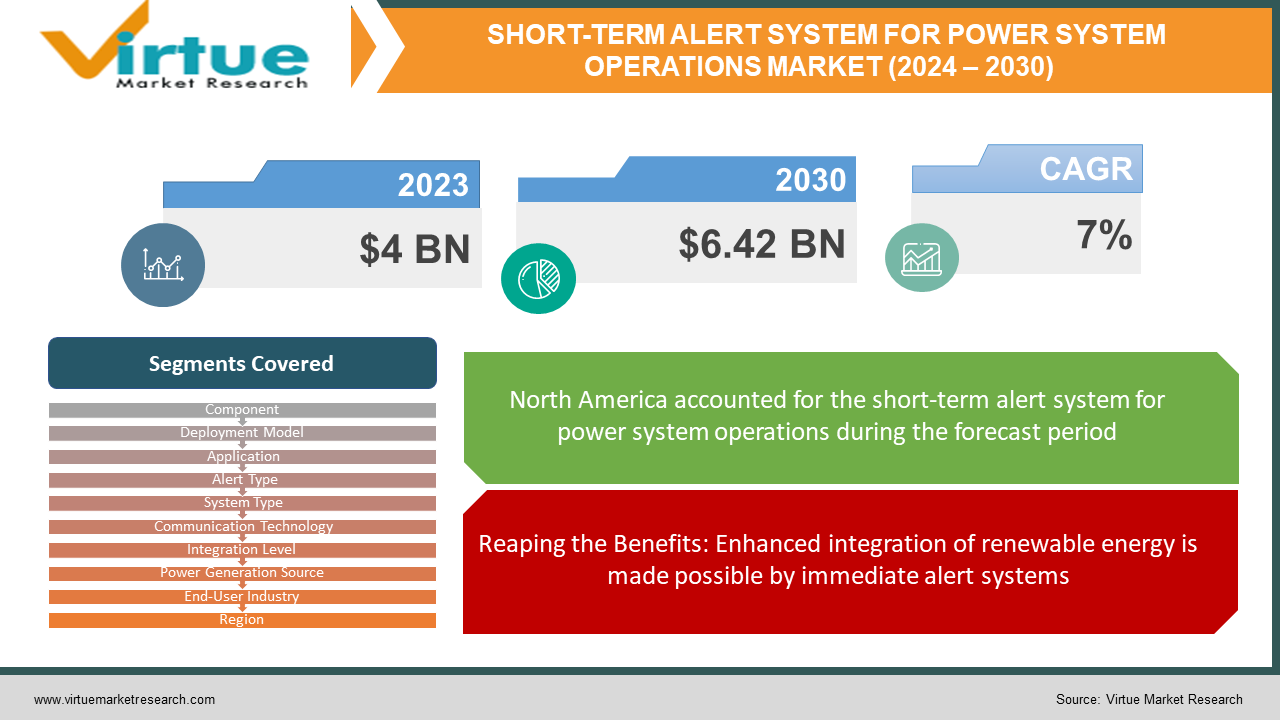

The short-term alert systems for power system operations market is predicted to expand from its estimated size of USD 4 billion in 2023 to USD 6.42 billion by the end of 2030. Between 2024 and 2030, the market is expected to increase at a compound annual growth rate (CAGR) of 7%.

The short-term alert system for the power system operations market is a crucial component that ensures the efficiency and reliability of power systems. For defect detection, load forecasting, grid monitoring, and other uses, a variety of technologies are available on the market. These solutions include services, hardware, and software. A range of deployment alternatives, such as on-premises and cloud-based models, allow stakeholders to choose the technologies that best meet their operational needs. Major competitors fighting for market share shape the competitive landscape in the business. End users, such as government organizations, energy dealers, Independent System Operators (ISOs), and electric utilities, are what propel the market's expansion.

Key Market Insights:

The growing focus on dependable grid operations and effective power management is driving an expansion of the global market for short-term alert systems for power system operations. Important market data suggests that there is an increasing need for these systems, which are essential to the power industry's monitoring, fault detection, and load forecasting. Leading companies in the sector are actively shaping the market by focusing on embracing new challenges, forming strategic alliances, and never stopping innovating. Developments in communication technologies, the combination of hardware and software solutions, and a regulatory environment that prioritizes standards and compliance are driving the market's progress.

Because of the anticipated increase in the use of short-term alert systems, the market is anticipated to develop dramatically over the next few years. A favorable outlook is impacted by factors such as the ongoing advancement of smart grids, the rise of renewable energy sources, and the need for real-time reaction and monitoring techniques. As the energy environment continues to change, these technologies are expected to play a critical role in enhancing the resilience and efficiency of power systems, with the potential for a sustained rise in the compound annual growth rate (CAGR) until 2030.

Short-term Alert System for Power System Operations Market Drivers:

Reaping the Benefits: Enhanced integration of renewable energy is made possible by immediate alert systems.

The rate at which renewable energy sources, such as solar and wind power, are being incorporated into conventional power networks is radically altering the global energy scene. The development of renewable energy presents challenges as well as opportunities for the international community in its search for sustainable alternatives. Short-term warning systems, which offer real-time monitoring and adaptive responses to the inherent variability of renewable sources, enable this paradigm change. These devices are necessary to keep the grid stable and to make it easier to integrate intermittent renewable energy sources. Additionally, they provide utilities and operators with valuable information that helps them manage variations and optimize the distribution of energy.

Flexible to Unpredictability: Instant alert systems boost grid stability and robustness.

Grid resilience and reliability are vital in an era of rising energy needs and evolving power infrastructures. As a vital safeguard for grid stability, short-term alert systems can promptly identify and address any faults or disturbances. These solutions enhance the resilience of our interconnected grids, enable proactive problem-solving, and decrease downtime by providing operators with a real-time perspective on the complexities of power networks. Modern energy management is reinventing the field of short-term alert systems, which ensure that our power grids are not only reactive but also adaptive and ready to face future uncertainty.

Managing the Storm: Timely warning systems fortify electrical systems against the rise in natural disasters.

As natural disasters happen more frequently and with increasing intensity, power systems face challenges never seen before. Temporary alert systems are vital barriers that provide robust protection against storms, extreme weather, and unforeseen disasters. These systems function as early warning systems, promptly identifying disruptions and supplying utilities with the necessary resources to enable prompt response and recovery. When the frequency of natural disasters rises, short-term alert systems act as bulwarks of resilience against the unpredictability of nature, ensuring the reliability and uninterrupted supply of power.

Short-term Alert System for Power System Operations Market Restraints and Challenges:

Managing temporary alert systems for data security concerns.

Data security issues are getting more attention as the short-term alert system for power system operations becomes a crucial component of contemporary energy management. Power networks are becoming more digital, which releases a lot of personal data and exposes these warning systems to assault. To guarantee the dependability of these systems, protection against unauthorized access, data breaches, and other cybersecurity threats is essential. As the energy environment changes, power system operators must simultaneously embrace new technology and strengthen current defenses to safeguard sensitive data. This highlights the pressing need for strong cybersecurity protections.

Managing incorporation difficulties in power alert systems: moving towards smooth fusion rather than smooth confusion.

Power system operators are trying to integrate short-term alert systems into their existing infrastructure, which is a complicated step. Integrating these state-of-the-art devices with more traditional technology is challenging without causing a divide. Overcoming integration obstacles, which might vary from compatibility issues to the need for real-time data synchronization, requires careful navigation. The key to these warning systems' success is their ability to seamlessly connect with current frameworks and provide a unified solution that boosts operational efficiency without adding more complexity. As the industry strives for innovation, resolving integration challenges will become a crucial performance indicator for the efficient operation of power systems in the future.

Short-term Alert System for Power System Operations Market Opportunities:

Boosting Precision: Short-term alert systems leverage AI and machine learning advancements.

Because they make use of the most recent developments in artificial intelligence (AI) and machine learning (ML), short-term alert systems for power system operations are at the forefront of innovation in this critical era of technological improvement. Due to technological improvements, alert systems may now anticipate and prevent possible interruptions, in addition to identifying and handling problems. Large-scale datasets are analyzed in real time by AI and ML algorithms, providing operators with previously unattainable insights into the properties of power systems. These intelligent alarm systems, which continuously learn from past data and react to changing conditions, usher in a new era of proactive, accurate, and efficient power system management.

Uncovering the Power Grid's Secrets: Short-term alert systems are fueling the increase in demand for energy analytics.

The increasing need for energy analytics is causing a revolution in the power sector, and short-term alert systems are essential to making this historic shift possible. As electricity systems adapt to meet the demands of a digital future, the requirement for precise insights on grid performance, fault predictions, and load trends has become increasingly important. Short-term warning systems meet this demand by providing operators with comprehensive energy analytics features that enable data-driven decision-making. By utilizing real-time data and advanced analytics, these solutions not only increase operational efficiency but also pave the way for a more intelligent and responsive electricity infrastructure. At a time when the need for actionable data is increasing, the combination of energy analytics and short-term alert systems has the potential to fundamentally alter how we monitor, operate, and optimize our power systems.

SHORT-TERM ALERT SYSTEM FOR POWER SYSTEM OPERATIONS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7% |

|

Segments Covered |

By Component, Deployment Model, Application, Alert Type, System Type, Communication Technology, Integration Level, Power Generation Source, End-User Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ABB Ltd., AECOM, Autodesk, Inc., C3.ai, Inc, General Electric, Schneider Electric, Cascade Energy, Inc., Cypress Envirosystems, Eaton Corporation Plc, Emerson Electric Company, Enel X S.r.l, General Electric Company, GridPoint, Inc., Honeywell International, Inc., Horiba, Ltd., IBM Corporation |

Short-term Alert System for Power System Operations Market Segmentation: By Component

-

Software

-

Hardware

-

Services (Maintenance, Support, and Consulting)

Software is both the largest and fastest-growing segment in the short-term alert systems for power system operations, enabling the industry to achieve efficiency and accuracy levels never seen before. The demand for sophisticated software systems that can identify potential disruptions, assess huge datasets, and support in-the-moment decision-making has surged due to the complexity of power networks. Modern software systems employ complex algorithms, often involving AI and ML, to monitor and optimize power system operations proactively, in addition to giving operators extensive insights into the behavior of the grid. Because software can be easily integrated with other components and is flexible enough to change with the times, it is positioned as the main component.

Short-term Alert System for Power System Operations Market Segmentation: By Deployment Model

-

On-Premises

-

Cloud-Based

Cloud-based solutions are both the largest and fastest-growing segment in this market. Scalability is one benefit of cloud-based deployment methods; it lets power system management adjust to fluctuating demands without being constrained by physical infrastructure. Smoother integration, improved accessibility, and quicker improvements are made possible via cloud-based system transfer. It transcends advancements in technology alone. The short-term alert system market's development will depend on the deployment tactics employed, with the cloud emerging as an innovative option. Because of its flexibility—which allows for quick adoption, fewer capital expenditures, and the ability to take advantage of distant data processing and storage—cloud-based deployment is more alluring. The market's response to the advantages of cloud-based deployment models makes it evident that the sector as a whole is shifting towards the adoption of dynamic, scalable, and future-proof solutions that maximize cloud technology to increase power.

Short-term Alert System for Power System Operations Market Segmentation: By Application

-

Grid Monitoring

-

Fault Detection and Analysis

-

Load Forecasting

-

Event Identification and Response

-

Others

Grid monitoring is the largest growing segment in this market. To efficiently manage the complexity of contemporary power systems, there is a rising demand for enhanced grid monitoring solutions due to the increasing integration of distributed energy resources, smart grid technology, and renewable energy sources. Fault detection and analysis is the fastest-growing category. It works together to proactively identify and diagnose potential issues to reduce downtime and enhance overall grid stability. Power grid complexity is increasing with the integration of dispersed generation, renewable energy sources, and smart grid technology. Therefore, to efficiently monitor and control grid operations, there is an increasing demand for sophisticated fault detection and analysis systems.

Short-term Alert System for Power System Operations Market Segmentation: By Alert Type

-

Emergency Alerts

-

Warning Alerts

-

Informational Alerts

The alert-type-based segmentation of short-term alert systems describes the different communication strategies applied to different power system operation scenarios. Emergency alerts are the largest growing segment and are meant for significant and imminent situations, signaling the necessity of prompt action in the event of potential outages or system failures. Warning alerts are the fastest-growing category. They are preemptive notifications of potential issues that provide operators with time to take appropriate action before things go out of control and turn into an emergency. Even if they do not signal impending hazards, informational alerts provide meaningful information about system settings, which aids in long-term planning and strategic decision-making.

Short-term Alert System for Power System Operations Market Segmentation: By System Type

-

SCADA-based Systems

-

DMS-based Systems

-

EMS-based Systems

-

Others

DMS-based systems are the largest segment in this market. Distribution Management System (DMS)-based systems improve fault management and electricity flow by focusing on the subtleties of grid distribution. To improve overall grid dependability, DMS-based systems delve deeper into the nuances of distribution, optimizing electricity flow, and supporting fault management. SCADA-based systems are the fastest-growing segment. A fundamental layer of visibility into power grid operations is provided by SCADA-based systems, which are renowned for their real-time monitoring capabilities. This enables quick responses to changing conditions.

Short-term Alert System for Power System Operations Market Segmentation: By Communication Technology

-

Wired

-

Wireless

The wired segment is the largest segment based on communication technology. As a mainstay in this field, wired communication technology offers a dependable and secure way to send data. Because of its resilience, it is especially useful in situations where reliable connections are essential for real-time control and monitoring. However, wireless communication technology is the fastest-growing. It adds a new level of adaptability that makes things more mobile and accessible. Smooth data transfer and communication are made possible by wireless technologies, particularly in locations where installing physical lines may not be feasible.

Short-term Alert System for Power System Operations Market Segmentation: By Integration Level

-

Integrated Systems

-

Standalone Systems

Standalone systems are the largest category. Standalone systems operate independently and provide a tailored, stand-alone solution for specific alarm functions. Operators of power systems have the option of either an integrated or independent configuration, which offers flexibility and adaptability to different operating conditions and preferences. Their varied needs are met by this selection. Integrated systems are the fastest-growing segment. Because integrated systems integrate easily into broader power management frameworks, they provide a holistic approach to monitoring and response. Often, these systems are integrated with other components, such as SCADA or DMS, to offer power grid operators a comprehensive solution.

Short-term Alert System for Power System Operations Market Segmentation: By Power Generation Source

-

Renewable Energy Sources

-

Non-Renewable Energy Sources

Non-renewable energy sources are the largest segment. Short-term alert systems for non-renewable energy sources focus on managing the risks and challenges associated with traditional energy sources, such as fossil fuels and nuclear power. Renewable energy sources are the fastest-growing segment. Short-term alert systems made expressly for renewable energy sources are crucial for addressing the unique challenges posed by the intermittent nature of solar, wind, and other renewable energy sources. These gadgets support grid stability by providing real-time insights into the erratic nature of renewable energy generation.

Short-term Alert System for Power System Operations Market Segmentation: By End-User Industry

-

Electric Utilities

-

Independent System Operators (ISOs)

-

Energy Traders

-

Government Agencies

-

Others

Electric utilities are the largest segment in this market. They benefit from these systems' real-time monitoring and response capabilities, which ensure the efficiency and dependability of power distribution. Electric utilities find specialized solutions for fault detection, demand forecasting, and grid reliability to ensure smooth power distribution. Independent system operators (ISOs) are the fastest-growing category. They use short-term alert systems to maintain system stability, optimize energy flow, and manage the grid. Because of these systems' flexibility, Independent System Operators (ISOs) are better able to optimize energy flow and oversee the grid.

Short-term Alert System for Power System Operations Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

In 2023, with a rough share of 40.00%, North America has the largest market. The region's prominence can be attributed to its sophisticated technological infrastructure, stringent regulatory frameworks, and growing emphasis on grid reliability and efficiency. Because of a strong commitment to grid optimization and technological advancements, the business is thriving in North America. The region's dominant position indicates this. With a 20.00% market share, the Asia-Pacific is the fastest-growing. This highlights its critical role in the sector, propelled by increasing industrialization, rising energy demand, and developing grid resilience. Due to its evolving industrial landscape and need for adaptable solutions to address shifting energy demands, Asia-Pacific offers enormous growth potential. Europe comes in second with a share of 25.00%, driven by a focused commitment towards sustainable energy practices and the integration of cutting-edge technologies. Europe is well-positioned to have a major influence on how the electricity system operates. Africa, the Middle East, and South America all contribute 10% and 5% of the total, respectively, indicating that awareness and the benefits of short-term alert systems for power system operations are also appreciated. South America, the Middle East, and Africa are regions that are ideal for growth and investment as real-time alert systems become more significant, even though their current shares are lower.

COVID-19 Impact Analysis on the Global Short-term Alert System for Power System Operations Market:

Like with many other industries, the global market for short-term alert systems for power system operations has been significantly impacted by the COVID-19 pandemic. The outbreak disrupted supply chains, messed with project timelines, and created uncertainty in the energy sector. Lockdowns and restrictions implemented globally led to a decline in industrial output, which affected energy demand patterns and caused challenges for power system operators. alert, but the outbreak has also highlighted how important it is to have reliable electrical infrastructure, which has accelerated the adoption of digital solutions like short-term alert systems.

Latest Trends/Developments:

The dynamic global short-term alert system for the power system operations market has been impacted by several notable trends. The major learning advancements in artificial intelligence (AI) and machine learning (ML) technology integration have enhanced the prediction capabilities and response mechanisms of short-term alert systems. Ensuring the resilience and efficacy of these systems has also required a greater focus on cybersecurity, an increase in the usage of cloud-based solutions, and the integration of cutting-edge communication technologies like 5G.

Furthermore, in keeping with the broader sustainability goals of the energy industry, the global push for the integration of renewable energy has impacted the adaptation of short-term alert systems to manage the variability associated with renewable sources. Globally, utilities and governments are pushing forward with grid modernization projects that promise to incorporate state-of-the-art technologies into short-term alert systems, increasing the power grids' overall flexibility and efficiency. As the industry navigates these trends, a deeper understanding of the need for resilient systems has been gained from the lessons learned during the COVID-19 pandemic. This awareness is driving innovation and strategic advances in the short-term warning system market.

Key Players:

-

ABB Ltd.

-

AECOM

-

Autodesk, Inc.

-

C3.ai, Inc

-

General Electric

-

Schneider Electric

-

Cascade Energy, Inc.

-

Cypress Envirosystems

-

Eaton Corporation Plc

-

Emerson Electric Company

-

Enel X S.r.l

-

General Electric Company

-

GridPoint, Inc.

-

Honeywell International, Inc.

-

Horiba, Ltd.

-

IBM Corporation

Chapter 1. Short-term Alert System for Power System Operations Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Short-term Alert System for Power System Operations Market – Executive Summary

2.1 Market Size & Forecast – (2024– 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Short-term Alert System for Power System Operations Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Short-term Alert System for Power System Operations Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Short-term Alert System for Power System Operations Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Short-term Alert System for Power System Operations Market – By Component

6.1 Introduction/Key Findings

6.2 Software

6.3 Hardware

6.4 Services (Maintenance, Support, and Consulting)

6.5 Y-O-Y Growth trend Analysis By Component

6.6 Absolute $ Opportunity Analysis By Component, 2024-2030

Chapter 7. Short-term Alert System for Power System Operations Market – By Deployment Model

7.1 Introduction/Key Findings

7.2 On-Premises

7.3 Cloud-Based

7.4 Y-O-Y Growth trend Analysis By Deployment Model

7.5 Absolute $ Opportunity Analysis By Deployment Model, 2024-2030

Chapter 8. Short-term Alert System for Power System Operations Market – By Application

8.1 Introduction/Key Findings

8.2 Grid Monitoring

8.3 Fault Detection and Analysis

8.4 Load Forecasting

8.5 Event Identification and Response

8.6 Others

8.7 Y-O-Y Growth trend Analysis End-Use Industry

8.8 Absolute $ Opportunity Analysis End-Use Industry, 2024-2030

Chapter 9. Short-term Alert System for Power System Operations Market – By Alert Type

9.1 Introduction/Key Findings

9.2 Emergency Alerts

9.3 Warning Alerts

9.4 Informational Alerts

9.5 Y-O-Y Growth trend Analysis End-User

9.6 Absolute $ Opportunity Analysis End-User, 2024-2030

Chapter 10. Short-term Alert System for Power System Operations Market – By System Type

10.1 Introduction/Key Findings

10.2 SCADA-based Systems

10.3 DMS-based Systems

10.4 EMS-based Systems

10.5 Others

10.6 Y-O-Y Growth trend Analysis Construction

10.7 Absolute $ Opportunity Analysis Construction, 2024-2030

Chapter 11. Short-term Alert System for Power System Operations Market – By Communication Technology

11.1 Introduction/Key Findings

11.2 Wired

11.3 Wireless

11.4 Y-O-Y Growth trend Analysis Site

11.5 Absolute $ Opportunity Analysis Site, 2024-2030

Chapter 12. Short-term Alert System for Power System Operations Market – By End-User Industry

12.1 Introduction/Key Findings

12.2 Integrated Systems

12.3 Standalone Systems

12.4 Y-O-Y Growth trend Analysis Concept

12.5 Absolute $ Opportunity Analysis Concept, 2024-2030

Chapter 13. Short-term Alert System for Power System Operations Market – By End-User Industry

13.1 Introduction/Key Findings

13.2 Renewable Energy Sources

13.3 Non-Renewable Energy Sources

13.4 Y-O-Y Growth trend Analysis Concept

13.5 Absolute $ Opportunity Analysis Concept, 2024-2030

Chapter 14. Short-term Alert System for Power System Operations Market – By End-User Industry

14.1 Introduction/Key Findings

14.2 Electric Utilities

14.3 Independent System Operators (ISOs)

14.4 Energy Traders

14.5 Government Agencies

14.6 Others

14.7 Y-O-Y Growth trend Analysis Concept

14.8 Absolute $ Opportunity Analysis Concept, 2024-2030

Chapter 15. Short-term Alert System for Power System Operations Market, By Geography – Market Size, Forecast, Trends & Insights

15.1 North America

15.1.1 By Country

15.1.1.1 U.S.A.

15.1.1.2 Canada

15.1.1.3 Mexico

15.1.2 By Component

15.1.2.1 By Deployment Model

15.1.3 By Application

15.1.4 By System Type

15.1.5 Countries & Segments - Market Attractiveness Analysis

15.2 Europe

15.2.1 By Country

15.2.1.1 U.K

15.2.1.2 Germany

15.2.1.3 France

15.2.1.4 Italy

15.2.1.5 Spain

15.2.1.6 Rest of Europe

15.2.2 By Component

15.2.3 By Deployment Model

15.2.4 By Application

15.2.5 By Alert Type

15.2.6 By System Type

15.2.7 By Communication Technology

15.2.8 Countries & Segments - Market Attractiveness Analysis

15.3 Asia Pacific

15.3.1 By Country

15.3.1.1 China

15.3.1.2 Japan

15.3.1.3 South Korea

15.3.1.4 India

15.3.1.5 Australia & New Zealand

15.3.1.6 Rest of Asia-Pacific

15.3.2 By Component

15.3.3 By Deployment Model

15.3.4 By Application

15.3.5 By Alert Type

15.3.6 By System Type

15.3.7 By Communication Technology

15.3.8 By Integration Level

15.3.9 By Power Generation Source

15.3.10 By End-User Industry

15.3.11 Countries & Segments - Market Attractiveness Analysis

15.4 South America

15.4.1 By Country

15.4.1.1 Brazil

15.4.1.2 Argentina

15.4.1.3 Colombia

15.4.1.4 Chile

15.4.1.5 Rest of South America

15.4.2 By Component

15.4.3 By Deployment Model

15.4.4 By Application

15.4.5 By Alert Type

15.4.6 By System Type

15.4.7 By Communication Technology

15.4.8 By Integration Level

15.4.9 By Power Generation Source

15.4.10 By End-User Industry

15.4.11 Countries & Segments - Market Attractiveness Analysis

15.5 Middle East & Africa

15.5.1 By Country

15.5.1.1 United Arab Emirates (UAE)

15.5.1.2 Saudi Arabia

15.5.1.3 Qatar

15.5.1.4 Israel

15.5.1.5 South Africa

15.5.1.6 Nigeria

15.5.1.7 Kenya

15.5.1.8 Egypt

15.5.1.9 Rest of MEA

15.5.2 By Component

15.5.3 By Deployment Model

15.5.4 By Application

15.5.5 By Alert Type

15.5.6 By System Type

15.5.7 By Communication Technology

15.5.8 By Integration Level

15.5.9 By Power Generation Source

15.5.10 By End-User Industry

15.5.11 Countries & Segments - Market Attractiveness Analysis

Chapter 16. Short-term Alert System for Power System Operations Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

16.1 ABB Ltd.

16.2 AECOM

16.3 Autodesk, Inc.

16.4 C3.ai, Inc

16.5 General Electric

16.6 Schneider Electric

16.7 Cascade Energy, Inc.

16.8 Cypress Envirosystems

16.9 Eaton Corporation Plc

16.10 Emerson Electric Company

16.11 Enel X S.r.l

16.12 General Electric Company

16.13 GridPoint, Inc.

16.14 Honeywell International, Inc.

16.15 Horiba, Ltd.

16.16 IBM Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global ad exchange software market, estimated to be worth USD 4 billion in 2023, is projected to grow at a compound annual growth rate (CAGR) of 7% to reach USD 6.42 billion by 2030.

The market for short-term warning systems for power system operations is being driven primarily by the increasing complexity of power grids, the increasing integration of renewable energy sources, and the need for real-time monitoring and response to preserve grid resilience and reliability.

The market for DMS-based systems dominates the short-term alert system market for power system operations.

North America dominated the short-term alert system for the power system operations market. The region is a hub of technological innovation and advancement.

The integration challenges section would play a major role in facilitating the growth of the short-term alert system for power system operations by addressing and resolving system integration concerns.