Security Hologram Market Size (2024 – 2030)

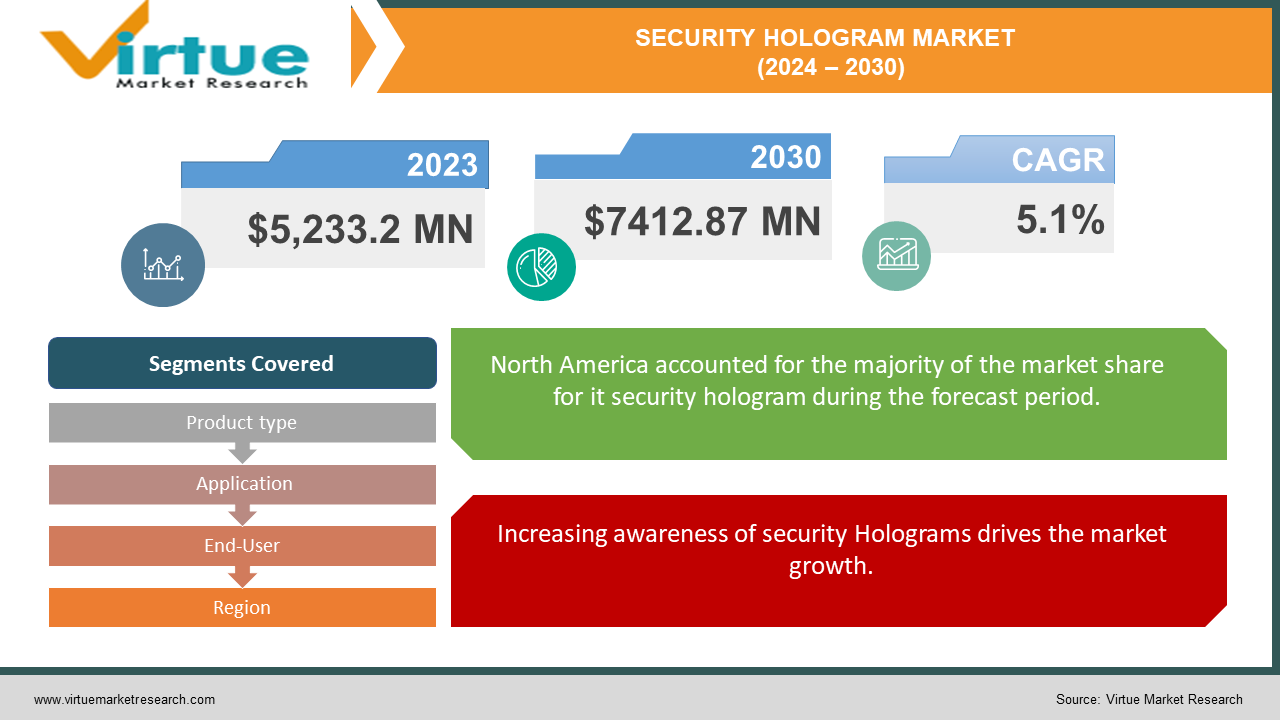

The Security Hologram Market was valued at USD 5,233.2 million in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 7412.87 million by 2030, growing at a CAGR of 5.1%.

The food and agriculture technology market is experiencing substantial transformation, driven by the imperative to address global food security issues and spurred by innovative technological progress. Concurrently, the security hologram market is undergoing significant expansion as holographic technology is increasingly utilized to enhance the security of various products and documents. These holograms are employed across multiple sectors, including document security, brand protection, and product authentication. They play a crucial role in protecting the interests of manufacturers, governments, and consumers by preventing the duplication and counterfeiting of goods and documents. The rising demand for authentication and security across diverse industries, such as pharmaceuticals, food and beverage, electronics, and government documents, is fueling the growth of the security hologram market. These holograms are integral to passports, ID cards, and security cards. Moreover, the security hologram market is expected to experience accelerated growth in the coming years due to ongoing technological advancements.

Key Market Insights:

The market for security holograms is expected to grow as holographic technology finds increasing applications in document security, brand protection, and product authentication. The adoption of holographic technology is likely to rise in sectors such as packaging, banking, and finance. Consequently, the expanding use of holographic technology in these industries is a primary driver of the growing demand for security holograms during the forecast period.

Security Hologram Market Drivers:

Increasing awareness of security Holograms drives the market growth.

The increasing prevalence of counterfeit products, such as auto parts and accessories, has significantly impacted the automobile market. Counterfeit vehicle parts not only pose a safety risk to passengers but also result in substantial revenue losses for companies. These counterfeit parts undermine brand credibility and fail to meet genuine manufacturing standards, further endangering passengers.

The incorporation of security features like holograms is anticipated to prevent the use of counterfeit parts and accessories, thereby protecting companies from losses and safeguarding passengers.

Raising awareness among customers about the importance of using genuine products is expected to boost the demand for security holograms, as these holograms on MRP labels help identify authentic products. Ultimately, increased customer awareness regarding the use of genuine products is projected to create growth opportunities for the security hologram market.

Education Industry to Increase Sales of Security Holograms

The University Grants Commission (UGC) has directed all universities in India to incorporate security features, such as security holograms and QR codes, on degree certificates to ensure proper verification and prevent duplications. This initiative is also expected to promote uniformity across the entire education system.

The UGC's mandate to include security holograms on mark sheets and certificates for various courses is likely to drive the demand for security holograms. This measure will also help create a unique personal identity for each student, facilitating recognition across different universities due to the standardized format. Each year, numerous students graduate and receive certificates, leading to a substantial demand for security holograms.

The wide range of programs offered by universities and the diverse courses enrolling many students are expected to further boost the sale of security holograms. An increase in the number of courses and students will consequently result in a higher demand for security holograms.

Security Hologram Market Restraints and Challenges:

Hologram counterfeiting poses a significant challenge in the global security hologram market. As holograms are increasingly used for product authentication, brand protection, and document security, the risk of counterfeit holograms being produced also rises. These fake holograms can be difficult to detect and can easily be mistaken for genuine ones. This issue can lead to substantial financial losses for manufacturers, governments, and consumers. Additionally, it can undermine consumer confidence in the authenticity of products and documents that rely on holograms for security.

Security Hologram Market Opportunities:

The e-commerce sector's growing use of holograms is driving the expansion of the global security hologram market. In e-commerce, holograms enhance transaction security, prevent product fraud, and deter product duplication. Additionally, the application of holograms in e-commerce can boost consumer confidence in the reliability of purchased goods. As the e-commerce sector continues to grow, the market opportunities for security holograms are expected to increase.

SECURITY HOLOGRAM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.1% |

|

Segments Covered |

By Product type, Application, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

The Griff Network, UPM Raflatac, Inc., De La Rue plc, Crown Roll Leaf, Mega Fortris Group Europe, Demax Holograms plc ,Andrews & Wykeham Ltd, Nova Vision Inc., Security Hologram, LLC., Opsec Security |

Security Hologram Market Segmentation: By Product Type

-

2D/3D Holograms

-

Dot Matrix Holograms

-

Flip Flop Holograms

-

Kinematic Holograms

-

Micro text Holograms

2D/3D holograms are the most widely used type, primarily for product authentication and brand protection. Dot Matrix holograms, also known as holographic hot stamping foils, are predominantly utilized in the packaging industry. Flip Flop holograms, also known as switchable holograms, are highly secure and are being increasingly adopted in the financial and banking sectors due to their ability to change appearance when viewed from different angles. Kinematic holograms, or animation holograms, find applications in the entertainment industry. Micro text holograms, which feature extremely small texts or images visible only under magnification, are used in the pharmaceutical industry and other high-security sectors. The 2D/3D holograms segment is projected to hold the largest market share, while the Flip Flop holograms segment is the fastest-growing, driven by its high-security features and rising adoption in banking and financial services.

Security Hologram Market Segmentation: By Application

-

Product Authentication

-

Brand Protection

-

Document Security

The most prevalent application, product authentication, protects the interests of producers and consumers by preventing product duplication and counterfeiting. Another essential application of holograms is brand protection, which ensures brand authenticity and prevents replica products from entering the market. Additionally, holograms are used in document security to prevent the counterfeiting of important documents such as passports, ID cards, and certificates. The security hologram market is anticipated to be led by the product authentication segment. Meanwhile, the brand protection segment is expected to grow at the fastest rate, driven by increasing demand in sectors such as electronics, food and beverage, and pharmaceuticals.

Security Hologram Market Segmentation: By End-User

-

Packaging

-

Passport

-

Electronics

-

Currency

-

Others (Credit Cards, Tickets, etc.)

Security holograms are most frequently utilized in packaging, where they protect both producers and consumers by preventing product duplication and counterfeiting. Another major application is in passports, which use holograms to ensure document validity and prevent the issuance of duplicate passports. In the electronics sector, holograms safeguard product authenticity and prevent the market from being flooded with imitations. Additionally, holograms are used on currency to maintain its authenticity and stop counterfeit money from circulating. Other end users, such as credit cards and tickets, also employ holograms to validate important documents and prevent duplication and counterfeiting.

Security Hologram Market Segmentation- by region

-

North America

-

Europe

-

Asia Pacific

-

Middle East and Africa

-

South America

Security holograms have significant markets in North America and Europe, where advanced technology is widely adopted and major industry players are prevalent. Key contributing countries in these regions include the United States, Canada, the United Kingdom, Germany, France, and Italy. The Asia Pacific region is experiencing the fastest growth in the security hologram market, driven by rapidly expanding populations and developing economies in China, India, Japan, and South Korea. Although the Middle East and Latin America represent smaller markets for security holograms, they are growing rapidly due to expanding populations, developing economies, and increasing adoption of advanced technology. The leading markets in these regions are the UAE, Saudi Arabia, Brazil, and Mexico.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic has brought about both positive and negative impacts on the global security hologram market. On the positive side, the crisis has spurred increased demand for security holograms as governments and businesses seek ways to enhance the security of goods and documents. Consequently, sales have risen for businesses operating in the security hologram market. However, the pandemic has also led to supply chain disruptions for many companies in this market, resulting in a decline in production capacity. Furthermore, the economic repercussions of the pandemic have caused businesses and governments to reduce spending on security holograms, presenting a downside to the market.

Latest Trends/ Developments:

On August 25, 2023, Proto Inc., a leading provider of holographic visual computing solutions, launched ProtoGPT Conversational AI Avatar Holograms for Enterprise. This groundbreaking technology combines advanced holographic visuals with sophisticated AI conversational capabilities, ushering in a new era of immersive experiences designed specifically for enterprise clients in the education, medical, and customer support sectors.

In October 2022, The Griff Network acquired Atlas Metallizing, a New Britain, Connecticut-based company specializing in production, extrusion, coating, lamination, and metallization. Through this acquisition, The Griff Network aims to expand its market presence in the packaging, graphic, and technical industries.

Key Players:

These are the top 10 players in the Security Hologram Market: -

-

The Griff Network

-

UPM Raflatac, Inc.

-

De La Rue plc

-

Crown Roll Leaf

-

Mega Fortris Group Europe

-

Demax Holograms plc

-

Andrews & Wykeham Ltd

-

Nova Vision Inc.

-

Security Hologram, LLC.

-

Opsec Security

Chapter 1. Security Hologram Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Security Hologram Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Security Hologram Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Security Hologram Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Security Hologram Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Security Hologram Market – By Product Type

6.1 Introduction/Key Findings

6.2 2D/3D Holograms

6.3 Dot Matrix Holograms

6.4 Flip Flop Holograms

6.5 Kinematic Holograms

6.6 Micro text Holograms

6.7 Y-O-Y Growth trend Analysis By Product Type

6.8 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Security Hologram Market – By Application

7.1 Introduction/Key Findings

7.2 Product Authentication

7.3 Brand Protection

7.4 Document Security

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Security Hologram Market – By End-User

8.1 Introduction/Key Findings

8.2 Packaging

8.3 Passport

8.4 Electronics

8.5 Currency

8.6 Others (Credit Cards, Tickets, etc.)

8.7 Y-O-Y Growth trend Analysis By End-User

8.8 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 9. Security Hologram Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By Application

9.1.4 By By End-User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By Application

9.2.4 By End-User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By Application

9.3.4 By End-User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By Application

9.4.4 By End-User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By Application

9.5.4 By End-User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Security Hologram Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 The Griff Network

10.2 UPM Raflatac, Inc.

10.3 De La Rue plc

10.4 Crown Roll Leaf

10.5 Mega Fortris Group Europe

10.6 Demax Holograms plc

10.7 Andrews & Wykeham Ltd

10.8 Nova Vision Inc.

10.9 Security Hologram, LLC.

10.10 Opsec Security

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market for security holograms is expected to grow as holographic technology finds increasing applications in document security, brand protection, and product authentication. The adoption of holographic technology is likely to rise in sectors such as packaging, banking, and finance.

The top players operating in the Security Hologram Market are - The Griff Network, UPM Raflatac, Inc., De La Rue plc, Crown Roll Leaf, Mega Fortris Group Europe, Demax Holograms plc, Andrews & Wykeham Ltd, Nova Vision Inc., Security Hologram, LLC., Opsec Security.

The COVID-19 pandemic has brought about both positive and negative impacts on the global security hologram market. On the positive side, the crisis has spurred increased demand for security holograms as governments and businesses seek ways to enhance the security of goods and documents.

The e-commerce sector's growing use of holograms is driving the expansion of the global security hologram market. In e-commerce, holograms enhance transaction security, prevent product fraud, and deter product duplication.

The Asia Pacific region is experiencing the fastest growth in the security hologram market, driven by rapidly expanding populations and developing economies in China, India, Japan, and South Korea.