Property and Casualty Insurance Market Size (2024 – 2030)

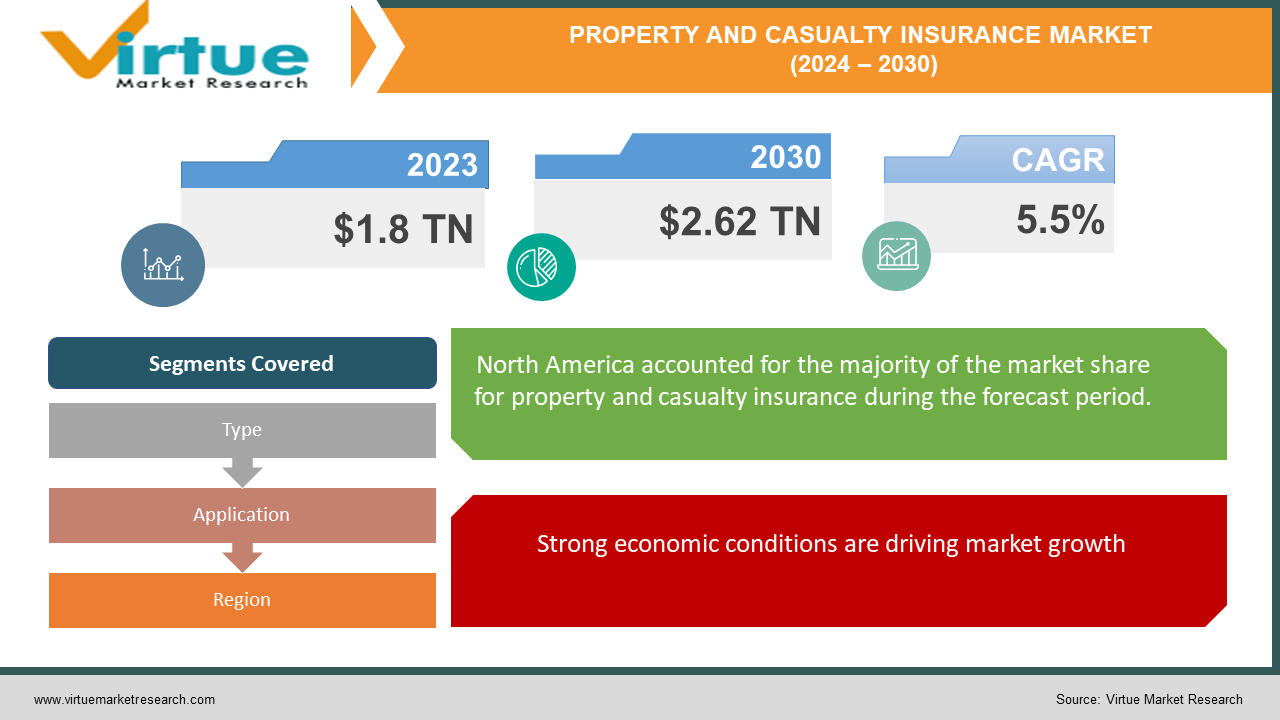

The Global Property and Casualty Insurance Market was valued at USD 1.8 trillion in 2023 and will grow at a CAGR of 5.5% from 2024 to 2030. The market is expected to reach USD 2.62 trillion by 2030.

The property and casualty (P&C) insurance market offers financial protection for your car, home, and other belongings, along with liability coverage for accidents. It's a major industry valued at nearly $2 trillion and is expected to grow as economies expand, extreme weather events become more frequent, and technology improves risk assessment.

Key Market Insights:

The market is expected to see steady growth, with estimates ranging from 5.5% to double-digit increases by 2033.

Factors like increasing urbanization, extreme weather events, and cyber threats are driving demand for P&C coverage.

Insurers are embracing InsurTech (insurance technology) to personalize policies, streamline claims, and offer new data-driven products.

Customers are increasingly looking for flexible and on-demand insurance options, with usage-based car insurance gaining traction.

Global Property and Casualty Insurance Market Drivers:

Strong economic conditions are driving market growth:

A strong economy leads to increased property values, business activities, and overall asset ownership. This translates into a greater demand for insurance coverage to protect against potential risks and losses. As economies grow, people tend to have more disposable income, allowing them to invest in properties, vehicles, and other valuable assets. This, in turn, increases the need for comprehensive insurance solutions to financially protect themselves in case of unforeseen events.

Population Growth and Rapid Urbanization leading the global Property and Casualty Insurance Market:

As the global population grows and migrates towards cities, the demand for property and casualty insurance rises. Urban areas tend to have higher concentrations of property and people, which leads to a greater risk of property damage and liability claims. With more people living nearby, the chances of fires spreading, or theft and vandalism incidents happening also increase.

Technological Innovations are having a profound impact on the P&C insurance industry:

Technological advancements are having a profound impact on the P&C insurance industry. InsurTech (insurance technology) is transforming the way insurance is priced, underwritten, and delivered. Technologies like big data and analytics allow insurers to better assess risks, develop more personalized policies, and offer customers faster and more efficient claims processing. On the other hand, these advancements also introduce new risks, such as cyberattacks, which can lead to data breaches and financial losses. This in turn increases the demand for cyber insurance products.

Global Property and Casualty Insurance Market challenges and restraints:

Intensified Competition resulting in the slowdown of the market:

The P&C insurance market is experiencing a digital revolution fueled by InsurTech startups and new entrants. These agile players are shaking things up with innovative products and disruptive pricing models. Unlike traditional insurers with their one-size-fits-all approach, InsurTechs leverage technology to personalize coverage, offering policies tailored to specific needs and risk profiles. Imagine car insurance that adjusts premiums based on real-time driving behavior, or homeowner's insurance that incentivizes smart home devices to prevent accidents. Furthermore, InsurTechs often employ usage-based pricing models, where customers pay only for the coverage they use. This flexibility and cost-effectiveness resonate with tech-savvy consumers, putting pressure on traditional insurers. To stay relevant, established players must adapt by streamlining operations, embracing digital tools, and potentially even partnering with InsurTechs. The future of P&C insurance hinges on the ability to innovate, personalize, and cater to the evolving needs of a digital generation.

Cyberattacks are a growing nightmare for P&C insurers:

Cyberattacks are a growing nightmare for P&C insurers. The ever-present threat of data breaches looms large, exposing sensitive customer information like names, social security numbers, and financial details. This can lead to severe reputational damage, regulatory fines, and costly lawsuits. The problem is compounded by the P&C industry's digital transformation. As insurers rely more heavily on technology for core operations like claims processing and underwriting, their attack surface expands. Hackers see a treasure trove of valuable data, making insurers prime targets. Unfortunately, fortifying cybersecurity requires significant investments. Insurers need to implement robust security measures like multi-factor authentication, data encryption, and regular security awareness training for employees. Additionally, they must have a comprehensive incident response plan in place to quickly contain and mitigate the damage in case of a cyberattack. This delicate balance of offering tech-driven convenience while safeguarding sensitive data remains a major challenge for P&C insurers in the digital age.

Climate change is throwing a curveball at the P&C insurance market:

The rising frequency and intensity of extreme weather events like floods, hurricanes, and wildfires are wreaking havoc. These catastrophes translate into a surge of insurance claims, potentially overwhelming insurers' financial reserves. Imagine a powerful hurricane causing widespread property damage – the resulting claims payouts could be staggering. To stay afloat, insurers urgently need to adapt their risk models. Traditional models based on historical data may no longer be enough. By leveraging advanced analytics and incorporating climate change projections, insurers can create more accurate risk assessments. This allows them to develop fairer pricing strategies that reflect the evolving risk landscape. For instance, areas prone to flooding may see higher premiums, while those investing in mitigation efforts could receive discounts. By taking a proactive approach, P&C insurers can ensure their long-term sustainability in the face of a changing climate.

Market Opportunities:

The Property and Casualty (P&C) insurance market is brimming with exciting opportunities fueled by a confluence of trends. Firstly, the ever-growing global population with rising disposable income creates a prime target market for property and vehicle ownership, driving demand for P&C coverage. This is further amplified by urbanization, where concentrated populations and dense living environments heighten the risks of property damage and liability claims. Insurers can capitalize on this by offering innovative products tailored to urban lifestyles, like micro-insurance for renters or coverage for electric vehicles. Secondly, technological advancements are transforming the P&C landscape. InsurTech startups are disrupting the industry with data-driven solutions, allowing insurers to personalize policies, streamline claims processing, and offer usage-based pricing models. By embracing InsurTech and big data analytics, traditional insurers can gain a competitive edge by offering real-time risk assessments and customized coverage options. Additionally, the rise of the Internet of Things (IoT) presents an opportunity to develop smart home and car features that prevent accidents and lower premiums. Thirdly, a growing awareness of emerging risks like cyber threats creates a demand for specialized insurance solutions. Insurers can develop cyber insurance products to protect businesses and individuals from data breaches and cyberattacks. Similarly, as climate change intensifies, there's an opportunity to offer flood insurance, parametric insurance (pays out based on pre-determined triggers), or coverage for specific perils in catastrophe-prone areas. By proactively addressing these evolving risks, insurers can position themselves as trusted partners for risk mitigation. Finally, the P&C market presents significant opportunities in under-insured and uninsured segments. In developing economies, a large portion of the population remains without proper insurance coverage. Insurers can bridge this gap by offering micro-insurance products that are affordable and accessible to low-income demographics. This can be particularly relevant for insuring homes, livelihoods, and basic transportation needs. By capitalizing on these opportunities and adapting to the changing market dynamics, P&C insurers can ensure their long-term success in a dynamic and ever-evolving global landscape.

PROPERTY AND CASUALTY INSURANCE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.5% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Berkshire Hathaway, State Farm , PICC , Allianz, Lloyd's of London , Liberty Mutual , AXA , Progressive , Allstate , Ping An |

Property and Casualty Insurance Market Segmentation - By Type

-

Property Insurance

-

Casualty Insurance

In the Property and Casualty (P&C) insurance market, Property insurance reigns supreme. While Casualty covers liability and accidents, Property insurance deals with protecting your physical assets like houses and cars against damage or loss. Considering the sheer value properties hold and the increasing frequency of natural disasters, Property insurance takes the lead in terms of prominence within the P&C market.

Property and Casualty Insurance Market Segmentation - By Application

-

Direct Sales

-

Agency Sales

Agency Sales hold the bigger market share in Property and Casualty insurance compared to Direct Sales. While Direct Sales allow companies to sell policies directly to consumers, Agency Sales leverage a network of insurance agents who build relationships with clients, assess their needs, and recommend suitable P&C products. This personalized approach and access to a wider range of policies make Agency Sales the more prominent distribution channel in the P&C market, though Direct Sales is growing in popularity.

Property and Casualty Insurance Market Segmentation - Regional Analysis

-

Asia-Pacific

-

North America

-

Europe

-

South America

-

Middle East and Africa

Currently, North America holds the top spot in the Property and Casualty (P&C) insurance market. This dominance is due to a well-established insurance industry offering a wide variety of P&C products, strong regulatory frameworks, and a high level of insurance penetration. However, the Asia Pacific region is catching up rapidly. Factors like rising disposable incomes, rapid urbanization, and increasing awareness of risk management are fueling significant growth in this region. While Europe remains a strong contender, South America and the Middle East & Africa have room for significant expansion in the P&C market.

COVID-19 Impact Analysis on the Global Property and Casualty Insurance Market

The COVID-19 pandemic left a mixed bag of impacts on the global P&C insurance market. While some sectors experienced a downturn, others saw unexpected developments. Lockdowns led to a decrease in car accidents, resulting in lower claims for auto insurers and potentially prompting them to offer rebates. Business interruption due to lockdowns also caused a decline in commercial property insurance premiums. However, the pandemic also highlighted new risks. The surge in remote work increased demand for cyber insurance as businesses faced a heightened threat of cyberattacks. Supply chain disruptions and rising construction costs are pushing property insurance premiums upwards. Overall, the impact on insurers' financials depended on their product mix and risk exposure. While COVID-19 may have led to short-term losses, it also accelerated the adoption of digital tools and remote work practices, paving the way for a more efficient and tech-driven P&C insurance landscape in the long run.

Latest trends/Developments

The P&C insurance market is undergoing a dynamic transformation fueled by several key trends. Firstly, technology is reshaping the industry with InsurTech startups offering innovative products like usage-based car insurance or policies tailored to specific needs. This data-driven approach allows for real-time risk assessments and personalized coverage options. Secondly, the ever-present threat of cyberattacks is pushing insurers to invest heavily in cybersecurity measures to protect sensitive customer information and mitigate financial losses. Thirdly, climate change is prompting insurers to develop new risk models and pricing strategies to address the increasing frequency and intensity of natural catastrophes. Finally, the growing awareness of emerging risks like cyber threats and pandemics is creating demand for specialized insurance solutions. By embracing these trends and adapting to a changing risk landscape, P&C insurers can ensure their long-term success and offer comprehensive protection to a tech-savvy generation in a world facing evolving threats.

Key Players:

-

Berkshire Hathaway

-

State Farm

-

PICC

-

Allianz

-

Lloyd's of London

-

Liberty Mutual

-

AXA

-

Progressive

-

Allstate

-

Ping An

Chapter 1. Property and Casualty Insurance Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Property and Casualty Insurance Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Property and Casualty Insurance Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Property and Casualty Insurance Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Property and Casualty Insurance Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Property and Casualty Insurance Market – By Type

6.1 Introduction/Key Findings

6.2 Property Insurance

6.3 Casualty Insurance

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Property and Casualty Insurance Market – By Application

7.1 Introduction/Key Findings

7.2 Direct Sales

7.3 Agency Sales

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Property and Casualty Insurance Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Property and Casualty Insurance Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Berkshire Hathaway

9.2 State Farm

9.3 PICC

9.4 Allianz

9.5 Lloyd's of London

9.6 Liberty Mutual

9.7 AXA

9.8 Progressive

9.9 Allstate

9.10 Ping An

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Property and Casualty Insurance Market was valued at USD 1.8 trillion in 2023 and will grow at a CAGR of 5.5% from 2024 to 2030. The market is expected to reach USD 2.62 trillion by 2030.

Economic Conditions, Population Growth and Urbanization, and Technological Innovations are the reasons that are driving the market.

Based on the Application it is divided into two segments – Direct Sales, Agency Sales.

Asia is the most dominant region for the luxury vehicle Market.

Berkshire Hathaway, State Farm, PICC, Allianz, Lloyd's of London.