Probiotic Ingredients Market Size (2024 – 2030)

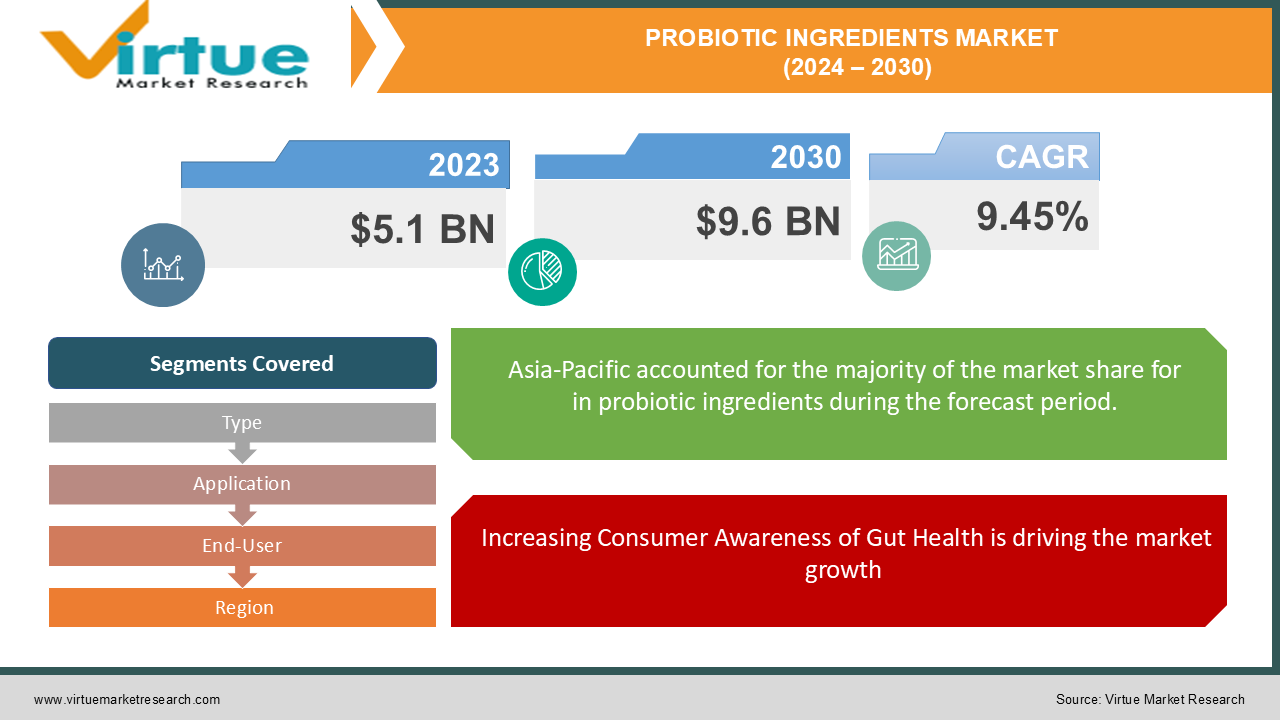

The market, valued at USD 5.1 billion in 2023, is expected to reach USD 9.6 billion by 2030, growing at a CAGR of 9.45% during the forecast period.

The Global Probiotic Ingredients Market has been experiencing significant growth, driven by increasing consumer awareness of the health benefits of probiotics, such as improved digestion, enhanced immunity, and overall well-being. Probiotic ingredients are living microorganisms, predominantly bacteria and yeast that are beneficial to gut health. Probiotics are being increasingly used in functional foods and beverages, dietary supplements, and animal feed to enhance health and wellness. Key market drivers include rising consumer demand for natural and functional ingredients, the growing prevalence of gastrointestinal issues, and the increased focus on preventive healthcare.

Key Market Insights:

-

Bacterial probiotics dominate the market, accounting for over 65% of total revenue, largely due to their widespread use in functional foods and supplements.

-

Human health applications represent the largest segment, contributing 75% of the market demand, fueled by increasing health-consciousness and the rising trend of gut health awareness.

-

The functional food and beverage segment is expected to grow at a CAGR of 9.5%, driven by the increased consumption of probiotic-rich products such as yogurts, drinks, and fermented foods.

-

Asia-Pacific is the leading region, generating more than 40% of the total market revenue, owing to the growing health and wellness trend in countries such as Japan, China, and South Korea.

Global Probiotic Ingredients Market Drivers:

1. Increasing Consumer Awareness of Gut Health is driving the market growth

The rising awareness of the importance of gut health in overall well-being is one of the primary drivers of the probiotic ingredients market. Consumers are increasingly seeking products that support digestive health, and probiotics are known for their role in maintaining a healthy balance of gut flora. The surge in gastrointestinal issues, such as irritable bowel syndrome (IBS), bloating, and indigestion, has further fueled demand for probiotics as a natural solution to improve gut health. Functional foods and beverages that contain probiotics, including yogurts, fermented drinks, and dietary supplements, are becoming increasingly popular among health-conscious consumers. This shift in consumer preference toward preventive healthcare and self-care is expected to drive market growth. Moreover, scientific studies and clinical trials highlighting the health benefits of probiotics have led to greater consumer trust and adoption of probiotic products.

2. Growing Demand for Functional Foods and Beverages is driving the market growth

The demand for functional foods and beverages fortified with probiotic ingredients is on the rise, particularly among health-conscious consumers. Probiotics are added to a wide range of food products, including dairy-based items such as yogurts and kefir, as well as plant-based alternatives, juices, and snack bars. The functional food and beverage segment represents the largest application of probiotic ingredients, accounting for a significant share of market revenue. Consumers are increasingly looking for food products that not only provide basic nutrition but also offer additional health benefits, such as improved digestion and enhanced immunity. This trend has prompted manufacturers to innovate and expand their product portfolios with probiotic-enriched foods. The growing interest in clean-label products and natural ingredients has further propelled the demand for probiotic-infused functional foods, as they align with consumer preferences for healthy and organic options.

3. Expansion of Probiotics in Animal Feed is driving the market growth

The use of probiotic ingredients in animal feed has gained traction in recent years due to growing concerns over the use of antibiotics in livestock production. Probiotics offer a natural and sustainable alternative to antibiotics for promoting animal health and improving feed efficiency. They help maintain a healthy gut microbiota in animals, leading to better nutrient absorption, enhanced immune function, and improved growth rates. The demand for probiotics in animal feed is particularly strong in the poultry, swine, and aquaculture industries, where maintaining gut health is essential for optimal growth and productivity. Probiotic feed additives are also gaining popularity in pet food, as pet owners seek products that support the digestive health of their animals. This expansion of probiotic use in animal nutrition is expected to contribute significantly to the overall growth of the global probiotic ingredients market.

Global Probiotic Ingredients Market Challenges and Restraints:

1. Regulatory Challenges and Quality Standards is restricting the market growth

The probiotic ingredients market faces several regulatory challenges, particularly in terms of product labeling, health claims, and quality standards. Regulatory frameworks for probiotics vary across regions, with some countries imposing stricter guidelines on the marketing and sale of probiotic products. For instance, in the European Union, health claims related to probiotics must be approved by the European Food Safety Authority (EFSA), which has stringent requirements for scientific evidence. Meeting these regulatory requirements can be a complex and time-consuming process for manufacturers, especially when attempting to launch new products or enter new markets. Inconsistent regulations across different regions also present challenges for companies operating in multiple countries, as they must navigate varying standards and labeling practices. The need for standardized guidelines for probiotic quality and efficacy remains a challenge for the industry, as consumers demand transparency and assurance about the benefits of probiotic products.

2. Stability and Shelf-Life Concerns is restricting the market growth

One of the key challenges associated with probiotic ingredients is maintaining their stability and viability throughout the product's shelf life. Probiotics are live microorganisms, and their effectiveness depends on their ability to survive until they reach the consumer's gut. Factors such as temperature, moisture, and packaging can affect the viability of probiotics during storage and transportation, leading to reduced efficacy. To address these concerns, manufacturers must invest in advanced encapsulation technologies and packaging solutions that protect probiotics from environmental factors and ensure their stability over time. The challenge of maintaining the potency of probiotic ingredients throughout the supply chain, from production to consumption, remains a critical issue for the industry. Ensuring that products contain the required number of live probiotics at the time of consumption is essential for delivering the desired health benefits.

Market Opportunities:

The Global Probiotic Ingredients Market offers significant growth opportunities, particularly in the development of personalized probiotic solutions. As consumers become more aware of the role of the gut microbiome in overall health, there is increasing interest in probiotics that are tailored to individual needs. Companies are exploring ways to create customized probiotic formulations based on genetic profiles, gut microbiome analysis, and specific health conditions. Another emerging opportunity lies in the development of probiotic supplements for targeted health applications beyond digestive health. Research is ongoing into the potential of probiotics to support immune function, mental health, skin health, and metabolic health. As the scientific understanding of the gut-brain axis and the role of probiotics in modulating immune responses continues to evolve, the demand for specialized probiotic products is expected to grow. Additionally, the expansion of probiotics into non-dairy applications presents an opportunity for manufacturers to reach a broader audience. As more consumers adopt plant-based diets or avoid dairy for health reasons, the development of probiotic-enriched plant-based products, such as almond milk yogurts and coconut kefir, can cater to this growing market segment.

PROBIOTIC INGREDIENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9.45% |

|

Segments Covered |

By Type, Application, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Chr. Hansen Holding A/S, DuPont de Nemours, Inc., Yakult Honsha Co., Ltd., Nestlé S.A., Danone S.A., Probi AB, Archer Daniels Midland Company (ADM), BioGaia AB, Lallemand Inc., Kerry Group plc |

Probiotic Ingredients Market Segmentation: By Type

-

Bacteria

-

Yeast

Bacterial probiotics dominate the market, accounting for over 65% of total revenue. The most common bacterial strains include Lactobacillus and Bifidobacterium, which are widely used in both dietary supplements and functional food products.

Probiotic Ingredients Market Segmentation: By Application

-

Functional Food & Beverages

-

Dietary Supplements

-

Animal Feed

The functional food and beverage segment holds the largest share of the market, driven by the increasing consumption of probiotic-rich yogurts, drinks, and fermented foods. This segment is expected to grow at a CAGR of 9.5% during the forecast period.

Probiotic Ingredients Market Segmentation: By End-User

-

Human

-

Animal

The human end-user segment dominates the market, accounting for 75% of demand, as consumers increasingly prioritize gut health and immunity. However, the use of probiotics in animal feed is also growing, particularly in the livestock and pet food industries.

Probiotic Ingredients Market Segmentation: Regional Segmentation

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

Asia-Pacific leads the global probiotic ingredients market, contributing over 40% of the total market revenue. The region's dominance is attributed to the increasing consumer demand for probiotic-enriched foods and beverages, particularly in countries like Japan, China, and South Korea, where the concept of functional foods is well-established. The rising prevalence of digestive disorders and the growing focus on preventive healthcare are also driving market growth in this region.

COVID-19 Impact Analysis on Global Probiotic Ingredients Market

The COVID-19 pandemic had a profound impact on the Global Probiotic Ingredients Market, as consumers became increasingly focused on boosting their immune systems and overall health. Probiotics, known for their role in supporting gut health and immunity, saw a surge in demand during the pandemic. Sales of probiotic supplements and functional foods increased as consumers sought natural ways to enhance their health and prevent illness.However, the pandemic also caused disruptions in supply chains, leading to challenges in the production and distribution of probiotic ingredients. Despite these challenges, the market remained resilient, with many companies adopting digital platforms and e-commerce channels to reach consumers. The long-term impact of the pandemic is expected to be positive for the probiotic ingredients market, as the focus on health and wellness continues to grow.

Latest Trends/Developments:

The global probiotic ingredients market is experiencing rapid growth, driven by increasing consumer awareness of gut health and its impact on overall well-being. Key trends include a shift towards personalized nutrition, with probiotics tailored to specific health needs, and a focus on natural and organic ingredients. The market is also witnessing a surge in demand for probiotic-infused food and beverages, as consumers seek convenient and enjoyable ways to incorporate probiotics into their diets. Additionally, advancements in probiotic delivery systems, such as encapsulation and microencapsulation, are enhancing the stability and efficacy of probiotic ingredients. The rising popularity of plant-based and fermented foods is also driving demand for probiotic ingredients, as these products are often naturally rich in beneficial bacteria. Overall, the global probiotic ingredients market is poised for continued growth as consumers increasingly prioritize gut health and seek innovative and effective solutions

Key Players:

-

Chr. Hansen Holding A/S

-

DuPont de Nemours, Inc.

-

Yakult Honsha Co., Ltd.

-

Nestlé S.A.

-

Danone S.A.

-

Probi AB

-

Archer Daniels Midland Company (ADM)

-

BioGaia AB

-

Lallemand Inc.

-

Kerry Group plc

Chapter 1. Probiotic Ingredients Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Probiotic Ingredients Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Probiotic Ingredients Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Probiotic Ingredients Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Probiotic Ingredients Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Probiotic Ingredients Market – By Type

6.1 Introduction/Key Findings

6.2 Bacteria

6.3 Yeast

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Probiotic Ingredients Market – By End-User

7.1 Introduction/Key Findings

7.2 Human

7.3 Animal

7.4 Y-O-Y Growth trend Analysis By End-User

7.5 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 8. Probiotic Ingredients Market – By Application

8.1 Introduction/Key Findings

8.2 Functional Food & Beverages

8.3 Dietary Supplements

8.4 Animal Feed

8.5 Y-O-Y Growth trend Analysis By Application

8.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Probiotic Ingredients Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By End-User

9.1.4 By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By End-User

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By End-User

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By End-User

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By End-User

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Probiotic Ingredients Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Chr. Hansen Holding A/S

10.2 DuPont de Nemours, Inc.

10.3 Yakult Honsha Co., Ltd.

10.4 Nestlé S.A.

10.5 Danone S.A.

10.6 Probi AB

10.7 Archer Daniels Midland Company (ADM)

10.8 BioGaia AB

10.9 Lallemand Inc.

10.10 Kerry Group plc

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Probiotic Ingredients Market was valued at USD 5.1 billion in 2023 and is projected to reach USD 9.6 billion by 2030, growing at a CAGR of 9.45%.

Key drivers include the increasing consumer awareness of gut health, rising demand for functional foods and beverages, and the expansion of probiotics in animal feed.

The market is segmented by type (bacteria, yeast), application (functional foods & beverages, dietary supplements, animal feed), and end-user (human, animal).

Asia-Pacific is the dominant region, contributing over 40% of total market revenue, driven by the growing demand for probiotic-rich foods in countries such as Japan, China, and South Korea.

Leading players include Chr. Hansen Holding, DuPont, Yakult Honsha, Nestlé, and Danone.