Global Polybutylene Adipate Terephthalate (PBAT) Market Size (2024 – 2030)

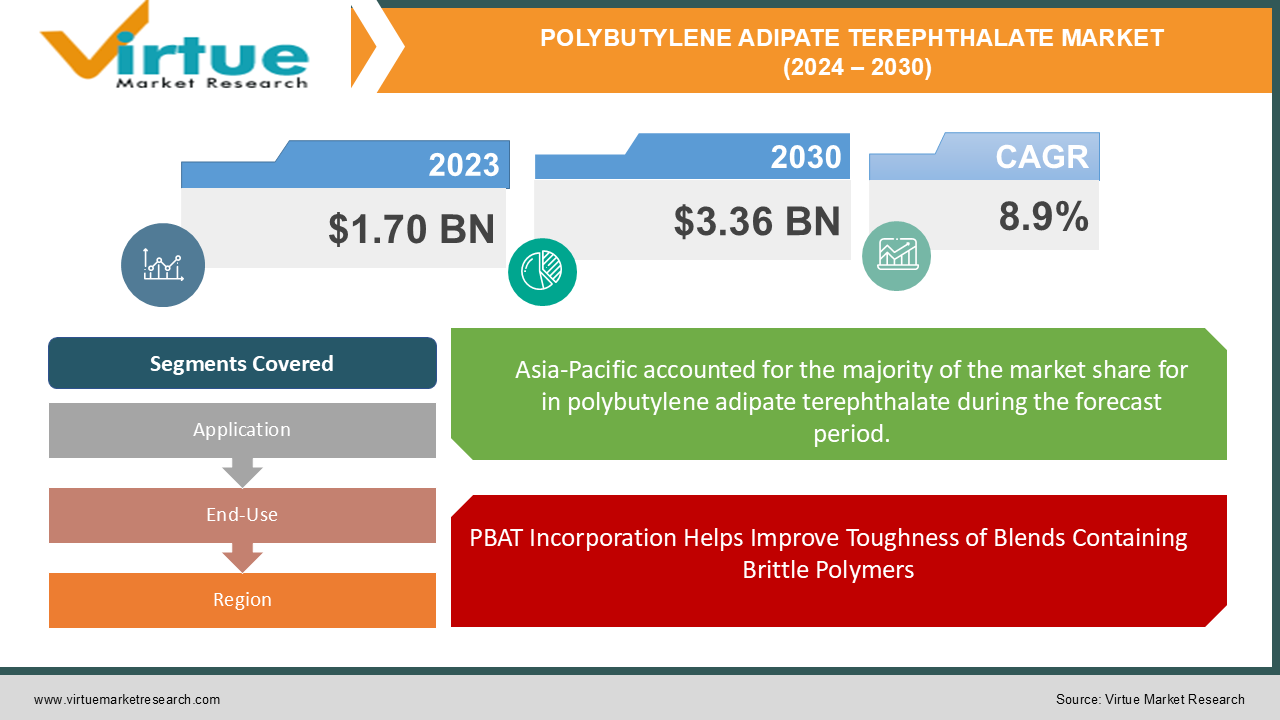

According to our research report, the global natural lipids market was valued at $1.70 billion in 2023, and is projected to reach a market size of $3.36 billion by 2030. The market is projected to grow with a CAGR of 8.9% per annum during the period of analysis (2024 - 2030).

Industry Overview

A kind of biodegradable plastic known as polybutylene adipate terephthalate (PBAT) is a copolymer of adipate acid. It is an elastomeric polymer whose enhanced mechanical properties are well known. A wide range of applications, including those for packaging, hygiene items, biomedical areas, and industrial composting, use PBAT due to its great flexibility and durability.

The use of PBAT as a suitable replacement for low-density polyethylene is what primarily drives demand for the material (LDPE). The flexibility and resilience of PBAT are comparable to those of LDPE, making it the material of choice for packing bags. Favorable government policies toward green procurement, an increase in the usage of biodegradable plastic in packaging, and a surge in customer preference for packaged foods are just a few of the fundamental causes boosting PBAT's growth. Due to their minimal toxicity and enhanced biodegradability, PBAT is used to make cling bags, plastic bags for gardening and agriculture, and the water-resistant coating used on paper cups. The need for PBAT is ultimately driven by the increased customer desire for packaged foods, which has increased the demand for cling bags.

These characteristics of PBAT make it the perfect material for producers to use when creating biodegradable goods to address the growing environmental issues brought on by traditional plastics. Low-density polyethylene is often replaced with polybutylene adipate terephthalate since it is completely biodegradable. PBAT is utilized in a variety of applications since it is extremely durable and highly versatile, including packaging, commercial composting, agriculture and fishery, consumer goods, and hygiene products. Consumer goods, foam materials, bin bags, composite bags, mulch films, cling films, and stabilizers are all made with it. Due to growing environmental awareness, increased demand for high-quality food increased adoption of biodegradable plastics worldwide, and increased preference for soil-biodegradable mulch films for landscaping, polybutylene adipate terephthalate materials and products are quickly gaining popularity.

Impact of Covid-19 on the Industry

The COVID-19 outbreak has increased the demand for plastic and single-use packaging. Shopping bags, packaging options, and other polymer-based items are being produced at breakneck speeds by manufacturers in the PBAT (polybutylene adipate terephthalate) sector. A slowdown in the world economy is being brought on by an all-around negative market sentiment regarding the demand for goods and services. However, in order to maintain the economies, manufacturers are primarily concentrating on crucial sectors like agriculture for mulch films, packaging, and consumer goods.

Lockdowns enforced in response to the COVID-19 pandemic led to a temporary prohibition on manufacturing, processing, and import/export activity across numerous industries, which reduced consumer demand for PBAT and associated items. Due to this, market growth declined in the second, third, and fourth quarters of 2020. However, as COVID-19 vaccination has begun in several economies around the world, which is anticipated to strengthen the global economy, the polybutylene adipate terephthalate market is likely to rebound by the second quarter of 2021.

Market Drivers

PBAT Incorporation Helps Improve Toughness of Blends Containing Brittle Polymers

PBAT is ductile and durable, and it may be produced using standard film extrusion methods. This contributes to the production of films having LDPE-like mechanical characteristics (low density polyethylene). Nevertheless, PBAT is more rigid than its homopolymers. Incorporating PBAT into polymer blends that contain brittle polymers like PLA (Polylactic Acid) or thermoplastic starch (TPS) can therefore aid increase their toughness without affecting their biodegradability.

Increasing research and development in the industry will drive the market growth

Increased research is being conducted by PBAT (polybutylene adipate terephthalate) industry participants to create flexible and moldable composites based on PBAT and calcium carbonate. When compared to other biodegradable plastics, the combination of cheap calcium carbonate and PBAT is somewhat cost-competitive. On the other hand, producers are boosting their output of packaging films made from a mixture of PBAT and PBS (polybutylene succinate).

Chinese Manufacturers Increasing Exports of 100% Biodegradable Plastic Bags

The biodegradable polymer materials PLA and PBAT are receiving a lot of attention as they are essential in reducing global white pollution, which is pollution brought on by traditional plastic. In order to create biodegradable blown films, PBAT and its compound are frequently utilized due to their flexibility and high elongation at break. Chinese PBAT (polybutylene adipate terephthalate) manufacturers are optimistic about growing their 100% biodegradable plastic bag business. These products are made from maize starch, PLA, and PBAT. Shopping bags are expected to command the biggest revenue share among all application types in the industry, which makes this obvious.

PBAT-based Soil-biodegradable Mulch Films Prevent Microplastic Residues

A number of PBAT (polybutylene adipate terephthalate) market enterprises are edging closer to building a circular economy in response to climate change. Businesses like BASF SE, a major chemical corporation with headquarters in Germany, have joined the race to attain sustainability through soil-biodegradable mulch films for agriculture. Competitor businesses in the PBAT (polybutylene adipate terephthalate) sector are keeping track of these developments to build a strong research foundation for PBAT soil-biodegradable mulch films where soil bacteria can utilize the film as food.

Microorganisms can utilize the carbon in the polymer in PBAT-based soil-biodegradable mulch films to produce energy and create biomass. Manufacturers are creating PBAT materials that break down organically in soil and don't stick around as microplastic.

Market Restraints

Poor Mechanical Strength in Biodegradable Mulch Films Affecting Demand Trends

The amount of leftover film in farming soil in Northwest China, which is substantially larger than that in North China and Southwest China, is what drives the demand for biodegradable mulch films. The market for PBAT (polybutylene adipate terephthalate) manufacturers is experiencing growth due to these developments and demands. Biodegradable mulch films, however, need to have increased mechanical strength if they are to avoid rupturing during varied applications. Manufacturers must therefore spend money on R&D to increase the mechanical strength of biodegradable mulch films in order to do this.

POLYBUTYLENE ADIPATE TEREPHTHALATE (PBAT) MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.9% |

|

Segments Covered |

By Application, End-Use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

AMCO POLYMERS, BASF SE, CHANG CHUN GROUP, COSMOS PLASTICS & CHEMICALS., EASTMAN CHEMICAL COMPANY, FAR EASTERN NEW CENTURY CORPORATION, GO YEN CHEMICAL INDUSTRIAL CO., LTD., HANGZHOU GGGGGGG CHEMICAL CO., LTD., JIN HUI ZHAO LONG HIGH-TECH CO., LTD., LOTTE FINE CHEMICAL |

This research report on the global Polybutylene Adipate Terephthalate market has been segmented and sub-segmented based on, and Geography & region.

Global Polybutylene Adipate Terephthalate Market- By Application

- Packaging and Bags

- Consumer Durables

- Agriculture and Horticulture

- Textiles

- Others

In terms of application, the packaging and bags industry held the greatest market share for polybutylene adipate terephthalate in 2020. This is explained by the fast (3–6 month) degradation of such plastic bags. Additionally, it is a better environmental alternative because of its lower carbon footprint when compared to plastics made from petroleum. Additionally, within the examined time frame, it is anticipated that the booming packaged food and beverage industries in places like Asia-Pacific and Europe will increase demand for biodegradable plastics like polybutylene adipate terephthalate.

Global Polybutylene Adipate Terephthalate Market- By End-Use

- Packaging

- Agriculture & Fishery

- Consumer Goods

- Others (Polymer)

In 2020, the packaging category accounted for a sizable portion of the PBAT market in terms of end-use. During the projection period, the packaging segment is anticipated to grow at a CAGR of 9.2 percent. Consumer goods and agriculture & fisheries are two other PBAT market categories that are quite profitable.

Global Polybutylene Adipate Terephthalate Market- By Geography & Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

In terms of revenue, Asia-Pacific held the largest market share for polybutylene adipate terephthalate in 2020, and it is projected that it will continue to hold this position during the forecast period. The region's important players and large consumer base are credited for this.

Additionally, it is predicted that during the projection period, increased government policies to support the use of bioplastics and increased awareness of the usage of biodegradable plastics will fuel demand for polybutylene adipate terephthalate in the area. In the years to come, it is anticipated that nations like China, India, Japan, Australia, and South Korea will experience rapid urbanisation and an increase in consumer expenditure on food and beverages online.

Global Polybutylene Adipate Terephthalate Market- By Companies

- AMCO POLYMERS

- BASF SE

- CHANG CHUN GROUP

- COSMOS PLASTICS & CHEMICALS.

- EASTMAN CHEMICAL COMPANY

- FAR EASTERN NEW CENTURY CORPORATION

- GO YEN CHEMICAL INDUSTRIAL CO., LTD.

- HANGZHOU GGGGGGG CHEMICAL CO., LTD.

- JIN HUI ZHAO LONG HIGH-TECH CO., LTD.

- LOTTE FINE CHEMICAL

NOTABLE HAPPENINGS IN THE GLOBAL POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET IN THE RECENT PAST:

- Business Partnership: - In 2021, PBAT, a biodegradable plastic that breaks down well in soil, was introduced and commercialized by SK Global Chemical in collaboration with Kolon Industries, Inc. of South Korea. This project seeks to increase sustainability while minimizing the usage of conventional plastics that are bad for the environment. By 2030, the businesses want to have produced more than 50,000 tonnes of PBAT.

- Merger & Acquisition: - In 2020, The acquisition of Solvay's polyamide business by BASF SE was completed (PA 6.6). The corporation was able to strengthen its position in North and South America, as well as Asia, thanks to the acquisition. Eight industrial facilities in Germany, France, China, India, South Korea, Brazil, and Mexico were part of the BASF SE and Solvay transaction. Additionally, it assisted the corporation in opening R&D facilities throughout the Americas and Asia.

- Product Launch: - In 2019, The advent of certified soil-biodegradable ecovioM 2351 for mulch films by BASF SE is intended to increase food output, improve soil quality, and provide tastier and higher-yielding tomatoes. For mulch films containing PBAT and other biodegradable polymers, the ecovioM 2351 is a certified soil-biodegradable plastic. The mulch films can increase tomato yield by 15 to 50%, utilize less water, and provide more effective weed control with less herbicides.

Chapter 1. Global Polybutylene Adipate Terephthalate (PBAT) Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Polybutylene Adipate Terephthalate (PBAT) Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Global Polybutylene Adipate Terephthalate (PBAT) Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Global Polybutylene Adipate Terephthalate (PBAT) Market Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Global Polybutylene Adipate Terephthalate (PBAT) Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Polybutylene Adipate Terephthalate (PBAT) Market – By Application

6.1. Packaging and Bags

6.2. Consumer Durables

6.3. Agriculture and Horticulture

6.4. Textiles

6.5. Others

Chapter 7. Global Polybutylene Adipate Terephthalate (PBAT) Market – By End-Use

7.1. Packaging

7.2. Agriculture & Fishery

7.3. Consumer Goods

7.4. Others (Polymer)

Chapter 8. Global Polybutylene Adipate Terephthalate (PBAT) Market - By Region

8.1. North America

8.2. Europe

8.3. Asia-Pacific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9. Global Polybutylene Adipate Terephthalate (PBAT) Market – Key Companies

9.1. AMCO POLYMERS

9.2. BASF SE

9.3. CHANG CHUN GROUP

9.4. COSMOS PLASTICS & CHEMICALS.

9.5. EASTMAN CHEMICAL COMPANY

9.6. FAR EASTERN NEW CENTURY CORPORATION

9.7. GO YEN CHEMICAL INDUSTRIAL CO., LTD.

9.8. HANGZHOU GGGGGGG CHEMICAL CO., LTD.

9.9. JIN HUI ZHAO LONG HIGH-TECH CO., LTD.

9.10 LOTTE FINE CHEMICAL

Download Sample

Choose License Type

2500

4250

5250

6900