Plant Phenotyping Market Size (2024 – 2030)

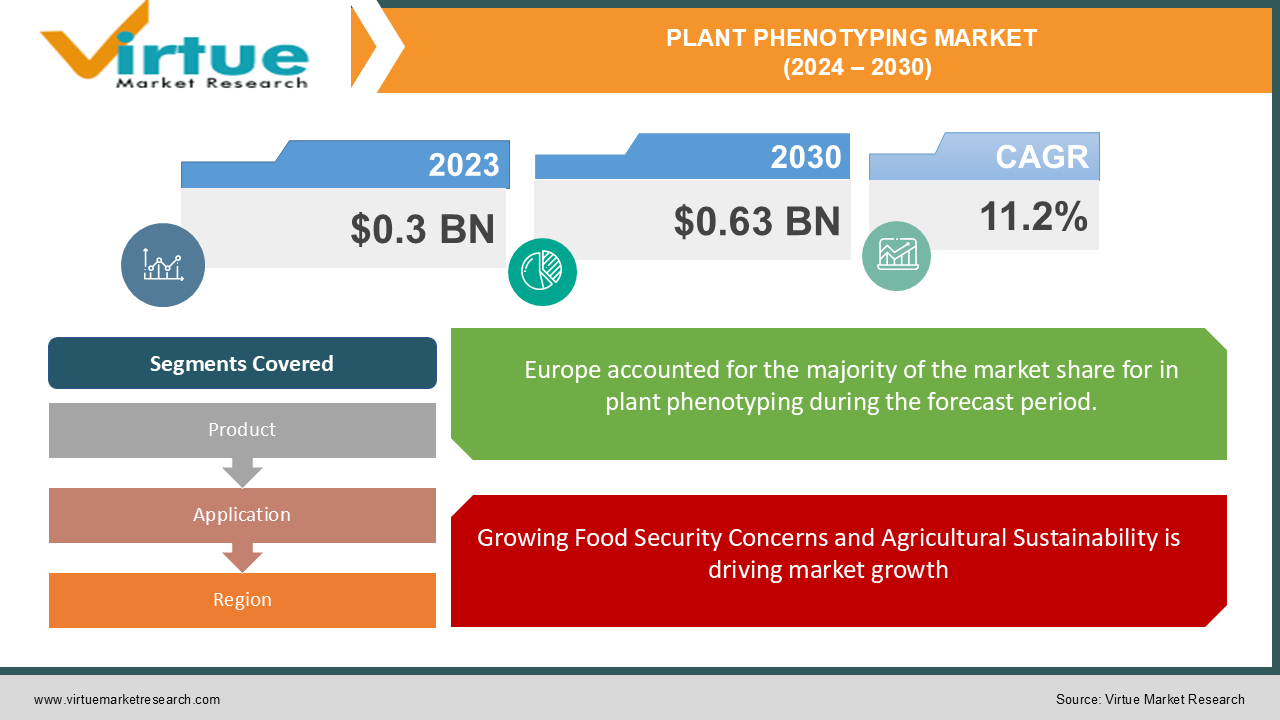

The Global Plant Phenotyping Market was valued at USD 0.3 billion in 2023 and is projected to grow at a CAGR of 11.2% from 2024 to 2030. The market is expected to reach USD 0.63 billion by 2030.

Plant phenotyping refers to the assessment of complex plant traits such as growth, development, tolerance, resistance, and overall performance by measuring various phenotypic parameters. These measurements are crucial for improving crop productivity, especially in the context of rising global food demand and climate change. Technological advancements, such as the integration of imaging, automation, and data analytics, are playing a pivotal role in driving the plant phenotyping market, enabling researchers to collect accurate data and insights for breeding more resilient crop varieties.

Key market insights:

Technological innovations such as remote sensing, drone-based imaging, and machine learning algorithms are revolutionizing phenotyping by enabling high-throughput and precise data collection.

Government initiatives supporting agricultural research and development, particularly in Europe and North America, are promoting the adoption of plant phenotyping technologies in both academic and commercial sectors.

The trend towards digital agriculture and the adoption of data-driven farming methods is enhancing the demand for advanced phenotyping platforms that provide actionable insights for precision agriculture.

High costs associated with the deployment of advanced phenotyping systems, such as 3D imaging and robotic solutions, continue to limit market expansion in emerging economies.

Increasing partnerships between academic institutions and private companies are resulting in the development of new phenotyping platforms that are both cost-effective and scalable.

The emergence of phenotyping technologies for small-scale, individual farmers is opening new opportunities for market growth, particularly in developing regions.

Global Plant Phenotyping Market Drivers:

Growing Food Security Concerns and Agricultural Sustainability is driving market growth: The pressing need to ensure global food security amidst a rapidly growing population and the ongoing impacts of climate change has created a significant demand for plant phenotyping technologies. Phenotyping helps in breeding crops that are more resilient to extreme environmental conditions such as drought, salinity, and heat, which are becoming more frequent due to climate change. Moreover, the rise in global food demand necessitates the development of high-yielding crop varieties that can withstand pests and diseases. By enabling scientists and researchers to accurately assess plant traits and identify superior genotypes, phenotyping is playing a crucial role in breeding efforts aimed at improving agricultural productivity and sustainability.

Technological Advancements in Phenotyping Platforms is driving market growth: Rapid advancements in imaging technologies, robotics, and artificial intelligence have significantly transformed the plant phenotyping landscape. High-throughput phenotyping platforms equipped with multispectral, hyperspectral, and thermal imaging systems now enable the non-invasive measurement of plant traits at various growth stages. These technologies, combined with machine learning and data analytics, allow for the real-time analysis of large datasets, offering insights into plant health, growth patterns, and stress responses. The integration of drones and other autonomous systems for field-based phenotyping further enhances the efficiency and scalability of data collection, driving market growth by making phenotyping more accessible to large-scale agricultural operations and research institutions.

Increased Government and Institutional Funding is driving market growth: Governments worldwide, particularly in developed regions like North America and Europe, are providing substantial funding for agricultural research, with a focus on improving crop productivity and resilience. This funding is often directed towards the development and adoption of advanced phenotyping technologies, which are seen as critical tools in addressing challenges such as food security and climate change. Public and private research institutions are also increasingly collaborating with agribusiness companies to develop cost-effective phenotyping solutions that can be used in both academic research and commercial breeding programs. These initiatives are further boosting the growth of the plant phenotyping market by fostering innovation and expanding the application of phenotyping technologies across various crops.

Global Plant Phenotyping Market Challenges and Restraints:

High Costs of Advanced Phenotyping Systems is restricting market growth: While technological advancements have greatly improved the capabilities of plant phenotyping systems, the high cost of implementing these technologies remains a significant barrier to their widespread adoption. Many of the advanced phenotyping platforms, such as those incorporating 3D imaging, robotic systems, and AI-driven data analytics, require substantial initial investments in terms of equipment, software, and training. These costs are particularly prohibitive for small to medium-sized enterprises (SMEs) and research institutions in developing regions. Moreover, the maintenance and operation of these systems often require specialized technical expertise, further increasing the overall cost of adoption. As a result, the high price of these advanced technologies limits their use to large-scale agricultural operations and well-funded research institutions, slowing market growth.

Data Management and Integration Challenges is restricting market growth: One of the key challenges faced by the plant phenotyping market is the effective management and integration of the vast amounts of data generated by high-throughput phenotyping systems. These systems produce large datasets that require sophisticated data analysis tools and computational power to extract meaningful insights. However, many users, particularly in the academic sector, lack the necessary expertise in data management and analytics to fully capitalize on the potential of phenotyping technologies. Additionally, integrating phenotypic data with other forms of agricultural data, such as genomic and environmental information, poses further challenges due to the complexity and heterogeneity of the datasets. Addressing these issues will be critical for the broader adoption of plant phenotyping technologies across various sectors.

Market Opportunities:

The plant phenotyping market presents several growth opportunities, driven by the increasing demand for sustainable agriculture and technological innovations. One significant opportunity lies in the growing adoption of precision agriculture practices. As farmers seek to optimize crop production and minimize resource usage, the use of phenotyping to gather detailed insights into plant growth, stress responses, and yield potential becomes increasingly important. This opens doors for companies to develop and offer more affordable, field-based phenotyping systems tailored to the needs of small and medium-sized agricultural operations. Additionally, the ongoing shift towards digital agriculture is creating opportunities for phenotyping technologies to be integrated with other digital tools such as remote sensing, GPS, and data analytics platforms. This integration enhances decision-making processes and enables farmers to implement site-specific management strategies. Emerging markets in Asia-Pacific and Latin America, where there is growing investment in modern agricultural techniques, also present significant opportunities for the expansion of plant phenotyping technologies. Moreover, collaborations between research institutions, technology providers, and agribusiness companies are fostering the development of next-generation phenotyping solutions that are scalable, cost-effective, and environmentally sustainable, further accelerating market growth.

PLANT PHENOTYPING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

11.2% |

|

Segments Covered |

By Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

LemnaTec GmbH, Phenospex B.V., KeyGene N.V., WPS Plant Phenotyping, Delta-T Devices, Heinz Walz GmbH, Photon Systems Instruments, BASF SE |

Plant Phenotyping Market segmentation: By Product

-

Equipment (Cameras, Sensors, Drones, Automated Systems)

-

Software (Data Management, Analytics, AI-based Solutions)

-

Services (Consulting, Data Analysis)

Equipment dominates the market, with a growing demand for advanced imaging systems, drones, and automated systems for precise and high-throughput phenotyping.

Plant Phenotyping Market segmentation: By Application

-

Crop Breeding

-

Product Development

-

Research Institutes

-

Academic Institutions

Crop breeding is the most dominant application, as phenotyping is widely used to develop high-yielding and climate-resilient crop varieties, crucial for meeting future food demands.

Plant Phenotyping Market segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Europe leads the global plant phenotyping market, driven by significant government funding for agricultural research and the presence of well-established research institutions. The region's focus on sustainable agriculture practices and advanced plant breeding programs has further cemented its dominance in this sector.

COVID-19 Impact Analysis on the Plant Phenotyping Market:

The COVID-19 pandemic initially caused disruptions in the global plant phenotyping market, particularly due to delays in research activities, project funding, and supply chain issues related to equipment manufacturing and distribution. Many agricultural research institutions and commercial breeding programs experienced temporary shutdowns, leading to a slowdown in phenotyping activities. However, the pandemic also highlighted the critical importance of agricultural resilience and food security, leading to renewed focus and investment in plant phenotyping technologies as part of the post-pandemic recovery. As research institutions adapted to remote and automated technologies, the demand for high-throughput phenotyping platforms that enable non-invasive and efficient data collection increased. The shift towards digital agriculture during the pandemic has further driven the adoption of AI and data analytics in phenotyping, offering new growth avenues for the market in the post-pandemic era.

Latest Trends/Developments:

The plant phenotyping market is experiencing several significant trends that are shaping its future. One major development is the integration of artificial intelligence (AI) and machine learning algorithms into phenotyping platforms. These advanced technologies enable real-time analysis of phenotypic data, empowering researchers and farmers to make informed decisions about plant growth and development. Another notable trend is the increasing use of drone-based phenotyping for field applications. This approach provides a scalable solution for large-scale agricultural operations, allowing for efficient monitoring and data collection across extensive areas. Sustainability is also gaining prominence, with phenotyping platforms being utilized to identify and breed crop varieties that require fewer resources and demonstrate greater resilience to climate change. This focus on sustainable practices aligns with the industry's growing commitment to environmentally friendly agriculture. Additionally, the shift towards automation and high-throughput phenotyping is driving innovations in robotic systems and sensor technologies. These advancements enhance the efficiency and accuracy of data collection, further improving the overall effectiveness of phenotyping efforts. As these trends continue to evolve, they will significantly influence the plant phenotyping market, promoting more efficient and sustainable agricultural practices that meet the demands of a changing environment.

Key Players:

-

LemnaTec GmbH

-

Phenospex B.V.

-

KeyGene N.V.

-

WPS Plant Phenotyping

-

Delta-T Devices

-

Heinz Walz GmbH

-

Photon Systems Instruments

-

BASF SE

Chapter 1. Plant Phenotyping Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Plant Phenotyping Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Plant Phenotyping Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Plant Phenotyping Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Plant Phenotyping Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Plant Phenotyping Market – By Product

6.1 Introduction/Key Findings

6.2 Equipment (Cameras, Sensors, Drones, Automated Systems)

6.3 Software (Data Management, Analytics, AI-based Solutions)

6.4 Services (Consulting, Data Analysis)

6.5 Y-O-Y Growth trend Analysis By Product

6.6 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 7. Plant Phenotyping Market – By Application

7.1 Introduction/Key Findings

7.2 Crop Breeding

7.3 Product Development

7.4 Research Institutes

7.5 Academic Institutions

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Plant Phenotyping Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Plant Phenotyping Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 LemnaTec GmbH

9.2 Phenospex B.V.

9.3 KeyGene N.V.

9.4 WPS Plant Phenotyping

9.5 Delta-T Devices

9.6 Heinz Walz GmbH

9.7 Photon Systems Instruments

9.8 BASF SE

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Plant Phenotyping Market was valued at USD 0.3 billion in 2023 and is projected to reach USD 0.63 billion by 2030, growing at a CAGR of 11.2% from 2024 to 2030.

Key drivers include the growing need for food security, advancements in phenotyping technologies such as AI and automation, and increased government funding for agricultural research.

The market is segmented by product (Equipment, Software, Services) and by application (Crop Breeding, Product Development, Research Institutes, Academic Institutions).

Europe dominates the plant phenotyping market due to substantial government funding for research and a focus on sustainable agriculture.

Leading players include LemnaTec GmbH, Phenospex B.V., KeyGene N.V., and WPS Plant Phenotyping.