Plant Factory Market Size (2024 – 2030)

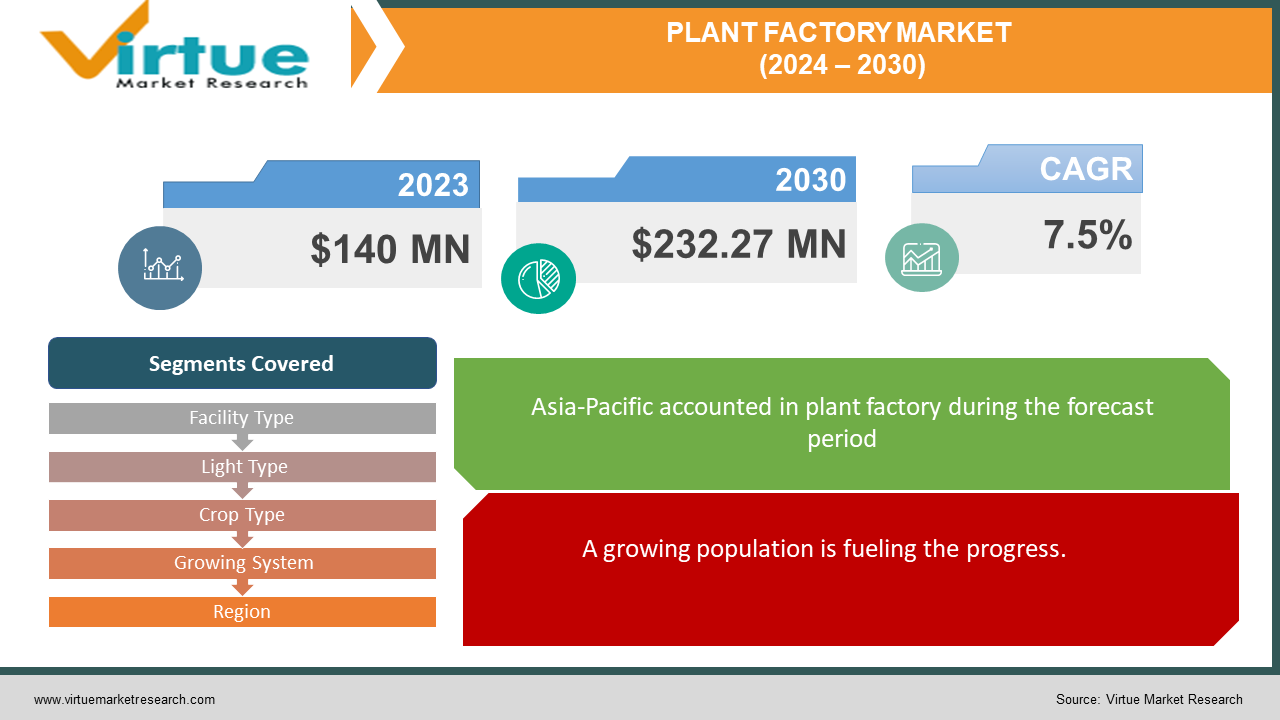

The plant factory market was valued at USD 140 million in 2023 and is projected to reach a market size of USD 232.27 million by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 7.5%.

A plant factory is a closed or semi-closed system that produces crops year-round, independent of weather conditions, by artificially controlling temperature, light, moisture, and carbon dioxide concentrations. Plant factories can grow crops in places unsuitable for agriculture, increase yields, and contribute to a steady food supply. They can also lessen the quantity of land and water required for farming, which is advantageous for nations with few water supplies or little arable land. Additionally, plant factories can supply the pesticide-free food that consumers are requesting more and more.

Key Market Insights:

Research by the International Institute for Applied Systems Analysis (IIASA) projects a 56% rise in food consumption until 2050. The manufacturing sector's industrial production index in 2023 was 137.1, up 4.7% from the year before. As per a survey carried out in January 2023 in Japan, the cultivated produce of the horticulture and plant industries in Japan included 27% each of tomatoes and lettuce. By 2024, the percentage of indoor farming expected to use hydroponics is predicted to be around 48.5%, as per Statista. A medium-sized plant's initial capital expenditure can typically vary from $1 million to $5 million, depending on the location, size, and technical infrastructure of the facility. Implementing leases or renting alternatives for infrastructure and equipment might be one such approach. This would free up ambitious indoor growers from having to shell out a lot of money upfront for necessities like climate control systems, hydroponic setups, and lighting systems.

Plant Factory Market Drivers:

A growing population is fueling the progress.

The plant industry market is experiencing growth due to many factors. The most important of them is the increase in the population of the world and the increase in the demand for food. With limited arable land and the adverse effects of climate change on traditional agriculture, there is an urgent need for new solutions to ensure food security. The plant industry provides a sustainable alternative by allowing crops to be grown year-round in a controlled environment, regardless of the weather conditions outside. In addition, the increase in consumer demand for fresh seeds without pesticides is driving the demand for crops that are grown in a controlled indoor environment.

Technological advancements are enabling the expansion.

Technological advancements play an important role in the growth of the plant industry market. Developments in areas such as LED lighting, hydroponics, and automation have improved efficiency and productivity in the home. These advances not only improve crop quality but also reduce resource consumption, making the company environmentally and economically sound. In addition, increased investment in research and development is expanding the variety of crops that can be grown successfully in the horticulture industry. From green leaves and vegetables to fruits and vegetables, the organization of the crop production system makes it possible to produce a variety of crops efficiently, meeting the nutritional needs of people who trade around the world. In general, these factors make the industrial market continue and have a good future for agriculture and food production.

Plant Factory Market Restraints and Challenges:

The industrial market, although promising, faces many important obstacles and challenges. One of the obstacles is the huge initial investment required to set up and maintain a factory. Sophisticated equipment, advanced technology, and specialized equipment require large amounts of money, hindering market access for small farmers and entrepreneurs. Additionally, operating costs, including energy costs for heating and air conditioning systems, can be prohibitive, especially in areas with high electricity costs. Another challenge comes from the complexity of the indoor farming system and the need for skilled labor to manage and optimize the production process. Labor shortages, especially of skilled agricultural workers, pose a persistent problem, affecting productivity and scalability. In addition, regulatory barriers and the lack of standardized guidelines for indoor farming practices present uncertainty for entrepreneurs and businesses, hindering growth and market expansion. Although the factory provides a well-controlled environment for annual production and the use of fewer resources, concerns about the sustainability of energy-intensive projects and the environmental impact of production remain. Addressing these challenges will require a collaborative effort by stakeholders, including policymakers, industry players, and technology providers, to enable innovations, improve opportunities, and create sustainable practices that make the industry more productive. Meeting these challenges requires a balance between cost, environmental considerations, and technological progress, making it necessary for plant factory marketers to manage these complexities for sustainable growth in market penetration.

Plant Factory Market Opportunities:

The market offers great opportunities, especially due to global challenges such as climate change, food security concerns, and the COVID-19 pandemic. With population growth and urbanization, traditional farming methods are facing challenges in meeting the growing demand for fresh produce. The horticulture industry provides sustainable solutions by providing a controlled environment for growing, depending on external factors such as weather conditions and soil quality. This provides an opportunity for those with limited investment in advanced technologies such as hydroponics, aeroponics, and vertical farming systems, which optimize resource utilization and maximize crop yields. In addition, consumer interest is shifting to locally grown and pesticide-free products, fueling demand for products from organic farms. These industries can be created in urban areas, reducing the carbon footprint associated with transportation and providing consumers with new products. Also, advances in LED lighting and automation technology make energy more efficient and reduce labor costs, making the industry more economically viable. Epidemics have shown the importance of a flexible food supply system, strengthening the case for indoor agriculture. Governments and investors are recognizing the industry's potential to improve food security and reduce the risks associated with external shocks. As such, the horticultural industry market is poised for significant growth and innovation, offering a variety of opportunities for entrepreneurs and agricultural managers.

PLANT FACTORY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.5% |

|

Segments Covered |

By Facility Type, Light Type, Crop Type, Growing System, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BrightFarms, AeroFarms, Gotham Greens, AppHarvest, Bowery Farming, Plenty Unlimited Inc., Mirai Co. Ltd., Farminova, Iron Ox, Taiksha Ltd., Crop One, Vertical Harvest, Farmone, Oishii |

Plant Factory Market Segmentation: By Facility Type

-

Greenhouse

-

Indoor Farms

-

Others

The greenhouse segment dominates the market. A standard greenhouse serves as a controlled environment for growing different crops, providing the best conditions for plant growth throughout the year. The main factors that affect growth in a greenhouse include temperature, humidity, heat, and wind. By carefully managing these changes, growers can extend the growing season, protect plants from adverse weather conditions, and increase yields. Greenhouses offer different opportunities, allowing the creation of different types of plants, from vegetables and fruits to flowers and herbs. In terms of the global industrial market, the greenhouse plays an important role as a traditional method of indoor agriculture. The impact of the standard greenhouse on the industrial market is many. On the one hand, they create competition, providing easy access and profitable options for farmers who want to enter the agricultural industry. On the other hand, they also serve as a gateway, introducing growers to environmentally controlled agriculture and stimulating interest. In general, standard greenhouses contribute to various types of agriculture and continue to influence the state of the global horticulture industry. Indoor farms are the fastest-growing segment. An indoor farm, often called a plant factory, is a controlled agricultural operation where crops are grown under controlled indoor conditions. These companies use advanced technology such as LED lighting, hydroponics, air conditioning, and climate control to improve growing conditions. Factors such as temperature, humidity, light, nutrient levels, and CO2 concentration are carefully monitored and adjusted to create an ideal environment for plant growth. This level of control allows for annual production, higher yields, and reduced resource consumption compared to traditional farming methods. The impact of the standard indoor farm on the global horticulture market has been enormous. Amid growing concerns for food security, environmental sustainability, and climate change, indoor farming solutions have gained traction as a viable option for agriculture. The growth and flexibility of the horticultural industry make it an attractive investment for those involved in high-profit agriculture. In addition, the COVID-19 pandemic has accelerated the adoption of domestic agricultural technologies while disrupting global supply chains, which has exposed the weaknesses of traditional agricultural practices. As a result, the industrial market is growing rapidly, with continuous progress and expansion across different regions and crops.

Plant Factory Market Segmentation: By Light Type

-

Sunlight

-

Full Artificial Light

Sunlight holds the largest market share. Sunlight is the main factor in the growth and development of plants, providing the necessary energy through photosynthesis. The quality, strength, and duration of sunlight affect plant growth, determining things like flowers, fruits, and seeds in general. However, although sunlight is abundant and free, its availability and stability may vary depending on the location, season, and weather conditions. This change presents a challenge for sustainable agricultural production, especially in areas where sunlight is scarce or environmental conditions are harsh. In response to these challenges, the global plant industry market has seen an increase in innovation and adoption of solar energy systems. These systems, such as LED grow lights, provide precise control of the type of light, power, and duration, allowing plants to grow every year, regardless of the external conditions. By mimicking the ideal conditions for growing crops, the horticulture industry can improve productivity, reduce resource consumption, and improve quality and yield. Full artificial light is the fastest-growing category. Artificial lighting plays an important role in modern agriculture, especially in the field of industrial plants. These companies use the light production system to provide the best conditions for plant growth, regardless of environmental factors. Various factors contribute to the effectiveness of light in promoting plant growth, including light intensity, spectrum, timing, and type. By carefully controlling these variables, growers can adjust the growing environment to the different needs of different plant species, resulting in optimal photosynthesis and overall health. In addition, active lighting allows year-round cultivation, regardless of seasonal changes, increasing productivity and reducing dependence on outdoor agricultural methods.

Plant Factory Market Segmentation: By Crop Type

-

Fruits

-

Vegetables

-

Flowers & Ornaments

-

Others

Vegetables are the largest growing crop type. This is mostly because there is a growing need for locally grown, fresh produce, particularly in cities where there is a shortage of space for traditional agriculture. Vegetables are also often high-value crops with quick growing cycles, which makes them ideal for indoor farming techniques. Fruits are the fastest-growing segment. Technological improvements in the plant factory business have made it possible to cultivate fruits inside. Many fruit crops may now be grown inside because of advancements in controlled environment agriculture (CEA), including LED lighting, hydroponic or aeroponic growth methods, and climate control systems. Fresh fruits that are cultivated nearby are in greater demand, especially in metropolitan settings where access to conventional agriculture is restricted. Producing fruits inside lowers transportation costs and brings fresher products to customers by enabling fruit production closer to consumer markets.

Plant Factory Market Segmentation: By Growing System

-

Soil Based

-

Non-Soil Based

-

Hybrid

Soil-based systems are the largest growing type. They are present in areas where conventional farming practices are prevalent or where implementing non-soil-based technology is difficult. Compared to high-tech, non-soil-based systems, soil-based systems have the benefit of being well-known to farmers and possibly requiring less initial infrastructure investment. The non-soil-based category is the fastest-growing. Soilless farming reduces the need for pesticides, water, and land, all of which raise the risk of overflow on a farm. Soilless growth is almost always the best option in an atmosphere where plants cultivated under controlled circumstances have become the standard.

Plant Factory Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Asia-Pacific region has the largest market share, almost around 37% in 2023 with its strong economy, technological advancements, and increasing population contributing to significant growth. Several key factors are driving the industry's expansion in the region. First, increasing urbanization and shrinking agricultural land have increased the need for efficient and sustainable agricultural methods. The horticultural industry offers a solution by increasing annual production in a controlled environment, regardless of external factors such as weather conditions or soil quality. Second, the growing appetite for high-quality innovations, coupled with concerns about food security, has spurred investment in indoor agriculture technologies. In addition, government initiatives supporting innovation and agricultural support drive market growth. The impact of the Asia-Pacific region on the global crop market is extensive. As the region is growing rapidly in terms of plant adoption, its market expansion is contributing significantly to the growth rate of the industry. Innovations and advances coming from Asia-Pacific countries are influencing the global market and shaping the future of indoor agriculture technology. Moreover, the cooperation and collaboration between local and international players promotes the exchange of knowledge and innovation, thereby promoting the global crop market. North America is the fastest-growing market. This region’s commitment to establishing standards not only improves the efficiency and security of indoor agriculture within its borders but also affects behavior worldwide. The growing focus on sustainability, caused by concerns about food security and environmental impact, has prompted North American countries to invest in different agricultural solutions, such as the plant industry. Stricter laws regarding the use of pesticides and food safety have influenced growers to adopt more environmentally friendly farming practices, thus boosting the industrial market.

COVID-19 Impact Analysis on the Plant Factory Market:

The emergence of the COVID-19 pandemic has brought about significant disruptions across various sectors, and the plant factory market is no exception. As countries worldwide implemented strict lockdown measures and social distancing protocols to curb the spread of the virus, the agricultural industry faced numerous challenges. Supply chain disruptions, labor shortages, and decreased consumer demand have all impacted the plant factory market. However, amidst these challenges, there have also been notable opportunities. The pandemic has accelerated the adoption of technology and automation within plant factories as businesses seek to enhance operational efficiency and minimize reliance on manual labor. Additionally, there's been a growing emphasis on food security and sustainability, driving investment in indoor farming solutions. As the world navigates through the ongoing pandemic and its aftermath, the plant-factory market is poised for both adaptation and innovation to meet evolving demands and challenges.

Latest Trends/ Developments:

In recent years, the plant industry market has seen significant trends and developments, changing the way we approach agriculture. An important trend is the integration of advanced technologies such as artificial intelligence, robotics, and the Internet of Things (IoT) into the production process. These technologies enable the monitoring and control of environmental factors such as temperature, humidity, and heat, thereby optimizing plant growth and resource utilization. Additionally, there is an increasing emphasis on sustainable practices within the industry, with a growing number of companies adopting eco-friendly solutions such as hydroponics and vertical farming to reduce waste, environmental impact, and resource consumption. In addition, there is a noticeable change in the organization of plant layouts to meet specific plant and customer requirements. This practice supports a variety of crops that are grown in a controlled indoor environment, guaranteeing high yields and high-quality products. In general, the latest trends and developments in the industrial market indicate a bright future for efficient, sustainable, and high-yield farming practices.

Key Players:

-

BrightFarms

-

AeroFarms

-

Gotham Greens

-

AppHarvest

-

Bowery Farming

-

Plenty Unlimited Inc.

-

Mirai Co. Ltd.

-

Farminova

-

Iron Ox

-

Taiksha Ltd.

-

Crop One

-

Vertical Harvest

-

Farmone

-

Oishii

-

In Feb 2023, the Public Investment Fund ("PIF") signed a joint venture agreement with AeroFarms to establish a company in Riyadh to build and operate indoor vertical farms in Saudi Arabia and the wider Middle East and North Africa (MENA) region. The joint venture is anticipated to enable year-round, sustainable local sourcing of high-quality crops cultivated on AeroFarms' unique smart agriculture technology ("AgTech") platform, which helps address more general supply chain issues in the sector.

-

In Feb 2023, Realty Income Corporation and Plenty Unlimited Inc. announced that they had entered into a strategic real estate alliance to support the development of Plenty's indoor vertical farms. Under the terms of the agreement, Realty Income will acquire and provide development funding for properties that will house Plenty's indoor farms. These properties are leased to Plenty under long-term net leases. The agreement provides for up to USD 1 billion of development opportunities.

Chapter 1. Plant Factory Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Plant Factory Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Plant Factory Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Plant Factory Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Plant Factory Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Plant Factory Market – By Facility Type

6.1 Introduction/Key Findings

6.2 Greenhouse

6.3 Indoor Farms

6.4 Others

6.5 Y-O-Y Growth trend Analysis By Facility Type

6.6 Absolute $ Opportunity Analysis By Facility Type, 2024-2030

Chapter 7. Plant Factory Market – By Light Type

7.1 Introduction/Key Findings

7.2 Sunlight

7.3 Full Artificial Light

7.4 Y-O-Y Growth trend Analysis By Light Type

7.5 Absolute $ Opportunity Analysis By Light Type, 2024-2030

Chapter 8. Plant Factory Market – By Crop Type

8.1 Introduction/Key Findings

8.2 Fruits

8.3 Vegetables

8.4 Flowers & Ornaments

8.5 Others Y-O-Y Growth trend Analysis By Crop Type

8.6 Absolute $ Opportunity Analysis By Crop Type, 2024-2030

Chapter 9. Plant Factory Market – By Growing System

9.1 Introduction/Key Findings

9.2 Soil Based

9.3 Non-Soil Based

9.4 Hybrid

9.5 Y-O-Y Growth trend Analysis By Growing System

9.6 Absolute $ Opportunity Analysis By Growing System, 2024-2030

Chapter 10. Plant Factory Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Facility Type

10.1.3 By Light Type

10.1.4 By Crop Type

10.1.5 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Facility Type

10.2.3 By Light Type

10.2.4 By Crop Type

10.2.5 By Growing System

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Facility Type

10.3.3 By Light Type

10.3.4 By Crop Type

10.3.5 By Growing System

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Facility Type

10.4.3 By Light Type

10.4.4 By Crop Type

10.4.5 By Growing System

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Facility Type

10.5.3 By Light Type

10.5.4 By Crop Type

10.5.5 By Growing System

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Plant Factory Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 BrightFarms

11.2 AeroFarms

11.3 Gotham Greens

11.4 AppHarvest

11.5 Bowery Farming

11.6 Plenty Unlimited Inc.

11.7 Mirai Co. Ltd.

11.8 Farminova

11.9 Iron Ox

11.10 Taiksha Ltd.

11.11 Crop One

11.12 Vertical Harvest

11.13 Farmone

11.14 Oishii

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The plant factory market was valued at USD 140 million in 2023 and is projected to reach a market size of USD 232.27 million by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 7.5%.

Growing populations and technological advancements are driving the growth of the plant factory market.

Based on light type, the plant factory market is segmented into sunlight and artificial light.

Asia-Pacific is the most dominant region for the plant factory market.

AeroFarms LLC, BrightFarms Inc., and Gotham Greens Holdings LLC are some of the leading players in the plant factory market.