Global Personal Protective Equipment Market Size (2024 – 2030)

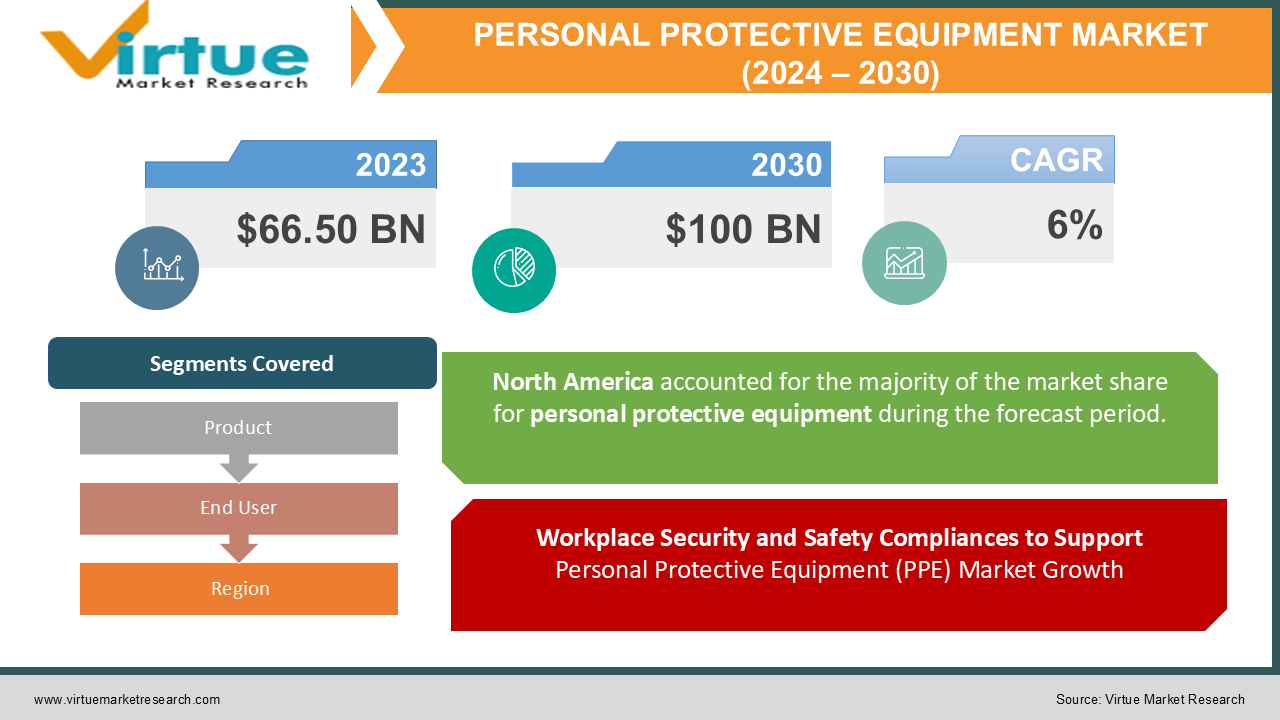

According to our research report, the Global personal protective equipment market was valued at USD 66.50 billion and is projected to reach a market size of USD 100 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6%.

Industry Overview

Increasing hygiene awareness to prevent disease transmission in healthcare institutions is likely to fuel demand for personal protective equipment (PPE) throughout the forecast period. Various nations established rigorous measures in response to the Covid-19, such as the Families First Coronavirus Response Act by the United States in 2020 to safeguard public health professionals, provide free testing, provide paid leaves, and provide substantial advantages to children and families. Rising local production, along with restrictions on product imports and exports, boosted PPE demand in 2020.

The strict restrictions set by the United States Department of Labor and the Occupational Safety and Health Administration (OSHA) in the United States have a favorable influence on product demand from the country's end-use sectors. Furthermore, rising employee knowledge of personal safety has a substantial impact on the expanding penetration of PPE in the United States. Constant innovation, such as the creation of lighter and more comfortable industrial protective equipment made of high-quality fabric, is expected to drive market expansion. Demand for protective equipment that combines safety with better aesthetics and technical innovation is expected to boost market expansion even more.

Private-label product production is predicted to benefit from factors such as greater technical assistance and increased knowledge of product price-performance ratios. Rising contract-based manufacture of PPE customized to distributor standards, mainly in North America and Western Europe's developed countries, has a significant influence on boosting product demand. Following the Covid-19 epidemic, textile firms in Asian nations converted their garment production factories to PPE manufacturing to bridge the demand-supply imbalance. China is the major supplier of personal protective equipment (PPE) including masks, goggles, protective gowns, and gloves; however, its shipments have decreased by roughly 15% since the outbreak.

Market Drivers

Workplace Security and Safety Compliances to Support Personal Protective Equipment (PPE) Market Growth

The market is being fueled by rising worker safety and health awareness, as well as an increase in industrial fatalities. Safety helmets, boots, protective clothes, earplugs, goggles, eyeglasses, protective gloves, emergency escape devices, and full-body harnesses are all available on the market.

The rising number of workplace mortality rates or risks has compelled workers to utilize personal protective equipment to safeguard individual safety. According to the International Association of Oil and Gas Producers (IOGP), for example, there was an 8% decline in the fatal accident rate and a fall in deaths in the oil and gas industry from 33% in 2017 to 31% in 2018. NIOSH has issued recommendations for reducing the risk of such fatalities by performing hazard assessments on the well site, training workers on the hazards associated with gauging tanks, using respiratory protection such as Self-contained Breathing Apparatus (SCBA), and establishing emergency medical response during the event.

Furthermore, OSHA has developed occupational health and safety rules in the United States to promote correct product usage. Furthermore, numerous compliance-consulting organizations offer recognized certifications and examinations for correct product usage to preserve a healthy workplace environment.

Personal Protective Equipment Market to be Driven by Construction Industry Growth

According to market research, expanding infrastructure and building projects in the United States, China, and India may generate significant market expansion prospects. According to OSHA, the construction industry had over 995 deaths out of 4,500 in 2019, primarily due to being struck by items, electrocution, falls, trench cave-ins, and malfunctioning equipment such as cranes and forklifts.

Falls are the leading cause of increased death rates in the construction industry. Every year, construction-related falls cause over 100,000 injuries and close to 100 to 200 deaths, according to OSHA. The growing number of unique infrastructure projects for residential and commercial construction developments will drive the expansion of the personal protective equipment market. Furthermore, when working around falling items or heavy equipment, construction workers wear safety boots or shoes with puncture-resistant and slip-resistant bottoms to prevent crushed toes. To protect employees' well-being, strict regulatory regulations, standards, and high mortality rates have been enacted. To protect workers' well-being, a high mortality rate has been imposed. It would help to boost the market growth.

Market Restraints

Sales of low-cost, low-quality goods will limit market growth

The lack of consumer knowledge about workplace risks, along with the selling of poor, low-quality, and low-cost items, may stymie market growth. Aside from that, the threat of duplicate, low-quality, and replacement items may stymie the expansion of the industrial safety footwear industry. Furthermore, these items are subjected to rigorous and stringent quality inspections, which are primarily designed by regulatory agencies to overcome such an unorganized industry.

Increased automation in end-use industries

Rising automation in the end-use industry is projected to act as a market restraint for the PPE kit market. As the covid-19 outbreak came under control and the economies started opening up. Many industries started to adopt automation in their manufacturing processes which led to a reduction in demand for labor and in turn resulted in a reduction in demand for PPE kits.

Personal Protective Equipment Market Report Coverage:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.5% |

|

Segments Covered |

By Product, End User and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Honeywell International, Inc., Lakeland Industries, Inc., DuPont, 3M, Ansell Ltd., Avon Rubber plc, COFRA S.r.l., Uvex Safety Group, Lindstrom Group, BartelsRieger Atemschutztechnik GmbH, Rock Fall (U.K.) Ltd., Mine Safety Appliances (MSA) Company, Radians, Inc., Poisonon Corp., Gateway Safety, Inc. |

This research report on the global personal protective equipment market has been segmented and sub-segmented based on Product, End-User, Geography & region.

Global Personal Protective Equipment Market – By Product

- Head, Eye & Face Protection

- Hearing Protection

- Protective Clothing

- Respiratory Protection

- Protective Footwear

- Fall Protection

- Hand Protection

The hand protection product sector accounted for more than 28 percent of total revenue in 2020 and is predicted to expand at a consistent CAGR over the forecast period. Corrosive chemical hazards, handling heated materials, and heavy-duty equipment are projected to drive demand for protective gloves in the construction, food processing, oil and gas, healthcare, and metal fabrication industries.

The second-largest product sector is protective clothing, which includes heat and flame protection, chemical defense, cleanroom clothing, and mechanical protective gear. These products' high-performance features have led to greater penetration, generating demand in a variety of end-use sectors. Protective footwear had a considerable market share and is predicted to grow at a CAGR of 6.8 percent during the forecast period due to strong product demand as a result of rising workplace fatalities. Growing employer awareness of the need to safeguard employees from foot injuries caused by chainsaws, electric shock, and metatarsal impact is expected to boost category growth.

Employees are protected from dangerous gases and vapors, particulates, chemical agents, radioactive particles, and biological pollutants with respiratory protection equipment. Rising demand for unpowered respirators is likely to drive market growth throughout the forecast period, especially in the petrochemical, mining, cement, construction, coal, fertilizers, and oil & gas sectors.

Global Personal Protective Equipment Market – By End User

- Construction

- Manufacturing

- Oil & Gas

- Chemicals

- Food

- Pharmaceuticals

- Healthcare

- Transportation

- Mining

- Others

In 2020, the healthcare end-use category led the market with a revenue share of more than 29 percent. Over the projection period, the category will maintain its dominance by increasing at the quickest CAGR. End-users assess a variety of aspects when selecting protective gear, including the material used and the coverage offered, seam barrier characteristics, and other features such as closures. Because of the fast spread of the coronavirus, the need for protective apparel, particularly coveralls and gowns, has skyrocketed in the United States.

Furthermore, the FDA has created an enforcement policy for gowns and other garments to increase the supply of necessary protective clothing for healthcare workers during the pandemic. Polyethylene and Spunbond Meltblown Spunbond are two common materials used in the manufacture of coveralls and gowns (SMS). The oil and gas sector accounted for a considerable part of revenue and is likely to expand steadily throughout the forecast period due to the high accident risk in upstream and midstream activities.

Global Personal Protective Equipment Market – By Geography & Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

North America, led by the United States, accounted for the highest revenue share of more than 33% in the worldwide market in 2020, due to established end-use industries and high product adoption in the healthcare sector. The high product penetration in the United States can be linked to a strict regulatory environment combined with substantial fines for noncompliance with the requirements that force companies to use PPE.

Due to economic growth and rapid industrialization across the area, Asia Pacific is predicted to emerge as the fastest-growing regional market, with a CAGR of 8.3 percent over the forecast period. Furthermore, the high compensation costs associated with workplace deaths are likely to compel employers in a variety of end-use industries to wear protective equipment, hence increasing product demand.

Russia's reform plan includes improvements to the public healthcare system and infrastructure, as well as investments in new facilities. These improvements are projected to increase demand for medical devices and equipment. The rapidly developing medical industry in the nation is expected to drive up demand for hand protection equipment such as disposable and long-lasting gloves.

The resurgence of Malaysia's manufacturing sector in the second half of 2018 boosted market growth positively. The chemical industry's continuous expansion, along with increased penetration of PPE in chemical manufacturing due to rising employee safety consciousness, is likely to boost the market throughout the forecast period.

Global Personal Protective Equipment Market – By Companies

- Honeywell International, Inc.

- Lakeland Industries, Inc.

- DuPont

- 3M

- Ansell Ltd.

- Avon Rubber plc

- COFRA S.r.l.

- Uvex Safety Group

- Lindstrom Group

- BartelsRieger Atemschutztechnik GmbH

- Rock Fall (U.K.) Ltd.

- Mine Safety Appliances (MSA) Company

- Radians, Inc.

- Poisonon Corp.

- Gateway Safety, Inc.

NOTABLE HAPPENINGS IN THE GLOBAL PERSONAL PROTECTIVE EQUIPMENT MARKET IN THE RECENT PAST:

- Merger & Acquisition: - In April 2021, Honeywell paid USD 1.2 billion for Norcross Safety Products L.L.C., a PPE maker. This purchase will give the company a foundation in the fragmented worldwide market, which is expected to create considerable growth potential. With this investment in Norcross, the firm will be able to fully join the highly regulated industrial safety sector.

- Product Launch: - In April 2020, Mallcom (India) Limited has introduced a PPE overall and shoe cover to their product line of disposable recyclable face masks for the medical business. Along with the shoe cover, the whole set will be offered in two configurations.

- Government Contract: - In January 2020, Following the award of two contracts from the US Department of Defense totaling more than USD 200 million, 3M increased its monthly domestic production of N95 masks. It has increased the local manufacture of N95 face masks to 35 million per year. The two DOD contracts, one costing USD 76 million and the other worth USD 126 million, allowed the business to grow production by 39 million units, with 3M's additional contributions increasing the total by another 22 million.

Impact of Covid-19 on the Industry

The COVID-19 epidemic is quickly spreading throughout regions and countries, wreaking havoc on all levels of the supply chain. The PPE market's supply chain has not been able to keep up with the increasing demand. Furthermore, supply and logistics difficulties, such as a prohibition on exports of the items and other crucial commodities, have been highlighted. The People's Republic of China (PRC), a key producer of personal protective equipment in the global trade market and the first country to be afflicted by the coronavirus pandemic, is experiencing supply interruptions that are affecting the Asia Pacific and the rest of the globe.

Furthermore, export prohibitions and trade restrictions in over 20 economies have compounded PPE manufacturing and distribution issues. Multilateral development banks, particularly the Asian Development Bank, are assisting in increasing PPE manufacturing and transportation capacity; strengthening the supply chain and other trade financing initiatives; and assisting vulnerable populations like women, children, and the elderly. According to Healthcare Organization Procurement Professionals, the viral epidemic has resulted in a 1,064 percent rise in the cost of required items for several hospitals and assisted living homes treating COVID-19 patients. The price increase is much bigger (1,084 percent) for customers who use nitrile gloves owing to a lack of vinyl gloves or other sensitivities.

Chapter 1. PERSONAL PROTECTIVE EQUIPMENT MARKET– Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. PERSONAL PROTECTIVE EQUIPMENT MARKET– Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2024 – 2030

2.3.2. Impact on Supply – Demand

Chapter 3. PERSONAL PROTECTIVE EQUIPMENT MARKET– Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. PERSONAL PROTECTIVE EQUIPMENT MARKET- Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. PERSONAL PROTECTIVE EQUIPMENT MARKET- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. PERSONAL PROTECTIVE EQUIPMENT MARKET– By Type

6.1. Head, Eye and Face Protection

6.2. Respiratory Protection

6.3. Hand and Arm Protection

6.4. Protective Clothing

6.5. Fall Protection

6.6. Protective Footwear

6.7. Hearing Protection

6.8. Others

Chapter 7. PERSONAL PROTECTIVE EQUIPMENT MARKET– By End User

7.1. Chemicals

7.2. Construction

7.3. Firefighting

7.4. Food

7.5. Healthcare

7.6. Manufacturing

7.7. Mining

7.8. Oil & Gas

7.9. Pharmaceuticals

7.10. Transportation

Chapter 8. PERSONAL PROTECTIVE EQUIPMENT MARKET– By Region

8.1. North America

8.2. Europe

8.3. The Asia Pacific

8.4. Latin America

8.5. Middle-East and Africa

Chapter 9. PERSONAL PROTECTIVE EQUIPMENT MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

9.1. Company 1

9.2. Company 2

9.3. Company 3

9.4. Company 4

9.5. Company 5

9.6. Company 6

9.7. Company 7

9.8. Company 8

9.9. Company 9

9.10. Company 10

Download Sample

Choose License Type

2500

4250

5250

6900