Global Period Health Tech Market Size (2023 – 2030)

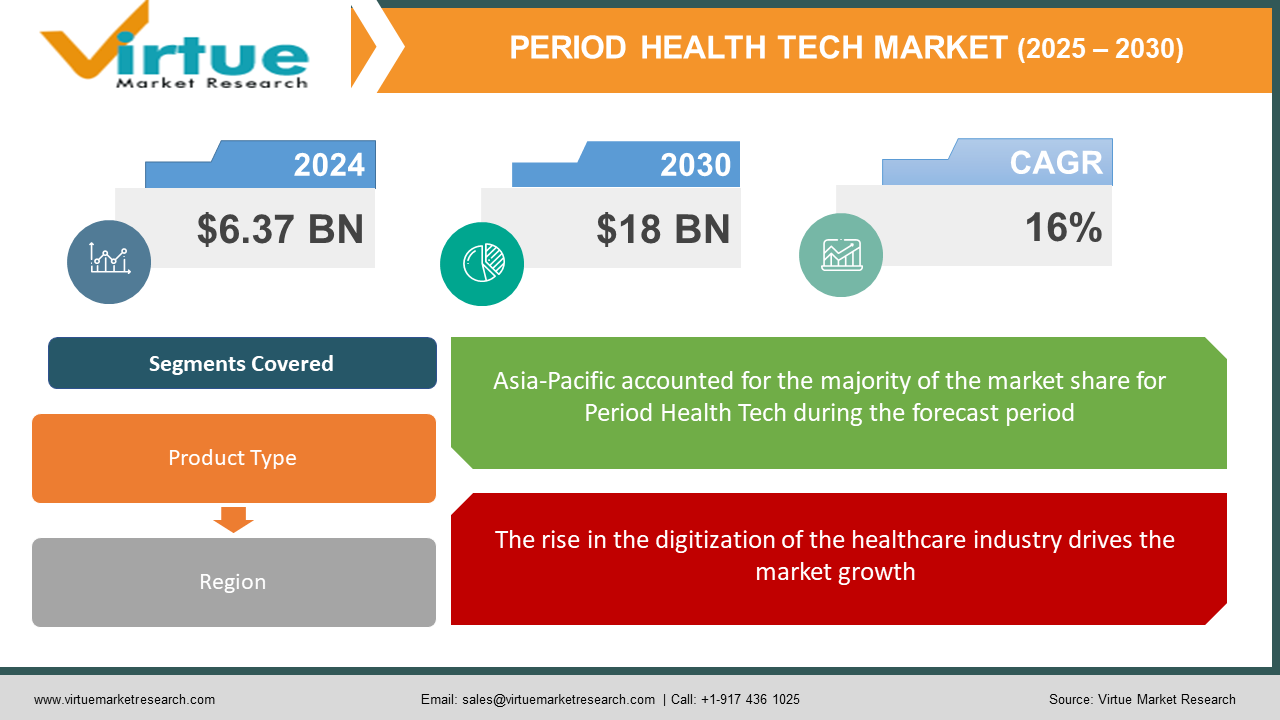

The Global Period Health Tech Market was valued at USD 6.37 billion and is projected to reach a market size of USD 18 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 16%.

Industry Overview

Women's healthcare improves results for women patients and consumers, investors and other value chain stakeholders, and society as a whole. In a linked post titled "Unlocking Opportunities in Women's Healthcare," We go through several of these opportunities as well as the larger environment in which they've emerged. In this article, we'll look at FemTech in particular, defining what it is, assessing its already outstanding growth, and considering its potential to better link resources, talent, and capital to women's unmet health needs.

Women's health is often overlooked as a niche sector. Historically, there hasn't been a separate market for women in technology. In addition, enterprises that created and marketed items specifically for female consumers failed. Currents, on the other hand, are shifting, thanks to the emergence of these-economy.' As consumers, decision-makers, healthcare professionals, and carers, women are now playing an increasingly important role in the healthcare system. FemTech emerged as a consequence of several start-ups and businesses seeing the vacuum that had been left. Software, diagnostics, products, and services that use technology to improve women's health are referred to as FemTech. It entails the application of digital health to improve women's health and well-being.

Market Drivers

The rise in the digitization of the healthcare industry drives the market growth:

The increased market demand for embryo screening, egg freezing, fertility, and other services has resulted from breakthrough femtech solutions. In addition, the development of wearable gadgets to track and monitor patient well-being will boost usage in the future years. During the analysis period, the availability of such technologically sophisticated gadgets will drive market expansion.

Software solutions development will drive the market growth:

This femtech market area includes equipment, software, and services. The rising prevalence of chronic and infectious disorders among women will increase the demand for better diagnosis and treatment options, pushing segmental growth. Furthermore, businesses are always working to develop novel and technologically sophisticated approaches to improve women's health and wellness. Improvements in women's health items like tampons, breast pumps, and pelvic floor exercise devices, among other things, will help the industry grow.

Increasing Government Menstrual Hygiene Initiatives:

Consumer knowledge of menstrual hygiene is growing, as is the number of working women and income levels. These are some of the primary drivers driving the global expansion of feminine hygiene products including tampons, sanitary pads, and menstrual cups. Furthermore, the feminine hygiene business has begun to expand faster internationally as a result of government programs to provide free sanitary pads, mainly in poorer nations. For example, the Japanese government set aside JPY 1.3 billion in March 2021 to assist women in need of menstruation supplies. The government also aided local governments by providing free sanitary pads and tampons to the people.

Market Restraints

Women's lack of understanding of femtech goods and uses may stymie the industry's progress in developing nations:

Menstruation is still taboo, and this topic has increased misinformation, as well as harmful and ridiculous misunderstandings, injuring individuals who require guidance or medical support. FemTech puts women in the spotlight in an industry where they are frequently overlooked. Misconceptions and inequities in women's health and wellness have existed for years. Many clinical studies were dominated by men, resulting in limited data on women's healthcare. FemTech, on the other hand, is completely focused on women and helps to handle all of these difficulties, from menstruation through menopause and pregnancy, through education and individualized services/products.

GLOBAL PERIOD HEALTH TECH MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

16% |

|

Segments Covered |

By Product Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Johnson & Johnson (US), Procter & Gamble (US), Kimberly-Clark (US), Essity Aktiebolag (publ) (Sweden), Kao Corporation (Japan), Daio Paper Corporation (Japan), Unicharm Corporation (Japan), Premier FMCG (South Africa), Ontex (Belgium), Hengan International Group Company Ltd. (China), Drylock Technologies (Belgium), Natracare LLC (US), First Quality Enterprises, Inc. (US), Bingbing Paper Co., Ltd. (China) |

This research report on the global Period Health Tech market has been segmented and sub-segmented based on, Geography & region.

Global Period Health Tech Market- By Product Type

-

Mobile Application

-

Software

-

Hardware

The market is segmented into product types by Mobile application, software, and hardware. Currently, the mobile applications to track the menstrual cycle hold the highest market shares among other product types.

Global Period Health Tech Market- By Region

-

Asia-Pacific

-

North America

-

Europe

-

Latin America

-

The Middle East and Africa

Distinct corporations have launched various brands of feminine hygiene products for different socioeconomic groups. In the Asia-Pacific area, China's domestic sanitary pad market is the largest. Though there is less knowledge regarding hygiene goods in Asian markets, there is an opportunity for many enterprises to tap into or investigate. Manufacturers in Asia-Pacific are releasing a variety of additional goods in response to the rising demand for feminine hygiene products. Market participants are constantly pursuing growth strategies to get a foothold in the regional market. In July 2021, for example, Nobel Hygiene in India increased its manufacturing capacity by establishing a new factory in the nation to meet rising demand.

Global Period Health Tech Market- By Companies

-

Johnson & Johnson (US)

-

Procter & Gamble (US)

-

Kimberly-Clark (US)

-

Essity Aktiebolag (publ) (Sweden)

-

Kao Corporation (Japan)

-

Daio Paper Corporation (Japan)

-

Unicharm Corporation (Japan)

-

Premier FMCG (South Africa)

-

Ontex (Belgium)

-

Hengan International Group Company Ltd. (China)

-

Drylock Technologies (Belgium)

-

Natracare LLC (US)

-

First Quality Enterprises, Inc. (US)

-

Bingbing Paper Co., Ltd. (China)

NOTABLE HAPPENINGS IN THE GLOBAL PERIOD HEALTH TECH MARKET IN THE RECENT PAST:

- Merger & Acquisition: - In April 2021, Essity, a hygiene and health firm, has agreed to buy roughly 44% of Colombian hygiene company Productos Familia S.A. ("Familia"). Essity will own at least 94 percent of Familia when the acquisition closes, making them the largest shareholder.

- Business Expansion: - In March 2021, Essity, a hygiene and health firm, expanded its line of sustainable goods with the introduction of the Libresse V-Cup, a reusable menstrual cup, in Denmark, Finland, Norway, and Sweden.

- Merger & Acquisition: - In May 2020, Ontex stated that it has reached a deal to purchase Albaad Massuot Yitzhak Ltd.'s feminine hygiene manufacturing assets in Rockingham County.

Impact of Covid-19 on the Industry

Pharmaceutical and biotech businesses, in collaboration with governments throughout the world, are working to combat the COVID-19 epidemic, from vaccine research to pharmaceutical supply chain planning. Approximately 115 vaccine candidates and 155 compounds are currently being developed in the R&D pipeline. Furthermore, routinely used medications like Hydroxychloroquine have shown a huge increase in demand for COVID-19 treatment. Because many affluent nations are experiencing a scarcity of these medications, the increasing demand has provided enormous prospects for developers of COVID-19 management therapies. As a result of the demand for COVID-19 vaccines and treatment medications, the pharmaceutical and biotechnology industries are predicted to increase significantly in the future. This will, in turn, have a tremendous influence.

Chapter 1. Global Period Health Tech Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Period Health Tech Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Global Period Health Tech Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Global Period Health Tech Market Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Global Period Health Tech Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Period Health Tech Market – By Product Type

6.1. Mobile Application

6.2. Software

6.3. Hardware

Chapter 7. Global Period Health Tech Market- By Region

7.1. North America

7.2. Europe

7.3. Asia-Pacific

7.4. Latin America

7.5. The Middle East

7.6. Africa

Chapter 8. Global Period Health Tech Market – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

8.1 Johnson & Johnson (US)

8.2 Procter & Gamble (US)

8.3 Kimberly-Clark (US)

8.4 Essity Aktiebolag (publ) (Sweden)

8.5 Kao Corporation (Japan)

8.6 Daio Paper Corporation (Japan)

8.7 Unicharm Corporation (Japan)

8.8 Premier FMCG (South Africa)

8.9 Ontex (Belgium)

8.10 Hengan International Group Company Ltd. (China)

8.11 Drylock Technologies (Belgium)

8.12 Natracare LLC (US)

8.13 First Quality Enterprises, Inc. (US)

8.14 Bingbing Paper Co., Ltd. (China)

Download Sample

Choose License Type

2500

4250

5250

6900