Oxygen Scavengers Market Size (2024 –2030)

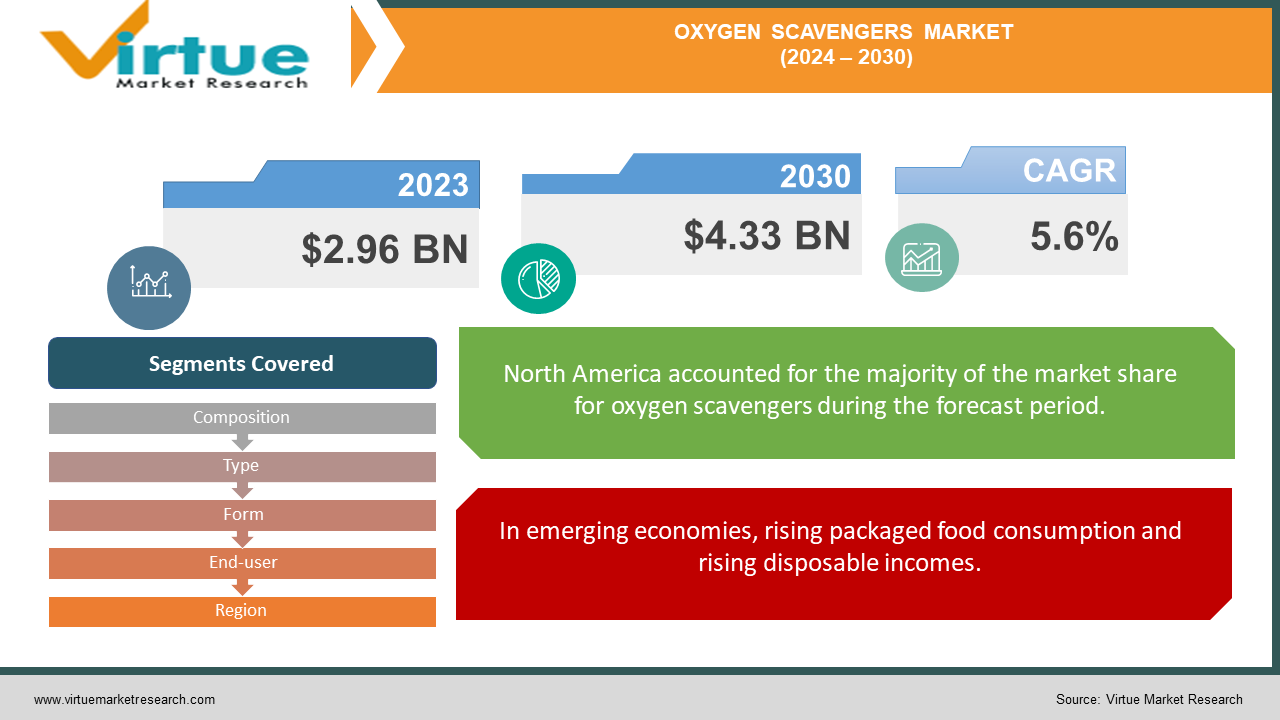

Global Oxygen Scavengers Market was valued at USD 2.96 billion and is projected to reach a market size of USD 4.33 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 5.6%.

Reduce the amount of oxygen inside sealed packages by using oxygen absorbers or scavengers. This preserves the freshness and quality of food for an extended period of time. Different kinds of oxygen absorbers are designed to serve different functions. The type you use will depend on the moisture content and what you're preserving. The oxygen absorber is typically placed in a tiny, permeable pouch, though occasionally it is included in the packaging To increase the shelf life of pharmaceuticals, specialty chemical manufacturer Clariant has created a new formula for its MEVOPUR range of medical-grade packaging materials. A novel component in the most recent version, MEVOPUR Safe, lowers the amount of oxygen exposed to supplements and medications kept in PET bottles. Cesa ProTect is an oxygen scavenger additive that was introduced and patented by Clariant AG, a company well-known for producing specialty chemicals. This product is anticipated to find use in a variety of polyester packaging applications in the future. It is intended for use in packaging composed of monolayer PET. The ColorMatrix Amosorb 4020G product is now available from Avient. This oxygen scavenger for PET rigid packaging has a low level of haze. Because it is made of non-nylon, it is more environmentally friendly during recycling because it reduces yellowing by 50%.

Key Market Insights:

Metallic oxygen scavengers, particularly those based on iron powder, account for approximately 45% of the market share, driven by their effectiveness, low cost, and wide range of applications in food packaging and industrial uses.

The food and beverage industry constitutes around 50% of the demand for oxygen scavengers, reflecting the critical need to prevent oxidation and extend shelf life in packaged foods and beverages.

In terms of form, sachets and labels represent about 55% of the market share for oxygen scavengers, attributed to their ease of integration into existing packaging systems and their ability to be customized for different product sizes.

The adoption of non-metallic, organic oxygen scavengers is growing at a rate of approximately 10% annually, driven by increasing demand for more sustainable packaging solutions and the need for oxygen scavengers compatible with metal detectors in food processing.

Global Oxygen Scavengers Market Drivers:

In emerging economies, rising packaged food consumption and rising disposable incomes.

To lessen the amount of oxygen in the container, food, beverage, and pharmaceutical packaging frequently uses oxygen scavengers. This prolongs the shelf life of products while preserving their fresh food's flavor, color, smell, and nutritional value. The convenience of ready-to-eat foods, busy lifestyles, and increased incomes are all contributing factors to the rise in the purchase of packaged food. Because more people are working, more households are having two incomes, professionals are living away from home, and more people are working from home, there is an increasing need for oxygen scavengers. In addition, the rise in nuclear families is contributing to an increase in packaged food demand.

Technological advancements and product developments can hasten market expansion:

Big industrial companies are constantly looking for ways to advance technology so they can produce better goods and operate more effectively. It is anticipated that the need for oxygen scavengers will increase, particularly in the food and beverage sectors. Producers also have to abide by a variety of rules and laws that are imposed by local authorities.

Oxygen Scavengers Market Challenges and Restraints:

In many industries, oxygen scavengers are very helpful in preventing costly boiler equipment from corroding. Sulfites and bisulfites are the most often utilized oxygen scavengers in the water treatment industry. These scavengers don't travel with the steam when it exits the boiler, though, because they are nonvolatile. They thus raise the concentration of dissolved solids in the water, influencing its conductivity. For the boiler water chemistry to remain at its best, these contaminants must be eliminated from the system. This is one of the primary obstacles impeding the market expansion for oxygen scavengers.

Oxygen Scavengers Market Opportunities:

The water treatment industry is one more significant user of oxygen scavengers. In order to prevent corrosion and damage to industrial equipment, dissolved oxygen in water is removed using oxygen scavengers. In the water treatment sector, oxygen scavengers are becoming more and more necessary as the demand for pure, safe water rises. Producers are working hard to create oxygen scavengers that remove dissolved oxygen from water in an economical, cost-effective, and efficient manner.

OXYGEN SCAVENGERS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.6% |

|

Segments Covered |

By Composition, Type, Form, End-user, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Robert Bosch GmbH, I.M.A. INDUSTRIA MACCHINE AUTOMATICHE S.P.A., Körber AG, Coesia S.p.A, Syntegon Technology GmbH, Romaco Group, Uhlmann Group, Maquinaria Industries Dara, SL, MULTIVAC |

Global Oxygen Scavengers Market Segmentation: By Composition

-

Organic

-

Inorganic

Based on composition, the oxygen scavengers market is split into two segments: organic and inorganic products. Compared to organic oxygen scavengers, inorganic ones are used far more frequently and have brought in over USD 950 million in revenue. Boiler feed water is frequently treated with sodium sulfite, bisulfite, and hydrazine hydrate; iron-based scavengers are frequently used in packaging applications. The organic oxygen scavenger market is anticipated to expand at a compound annual growth rate (CAGR) of roughly five percent. Despite having a more limited range of uses, they have a bright future because research and development are still ongoing. Salts derived from ascorbic acid and catechol for packaging purposes, as well as salts from carbohydrazide, diethyl hydroxylamine (DEHA), hydroquinone, erythorbate, and other substances, are included in this category.

Global Oxygen Scavengers Market Segmentation: By Type

-

Metallic

-

Non-metallic

Market segmentation for oxygen scavengers is based on type, with the metallic segment leading at 48%. Iron powder, metal halides, bisulfite ions, and sodium bisulfite are common metallic oxygen scavengers. The reason for this segment's growth is their application in halting the growth of mold, spoiling, and color change. Compared to non-metallic scavengers, metallic scavengers are also simpler to use and react quickly. Over the course of the forecast period, a notable increase is anticipated in the non-metallic category. The decreasing toxicity of non-metallic oxygen scavengers and the requirement for solutions that don't set off metal detectors in specific packaging applications are driving this segment's growth. However, because they are more expensive than metallic scavengers, non-metallic scavengers are not as widely utilized. Non-metallic oxygen scavengers include glucose oxidase, ascorbic acid, hydrazine, activated carbon, and citrus.

Global Oxygen Scavengers Market Segmentation: By Form

-

Sachets/Canisters/Bottle Caps & Labels

-

OS Films & PET Bottles

-

Liquid

-

Powder

Based on form, the market for oxygen scavengers is split into four segments: liquid, powder, sachets/canisters/bottle caps & labels, and OS films & PET bottles. The categories of bottle caps, labels, sachets, and canisters accounted for a substantial 30% of the market in terms of volume. These forms are widely used because they are affordable and easily accessible. Labels and sachets remove oxygen far faster than materials that are directly used in packaging. Over the course of the forecast period, liquid oxygen absorbers are anticipated to grow at a compound annual growth rate (CAGR) of about 4%. They work well to keep residual oxygen out of boilers and guard against component corrosion, which lowers the chance of a system failure and boosts industrial boiler productivity.

Global Oxygen Scavengers Market Segmentation: By End-user

-

Food & Beverage

-

Pharmaceutical

-

Oil & Gas

-

Power Generation

With 38% of the market, the food and beverage industry is the largest end-use sector for oxygen scavengers. This is brought on by the rising need for quick meals, high-quality packaged foods, less food waste, and swift urbanization in developing nations. Processed food shelf life is increased and freshness is preserved with the aid of oxygen scavengers. Additionally, the need for oxygen scavengers in this industry is driven by the growth of the middle class and rising income levels. In the oxygen scavengers market, the pharmaceuticals category is expanding at the fastest clip. The pharmaceutical industry uses oxygen scavengers to stop drugs, vaccines, and other medical supplies from oxidizing and degrading. The market is expanding due to rising awareness of oxygen's detrimental effects on pharmaceutical and medical products as well as rising demand for these products. In addition, the need for increasingly sophisticated oxygen scavenger technologies is being driven by the creation of novel medication formulations as well as the rising usage of biologics and biosimilars.

Global Oxygen Scavengers Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

With a 45% market share, North America currently commands the largest portion of the global oxygen scavenger market, primarily due to its widespread use in the food and beverage industry. The need for oxygen scavengers to increase the shelf life of food products has increased due to the region's strict food safety regulations. The market is anticipated to rise gradually as a result of the growing food and beverage sector and rising consumer demand for oxygen scavengers that are biodegradable and ecologically friendly. Most of the demand for oxygen scavengers in the United States, the largest market in North America, is driven by the food and beverage sector. Prominent companies in the region include Ecolab Inc., Mitsubishi Gas Chemical Company, and BASF SE. Due to the requirement for packaging materials that extend the shelf life of medications, the pharmaceutical industry in the US also makes a significant contribution to the demand for oxygen scavengers. Due to strict food safety laws and rising demand for environmentally friendly packaging options, Canada is another sizable market for oxygen scavengers in North America. Asia-Pacific (APAC) is home to the oxygen scavenger market with the fastest rate of growth. The region's growing economies—those of India, China, Indonesia, Malaysia, Singapore, Vietnam, and Thailand—are principally to blame for this expansion. The demand for oxygen scavengers in Asia-Pacific is being driven by factors such as growing urbanization, population growth, and rising consumption of packaged and convenient food products. The market for oxygen scavengers in the area is further supported by industrialization, rising living standards, disposable incomes, and government initiatives to draw investment in industries like energy, oil and gas, and chemicals.

COVID-19 Impact on the global Oxygen Scavengers Market:

In the water treatment process, oxygen scavengers are used to eliminate oxygen that could harm pipelines and equipment. They are also utilized in the food and beverage, power, oil and gas, pharmaceutical, paper, and chemical industries for the packaging of food and medications. Global industries impacted by the ongoing pandemic include food and beverage production, textiles, paper manufacturing, and electricity generation. In 2020, the water treatment industry encountered difficulties amid the lockdowns. Emergencies, changes in consumer demand, and supply chain interruptions were frequent. Due to shutdowns or reduced operations, many large water users decreased their needs.

Latest Trend/Development:

Poliquímicos, a well-known producer and supplier of specialty chemical solutions for water-intensive industries in Mexico, was acquired by Solenis. A component of Solenis' plan to bolster its direct-to-market strategy is this acquisition. A brand-new kind of oxygen scavenger material has been created by Mitsubishi Gas Chemical Company for use in food and pharmaceutical packaging. This novel substance promises to eliminate oxygen more efficiently than current techniques, possibly increasing product shelf life and decreasing waste.

In a $5.25 billion deal, Platinum Equity purchased Solenis from Clayton, Dubilier & Rice (CD&R) and BASF. Solenis combined with Sigura Water, another business in Platinum Equity's portfolio, as part of this acquisition, resulting in a combined transaction value of about $6.5 billion. Solenis now makes about $3.5 billion in total sales when combined with Sigura Water.

A new masterbatch solution was introduced by Swiss specialty chemical manufacturer Clariant. The range of oxygen scavenger solutions Clariant offers for plastic packaging materials is increased by this solution. With the help of the new masterbatch, packaged goods will have a longer shelf life since plastic packaging will be better at removing oxygen.

Key Players:

-

Robert Bosch GmbH

-

I.M.A. INDUSTRIA MACCHINE AUTOMATICHE S.P.A.

-

Körber AG

-

Coesia S.p.A

-

Syntegon Technology GmbH

-

Romaco Group

-

Uhlmann Group

-

Maquinaria Industries Dara, SL

-

MULTIVAC

Chapter 1. Oxygen Scavengers Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Oxygen Scavengers Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Oxygen Scavengers Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Oxygen Scavengers Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Oxygen Scavengers Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Oxygen Scavengers Market – By Composition

6.1 Introduction/Key Findings

6.2 Organic

6.3 Inorganic

6.4 Y-O-Y Growth trend Analysis By Composition

6.5 Absolute $ Opportunity Analysis By Composition, 2024-2030

Chapter 7. Oxygen Scavengers Market – By Type

7.1 Introduction/Key Findings

7.2 Metallic

7.3 Non-metallic

7.4 Y-O-Y Growth trend Analysis By Type

7.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 8. Oxygen Scavengers Market – By Form

8.1 Introduction/Key Findings

8.2 Sachets/Canisters/Bottle Caps & Labels

8.3 OS Films & PET Bottles

8.4 Liquid

8.5 Powder

8.6 Y-O-Y Growth trend Analysis By Form

8.7 Absolute $ Opportunity Analysis By Form, 2024-2030

Chapter 9. Oxygen Scavengers Market – By End-User

9.1 Introduction/Key Findings

9.2 Food & Beverage

9.3 Pharmaceutical

9.4 Oil & Gas

9.5 Power Generation

9.6 Y-O-Y Growth trend Analysis By End-User

9.7 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 10. Oxygen Scavengers Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Composition

10.1.2.1 By TypeApplication

10.1.3 By Form

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Composition

10.2.3 By TypeApplication

10.2.4 By Form

10.2.5 By End-User

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Composition

10.3.3 By TypeApplication

10.3.4 By Form

10.3.5 By End-User

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Composition

10.4.3 By TypeApplication

10.4.4 By Form

10.4.5 By End-User

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Composition

10.5.3 By TypeApplication

10.5.4 By Form

10.5.5 By End-User

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Oxygen Scavengers Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Robert Bosch GmbH

11.2 I.M.A. INDUSTRIA MACCHINE AUTOMATICHE S.P.A.

11.3 Körber AG

11.4 Coesia S.p.A

11.5 Syntegon Technology GmbH

11.6 Romaco Group

11.7 Uhlmann Group

11.8 Maquinaria Industries Dara, SL

11.9 MULTIVAC

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Global Oxygen Scavengers Market was estimated to be worth USD 2.96 billion in 2023 and is projected to reach a value of USD 4.33 billion by 2030, growing at a CAGR of 5.6% during the forecast period 2024-2030.

Growing disposable incomes and rising packaged food consumption in emerging economies and Product developments and technological progress can accelerate market expansion are the factors driving the Global Oxygen Scavengers Market.

The non-volatile nature of oxygen scavengers and the absence of technical know-how for managing certain oxygen scavengers.

Pharmaceutical end-users are the fastest growing in the Global Oxygen Scavengers Market.

Asia-Pacific region is the fastest growing in the Global Oxygen Scavengers Market.