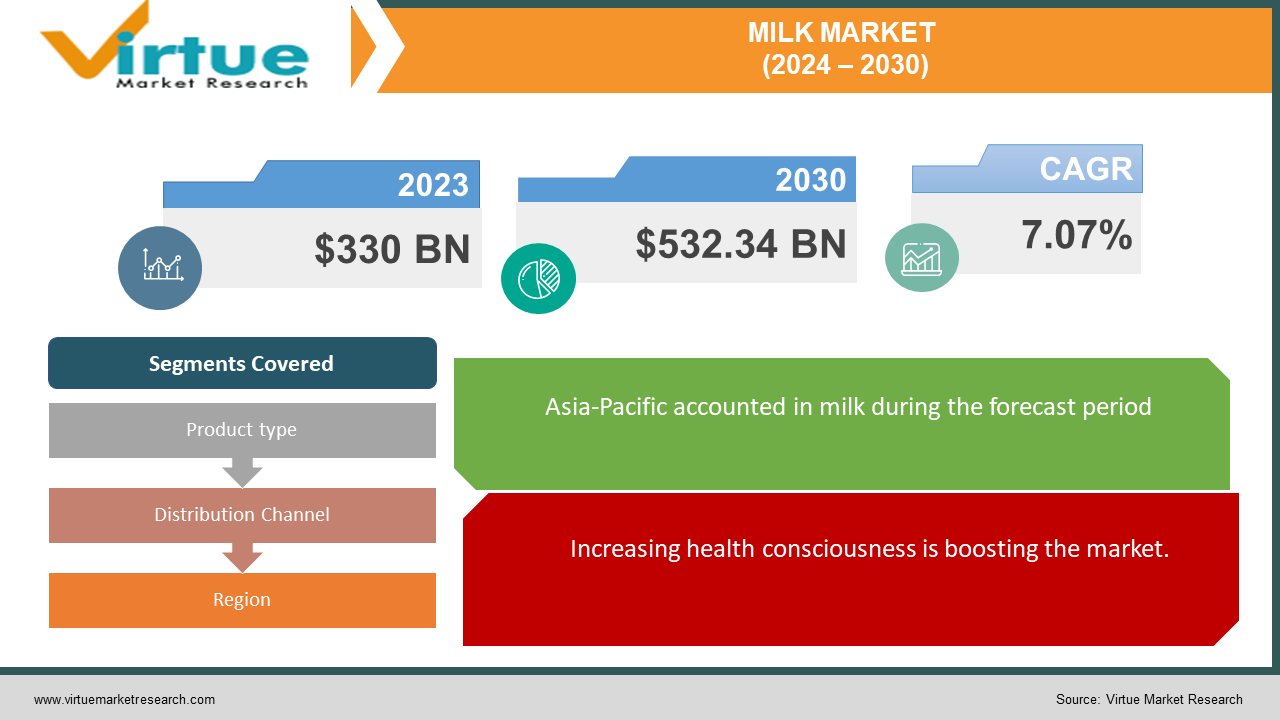

Milk Market Size (2024 – 2030)

The milk market was valued at USD 330 billion in 2023 and is projected to reach a market size of USD 532.34 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 7.07%.

The mammary glands of female mammals generate milk, a white or bluish-white liquid, to feed their young. Water, proteins, lipids, vitamins, and minerals are all present. An emulsion, or colloid, of butterfat globules in a water-based liquid is what makes up milk. All of the essential amino acids are present in milk's proteins. For infants, milk is the ideal nourishment since it is well tolerated during the development and maturation of their digestive tracts. Humans also rely on the milk of domesticated animals as a major source of nutrition, either raw or processed into a variety of dairy products like cheese and butter.

Key Market Insights:

In the fiscal year 2022, India produced more than 221 million metric tons of milk.California was the nation's largest producer of milk in 2022, producing close to 41.8 billion pounds.Global production of cow milk was estimated to be 549 million metric tons in 2023. The value of milk produced in the United Kingdom was projected to reach 6.66 billion British pounds in 2022.New Zealand became the world's largest milk exporter in 2022, with exports valued at $7.8 billion US dollars. With milk exports of US$3.5 billion that year, Germany came in second.

Milk Market Drivers:

Increasing health consciousness is boosting the market.

Growing consumer knowledge of milk's nutritional advantages is a key factor driving the milk market. Milk is generally regarded as an excellent source of essential nutrients, such as calcium, protein, vitamins, and minerals, all of which are necessary for overall health but especially for the development of strong bones and muscles. The market for milk and milk-based products is growing as more individuals value healthy nutrition and become health-conscious.

The rising population has been facilitating the expansion.

The world's population is expanding, especially in cities where access to fresh milk may be restricted. Dietary patterns are frequently altered by urbanization, with a move toward convenience meals like packaged milk and dairy products. Additionally, more people can frequently purchase dairy products due to increased disposable earnings in urban regions. The demand is fueled by this demographic shift.

Technological advancements in dairy farming are accelerating the growth rate.

Innovations in dairy farming technology have had a big impact on the milk market. Technological innovations, including genetically engineered dairy cattle, automated milking equipment, and precision farming methods, have raised productivity, cut expenses, and enhanced the quality of milk produced. Better animal welfare and increased yields are the outcomes of dairy farmers' increased ability to monitor and manage herd health due to technological improvements. Consequently, the expansion and stability of the milk market are facilitated by increased productivity and quality assurance in the production of milk.

Milk Market Restraints and Challenges:

The dairy market faces many obstacles and challenges, limiting its growth potential. First, shifting consumer preferences toward plant-based alternatives poses a major challenge as individuals seek alternatives for health, the environment, and ethics. In addition, fluctuations in milk prices due to supply imbalances and systemic pressures disrupt the market. Rising production costs, including those for food, labor, and transportation, add to the industry's challenges, reducing profit margins for dairy producers and consumers. produce milk. Growing competition from other dairy products such as almond, soy, and oat milk is making the market more competitive, forcing dairy producers to innovate and change their offerings to stay relevant. Finally, concerns about sustainability for dairy farming, including water consumption, greenhouse gases, and animal welfare, require strong efforts by the industry to address and reduce their impact on sustainability and future market growth.

Milk Market Opportunities:

With a growing global population and increasing health, there is a strong demand for fresh dairy products that meet different nutritional needs. Alternative milk options such as almond, soy, and oat milk have gained popularity among health consumers, allowing for market expansion and product diversification. In addition, advances in milk processing technology have enabled the creation of valuable products such as lactose-free milk, fortified milk, and probiotic-rich varieties, thus entering niche and weight-bearing markets. The support movement has led to a change in environmentally friendly practices in livestock and milk production, providing opportunities for brands to differentiate themselves and attract environmentally conscious consumers. As consumer interest continues and advances in technology continue, the dairy market is full of opportunities for those willing to innovate and adapt to change.

MILK MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.07% |

|

Segments Covered |

By Product type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Dean Foods, Royal Friesland Campina N.V, China Mengniu Dairy Company Limited, Arla Foods, Kraft Foods Group, Inc., Land O'Lakes Inc., Yili Group, Meiji Dairies Corporation |

Milk Market Segmentation: By Product Type

-

Skimmed Milk

-

Whole Milk

-

Flavored Milk

-

Milk Powder

-

Condensed Milk

-

Others

Whole milk is the largest-growing product type. Whole milk is still a common beverage in many homes and is consumed in many different parts of the world. Its natural abundance of vitamins and calcium contributes to its popularity, making it a top pick for consumers looking for healthy dairy products. Whole milk also plays a major role in the market presence and consumption of other products because it is a basic ingredient in many recipes. Flavored milk is the fastest-growing category. Because of its many tastes and alleged nutritional advantages, flavored milk has been growing significantly in popularity among a broad spectrum of consumers, including kids, young adults, and health-conscious people. Further boosting their appeal and commercial expansion is the fact that flavored milk products frequently satisfy changing customer preferences, such as those for lactose intolerance or those enriched with extra vitamins and minerals.

Milk Market Segmentation: By Distribution Channel

-

Convenience Stores

-

Supermarkets & Hypermarkets

-

Online Retail

-

Others

Supermarkets and hypermarkets are the largest growing channels, accounting for almost 50% of the market. They offer a wide range of products. Customers can also alter the price by haggling over the goods. Demand is further increased by the preference of those who are uneasy or unfamiliar with the Internet to make in-person purchases. Accessibility is further facilitated by the fact that these stores are present throughout the majority of the colonies. Online retail is the industry distribution channel with the fastest rate of growth. This is mostly due to availability. Customers choose this option since it is so convenient. Additionally, they will have more access to a wider range of native and imported types. Online retailers may benefit their customers by offering free shipping and discounts. In addition, the industry has grown as a result of the expanding digitalization trend.

Milk Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Asia-Pacific region is the largest and fastest-growing market, driven by a combination of traditional dairy consumption patterns and increasing economic growth. Factors such as rapid urbanization, rising disposable income, and growing awareness about health and nutrition have fueled the demand for dairy products in the region. Emerging economies such as China, India, and Southeast Asian countries are experiencing an increase in milk consumption, with a growing middle class and changing dietary habits. In addition, the adoption of Western lifestyles and food preferences among the urban population is leading to increased demand for milk and milk products. This growing demand in the Asia-Pacific region not only provides lucrative opportunities for local and international dairy producers but also has a significant impact on the dynamics of the global dairy market. As Asia-Pacific continues to assert its influence, it is reshaping supply chains, production methods, and marketing strategies globally, demonstrating its key role in shaping the future of the global dairy market. together.

COVID-19 Impact Analysis on the Milk Market:

The COVID-19 pandemic has had a significant impact on the dairy industry, creating many challenges and opportunities throughout the supply chain. With lockdowns and restrictions disrupting traditional distribution channels, milk producers have faced disruptions in transport, processing, and distribution, leading to disruptions of supply chains and fluctuations in market prices. Changes in consumer behavior, including panic buying and hoarding of essential goods, initially led to an increase in demand for milk and dairy products. However, as the pandemic continues, changing consumer behavior, economic uncertainty, and the shift to online shopping have changed consumption patterns. Restaurants, cafes, and other food establishments have closed or reduced operations, leading to a decrease in the purchase of milk and milk products. On the other hand, the increased focus on health and prevention has created a demand for functional dairy products that contain vitamins and probiotics. Among these challenges, the dairy market has also seen opportunities for innovation, and companies are exploring new distribution channels, adopting digital marketing strategies, and investing in product development to adapt to changes in geography.

Latest Trends/ Developments:

Companies in this industry are motivated to increase their market share by using a range of strategies, including acquisitions, joint ventures, and investments. Businesses are spending a lot of money to develop techniques to retain competitive pricing. Further growth has resulted from this.

In a strong dairy market, many popular trends and developments are reshaping the industry. Notable is the increase in demand for plant-based milk, which is driven by increased awareness of health and environmental issues. Almond, soy, oat, and coconut milk are gaining popularity among consumers looking for dairy-free options, leading to the creation of product offerings in both product categories for new entrants to the established market. In addition, there is a focus on supporting the entire life cycle of milk, from farm to table. This includes initiatives to reduce carbon emissions, improve animal welfare standards, and find environmentally friendly packaging solutions. Technological innovations are changing the process of production and distribution of dairy products, improving efficiency and quality control.

Key Players:

-

Dean Foods

-

Royal Friesland Campina N.V

-

China Mengniu Dairy Company Limited

-

Arla Foods

-

Kraft Foods Group, Inc.

-

Land O'Lakes Inc.

-

Yili Group, Meiji Dairies Corporation

-

In March 2024, Amul introduced its fresh milk products, such as Amul Taaza, Amul Gold, Amul Shakti, and Amul Slim-n-Trim, to the US market. Cities like New York, New Jersey, Chicago, Washington, Dallas, and Texas will be able to purchase the milk. While GCMMF will take care of marketing and branding, the Michigan Milk Producers Association (MMPA) will gather and process the milk. In the future, the brand intends to launch other fresh milk products like buttermilk, curd, and paneer.

-

In January 2024, Mother Dairy introduced a new pure buffalo milk variety to the Delhi-NCR market. The milk comprises A2 protein, 6.5% fat, and 9% SNF (Solid Not Fat). It costs ₹70 per liter and comes in 500-ml and 1-liter packets. Fresh milk is good for cooking and regular eating because of its rich flavor and creamy texture. A1 beta-casein protein, which some people may experience digestive problems with, is absent from A2 buffalo milk. For those who are lactose intolerant or have problems digesting ordinary cow's milk, this makes it a good substitute.

-

In January 2022, French dairy company Lactalis continued on its way towards the goal of becoming a guilty company by acquiring India-based Prabhat Dairy for $ 23 million to gain a leading market share in West India.

Chapter 1. MILK MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. MILK MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. MILK MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. MILK MARKET - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. MILK MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. MILK MARKET – By Product Type

6.1 Introduction/Key Findings

6.2 Skimmed Milk

6.3 Whole Milk

6.4 Flavored Milk

6.5 Milk Powder

6.6 Condensed Milk

6.7 Others

6.8 Y-O-Y Growth trend Analysis By Product Type

6.9 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. MILK MARKET – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Convenience Stores

7.3 Supermarkets & Hypermarkets

7.4 Online Retail

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Distribution Channel

7.7 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. MILK MARKET , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. MILK MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Dean Foods

9.2 Royal Friesland Campina N.V

9.3 China Mengniu Dairy Company Limited

9.4 Arla Foods

9.5 Kraft Foods Group, Inc.

9.6 Land O'Lakes Inc.

9.7 Yili Group, Meiji Dairies Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The milk market was valued at USD 330 billion in 2023 and is projected to reach a market size of USD 532.34 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 7.07%.

Factors driving the milk market include increasing health consciousness, a rising population, and technological advancements in dairy farming.

Based on distribution channels, the milk market is segmented into convenience stores, supermarkets & hypermarkets, online retail, and others.

Asia-Pacific is the most dominant region for the milk market.

Major key players in the global milk market are Dean Foods, Royal Friesland Campina N.V., China Mengniu Dairy Company Limited, Arla Foods, Kraft Foods Group, Inc., Land O'Lakes Inc., Yili Group, and Meiji Dairies Corporation.