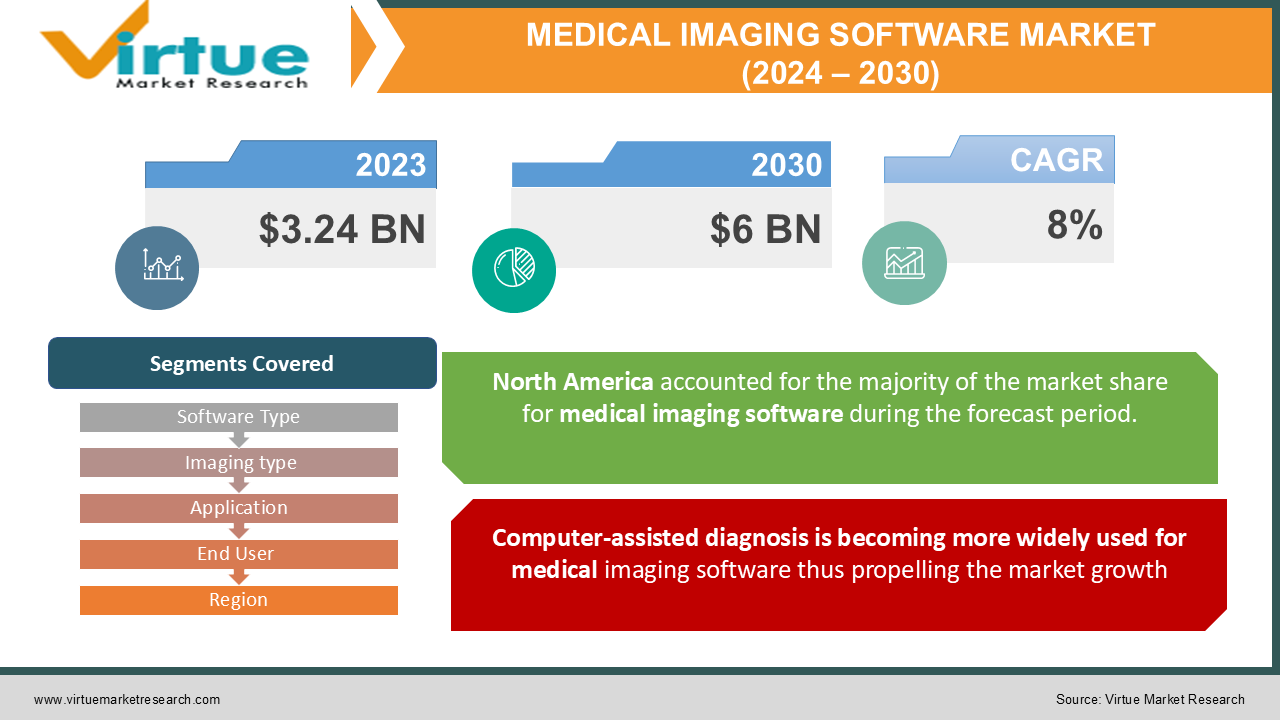

Global Medical Imaging Software Market Size (2024 – 2030)

According to our research report, the global medical imaging software market is estimated to reach a total market valuation of USD 3.24 billion in 2023 to USD 6 billion by 2030. The market is projected to grow with a CAGR of 8% during the period of analysis (2024 - 2030).

Industry Overview:

The market is projected to develop due to increased demand for diagnostic imaging software in industries such as dentistry, orthopedics, urology, neurology, and cancer. The need for ultrasound imaging equipment is likely to rise as more people use them to make speedier diagnoses, especially for chronic conditions. Furthermore, ongoing advancements in imaging technologies, such as Computer-aided Diagnosis (CAD), are estimated to drive demand for these systems. In recent years, the advent of Artificial Intelligence (AI) in medical imaging has transformed market dynamics, and it is estimated to have a favorable impact on growth shortly.

Medical imaging applications for AI-based systems include diagnosis, detection, image analysis, and clinical decision support. Though AI use in MRI and CT technologies is still in its early stages, an increased need for accuracy, efficiency, and patient safety is anticipated to drive AI-enabled medical imaging acceptance throughout the projected period. The rising demand is being fuelled by the adoption of technologically sophisticated goods such as multimodality imaging platforms and 3D imaging, as well as the benefits associated with their use, such as high-resolution imaging, ease of use, and flexibility. In the next years, the market expansion will be fuelled by the launch of technologically sophisticated goods and the development of effective information management systems.

Market Drivers:

Computer-assisted diagnosis is becoming more widely used for medical imaging software thus propelling the market growth:

Computer-aided diagnosis (CAD) aims to provide a computer-assisted data interpretation technique. Image processing, computer vision, mathematics, physics, and statistics are all combined in CAD to aid radiologists in their analysis and decision-making processes. Image enhancement, initial detection, and image feature extraction, including segmentation, are all part of CAD image analysis. This approach helps radiologists decrease manual data interpretation mistakes and diagnose problems that are frequently missed during manual analysis operations. This approach was originally developed for mammographic image processing, but it has now been expanded to include the detection and analysis of cancers of the colon, lung, liver, and prostate. As a result, the expanding use of CAD technology for image analysis is likely to propel the image analysis industry forward.

Emerging demand for cloud-based image analysis software has boosted the medical imaging software market:

Since it provides improved data accessibility and real-time analysis, the cloud-based approach has emerged as a viable option for delivering image analysis software. Cloud-based image analysis tools make it simple to offer analytical insights from a multi-terabyte database from anywhere, at any time, on any platform. Every data change is gathered and immediately updated on the dashboard in real-time using these solutions. Furthermore, a cloud-based imaging solution requires no upfront hardware investment, decreases the load on healthcare systems by reducing or eliminating the need for in-house IT workers, and allows for speedier data transmission across companies. Because of these benefits, end customers are projected to place a significant demand for cloud-based image analysis systems in the approaching years.

Market Restraints:

Budgetary Constraints act as market restraints for the growth of the medical imaging software market:

The high cost of imaging equipment, along with the high cost of software development and license, is the main constraint limiting market expansion, particularly in countries with inadequate reimbursement scenarios. Most healthcare institutions in developing countries, such as hospitals and diagnostic centers, cannot afford these systems due to high installation and maintenance expenses. Healthcare institutions in emerging nations are hesitant to invest in new or technologically sophisticated systems due to the high cost of these systems and limited financial resources. End users are also burdened financially by the deployment and subscription/licensing fees for sophisticated imaging technologies. These constraints may stifle digitalization in healthcare institutions and limit the use of modern diagnostic and analytical technology.

Risks linked with the usage of imaging equipment and software due to hacking has stifled the medical imaging software market:

Medical equipment hacking can reduce efficiency and result in negative effects for patients. Other high-risk businesses, such as avionics, have safety precautions that medical equipment manufacturers lack. As a result, medical equipment does not incorporate the most recent improvements in IT security, which can guard against hacking.

Hackers can successfully shut down equipment, resulting in data breaches and affecting patient outcomes, which is a big worry in the medical imaging software industry. Furthermore, the rising reliance on software raises concerns about vulnerabilities, crashes, and vulnerability to cyber-attacks. As a result of the negative repercussions of unintentional malfunctioning and hacking, healthcare practitioners are hesitant to implement IT solutions, such as image analysis software.

GLOBAL MEDICAL IMAGING SOFTWARE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

8% |

|

Segments Covered |

By Software Type, Imaging type, Application, End User and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Toshiba Medical Systems Corp., Bruker Corp., Xinapse Systems Ltd., Esaote, Inc., ClaroNAv, Inc., Merge Healthcare Inc., Aquilab GmbH, Spacelabs Healthcare, Inc., MIM Software Inc., Carestream Health, Inc. |

This research report on the global Medical Imaging Software Market has been segmented and sub-segmented based on Software Type, Imaging Type, Application, End-User, and Region.

Global Medical Imaging Software Market - By Software Type

- Integrated Software

- Stand-alone Software

With a sales share of more than 54.5 percent in 2021, integrated software dominated the market. This high percentage can be linked to the advantages of using these solutions. The integrated toolset is intended to enhance workflow in a variety of radiology applications. Philips’ Xcelera Cardiology Information Management, for example, is an integrated image management program that provides a single point of entry to sophisticated clinical applications while also improving clinical efficiency. The emergence of these sorts of solutions has aided the segment’s revenue dominance. High adoption of integrated systems is expected to fuel market expansion due to benefits such as cost-effectiveness, centralized data storage, and access to live data for many users to handle.

Stand-alone platforms are expected to continue to develop steadily. These platforms are easier to use and less expensive than integrated systems. Researchers choose these solutions because they provide additional information and features, allowing them to exchange and access research data and analysis, improving their capacity to diagnose, analyze, monitor, and treat illnesses. ViewPoint 6 (for MFM), for example, is a standalone ultrasound reporting and picture management program from GE Healthcare.

Global Medical Imaging Software Market- By Imaging type

- 2D Imaging

- 3D Imaging

- 4D Imaging

In 2021, the 4D imaging sector had the biggest market share of more than 45.00 percent. Due to technical improvements in 4D imaging technology, which allows for efficient and accurate real-time viewing of the human body, minimizing distortion in operations, this sector is likely to continue its leadership position during the forecast period. 4D imaging is a three-dimensional picture analysis that moves in real-time. Because of the rising acceptance of these technologies, the 3D and 4D imaging software solutions markets are estimated to rise at a healthy rate over the projected period.

Furthermore, a shift in focus to deliver better treatment has resulted in the use of different computer-aided diagnostic methods, which is fuelling market expansion. In the next years, demand for software is projected to be fuelled by the launch of technologically improved goods and multimodality imaging systems. Philips’ SmartCT 3D imaging software, for example, received 510(k) clearance from the US FDA in April 2021.

Global Medical Imaging Software Market- By Application

- Orthopedic

- Dental

- Neurology

- Cardiology

- Oncology

- Obstetrics & Gynaecology

- Mammography

- Urology & Nephrology

In 2021, the cardiology segment had the largest proportion of worldwide sales, accounting for more than 20 percent. The high frequency of cardiovascular and congenital heart illnesses, as well as government funding to promote treatment accessibility, are contributing to the growth. The FDA approved the commercialization of software to assist medical practitioners in the collection of echocardiography or cardiac ultrasound images in February 2020. Caption Guidance software is an add-on for compatible diagnostic ultrasound devices that uses artificial intelligence to assist the user in capturing normal diagnostic quality heart pictures of a patient.

As the frequency of cancer rises at an alarming rate, the oncology and mammography divisions are projected to develop significantly in the future years. Over the projection period, this is anticipated to result in increased demand for diagnostic solutions. Surgeons are working on expanding computer technology to better the visibility of dangerous tumors, according to research done by the American College of Surgeons Clinical Congress. This is expected to accelerate the use of these software solutions in the coming years.

Global Medical Imaging Software- By End User

- Hospitals

- Diagnostic Centers

- Ambulatory Surgical Centers (ASCs)

- Others (Academic & Research Centers)

The worldwide market has been split into hospitals, diagnostic centers, Ambulatory Surgical Centers (ASCs), and others based on end-users. In 2021, the hospital’s category had the highest revenue share of more than 36.00 percent, and this trend is estimated to continue throughout the projected period. Supportive infrastructure, which is critical in executing surgical procedures utilizing medical imaging software, is one of the primary drivers boosting market expansion. Hospitals have a larger installed base of diagnostic imaging equipment and solutions than research and diagnostic institutes. Furthermore, patient inflow is significantly higher. As a result, the end-use segment continues to lead.

Furthermore, attractive reimbursement schemes implemented by governments across the world have resulted in higher surgical volumes, boosting demand. The rising cost of healthcare is a big worry in the industry, and it stems from the fact that many people cannot afford the treatment they require, including surgical operations. As a result, healthcare providers have had to devise innovative ways to make such treatments more affordable while maintaining high quality. In these situations, ASCs have shown to be a viable answer. As a result, throughout the projected period, the ASC sector is predicted to develop at the quickest CAGR.

Global Medical Imaging Software- By Geography & Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

In 2021, North America dominated the market, accounting for more than 37.00 percent of worldwide sales. The availability of well-established healthcare institutions with modern diagnostic equipment, as well as favorable government actions to boost the use of healthcare IT in this region, are credited with this increase. Increasing R&D investments and the presence of significant market players are also contributing to regional market expansion. MIM Software Inc. announced a partnership with GenesisCare, a worldwide provider of integrated cancer care, to enhance patient access globally.

GenesisCare’s clinical teams serve over 400,000 cancer patients in over 440 locations across Australia, the United States, the United Kingdom, and Spain. As a result, such measures are projected to aid regional market expansion. Due to the increased usage of medical image analysis software by healthcare professionals in the area, Asia Pacific is estimated to have the second-fastest CAGR throughout the projection period. Growing public awareness of the related benefits of these systems is likely to drive market expansion. Furthermore, rising healthcare spending and disposable income levels in nations like China and India are boosting regional market growth.

Global Medical Imaging Software- By Companies

- Toshiba Medical Systems Corp.

- Bruker Corp.

- Xinapse Systems Ltd.

- Esaote, Inc.

- ClaroNAv, Inc.

- Merge Healthcare Inc.

- Aquilab GmbH

- Spacelabs Healthcare, Inc.

- MIM Software Inc.

- Carestream Health, Inc.

NOTABLE HAPPENINGS IN THE GLOBAL MEDICAL IMAGING SOFTWARE MARKET IN THE RECENT PAST:

- Merger & Acquisition: - In 2021, GE (NYSE: GE) said today that it has completed the previously announced purchase of BK Medical from Altaris Capital Partners, LLC, a pioneer in enhanced surgical imaging.

- Merger & Acquisitions: - In 2020, Spacelabs Healthcare, a global provider of patient monitoring and diagnostic cardiology solutions, announced today that it has acquired BoxView, LLC ("Box view" revolutionary)'s cloud platform. BoxView, which was founded in 2011, creates corporate software to manage patient monitoring data, coordinate treatment, and measure metrics to improve quality, throughput, and efficiency.

Impact of Covid-19 on the Industry:

Certain steps are being taken as a result of the focus on innovation in medical image analysis. Medical image processing can also help with illness detection, treatment, and diagnosis. One of the most cutting-edge technologies utilized to fight the COVID-19 issue has been identified. Numerous AI, machine learning, and deep learning technologies have been employed in medical image processing in the context of COVID-19 illness, which will fuel market expansion. Due to the growing demand for efficient solutions for better patient outcomes, diagnostic and research institutes are likely to become critical end-users of image analysis solutions. Because they frequently outsource imaging services from hospitals, these categories accounted for lesser revenue shares.

Chapter 1. Global Medical Imaging Software Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Medical Imaging Software Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Global Medical Imaging Software Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Global Medical Imaging Software Market Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Global Medical Imaging Software Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Medical Imaging Software Market – By Software Type

6.1. Integrated Software

6.2. Stand-alone Software

Chapter 7. Global Medical Imaging Software Market – By Imaging type

7.1. 2D Imaging

7.2. 3D Imaging

7.3. 4D Imaging

Chapter 8. Global Medical Imaging Software Market – By Application

8.1. Orthopedic

8.2. Dental

8.3. Neurology

8.4. Cardiology

8.5. Oncology

8.6. Obstetrics & Gynaecology

8.7. Mammography

8.8. Urology & Nephrology

Chapter 9. Global Medical Imaging Software Market- By End User

9.1. Hospitals

9.2. Diagnostic Centers

9.3. Ambulatory Surgical Centers (ASCs)

9.4. Others (Academic & Research Centers)

Chapter10. Global Medical Imaging Software Market- By Region

10.1. North America

10.2. Europe

10.3. Asia-Pacific

10.4. Latin America

10.5. The Middle East

10.6. Africa

Chapter 11. Global Medical Imaging Software Market – Key Companies

11.1. Toshiba Medical Systems Corp.

11.2. Bruker Corp.

11.3. Xinapse Systems Ltd.

11.4. Esaote, Inc.

11.5. ClaroNAv, Inc.

11.6. Merge Healthcare Inc.

11.7. Aquilab GmbH

11.8. Spacelabs Healthcare, Inc.

11.9. MIM Software Inc.

11.10. Carestream Health, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900