Global Meal Substitutes Market Size (2024 – 2030)

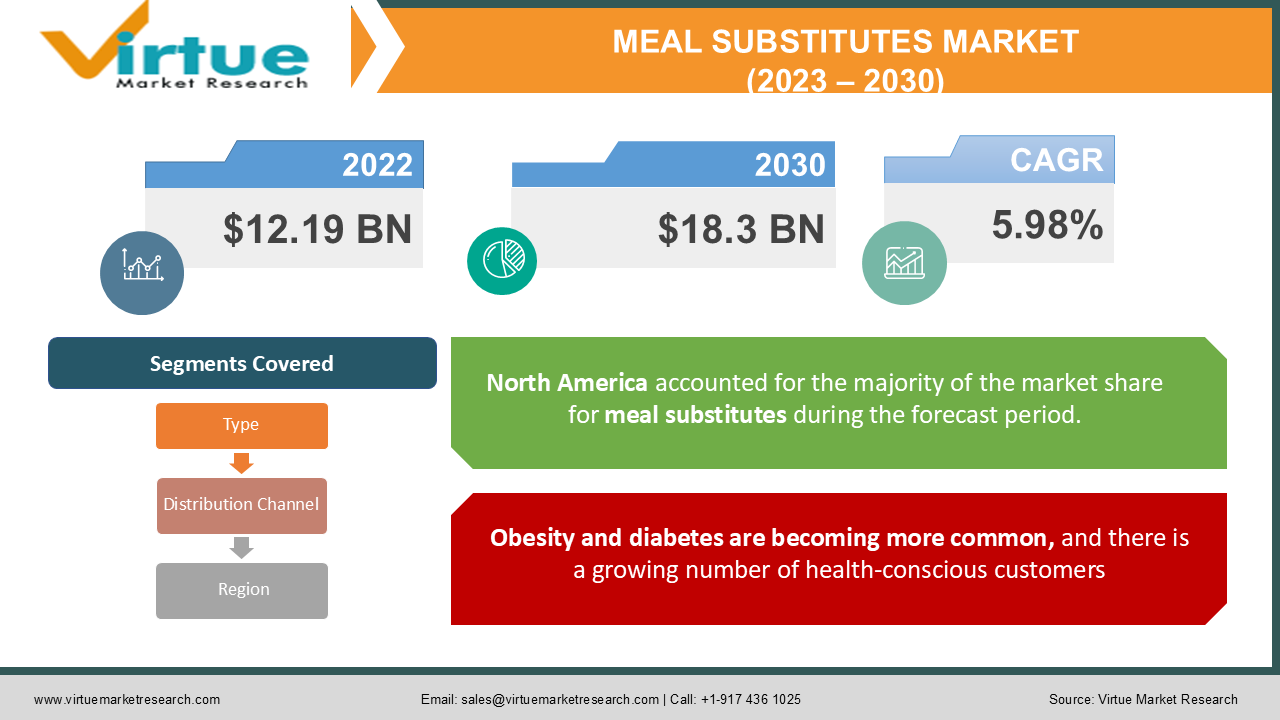

Global Meal Substitutes Market was valued at USD 12.19 billion in 2023 and is projected to reach a market size of USD 18.3 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.98%.

Industry Overview

The industry is expected to develop due to a busy lifestyle and growing demand for tasty, high-quality, and healthful food items. Additionally, the market for ready-to-eat meal replacement products is likely to be driven by extended working hours and an increasing number of individuals leading sedentary lifestyles. These foods are high in fats, calories, proteins, and other essential components, yet they take relatively little time to prepare. Furthermore, the clean label movement is predicted to increase consumer knowledge of nutrition and ingredient lists, boosting demand for natural and organic meal replacement meals.

Meal replacement bars and shakes are seen as healthier alternatives to fast food by consumers. This feature is expected to provide market participants with growth prospects. Furthermore, the availability of goods with varied vitamin combinations is expected to boost demand. The growing popularity of vegan foods is projected to spur innovation in the meal replacement products sector. To meet the rising demand for vegan choices, major producers such as Soylent provide plant-based meals.

Meal replacements are convenient to store and have a longer shelf life. The majority of these goods come in the shape of bars or ready-to-drink shakes, making them convenient to transport and eat on the move. One of the most popular product varieties, especially among fitness fanatics, is powdered form. Many gyms sell meal replacement items to encourage their members to adopt healthy eating habits. Meal replacement product producers are likely to establish their goods in-house web portals to boost their market size as the use of e-commerce as a selling medium grows.

IMPACT OF COVID-19 ON THE INDUSTRY

The worldwide lockdown imposed by the COVID-19 epidemic has created unparalleled health difficulties, with consumers' adaption to this lifestyle being hailed as the new normal. Less activity has resulted in stress, which has led to overeating and weight gain. During this time, the notion of healthy eating has gained a lot of traction, and consumers' attempts to stay self-immune have been crucial, boosting the sales of meal replacements on the market.

Market Drivers

Obesity and diabetes are becoming more common, and there is a growing number of health-conscious customers

Obesity is on the rise worldwide, having more than quadrupled since 1975. Obesity, which is one of the most serious health issues, has spread from industrialized countries to low- and middle-income countries. Because of the rise in obesity incidence, many are turning to meal replacement programs as a weight-loss option. Diabetes, cardiovascular mortality, dyslipidemia, and hypertension are all increased by obesity. Long-term, meal replacement weight management strategies are preferable to other therapies because they help people lose more weight. Furthermore, the worldwide market is expected to be driven by rising awareness of healthy lifestyles. The tendency and adoption of a nutritious diet to replace regular meals with simple and easy meals are growing.

Rising consumer demand for meal substitutes market in emerging markets will drive the market growth

Growing consumer awareness is causing a jump in expenditure on healthful food in emerging nations. Rising obesity rates, a surge in sedentary lifestyles, an aging population, and growing interest in health and nutrition are all contributing to the expansion of meal replacement throughout emerging regions. Furthermore, lifestyle disorders such as cardiovascular disease, type 2 diabetes, and osteoporosis are on the increase in nations such as India, Australia, and Japan. Furthermore, countries in the Asia Pacific area have experienced rapid increases in overweight and obesity. Obesity has also become one of the most pressing health issues in South America. Brazil has 15,733.6 thousand diabetics in 2021, with the number predicted to rise to 23,223.6 thousand by 2030.

Market Restraints

Meal substitute products are expensive as compared to normal meals

Science and technology assist people in identifying foods that will aid in weight management and general wellness. Meal replacements are expensive, which may limit market expansion. The cost of a healthy meal replacement is more than a conventional meal since it involves additional manufacturing procedures to boost the nutritional content of the product. The high price of meal replacement is due to the high expense of research and development, as well as personalization. Consumers have moved to meal replacement products to improve their overall health as health concerns have grown and lifestyles have changed. Because meal replacement products are more expensive, market expansion may be limited.

Protein shakes are sometimes mistaken for meal replacement shakes

Protein shakes are sometimes confused with meal replacement shakes. Protein drinks are made to help athletes perform better and grow muscle. Meal replacement shakes, on the other hand, are intended for weight loss, wound healing, and convalescence, among other things. Meal replacement shakes are designed to replace breakfast, lunch, or supper, whereas protein shakes are meant to be consumed before and after an intense workout. Protein shakes just meet the person's protein needs, whereas meal replacement shakes give full nutrients as a meal. For market participants, the confusion between protein drinks and meal replacement shakes is a challenge. The lack of clarity about meal replacement drinks and protein shakes stymies sales and stunts the expansion of the meal replacement sector.

Meal Substitutes Market Report Coverage:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.98% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Abbott Laboratories, Amway, Atkins, Glanbia plc, Herbalife Nutrition, Huel, Kellogg Co., Nestle, NU Skin Enterprises, Inc., Usana Health Sciences Inc. |

This research report on the global meal substitute market has been segmented and sub-segmented based on Product, Distribution Channel, and Region.

Global Meal Substitute Market- By Product Type

- Powder

- Ready to Drink

- Protein Bar

In 2018, meal replacement powder had the biggest market share. Powder items' simple storage and fast-paced lifestyles are projected to promote this segment's growth. In addition, the powder packets come with a complimentary glass shaker. The availability of a wide range of tastes is expected to attract more customers who are concerned with weight loss and living a healthy lifestyle. From 2019 to 2025, ready-to-drink bottles are predicted to grow at the fastest rate of 7.0 percent. The growing popularity of bottled energy drinks is projected to drive up demand for meal replacement beverages. Consumer demand for ready-to-drink foods is growing as a result of attractive packaging, internet marketing, and celebrity endorsements. Furthermore, these items are readily available, with a clear label that includes all nutritional information. Manufacturers also guarantee that their goods including flavored components adhere to federal food laws. Over the next eight years, these variables are likely to broaden the scope of this segment's expansion.

One of the least popular meal replacement products was the protein bar. These items are more costly than powdered and ready-to-drink meals. Protein bars are predicted to be used as on-the-go snack options shortly due to a hectic lifestyle and willingness to spend on luxury and convenience items.

Global Meal Substitute Market- By Distribution Channels

- Online

- Offline

Meal replacement products are mostly sold through offline channels, thanks to a large offline distribution network of multinational manufacturers. This sector is likely to have the largest market share over the projection period, as manufacturers have complete control over how and where their products are displayed in supermarkets. Many gym owners also offer major meal replacement products at their facilities, which should boost offline sales.

Manufacturers are finding it easier to reach a larger audience at a lower cost because of the rise of e-commerce. To promote online sales, manufacturers are being pushed to build their websites and form partnerships with large e-commerce platforms. Furthermore, thanks to many fitness blogs and vlogs, virtual word-of-mouth advertising is on the rise. Shortly, this is projected to boost online sales. In addition, manufacturers are spending on web ads and digital marketing tactics to expand their consumer base and persuade people to buy their products. This is likely to help meal replacement items sell quickly through online distribution channels.

Global Meal Substitute Market- By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

North America had the greatest market share of almost 45 percent. Due to the existence of a majority of the health-conscious population and the rising incidence of obesity, diabetes, cardiovascular illnesses, high blood pressure, and high cholesterol levels, among others, the United States generated the majority of regional demand. The Food and Drug Administration (FDA) does not classify such items as meal replacements, but rather as meals for particular dietary purposes. FDA laws and terminology are becoming more well known among consumers and producers. As a result, this categorization of meal substitutes may influence market growth. To increase sales, producers work on designing goods that fulfil the FDA's nutritional and quality guidelines.

From 2023 - 2030, Asia Pacific is predicted to have the highest CAGR of 8.3%. Rapid urbanization, rising population, and increased understanding of varied nutritious dietary requirements are predicted to drive growth in developing nations such as China and India. Furthermore, rising e-commerce in these regions is expected to improve meal replacement product sales. To increase market penetration, several manufacturers use the digital channel for advertising and accessing untapped or physically inaccessible consumers. This is expected to have a beneficial impact on market growth. Meal replacement products are mostly used to help people lose weight. As a result, many gym-goers and exercise instructors prescribe such items for successful weight loss. This is likely to help boost the regional market. Because of growing knowledge of the benefits of meal replacement diets, several European nations are contributing considerably to market share. Manufacturers entering these areas via e-commerce are expected to see sustained development in major nations in Central and South America, the Middle East, and Africa.

Global Meal Substitute Market- By Companies

- Abbott Laboratories

- Amway

- Atkins

- Glanbia plc

- Herbalife Nutrition

- Huel

- Kellogg Co.

- Nestle

- NU Skin Enterprises, Inc.

- Usana Health Sciences Inc.

NOTABLE HAPPENINGS IN THE GLOBAL MEAL SUBSTITUTE MARKET IN THE RECENT PAST:

Product Launch: - In 2020, Huel has released its new Huel Black Edition, a nutritious meal replacement shakes with 33 percent more protein than Huel Powder, 50 percent fewer carbohydrates, and a recipe that is naturally gluten-free and free of artificial sweeteners.

Merger & Acquisition: - In 2021, Nestlé and KKR have reached an agreement in which Nestlé would buy The Bountiful Company's key brands for USD 5.75 billion. The Bountiful Company is the world's leading pure-play nutrition and supplement company, with a very appealing and rising worldwide market.

Chapter 1. Global Meal Substitutes Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Meal Substitutes Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2024 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Global Meal Substitutes Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Global Meal Substitutes Market Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Global Meal Substitutes Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Meal Substitutes Market – By Type

6.1. Powder

6.2. Ready to Drink

6.3. Protein Bar

Chapter 7. Global Meal Substitutes Market – By Distribution Channels

7.1. Online

7.2. Offline

Chapter 8. Global Meal Substitutes Market- By Region

8.1. North America

8.2. Europe

8.3. Asia-Pacific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9. Global Meal Substitutes Market – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

9.1. Abbott Laboratories

9.2. Amway

9.3. Atkins

9.4. Glanbia plc

9.5. Herbalife Nutrition

9.6. Huel

9.7. Kellogg Co.

9.8. Nestle

9.9. NU Skin Enterprises, Inc.

9.10. Usana Health Sciences Inc.

Download Sample

Choose License Type

2500

4250

5250

6900